People still call it “credit card hacking.” That phrase spreads fast on social media because it sounds bold and rebellious. But most of the time, the person saying it is not talking about crime. They are talking about credit card churning: opening cards to earn welcome bonuses, then deciding whether to keep, downgrade, or close them.

So, is the game over in 2026? Not exactly. The easy wins are rarer. Issuers use tighter rules, smarter screening, and faster shutdowns. They also face a fraud environment that keeps getting worse, which changes how they treat anything that looks like abuse. In 2024 alone, consumers reported losing more than $12.5 billion to fraud, according to the U.S. Federal Trade Commission.

This article breaks down what is actually happening, what is hype, and what a realistic rewards strategy looks like now.

The 2026 Reality Check: Why This Debate Won’t Go Away

A lot of people feel like something “changed.” They are not imagining it. Banks and card networks are operating in a world where digital scams scale quickly and bad actors move fast. Visa’s payment-risk team has described a growing mix of social engineering and technology-driven fraud tactics, which pushes the ecosystem toward stronger controls.

At the same time, consumers keep chasing rewards because travel and everyday costs feel expensive. Welcome bonuses still look like a shortcut. That tension keeps the debate alive.

| Key Question | What’s Different In 2026 |

|---|---|

| Why do issuers tighten rules? | Higher fraud pressure and higher loss risk. |

| Why do people keep churning? | Bonuses can still deliver outsized value vs everyday earnings. |

| Why the confusion? | “Hacking” is used as slang, but it also overlaps with real fraud. |

Two Conversations Get Mixed Into One

One conversation is about rewards optimization. The other is about theft and deception. When people blend them together, the result is bad advice and unnecessary risk.

The Big Signals Behind The Crackdown

-

Fraud losses remain a major headline risk for financial firms. Global payment card fraud losses were reported at $33.41 billion for 2024.

-

Underwriting remains disciplined. TransUnion projected credit card balances reaching $1.18 trillion by the end of 2026, with the slowest annual growth since 2013 (excluding 2020).

-

Delinquency and household stress stay on the radar, which makes issuers more cautious about new accounts.

Credit Card Churning: The Plain-English Definition

Credit card churning is a strategy where someone opens credit cards mainly to earn welcome bonuses and perks, then manages the accounts over time. That can mean keeping the card, downgrading it, or closing it after the first year. It is not the same as “carding” or stealing card details.

Churning sits in a gray zone because it can be legal while still violating a bank’s terms. Banks can respond by denying a bonus, closing accounts, or limiting future approvals.

| Term | Simple Meaning | Typical Outcome |

|---|---|---|

| Churning | Bonus-focused applications with honest info | Approval risk, bonus restrictions, possible closures |

| Aggressive churning | High volume, fast cycling, thin relationship | Higher shutdown risk |

| Fraud | Deception, stolen identities, illegal use | Criminal risk and permanent bans |

Is Churning Illegal?

In many cases, churning is not a crime by itself if you provide truthful information and follow the law. But issuers can still enforce their own rules. They can decide you are not the customer they want.

The Bright Line You Should Not Cross

-

Do not lie on applications.

-

Do not misstate income or identity details.

-

Do not use anyone else’s identity.

-

Do not treat “hacking” as a how-to guide for breaking systems.

If you stay on the honest side, the biggest risk becomes financial and account-related, not legal.

Is “Credit Card Hacking” Dead? The Better Question To Ask

If you ask, “Is it dead?” you may get a dramatic answer. A better question is: “Which parts got harder, and which parts still work?”

The short version is this: churning still exists, but it demands more patience and better risk control. Many of the old loopholes are gone. Many of the easy approvals are gone. And many issuers have become comfortable saying “no” without explaining why.

| What People Mean By “Dead” | What’s Usually True |

|---|---|

| “I can’t get bonus after bonus.” | Many issuers restrict repeat bonuses more tightly now. |

| “Everyone gets shut down.” | Shutdowns happen, but they cluster around high-risk patterns. |

| “Points are worthless.” | Value changed, but good redemptions still exist with planning. |

The Language Problem

“Hacking” suggests breaking into something. Most churners are not doing that. They are playing inside a system built for marketing, and issuers are adjusting the rules when they see abuse.

