Many people think stablecoins are all identical or just for crypto trading. Others worry they’re unsafe or tied to shady deals. These myths keep folks from seeing their real benefits, like fast digital payments or helping with decentralized finance.

The truth? Not all stablecoins work the same way. Some use U.S. treasuries as backing, while others rely on smart contracts. In this post, we’ll bust seven big myths about them—from money supply fears to risks of bank failures.

You’ll see why these digital currencies matter beyond speculation. Keep reading to get the facts straight.

Misconception #1: All stablecoins are the same

Stablecoins come in different flavors, each with its own backing and rules. Some, like USDC, are pegged to the U.S. dollar and hold reserves in cash and U.S. Treasuries. Others, like algorithmic stablecoins, rely on code to manage their value without full fiat backing.

Dante Disparte of Circle points out these differences matter for users.

Not all stablecoins work the same way or carry the same risks. Fiat-backed coins like those from Paxos Trust Company keep reserves, while others might not. Bank deposits and money market funds follow different rules too.

Understanding these distinctions helps avoid surprises when using digital payments or DeFi.

Misconception #2: Stablecoins are not fully backed by fiat currency

Many assume all stablecoins are backed one-to-one by cash in a bank. That’s not always true. Some use fiat currency reserves, like the US dollar, while others rely on assets like U.S. Treasuries or corporate debt.

Circle’s CSO Dante Disparte highlights this mix—proving not every stablecoin is created equal.

Not all stablecoins are backed by fiat, and that’s where confusion starts.

Transparency varies too. A few issuers publish audits showing full backing, but others operate in the shadows of shadow banking. FDIC insurance doesn’t cover most stablecoins either, unlike checking accounts.

Buyers should check reserve reports before trusting a coin’s stability claim. Words aside, the underlying asset matters—cash beats vague promises any day.

Misconception #3: Stablecoins create new money

Stablecoins don’t create new money like banks do. They are tied to real assets, such as U.S. Treasuries or fiat currencies. Each stablecoin issued must have matching reserves, preventing unchecked money creation.

Unlike fractional reserve banking, stablecoin issuers can’t lend out more than they hold. Dante Disparte of Circle points out that their structure limits risk compared to traditional credit systems.

Stablecoins support digital payments and DeFi without fueling inflation through extra currency supply.

Misconception #4: Stablecoins are slow and inefficient

Stablecoins, contrary to common belief, settle transactions in seconds or minutes on blockchain networks, far surpassing the speed of traditional banking systems. While banks may delay payments for days, especially over weekends and holidays, digital cash operates continuously without interruptions.

Some argue that processing slow equates to high fees for stablecoins. Yet, compared to credit card networks charging merchants rates of up to 3%, stablecoin payments are far more cost-effective, clearing peer-to-peer transfers almost instantaneously without intermediaries taking a cut.

Meanwhile, legacy financial institutions continue to face challenges, handling consumer loans and simple deposits between accounts domestically or across borders under outdated federal deposit insurance rules crafted long before the advent of the internet.

These older systems are struggling to keep up as the landscape of finance transforms globally through decentralized platforms. Regulators, despite their efforts, face difficulties catching up with the rapid changes surrounding virtual currencies.

Nonetheless, disruptive technologies persist in shaping the future of finance and economics, rendering progress inevitable, as history has shown time and again.

Misconception #5: Stablecoins are highly risky for users

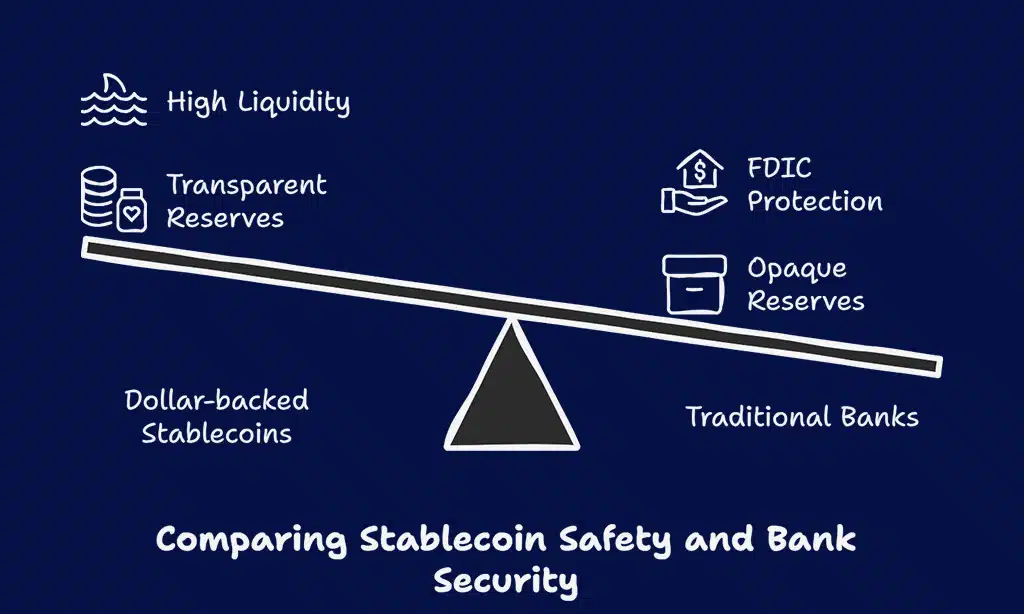

Many people think stablecoins are unsafe. That is not true for all types. Stablecoins like USDC have full backing from cash and U.S. Treasuries, making them as safe as bank deposits.

