Ever checked your credit score and felt a bit worried? You are not alone. Many people feel lost about how to raise their scores or keep them safe from sudden drops. Mistakes pile up, bills get missed, and next thing you know, getting a car loan or new apartment feels out of reach.

One key fact is simple: good habits with your credit card can push your score higher over time. The right steps—like paying bills on time and controlling how much of your available line of credit you use—can make all the difference.

This post shares 10 Credit Card Habits That Boost Your Score in clear words anyone can follow.

Want to see which quick habit you should start today? Stick around for number seven—it’s easier than you think!

Ensure Timely Payment of Your Bills

Paying bills on time works like magic for your credit score. Credit bureaus like Experian, TransUnion, and Equifax look at payment history more than any other factor. One late payment can stay on your credit report for up to seven years.

Make sure every card payment gets in before the due date—even paying just one day late can set you back.

Credit card companies send alerts by email or phone, so sign up for those reminders from your bank or online banking app. Set up automatic payments if possible; this covers at least your minimum amount each month and lowers your risk of missed bills or late fees.

FICO® Score loves a clean record with no skipped payments—so do lenders who check reports before handing out new lines of credit, car loans, or even apartment leases.

Maintain Low Credit Utilization Ratios

Lenders peek at your credit utilization ratio, like it’s the secret sauce of your credit score. Keep this number below 30%. That means if you have a $1,000 credit limit on each card from banks or Mastercard International, try not to let your balance go over $300 per card.

Large balances on revolving accounts, even with steady payments, can trip up your FICO® score faster than a kid tripping over shoelaces. High ratios signal risk to credit bureaus and bring down scores as fast as late payments do.

Spreading out spending across several cards instead of maxing one helps keep those numbers low. Paying more than the minimum payment chops down your balance quickly and gives you room for holiday shopping sprees—without hurting your financial planning or interest rates.

“Don’t let today’s swipe become tomorrow’s headache,” says Sarah Nguyen from Credit Counseling Solutions in Dallas. Keeping old accounts open boosts available credit—and lowers that sneaky ratio—even when using debit cards for most purchases.

This habit shapes good credit history quicker than any shortcut or new app could promise.

Regularly Review Your Credit Report

Pull your free credit report every year from each of the three big credit bureaus—Equifax, Experian, and TransUnion. Use sites like AnnualCreditReport.com for quick access. Scan for mistakes or signs of identity theft.

Sometimes you spot wrong account details or see a strange loan pop up, like an auto loan you never took out.

Spotting errors early helps protect your score and stops small issues from growing into big headaches. Even one late payment listed by mistake can lower your FICO® Score fast. If you see something off, file a dispute right away with the reporting agency.

Keep watch on changes—credit monitoring tools alert you about new activity so no funny business slips through the cracks. Checking your own file does not hurt your score at all—it is just smart financial planning!

Preserve Old Credit Card Accounts Open

Older credit card accounts can be real gold mines for your credit score. The longer you hold a credit card, the better it can look to credit bureaus and lenders. Credit history length makes up about 15% of your fico® score, so try to keep old accounts open even if you do not use them much.

Closing an old account may shorten your average credit history and could drop your scores.

Your oldest cards also help with low credit utilization rates since they add to your total available limit. For example, let’s say you have three cards—two are new but one is over ten years old from Citigold or another bank.

If you close that oldest card, the clock starts over on part of your history, making you seem less experienced at managing debt. Try using each open card for a small purchase now and then—maybe pay a bill or buy gas—to keep those lines active without running up large balances or paying extra interest rates.

Long story short: Old plastic? Keep it in your wallet!

Expand Your Types of Credit

Mixing different types of credit can boost your fico® score. Credit bureaus like to see how you handle more than one kind of debt. Using both revolving credit, such as credit cards, and installment loans like student loans or auto loans, helps show strong money skills.

For example, paying off a car loan while keeping up with credit card payments shows lenders you are responsible with many kinds of debts. FICO scores rise when people manage at least two different account types well.