The Real Shift In 2026

The skill today is less about finding an offer and more about managing:

-

issuer eligibility rules

-

timing and velocity

-

long-term credit health

-

shutdown risk

What Changed Heading Into 2026: The Trendlines That Matter

A few big forces shape the churning environment.

First, fraud remains a huge ecosystem problem. The FTC said consumers reported losing more than $12.5 billion to fraud in 2024, a jump from the year before. Second, global payment card fraud losses were reported at $33.41 billion in 2024. When losses rise, companies invest in detection and tighten access.

Third, consumer credit conditions influence issuer behavior. TransUnion’s 2026 consumer credit forecast points to moderated credit card balance growth and disciplined underwriting.

| Trend | Why It Affects Churning | What You’ll Notice |

|---|---|---|

| Higher fraud pressure | More screening and more caution | More denials, more verification |

| Disciplined underwriting | Less tolerance for “thin profit” customers | Fewer borderline approvals |

| Elevated delinquency concerns | Issuers protect portfolios | Conservative credit lines, tighter rules |

Automation Changed The Experience

More decisions happen instantly. That can be good for legitimate customers, but it also means fewer “manual saves” for borderline applications. A small pattern can trigger a denial or a bonus-ineligibility warning.

Rates And Fees Still Shape Rewards

High interest costs also matter. When interest rates stay elevated, issuers earn more from revolving balances but also face higher default risk. Federal Reserve consumer credit reporting tracks credit conditions and lending terms over time.

How Issuers Fight Bonus Abuse In 2026

Issuers rarely publish every internal rule. But the public pattern is clear: they are reducing repeat bonuses, limiting rapid account openings, and reacting faster when they see behavior they dislike.

One major change is clearer bonus eligibility language. For example, Capital One has publicly clarified bonus eligibility language for some products, including references to a 48-month window in published guidance and reporting.

| Issuer Control Type | What It Targets | What It Means For Users |

|---|---|---|

| Bonus eligibility limits | Repeat bonuses on the same product | You may be blocked for years or longer |

| Velocity rules | Too many new accounts quickly | “Too many recent accounts” denials |

| Relationship signals | Profitability and normal use | “Gaming” patterns raise risk flags |

The Famous “5/24” Style Restrictions

Chase’s “5/24 rule” is widely reported as a practical barrier for many cards: if you have opened five or more new cards in the past 24 months, you may be denied for many Chase products. It is not formally published in a single official rulebook, but it is consistently documented by major personal finance outlets.

Bonus Warnings And “Pop-Up” Eligibility Checks

American Express has become known for warning applicants during the application flow if they may not qualify for a welcome offer. Reporting and guides describe this as a “pop-up” style warning tied to bonus eligibility.

Shutdowns And Clawbacks

Banks can close accounts if they believe your behavior violates terms or indicates abuse. They may also deny or remove bonuses. This is one reason the “credit card hacking” label is risky. It attracts people who want shortcuts and do not plan for consequences.

The Economics: Why Big Bonuses Still Exist

If churning is such a headache for banks, why keep offering huge bonuses? Because rewards are a marketing engine. Issuers still compete for high-value customers. Co-branded cards compete for loyal travelers. Premium cards compete for affluent spenders.

But the economics only work if enough customers keep the cards, pay annual fees, or carry balances. When too many customers behave like short-term bonus seekers, issuers react.

| Economic Driver | Why Bonuses Exist | Why Rules Tighten |

|---|---|---|

| Customer acquisition | Bonuses attract attention | Abuse increases marketing cost |

| Annual fees | Premium cards monetize benefits | Low retention reduces profit |

| Interchange and spend | Spend generates revenue | Low spend after bonus looks unprofitable |

Devaluations Are Part Of The Cycle

Rewards programs adjust all the time. Sometimes points lose value. Sometimes perks become harder to use. Sometimes annual fees rise while credits multiply. Many users call this “couponization.” The pattern pushes serious travelers toward deeper planning and pushes casual users toward simpler cash back.