Circle’s CSO, Dante Disparte, points out recent bills miss this key fact.

Some fear they could vanish overnight like failed banks. Unlike traditional lenders facing a bank run, top dollar-backed stablecoins hold reserves you can check anytime. Their transparency acts like a safety net in financial markets.

No need to worry about the FDIC or bankruptcy code here – these assets stay liquid and ready for digital payments whenever needed.

Misconception #6: Stablecoins have no real-world use cases

Some think stablecoins just sit in digital wallets with no purpose, but they’re wrong. These tokens power fast, low-cost digital payments, help businesses avoid slow bank transfers, and even let people send money across borders cheaply.

Platforms like DeFi use them for lending or earning interest without traditional banks.

Stablecoins aren’t just for traders—they offer real solutions. Unbanked populations use them to store value securely, and merchants accept them to cut processing fees tied to credit cards.

Even central banks explore stablecoins for faster settlements. Dante Disparte of Circle notes their role in providing banking access where systems fail, proving critics wrong about their utility in everyday finance.

Misconception #7: Stablecoins facilitate financial crime

People often assume stablecoins make illegal activities easier. That’s not true. Stablecoin issuers follow strict anti-money laundering (AML) rules and KYC (Know Your Customer) standards just like banks.

Most operate under the same regulations as depository institutions.

Digital payments with stablecoins are traceable on public blockchains, making fraud harder to hide. Unlike cash, every transaction leaves a clear record. Law enforcement can track suspicious activity more effectively with blockchain transparency than with traditional money transfers.

Why Misconceptions About Stablecoins Persist

Many myths about stablecoins stay alive because folks confuse them with other digital currencies. People think all stablecoins work the same, but they don’t. Some hold U.S. Treasuries, others rely on complex algorithms or collateral like mortgages.

The Federal Reserve and monetary authorities haven’t made rules as clear as reserve requirements for banks. This lack of clarity fuels confusion, making it easy to lump stablecoins into one risky category, like uninsured bank deposits during a bankruptcy proceeding.

Another reason is how money moves in digital payments today. Stories about Silicon Valley Bank’s collapse scare people into thinking stablecoins face the same risks. Yet Dante Disparte from Circle argues that dollar-backed stablecoins aren’t inherently riskier than traditional savings accounts.

Misinformation spreads when terms like “credit creation” sound too technical for casual talks about DeFi or virtual currency. Without simple comparisons—like how money market mutual funds operate—the basics get lost in financial jargon and fear-mongering headlines about financial stability crimes involving shadow bankers unscathed by laws protecting insured depositors under receivership protocols at national credit unions facing liquidation scenarios worse than automatic stay protections granted through normal bankruptcy courts overseen by Martin J Gruenberg-appointed comptrollers who set interest rates based on outdated opinions rather than tracking underlying assets held inside every wallet controlled via decentralized finance apps nobody fully understands yet!

The Importance of Understanding Stablecoins

Stablecoins play a big role in digital payments and decentralized finance (DeFi). Knowing how they work helps users make smart choices. Some think all stablecoins are the same, but they come in different forms, like those backed by U.S. Treasuries or fiat currency.

Misinformation can lead to unnecessary fear. Dante Disparte from Circle points out that stablecoins aren’t just for trading—they offer real-world uses, like low-cost banking solutions.

Unlike risky assets, well-backed stablecoins can be safer than bank deposits if rules are clear. Understanding them unlocks their potential in the financial system without falling for myths.

Future Potential of Stablecoins

Stablecoin growth could reshape digital payments worldwide by making transactions faster—and cheaper—than traditional banking systems offer today (Federal Reserve Banks take note).

These tokens already help people move money across borders without high fees or delays tied up with national currencies like dollars or euros (Martin J Gruenberg might agree).

Their ties backings—like U.S Treasuries held securely under issuers such Circle’s CSO Dante Disparte —show promise beyond crypto trading too; think mortgage loans settled instantly via smart contracts instead paperwork nightmares during bankruptcy proceedings elsewhere! With clearer rules coming soon maybe even National Credit Union Administration members will tap them daily someday soon enough?

Takeaways

Stablecoins aren’t all cut from the same cloth. They prove useful for fast digital payments, not just crypto trading. Some think they print money, but real ones are backed by cash or assets like U.S. Treasuries.

Banks and regulators worry about risks, yet stablecoins offer safety when rules are clear. They help people without banks move money cheaply and quickly. Knowing the truth helps us use them right while keeping scams at bay.

FAQs

1. Are stablecoins backed by U.S. treasuries?

Not always. Some stablecoins use U.S. treasuries for backing, but others rely on different assets like securities or national currency reserves.

2. Do stablecoins offer consumer protection like banks?

Nope. Unlike bank deposits, stablecoins lack full consumer protection. Martin J. Gruenberg has warned about risks during bankruptcies or liquidating events.

3. Can stablecoins replace digital payments entirely?

They’re handy for digital payments, but hurdles exist. The monetary authority and the Office of the Comptroller of the Currency still debate their role.

4. Do stablecoins pay interest like bank accounts?

Some do, but it’s not guaranteed. Interest on excess reserves isn’t standard, and terms vary by issuance.

5. Are stablecoins immune to market crashes?

Far from it. They’re tied to real-world assets, so if those tank, stablecoins feel the heat. Options exist to limit risk, but nothing’s bulletproof.