Do you see a low credit score on your credit report? You pay bills on time, yet your score stays flat. You need a higher credit score to get a car loan or a mortgage. That thin credit history can hold you back.

A 2010 Federal Reserve study shows piggybacking can add 45 to 64 points to a thin credit score. We share seven credit piggybacking tips, show how to use authorized user status, and track credit utilization.

We warn you about for-profit piggybacking risks and fraud charges. Keep reading.

Key Takeaways

- A 2010 Fed study found piggybacking can add 45-64 points to thin credit scores.

- Add an authorized user on a trusted 15-year-old card, and track the primary cardholder’s payments and balances.

- For-profit tradeline services cost hundreds or thousands of dollars, and the FTC flagged a firm in 2022 for taking fees without adding accounts.

- Use secured cards, small personal loans, and Regulation B spouse rules to build credit history on your own.

- Remove yourself from tradelines when you hit your target score, and monitor your report for odd activity.

Become an Authorized User on a Trusted Account

Add a person as an authorized user on a well-managed credit card account to piggyback credit history. This method helps you build credit scores without legal liability for charges.

Your credit report will list the added card account, flagged as an authorized user. Older accounts, like those aged 15 years or more, can stretch your credit history length, a big boost for mortgage lenders.

Lower credit utilization follows when the added card has a high limit and low balance. Some issuers only report to one or two credit bureaus like Equifax, Experian, or TransUnion.

Pick a family member or close friend you trust, since a single late payment can drag your score down fast. Track the primary cardholder’s on-time payments and low balances with credit monitoring.

You might spot bank fraud or identity theft early, if someone makes odd charges. Exit the arrangement once your scores hit a solid range, avoiding dependency on piggybacking credit.

Leverage Family Relationships for Credit Building

Parents add kids as authorized users on a credit card account. This step helps young adults build a solid payment history with credit cards and raise credit scores. The bank treats the child’s use as part of the primary cardholder’s on time payments.

It also shows lower credit utilization on credit reports. They set clear spending and repayment rules to avoid conflicts.

Marriage unlocks extra credit building under the Federal Reserve’s Regulation B. Creditors must report both authorized user and joint account holder histories. The policy gives spouses a balanced credit report, which banks view in mortgage and car loan applications.

Account owners carry full liability for every charge, so they monitor charges and payment habits closely. This level of financial trust makes family piggybacking safer than co signing a loan.

Use For-Profit Piggybacking Services with Caution

Renting a credit line through a for-profit piggybacking service can sound like a smart hack, but it often costs hundreds or even thousands of dollars. Tradeline companies emerged around 2007 to connect strangers to a credit card account for a fee split with the primary cardholder.

FICO and other credit scoring agencies warn that many ads overpromise score gains on your credit report. Some outfits even list a cardholder address where an authorized user never lived, and that move breaches federal trade practice laws.

In 2022 the Federal Trade Commission flagged a tradeline firm that took fees but gave no account access.

Buying a link tied to a defaulted card can drag your credit score down. Authorized user status lasts just until the paid window closes, and a sudden drop from a removed tradeline can wreck your credit history.

Keep an eye on payment history and credit utilization in your reports, or you could face surprises from lenders or banks. Use a credit monitoring tool from a credit reporting agency to spot sudden score dips.

Monitor the Primary Cardholder’s Credit Habits Closely

Credit monitoring tools help spot slip ups on a primary cardholder’s credit report. Missed payments or sky high balances on a credit card account can drag down your credit score too.

Some banks let primary holders opt out of reporting non family members to credit bureaus. Ask your credit card issuer if they report authorized users. Lower a user’s credit limit to cut your risk.

Check your payment history each month. High credit utilization can tank your FICO score fast. Identity theft alerts can catch odd charges before they ruin your report. Use a free portal from Equifax or Experian for simple updates.

Tight oversight stops bad moves from hitting your score.

Remove Yourself When Goals Are Achieved

Choose the right time to leave a tradeline as an authorized user. Account owners call the credit card issuer to revoke your status. Experian and TransUnion update your credit report within 30 days of the change.

This stop in on-time payments and low credit utilization can drop your credit score if your file stays thin. Removal should match your target score milestone.

Craft a plan that uses independent accounts. Open a small personal loan or a secured card. Make on-time payments and keep your credit utilization low. Use a credit monitoring service to watch your new tradelines.

Skip this step and your score may fall when boost effects fade.

Explore Alternatives Like Secured Credit Cards

Some banks offer secured cards that let you build a credit history without a co-signer. You place a cash deposit equal to your limit. Your payments show up on a credit record at a bureau.

You show on-time payments and low credit utilization to boost your credit score. A solid six months of use can earn you an upgrade to an unsecured card.

Experian Boost can add utility and phone bills to your file. You link a checking account or a debit card from your credit card issuer. The tool sends data to three consumer reporting agencies.

This moves more of your good financial habits onto your credit report. This path sidesteps for-profit piggybacking and cuts out data exposure or fraud.

Build a Strong Payment History on Your Own

A secured credit card lets new borrowers log on-time payments on their credit report. Automatic drafts take away late fees and guard your payment history. Small personal loans or a retail card add credit mix and boost score.

You can aim for under 30 percent credit utilization on revolving accounts. That habit helps your credit score rise over time.

Check your statements in online banking or use a credit monitoring tool weekly. Spot errors on your report fast, and report them to your credit bureau. Limit new credit inquiries to keep your score steady.

Long stretches of steady payments, over six months or more, build solid records. This practice readies you for auto loans, home loans or a HELOC.