Why “Manufactured Value” Became Harder

Even when someone stays honest, issuers look for natural spending patterns. They do not want behavior that looks like a short-term extraction of value.

This is where credit card churning becomes less about tricks and more about long-term fit.

The Credit Score And Lending Side Effects People Underestimate

Credit score impact is not one simple yes or no. It depends on the profile and the pace.

Opening many accounts can reduce average age of credit. It can add hard inquiries. It can shift utilization. It can also help utilization if higher limits reduce your overall usage ratio. The same behavior can help one person and hurt another.

Also, lenders look beyond the score. They look at recent account behavior and risk signals. That is why a high score does not guarantee approvals.

| Factor | What Churning Can Do | Why It Matters |

|---|---|---|

| Inquiries | Adds hard pulls | Too many can lower approvals |

| Average age | Lowers age if many new accounts | Some lenders prefer older profiles |

| Utilization | Can improve if limits rise | Spikes can hurt short-term |

| Payment history | Any missed payment is costly | One miss can erase years of gains |

Credit Card Churning And Real-Life Lending Goals

If you plan to apply for a mortgage, a car loan, or business financing soon, churning can create noise in your profile. Even stable delinquency forecasts do not change the fact that lenders dislike uncertainty.

Who Should Avoid Churning

-

anyone who carries card balances month to month

-

anyone who struggles with organization

-

anyone with a major loan application in the next 6 to 12 months

-

anyone rebuilding credit after late payments

-

anyone tempted to overspend to hit a bonus

If that list fits you, a simple cash-back setup often works better.

