You filed for bankruptcy, so banks say no. You lost most credit options in a flash. You watch your credit score fall and your wallet shrink. You need a credit card that works, even after bankruptcy.

Chapter 7 bankruptcy stays on your credit report for up to ten years. This post shows five secured credit cards you can get right after bankruptcy. It covers fees, credit line, credit limit, APR, and credit bureau reporting.

You will learn how to rebuild credit and boost your credit score. Keep reading.

Key Takeaways

- Chapter 7 bankruptcy stays on your credit report for up to 10 years. You can rebuild sooner with a secured credit card after discharge.

- You can get these five cards right after bankruptcy: OpenSky® Secured Visa®, Discover it® Secured, Capital One® Platinum Secured, U.S. Bank Cash+® Visa® Secured and First Progress Platinum Select Mastercard®.

- Each card needs a security deposit of $49 to $3,000, reports to Experian, TransUnion and Equifax every month, and has APRs near 18%–27% with fees from $0 to $35.

- Discover it® Secured pays 2% back on gas and dining and 1% on other buys. U.S. Bank Cash+® Secured pays up to 5% back in two chosen categories and 2% in one.

- To boost your FICO score, pay on time, keep your balance under 30% of your limit, check your free credit report monthly and use prequalification tools to avoid hard pulls.

What to Look for in a Credit Card After Bankruptcy

Pick a card that sends your on-time payments to major credit bureaus so your credit score can rise. Choose one with a low security deposit and fair interest rate to keep your utilization low.

Secured vs. Unsecured Credit Cards

A secured credit card asks for a security deposit. You might place two hundred to three hundred dollars. That deposit becomes your credit limit. The card reports your activity to credit bureaus.

You rebuild credit after chapter 7 or chapter 13 bankruptcy.

An unsecured credit card works without a deposit. Issuers set your credit limit by risk and FICO score. Cards for poor credit may charge high APR and fees. They still send your payment data to credit bureaus.

You can track progress with a free credit report.

Low or No Annual Fees

Many secured credit cards charge a yearly fee. Some unsecured credit cards waive that cost. This fee cuts into a tight budget. You keep more dollars for essentials. You can steer those funds into on-time balance payments.

That lowers your credit utilization ratio.

A no-fee card reports to all three major reporting agencies. Each update can boost your credit report and raise your FICO score. You watch your credit limit grow without extra costs.

You avoid fee traps and costly cash advances. This simple step moves you past a chapter 7 bankruptcy rapidly.

Reporting to Credit Bureaus

Credit card issuers send payment data each month to all three major credit bureaus: Experian, TransUnion and Equifax. That activity updates your credit report with fresh history. Lenders use this data and credit history to gauge your risk.

On-time payments reflect well on your file. Improved records can boost your FICO score over time. Stronger scores open doors to car loans, mortgages and lines of credit.

Reasonable APR Rates

Issuers set annual percentage rates based on your FICO score. Poor credit or chapter 7 bankruptcy often brings rates near 25 percent. That rate can inflate a $500 balance by $10 a month.

Look for secured Visa credit cards with rates near 18 percent. Those cards cost less interest and boost your credit. Each hard credit inquiry can dip your FICO score. Space out your searches to limit that hit.

OpenSky® Secured Visa® Credit Card

OpenSky Secured Visa lets you build a strong FICO score with a small security deposit, works with Google Pay for contactless buys, and reports to the three major credit bureaus—read on to learn more.

Features & Description (OpenSky® Secured Visa® Credit Card)

Applicants with bad credit face no credit check to apply. A cash deposit sets the credit limit equal to the security deposit. The card carries a $35 annual fee, billed each year, and it reports to the three major credit bureaus to help rebuild credit profiles.

The Visa card works with Apple Pay, Google Pay, and contactless payment at most stores. Cardholders can log into the online account portal to view credit reports and track FICO score changes.

Security deposit choices start at $200 and range up to $3,000, letting users set a suitable line of credit. The account posts activity each month to Experian, TransUnion, and Equifax for a steady credit history rebuild.

People working through chapter 7 bankruptcy or chapter 13 bankruptcy discharge may prefer this option. It keeps a low interest rate compared to other secured credit cards and avoids a hard credit inquiry at signup.

Pros & Cons (OpenSky® Secured Visa® Credit Card)

OpenSky Secured Visa Credit Card uses a deposit to set your credit limit. This card works for folks with bad credit after bankruptcy discharge.

