Southeast Asia’s car market is changing in a way you can feel, not just measure. You see it in new showroom banners, new badge names, and new model launches that arrive faster than people expect. You also see it in street traffic, where unfamiliar EVs and compact SUVs are showing up in growing numbers.

At the center of this shift is one clear trend: Chinese car brands in Southeast Asia are gaining ground quickly. This is not only about “cheap cars.” It is about timing, strategy, and how buyers are changing. Prices are competitive, features are rich, and EV lineups are arriving when governments and consumers are finally ready to move.

This article stays objective. It explains what is driving the rise, where the momentum is strongest, and what buyers should check before signing a deal. It also covers why legacy leaders are under pressure, and what could slow down the surge.

Quick Snapshot: What’s Actually Happening In Southeast Asia’s Car Market

The simplest way to describe the moment is this: the market is not flipping all at once, but the growth is happening where attention is highest. In many countries, Japanese brands still lead overall. But Chinese brands are winning share in the fastest-growing segments, especially EVs and tech-heavy models.

This matters because market shifts usually begin at the edges, then move inward. A region that was once “stable” becomes “competitive,” and then becomes “redefined.” Southeast Asia is now in the competitive phase, and the direction is clear.

Another reason this shift feels bigger than it is on paper is visibility. Chinese brands are marketing aggressively and placing cars in high-traffic areas. That changes perception fast. Once buyers see a model repeatedly, it stops feeling unfamiliar.