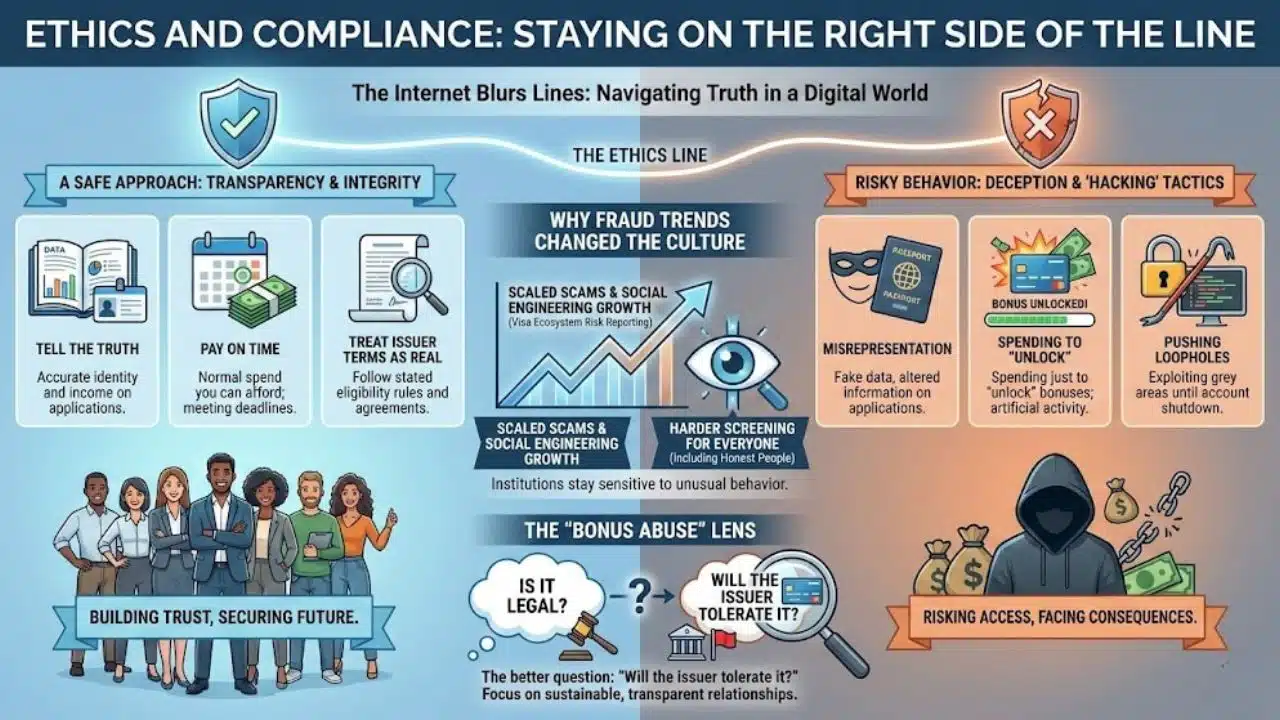

Ethics And Compliance: Staying On The Right Side Of The Line

This section matters because the internet blurs lines. Some creators present risky behavior as “smart.” Some hide the costs. And some promote illegal tactics under the word “hacking.”

A safe approach starts with a simple rule: tell the truth, pay on time, and treat issuer terms as real.

| Boundary | Safe Practice | Risky Practice |

|---|---|---|

| Application info | Accurate identity and income | Misrepresentation or fake data |

| Account use | Normal spend you can afford | Spending just to “unlock” bonuses |

| Terms | Follow stated eligibility rules | Pushing loopholes until shutdown |

Why Fraud Trends Changed The Culture

When fraud gets worse, everyone gets screened harder. That includes honest people. Visa’s ecosystem risk reporting has described scaled scams and social engineering growth, which helps explain why institutions stay sensitive to unusual behavior.

The “Bonus Abuse” Lens

Issuers may treat some churning patterns as “abuse” even when there is no crime. That is why the question “Is it legal?” is not the only question. The better question is “Will the issuer tolerate it?”

If Churning Feels Risky, What Works Better In 2026?

Here is the practical truth: most people do not need ten cards to earn meaningful rewards. They need a strategy that matches their life.

That might mean one strong cash-back card and one category card. Or it might mean two travel cards in the same ecosystem. The goal is fewer moving parts, less stress, and lower risk.

| Strategy | Best For | Why It Works |

|---|---|---|

| 2–3 card cash-back setup | Most households | Predictable value, low complexity |

| One ecosystem travel setup | Frequent travelers | Easier redemptions, fewer rules |

| Premium card plus keeper card | High spend and travel | Credits and perks can offset fees |

Sustainable Rewards, Not Constant New Accounts

Sustainable setups usually include:

-

autopay for at least the minimum payment

-

full payoff on a schedule you never break

-

a clear plan for annual fees

-

cards you actually use after the bonus

Travel Savings Without The “Hacking” Mindset

You can still save a lot without churn-heavy behavior:

-

flexible travel dates

-

off-peak travel

-

airline and hotel programs used thoughtfully

-

fare alerts and price tracking

-

picking cards based on routes you actually fly

This approach also avoids drawing attention from issuer risk systems.

Credit Card Churning In 2026: A Balanced Verdict

So, is credit card churning dead? No. But it is more selective, more monitored, and less forgiving.

Fraud pressure remains a key backdrop. The FTC reported more than $12.5 billion in consumer-reported fraud losses for 2024, and global payment card fraud losses were reported at $33.41 billion. Those numbers help explain why issuers keep sharpening tools and tightening policies.

At the same time, the credit market is not in “easy mode.” TransUnion’s forecast points to modest balance growth and disciplined underwriting, which often means stricter approval conditions for consumers who look risky or unprofitable.

| Final Take | What It Means |

|---|---|

| Churning isn’t gone | Offers exist and bonuses still attract customers |

| The rules are tougher | Eligibility limits and velocity controls are common |

| Risk is higher for casual users | Shutdowns and denials can be sudden |

| Simple strategies often win | Most people do better with fewer cards |

What To Watch Next

-

More bonus eligibility checks during applications

-

More dynamic underwriting tied to recent account behavior

-

Continued fraud-driven tightening across the payments ecosystem

Final Thoughts

Credit card churning still works for disciplined people who treat it like a long-term plan, not a thrill. But the “credit card hacking” vibe is outdated and risky. It encourages shortcuts in a system that now watches patterns more closely than ever.

If you choose to try credit card churning in 2026, keep it simple. Use fewer cards. Protect your credit goals. And remember that the safest rewards strategy is the one you can manage without stress.