Having only one type of account may hold back your score a bit, even if you pay on time every month. You do not need ten accounts—just cover the basics. A secured credit card is often easy to get if you are just starting out or rebuilding after mistakes.

Some use personal checks to pay bills, but making monthly payments online is faster and safer these days for tracking purposes too. Spread out your new applications though; opening several accounts in a short span can flag risks for lenders and lower your score fast due to hard inquiry warnings from the big three reporting agencies: Experian, Equifax, and TransUnion.

Restrict Applications for New Credit

Applying for too many new credit cards can hurt your credit score fast. Each time you ask for a new card, a hard inquiry shows up on your credit report. Too many checks like these tell lenders you might be risky with money.

Keep space between applications—at least six months is best to help keep your credit scores safe.

New accounts lower the average length of your credit history. That drop can chip away at good scores from FICO® or other bureaus. Credit mix matters, but go slow with opening extra cards or loans like auto loans and student loans.

Be patient; smart financial planning means waiting before borrowing more money just for another shiny plastic card in your wallet!

Increase Frequency of Balance Payments

Paying your credit card bill more often than once a month can help raise your credit score. Try making small payments every week or after each big purchase. This keeps your credit utilization low, which helps boost your FICO® score fast.

Credit bureaus look at the balance reported by the card issuer, not just what you owe on due day. If you make frequent payments, less debt shows up on your credit reports and lowers your debt-to-credit ratio.

Even paying a bit right after using the card—like ten dollars here or twenty there—can move the needle for good credit habits. It’s like sweeping crumbs off the table before they pile up into a mess!

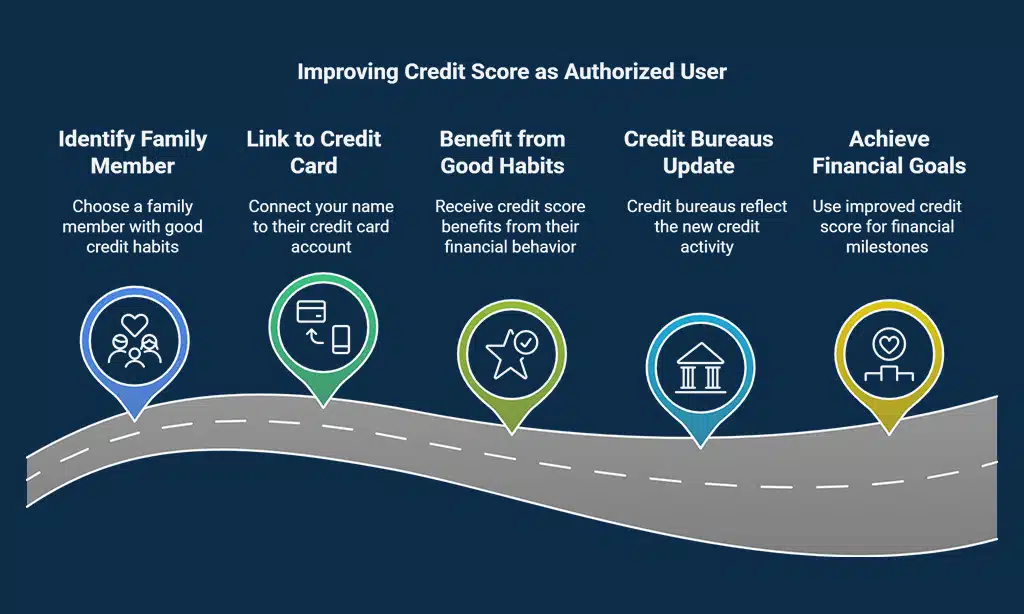

Secure Authorized User Status on Other Accounts

Joining a family member’s credit card as an authorized user can give your credit score a jumpstart. Your name gets linked to their account and the on-time payments, long account history, and low credit utilization rates can flow over to your own credit report.

This move works best if the primary cardholder pays every bill in full each month and keeps balances well below their limits.