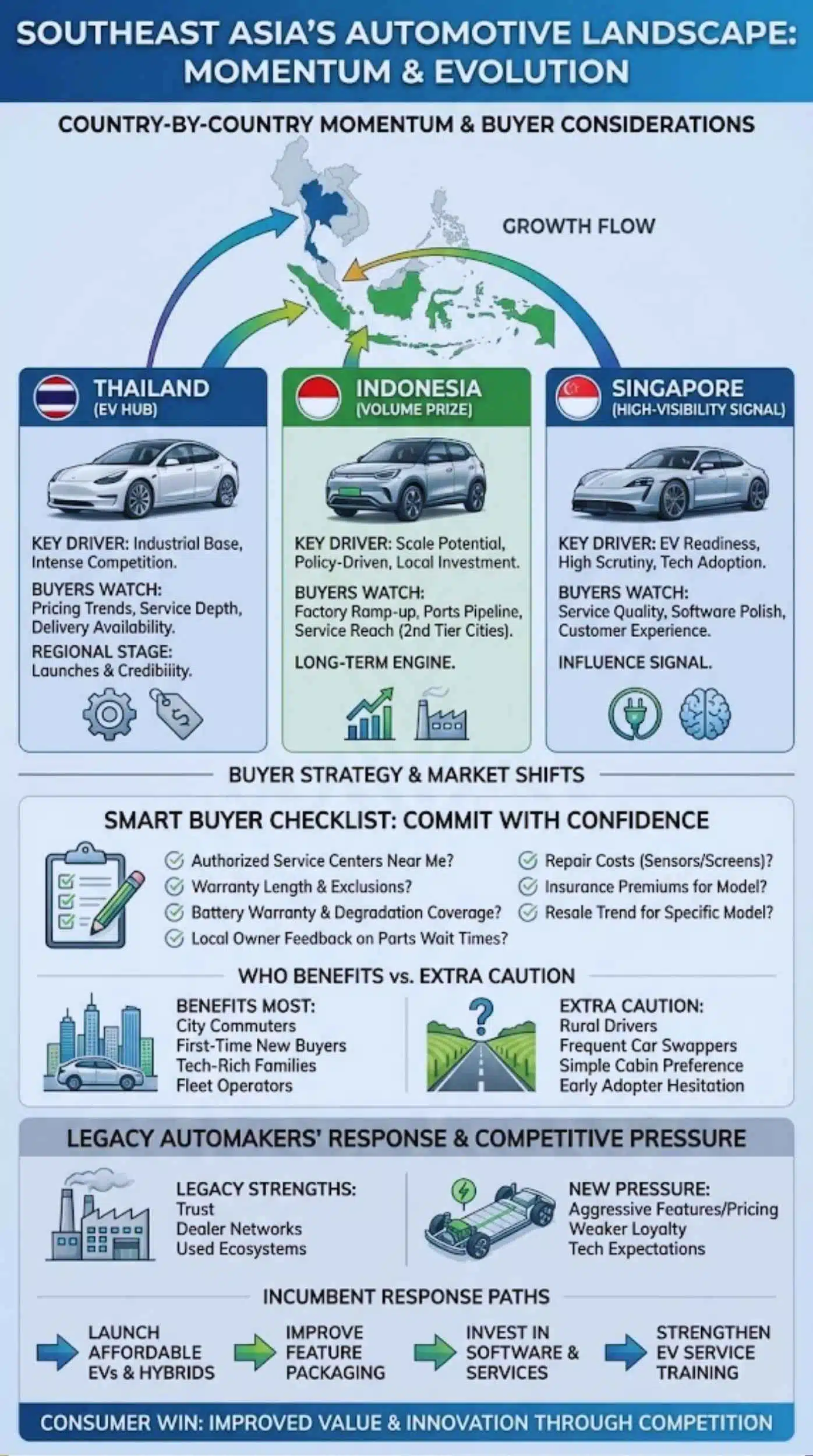

Finally, Southeast Asia is not one market. Thailand, Indonesia, and Singapore each play different roles. Thailand acts like a stage for EV adoption and production. Indonesia acts like the long-term volume prize. Singapore acts like a high-visibility signal market.

The New Competitive Map: Legacy Leaders vs New Challengers

For decades, buyers in the region trusted familiar strengths: durability, easy resale, and huge service networks. That favored Japanese brands and, to a smaller extent, Korean brands. The new challengers are not trying to beat legacy brands at everything on day one. They are targeting pressure points where consumers are more flexible.

One pressure point is “value expectation.” Buyers now expect advanced screens, safety aids, and connected features even in mid-range trims. Another pressure point is EV readiness. When buyers decide to go electric, they often feel less emotionally tied to old brand habits.

Chinese brands also benefit from being “new.” That sounds odd, but it can work. New entrants can design interiors around modern habits, not old layouts. They can ship new models faster and refresh them more often.

At the same time, not all challengers are equal. Some brands look polished and consistent. Others look fast but uneven. That is why buyers must compare brand-by-brand, not “China vs Japan” in a single sentence.

The Growth Signals That Matter

When you want to understand momentum, ignore hype and look for repeated signals. A brand that sells a few headline models might be experimenting. A brand that expands dealers, adds service centers, and builds factories is making a long bet.

The big signals include:

- Rapid dealer footprint growth, especially beyond capital cities

- Local assembly or factory investments

- Frequent new model launches in popular body styles

- Strong fleet deals that put cars on the road quickly

- High conversion rates from test drives to purchases

Another key signal is export behavior. If a country becomes a production base, it changes the economics for everyone. That can lower prices, stabilize supply, and create new political support for the brands investing there.

Which Brands Are People Seeing Most Often

Across Southeast Asia, you will repeatedly hear the same names in EV and compact SUV conversations. Many buyers mention BYD, MG, Great Wall Motor, Chery, and Wuling-related models, depending on the local importer and dealer network.

This does not mean those brands dominate everywhere. It means they are visible enough to shape buyer choices. Visibility is the first step to adoption. After that, service quality and ownership satisfaction decide whether growth lasts.

Quick Snapshot Summary

| What You’re Seeing | What It Means | Why It Matters To Buyers |

| More Chinese showrooms and mall pop-ups | Brands are buying visibility | Reduces “unknown brand” fear |

| EV models leading attention | EV demand is pulling new entrants | EV buyers compare differently |

| Factory and assembly plans | Long-term commitment | Helps pricing and parts supply |

| More feature-packed trims | “Value” expectations rising | Shifts what buyers demand |

Reason 1: Aggressive Pricing And High “Value Per Dollar”

Pricing is the first reason many buyers notice. In markets where monthly payment matters more than brand loyalty, a sharp price can overcome hesitation. Chinese brands often enter with prices that undercut rivals or match rivals while offering more equipment.