- No credit check makes approval simple after a Chapter 7 bankruptcy, letting you start rebuilding credit right away.

- Fixed monthly reports to Equifax, Experian and TransUnion boost your credit score when you pay on time.

- A cash security deposit, often $200 or more, defines your credit limit but holds funds in your checking account.

- Comparatively higher annual fees and APR cut into any cash back rewards if you carry a balance.

Discover it® Secured Credit Card

The Discover it® Secured Credit Card earns 2% back on fuel pumps and 1% on other buys, reports to all three credit bureaus, skips foreign fees, and boosts your credit score—read on to see if it suits your needs.

Features & Description (Discover it® Secured Credit Card)

Credit limit matches the security deposit you provide, from two hundred to twenty-five hundred dollars. Discover it Secured Credit Card reports to all three credit bureaus. That means your on-time payments can boost credit scores after bankruptcy discharge.

A soft inquiry replaces a hard credit inquiry, so your FICO score avoids extra ding. No annual fee applies and no foreign transaction fees raise your bill. Your deposit acts as collateral and helps you rebuild credit history after chapter 7 bankruptcy or chapter 13 bankruptcy.

Cashback rewards program pays two percent back at gas stations and restaurants on up to one thousand dollars in quarterly spending. Other purchases earn one percent back in unlimited cashback rewards.

Monthly statements detail your balance, due date and credit utilization ratio. Digital tools like online banking, the mobile app and ATM networks let you check your credit report and track FICO score improvement.

After eight billing cycles, Discover might move you to an unsecured rewards card, raising your credit limit without a new security deposit.

Pros & Cons (Discover it® Secured Credit Card)

Discover it® Secured Credit Card offers solid perks for bad credit and bankruptcy discharge. It helps rebuild credit after chapter 7 bankruptcy or chapter 13 bankruptcy.

- Generous cash back rewards mean you earn 5% on rotating categories and 1% on all other purchases. You get a cash back match at your first anniversary.

- No annual fee lets you keep more of your money. You avoid hidden costs that could hurt your personal finance plan.

- Soft pull at application avoids a hard credit inquiry. This protects your fico score after a debt discharge.

- Reports to all three major credit bureaus help rebuild credit. Your on-time payments show on your credit report and improve your credit utilization ratio.

- Security deposit from $200 to $2,500 ties up your cash. This sets your credit limit at the same level as your deposit.

- Interest rates can run above 20% APRs when you carry a balance. High aprs can cost you more on any credit card debt.

Capital One Platinum Secured Credit Card

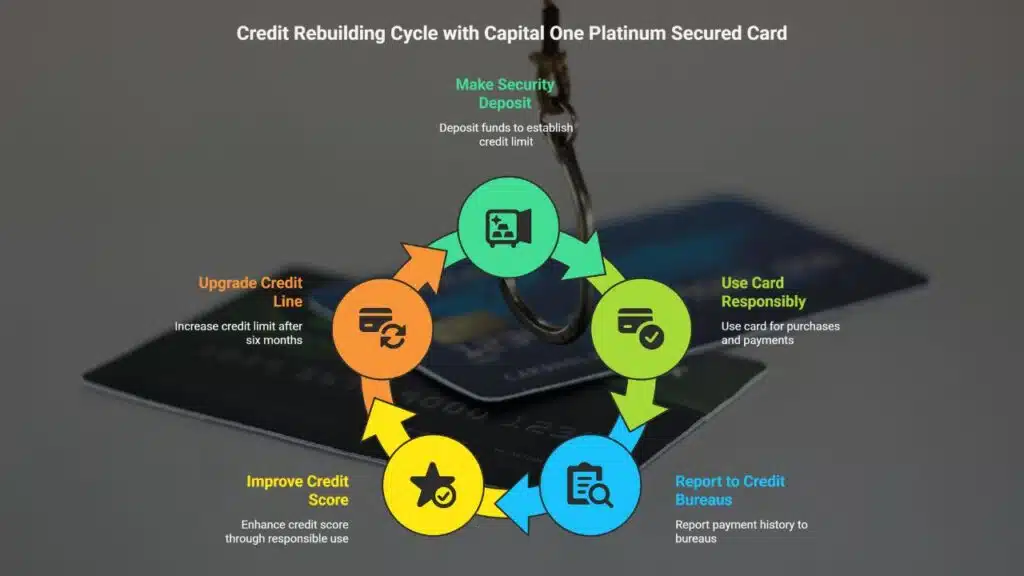

With a low $49 deposit to set your credit limit, regular reports to Equifax, Experian, and TransUnion, and a clear way to boost your FICO score, the Capital One Platinum Secured card makes rebuilding simple—read on.