Big names like Experian, Equifax, and TransUnion may start showing this activity right away. You don’t borrow money yourself but you get the boost in your payment history. Want to improve your FICO® score or need help with financial milestones like an auto loan? Using someone else’s good habits beats going it alone—just be sure you pick someone who makes wise choices with their plastic!

Automate Credit Card Bill Payments

Setting up automatic payments is a smart move for your credit score. Credit card issuers let you schedule your monthly bill so it pulls straight from your bank account, no sticky notes needed.

You can pick to pay the minimum payment, the full balance, or a fixed amount every month—whatever fits your budget and stops late payments in their tracks.

A single forgotten due date can haunt your credit record for years. Automated payments help you keep on-time payments and avoid costly late fees or higher interest rates. Many users find they stress less about hitting deadlines, setting alerts just as backup.

Choosing auto pay protects both your wallet and payment history with little effort.

Regularly Track Your Credit Score Changes

Checking your credit score is like checking your health. You might not feel the pain, but a drop can sting later.

- Use credit monitoring services from places like Experian, Equifax, or TransUnion. These agencies let you peek at your report for free at least once a year.

- Sign up for alerts with apps from your bank or credit card issuer. Many have tools to track changes in your FICO® Score or VantageScore.

- Track your payment history and spot errors early. A late payment you forgot about last year could still cause trouble.

- Watch for hard inquiries each time you apply for borrowing money. Too many in six months can lower your score—think of them as little speed bumps.

- Keep old credit card accounts active, even if you do not use them much. Longer credit history boosts that magic number.

- Note sudden drops. An unpaid balance or an account added by mistake can hurt fast—it pays to act quickly.

- Check for signs of identity theft on all annual credit reports. A new auto loan or student loan opened in your name? That’s a red flag bigger than a parade float.

- Celebrate small wins when you see progress toward good credit goals, whether it’s higher limits or lower rates on loans.

- Make looking at statements and reports part of your monthly financial planning routine—even teenagers should start early.

- Use different devices—apps, computers, statements—to catch every detail. One missed alert could mean missing out on cash back offers too!

- Share tips with others who want to improve their fico score. Sometimes a quick chat helps more than all the numbers on the page combined.

Takeaways

Pay bills on time, keep your card balance low, and check your credit reports often. Use different kinds of credit and let old accounts age like a fine cheese. Space out new card requests—doing #7 every day keeps trouble away! These habits are easy to follow, save you money with better interest rates, and can stop late payment stress in its tracks.

Want more tips or tools? Free credit monitoring from agencies like TransUnion or Equifax helps track progress fast. The sooner you start these steps, the sooner you’ll hit big financial goals—with a score that shines bright as the summer sun! I once fixed my own score by following these simple habits; if I can do it, anyone can.

FAQs

1. How do on-time payments help my credit score?

Paying your credit card bill by the due date is like watering a plant—it keeps things growing strong. On-time payments show lenders you’re responsible, and this habit builds solid payment history. Payment history matters most for your FICO® score, so never skip it.

2. Why should I keep my credit utilization low?

When you use too much of your available credit limit, lenders get nervous—like seeing someone eat an entire cake alone. Keep your credit utilization rate under 30%. This means if you have a $1,000 limit, don’t let your balance go above $300.

3. What’s the deal with checking my free credit report?

Checking your free credit report helps catch errors or signs of identity theft early on. Credit bureaus update reports often; review them at least once a year to spot mistakes in personal info or late payments that could hurt your score.

4. Does having different types of loans help boost scores?

Yes! Mixing up installment loans like auto loans or student loans with revolving accounts such as cards can improve your overall credit mix. Lenders want to see you juggle more than one kind of debt without dropping any balls.

5. Should I pay only the minimum payment each month?

Making just minimum payments keeps creditors off your back but leaves interest rates piling up higher than dirty laundry before vacation time. Paying more lowers balances faster and cuts down that pesky interest charge eating away at financial resources.

6. Is using automatic payments smart for building good habits?

Setting up automatic payments is like putting guardrails on a winding road—you avoid missing due dates and late fees while keeping emotional health in check too! Automatic card payments protect against missed bills and support steady financial planning over time.