But pricing alone is not the full story. The bigger story is value perception. Buyers feel they are getting a “higher class” cabin or tech package for the same money. That feeling is powerful, especially for first-time new-car buyers upgrading from used cars.

Pricing also influences online conversation. When a model is priced aggressively, it becomes a viral comparison topic. Social media and review channels amplify it. That creates momentum that traditional advertising cannot easily replicate.

There is also a strategic element. Some brands may accept thinner margins early to gain market share. That can be risky long term, but it is effective short term. The goal is to become a normal choice, not a curiosity.

Why Prices Can Be So Competitive

Chinese automakers benefit from scale and intense home-market competition. High volume production can lower component costs. Fast product cycles can improve manufacturing efficiency. And supply chains built for large domestic demand can support exports.

Another factor is trim strategy. Many Chinese brands bundle features into fewer variants. That can simplify production and reduce dealer complexity. It can also make the buyer feel like they are not being “upsold” for basics.

Logistics and localization also change pricing. When assembly moves closer to the buyer, costs can drop. Over time, that can support stable pricing rather than one-time “launch discounts.”

Value Beyond Price: Features Buyers Notice Immediately

Showroom decisions often happen emotionally first, logically second. Features that trigger “wow” include big screens, modern lighting signatures, 360-degree cameras, and clean cabin design.

Common value features buyers talk about:

- Large infotainment screens with sharp visuals

- Digital driver displays with multiple modes

- 360-degree cameras and parking sensors

- Driver-assistance packages, depending on model

- Connected apps for vehicle status and controls

- Premium-looking seats and trims in mid-range variants

This does not guarantee better ownership. But it improves first impressions. And first impressions sell cars.

Ownership Math That Converts Shoppers

A buyer might like a car, but still hesitate. Ownership math closes the gap. If the monthly payment is lower, or the warranty is longer, the risk feels smaller.

Ownership questions buyers ask:

- What is the warranty length and what is excluded?

- How much will scheduled maintenance cost?

- How long do parts take to arrive?

- Is insurance expensive because of sensors and screens?

- How quickly does the model lose value in the used market?

When brands offer clear answers and strong packages, adoption becomes easier.

Pricing And Value Drivers

| Lever | What Brands Do | Buyer Effect |

| Entry price | Lower sticker or promo pricing | Faster interest and test drives |

| Feature bundling | More tech at lower trims | Strong “value for money” feeling |

| Warranty packages | Longer coverage, service plans | Reduces risk perception |

| Financing deals | Low down payment options | Expands eligible buyer pool |

Reason 2: EV Leadership Arrived At The Perfect Moment

EV timing is a major accelerator. Southeast Asia is now at a stage where EVs are no longer niche, but still early enough that brand loyalty is flexible. That is the sweet spot for new entrants.

Governments in the region are using incentives, tax tools, and industrial policies to attract EV investment. Consumers are also paying more attention to running costs, fuel price swings, and the idea of “future-proof” vehicles.

Chinese automakers arrived with EV products ready at scale. They did not need to wait years to build lineups. They had models, battery supply, and platform experience already in motion.

This matters because early movers shape perception. If buyers associate “EV choice” with a few brands early on, those brands enjoy compounding advantages.

Why Southeast Asia’s EV Push Created A Demand Window

Southeast Asia has dense cities and heavy daily commuting. That creates strong demand for efficient mobility. EVs also fit well in places where short daily travel is common, especially if home charging is possible.

At the same time, infrastructure varies. Some countries are building fast-charging quickly. Others are slower. So the EV opportunity is uneven, but still large.

The demand window exists because:

- Incentives make EV prices more competitive

- New EV options are arriving in popular body styles

- Buyers want modern tech and quiet driving

- Businesses want lower running costs for fleets

EV growth often begins in cities, then spreads outward as charging grows.

Chinese EV Supply Met Demand Faster Than Others

Chinese brands have invested heavily in EV platforms, battery supply chains, and rapid model development. That allows them to offer multiple models across price bands quickly.

They also tend to launch EVs in segments Southeast Asia likes:

- Compact and mid-size SUVs

- City EVs for urban use

- Family-friendly crossovers

- Occasionally performance-style variants to build brand image

Speed matters because incentives and buyer interest can change within a few years. Brands that arrive early capture the first wave.