Features & Description (Capital One Platinum Secured Credit Card)

Capital One Platinum Secured Credit Card stands among secured credit cards you can get after chapter 7 bankruptcy. You post a security deposit that becomes the credit limit. Your deposit varies based on creditworthiness.

This card reports on time payments to all three credit bureaus.

Cardholders use it for rebuilding credit and improving their FICO score. It updates your credit report each month. You can monitor your credit utilization ratio on your account.

Pros & Cons (Capital One Platinum Secured Credit Card)

The Capital One Platinum Secured Credit Card asks for a $49 to $200 security deposit. It can rebuild credit after chapter 7 bankruptcy discharge.

- Low deposit options charge $49, $99, or $200 and set your initial credit limit.

- Credit line upgrade may occur after six months if you pay on time.

- Higher limits lower your credit utilization ratio to improve your credit score.

- Card reports payment history to Equifax, Experian, and TransUnion for steady credit building.

- No annual fee keeps costs low and aids your financial recovery.

- Variable APR at 26.99 percent makes high balances costly.

- Deposit ties up your cash, which may limit spending power.

- Issuer runs a hard credit inquiry when you apply after bankruptcy discharge.

- No cash back or rewards points leaves perks out of reach.

U. S. Bank Cash+® Visa® Secured Card

You lock in your credit limit with a deposit, earn 2% back in two spots and 5% in one, and U.S. Bank reports your progress to credit bureaus—keep reading!

Features & Description (U.S. Bank Cash+® Visa® Secured Card)

This secured credit card uses your security deposit to set your credit limit. It reports activity to all three credit bureaus to rebuild your credit score fast. You earn cash back on the categories you pick each cycle.

Your payments show up on your credit report and help your FICO score climb. It tracks credit utilization ratio so you can keep balances low. This tool works for chapter 7 bankruptcy filers and other paths to debt discharge.

Pros & Cons (U.S. Bank Cash+® Visa® Secured Card)

U.S. Bank Cash+ Secured Visa card gives you cash back rewards and a clear path to rebuild credit. A security deposit sets your credit limit and you earn extra cash back in chosen categories.

- 5% cash back on two categories each quarter, up to $2,000 in combined spend, plus 2% on one everyday category helps boost rewards.

- $0 annual fee keeps your out-of-pocket costs low as you rebuild credit.

- Monthly reporting to Experian, Equifax and TransUnion lifts your credit report after chapter 7 or chapter 13 bankruptcy discharge.

- Security deposit from $300 to $2,500 equals your credit limit, so you control your credit utilization ratio.

- Variable APR near 25% can hike interest charges if you carry a balance past the due date.

- Late payment fee up to $39 adds cost when you miss your payment, so on-time pay is key.

- 3% foreign transaction fee makes overseas spending more costly on travel or streaming services.

- Security deposit ties up your funds until you close the account, which can feel like locked cash.

First Progress Platinum Select Mastercard® Secured Credit Card

- First Progress Platinum Select Mastercard® Secured Credit Card: It asks for a security deposit, reports on-time payments to all three credit bureaus, and steers your FICO score in the right direction, so read on to learn more.

Features & Description (First Progress Platinum Select Mastercard® Secured Credit Card)

This card sits on the Mastercard network. It needs a security deposit to open. The deposit sets your credit limit. The issuer reports each payment to Equifax, Experian, and TransUnion.

You can raise your FICO score with steady on-time payments.

Cardholders pay no annual fee. The APR sits at 24.99% variable, so clear the balance each month. It suits chapter 13 bankruptcy cases. You can make payments via Automated Clearing House or debit card.

The account shows on your credit report to improve your credit history.

Pros & Cons (First Progress Platinum Select Mastercard® Secured Credit Card)

First Progress Platinum Select card, issued on a major payment network, ranks high among credit cards after bankruptcy. It sets your credit limit by your security deposit, and reports on-time payments to all three credit bureaus.

- Pro: Accepts Chapter 13 bankruptcy filers and many Chapter 7 cases after a debt discharge. It links your cash deposit to your credit limit and sends data to your credit report.