Understand the Legal and Ethical Implications

The Equal Credit Opportunity Act bars lenders from denying authorized users on existing accounts. Regulation B, set by the Federal Reserve Board, forces creditors to list user accounts for spouses and to use that credit history in lending decisions.

Some services sell spots on a prime credit card account, but they can trigger bank fraud or identity theft charges. The Federal Trade Commission found a piggybacking firm in 2022 that lied about adding tradelines and left customers empty handed.

Most people choose person-to-person piggybacking and link with someone they trust. Scanning your credit report can spot odd activity fast, then you call the FTC to report fraud.

Lender skepticism can spike fast. They can spot odd payment history and strange credit utilization patterns on your credit report. Such doubt can jack up your interest rate on a car loan or a second mortgage.

Some credit repair firms hawk credit privacy numbers, trying to look legit, but that trick breaks federal rules. Courts can call it bank fraud or identity theft. You can build real on-time payments on your own.

Adding a parent as a joint account holder makes the process clear to card issuers.

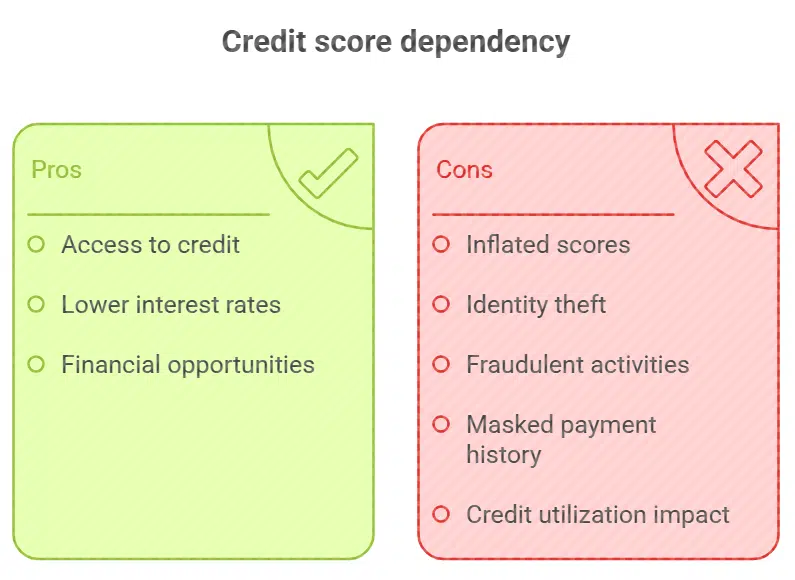

Evaluate the Risks of Credit Score Dependency

Credit score dependency risks lurk in hidden corners. Inflated scores can make you chase a car loan too big. Lenders believe you can pay, yet you might not handle the bills. Identity theft looms if a fraudster grabs your SSN and personal data off a credit report.

Some for-profit piggybacking services fake your address on a credit card account. That trick triggers credit bureau flags and can lead to bank fraud accusations.

Leaning on a tradeline can mask weak payment history. Removing an authorized user role can send your score plunging, especially if you show no other accounts. A sudden spike in credit utilization also hurts more.

Lenders might spot piggybacking activity and raise interest rates on mortgages or home equity lines of credit. Dishonest third-party firms often disappear, leaving you with lasting damage to your credit history.

Avoid Overreliance on Piggybacking for Long-Term Credit Health

Relying too long on a joint account holder’s authorized user status can backfire. Score gains vanish if the primary cardholder misses on-time payments or shuts a credit card account.

Tradeline boosts expire fast, and losing a line of credit can drop your credit score. Thin credit files need piggybacking credit as a jumpstart, yet high scores see little lift. Bank fraud, identity theft, or erratic spending by a credit card issuer could hit your credit report hard.

Mature credit health starts with building credit habits on your own. Pay every bill on time, manage credit utilization, and track your credit history with credit monitoring. Open a low interest loan, line of credit, or secured card from an insurer or Mastercard International to diversify your mix.

Follow Reg B rules under the Equal Credit Opportunity Act to protect your rights. Good financial trust and real experience with car loans or a mortgage loan shape steady scores.

Takeaways

Piggybacking can kick a thin credit history into gear. You must watch every payment and credit utilization curve. Chat with the main account holder and set clear ground rules. Use a credit report platform and a tracking app.

Check with your credit card issuer whenever you spot odd moves. Pull off this stunt once your credit score hits target.

FAQs on Credit Piggybacking Strategies

1. What is piggybacking credit?

Credit piggybacking is when you join as an authorized user on someone else’s credit card account, like hopping on a buddy’s Visa ride, to boost your credit score. It is one of many strategies for building credit fast. It blends with the main account’s payment history and credit utilization, giving your credit history a quick lift.

2. How does becoming an authorized user affect my credit report and credit score?

When you join as an authorized user, the Chase line reports on-time payments to the bureaus. Good payment history, low credit utilization, and a long credit history can push your credit score up. A single late fee can drag it right back down.

3. Is person-to-person piggybacking legal under the Equal Credit Opportunity Act?

Yes, this practice follows the Equal Credit Opportunity Act, and it is legal. But watch for for-profit piggybacking schemes, they can tip into bank fraud or even lead to identity theft. Pick someone you trust, skip the shady deals.

4. Can piggybacking credit improve my loan odds?

It can help, if you keep low balances and steady on-time payments. Lenders like to see a long payment history and low credit utilization. A healthy home equity line of credit or a clean card record shows strong financial habits and can shift subprime loan odds in your favor.

5. How do I track the impact of credit card piggybacking?

Check your credit report each month. Sign up for credit monitoring to watch your credit histories move. Tie your progress to real data, and adjust your habits with more on-time payments if you need a boost.