- Pro: Helps you improve your credit score when you pay on time each month. Steady habits can lower your credit utilization ratio and lift your fico score in weeks.

- Con: Requires a security deposit, often from $200 to $2,000, which locks up cash in your bank of america account. That idle money cannot work for you on other personal loans or a heloc.

- Con: Carries higher interest rates than most unsecured credit cards, so any balance triggers steep finance charges. Those charges can stall your repayment plan and hurt your financial recovery.

Tips for Rebuilding Credit After Bankruptcy

Track your FICO score on Equifax, pay small balances on time, and read on for more tips.

Always Pay Your Balance on Time

Pay each credit card bill by its due date, every month. Late or missed payments cut into your credit history. Payment history drives the largest share of your FICO Score. Consistently on-time payments raise a poor credit score after a chapter 7 bankruptcy.

Use the mobile portal or set an autopay through your credit card company. That way you never miss a due date. Low credit utilization ratio and steady payments show up on your credit report with Experian, TransUnion and Equifax.

These steps help rebuild credit after a bankruptcy discharge.

Avoid Overspending or Carrying High Balances

Carry low balances on secured cards. Keep your credit utilization ratio under 30 percent; staying below 10 percent works best. That small figure on your credit limit can shield your FICO score from damage.

High balances can slow your financial recovery and delay your personal finance goals.

Charge small amounts each month, and clear the balance before the statement date. Major credit bureaus get reports every billing cycle. A low utilization ratio can boost your credit score improvement after chapter 7 bankruptcy or chapter 13 bankruptcy.

Use your credit report tool to watch your FICO score rise.

Monitor Your Credit Score Regularly

Check your credit report each month using services like Experian or AnnualCreditReport.com. Spotting errors fast can stop wrong info from dragging down your FICO score. You call credit bureaus to clear mistakes.

This step aids anyone rebuilding credit after chapter 7 or chapter 13 bankruptcy.

Watch your credit utilization ratio on secured credit cards after bankruptcy. Keep balances under 30 percent of your credit limit on each card. This small act can lift your credit score.

It feels like a pit stop before a race. Regular reviews show real progress and catch fraud early.

Takeaways

Think of it as a fresh start after chapter 7 or chapter 13 bankruptcy. A secured card and a solid security deposit can give you a jump start on your FICO score. Try prequalification tools to peek at your odds, and dodge a hard credit inquiry.

Track your progress on your credit report, and watch your records at the credit bureaus improve. Small, on-time payments and low credit utilization ratio pave the way to a Visa Signature or American Express offer down the road.

FAQs

1. How soon can I apply for credit cards after bankruptcy?

Right after your bankruptcy discharge you can seek secured credit cards or prepaid cards. Your fresh start date goes on your credit report, but card issuers may wait a few weeks. A small hard credit inquiry will show, yet it won’t hurt much. You add a security deposit, and you grab a secured card fast.

2. What credit limit can I expect with a secured or unsecured card?

With Chapter 7 bankruptcy you get a clean slate when your debt discharge posts with the credit bureaus. Secured cards set your credit limit by your security deposit, often $200 to $500. A platinum secured card by Capital One might kick off at $300. Some unsecured credit cards let you start low, around $300. Keep your credit utilization ratio under 30 percent.

3. Can a new card really help rebuild bad credit and boost my FICO score?

Yes, if you pay on time and keep balances low. Each on-time payment shows up on your credit report and nudges your FICO score up. Think of it like planting seeds in a garden; each payment helps your rebuilding credit grow strong.

4. Will a prepaid card or apps like Venmo or Cash App improve my credit history?

No. Prepaid cards and mobile wallets don’t report to credit bureaus. They act like cash; they won’t raise your credit score. Overdraft services may charge fees and offer no credit boost. You need real credit cards to rebuild.

5. Do cards for fresh starts charge foreign transaction fees or offer rewards?

Some secured cards carry foreign transaction fees, others don’t. A secured card by Discover might have no fee but few rewards. A prepaid card by PayPal often tacks on a load fee, and no points. A premium card network may still offer rewards programs, but watch the fine print.

6. How do I chart a path to financial recovery in personal finance?

Track your credit utilization, pay balances in full, and avoid a lump sum splurge. Check your credit report often. Use an investment site like fidelity.com or a budgeting app to stay on track. When you’re ready, apply for unsecured credit cards for higher limits. Each step raises your credit history to new heights.