Practical EV Lineups, Not Just Flagships

EV success in Southeast Asia is not about luxury flagships alone. It is about usable vehicles that handle heat, rain, traffic, and mixed road conditions.

Practical EV design points that matter locally:

- Strong air-conditioning performance

- Heat management for batteries and cabin systems

- Ground clearance and suspension tuning

- Clear charging guidance from dealers

- Simple user interfaces for daily use

Buyers also care about battery warranty terms and what happens if the battery degrades faster than expected. Brands that communicate clearly win trust faster.

EV Timing Advantage

| EV Factor | Why It Helps | What Buyers Should Check |

| Incentives and tax benefits | Lowers effective price | Eligibility rules, policy changes |

| More EV models available | More choice across budgets | Safety ratings, real-world range |

| Platform maturity | Better efficiency and packaging | Warranty and service readiness |

| City-ready segments | Matches ASEAN demand | Charging access and resale outlook |

Reason 3: Local Factories And Partnerships Are Cutting Lead Times And Building Trust

Imports can start a trend, but localization sustains it. When brands build plants, assemble locally, or deepen partnerships, they reduce cost and improve supply stability. That changes the buying experience.

Local production can also reduce delivery delays. It can support faster parts supply. It can create local jobs, which increases political goodwill. Over time, it can shift the industry structure of entire countries.

For buyers, localization is a psychological anchor. It signals commitment. It suggests the brand is less likely to disappear or leave owners stranded without service support.

For governments, localization is economic leverage. It turns EV adoption into industrial development, not just consumer spending.

Why Local Assembly Matters For Buyers

Local assembly can influence:

- Price stability

- Availability of popular trims

- Faster repair and parts pipelines

- Growth of local supplier ecosystems

It also changes dealer confidence. Dealers invest more when they see stable supply and long-term brand planning.

Buyers should still confirm service coverage. A factory does not automatically mean every city has great service. But it is often a positive signal.

Big Bets: Plants, Capacity, And Long-Term Presence

Manufacturing decisions are expensive and slow to reverse. That is why they are strong signals.

When brands build in the region, they often aim for:

- Local sales supply

- Export opportunities to nearby markets

- Access to incentives tied to local production

- Lower exposure to import rule changes

As production scales, the market can see:

- More competitive pricing

- More model variants

- Faster delivery times

- More stable parts supply

Supplier Ecosystems And Job Creation As A Competitive Advantage

Cars are not only built by automakers. They depend on suppliers: seats, plastics, electronics, tires, and software services. When factories arrive, suppliers follow.

This can create clusters, especially in places like Thailand’s automotive zones. Clusters improve efficiency and reduce cost over time.

For Chinese brands, this is a path to normalcy. When local suppliers and technicians are trained around a brand, that brand becomes harder to displace.

Localization Benefits And Risks

| Localization Move | Benefit | Potential Risk |

| Local assembly | Lower costs, faster supply | Early quality consistency challenges |

| Local supplier growth | Better parts availability | Supplier ramp-up takes time |

| Export production | Scale economics | Dependence on export demand |

| Partnerships | Faster market access | Coordination and brand control issues |

Reason 4: Software, Connectivity, And Smart Features Are Reshaping Buyer Priorities

Many car buyers now judge a vehicle by how it feels to use every day. The screen response, the camera clarity, the voice system, and the phone integration matter more than before.

This shift favors brands that treat cars like consumer technology. Many Chinese automakers built their product identity around digital cockpits, connected apps, and fast design updates.

EVs amplify this trend because EVs are naturally more digital. They often rely on software to manage energy, charging, and driver displays. That makes user experience a direct part of perceived quality.

But software also introduces new expectations. Buyers expect updates. They expect bugs to be fixed. They expect localization that feels natural in their language and region.

Cars Are Becoming Consumer Tech Products

A modern car is no longer just engine, gearbox, and body. It is also:

- Touchscreen interface quality

- Camera and sensor integration

- App ecosystem and connectivity

- Driver-assistance behavior and tuning

- Update support over the life of the car

This changes competition. Brands that were once “good enough” mechanically must now compete in UI and experience.

For younger buyers, the cabin experience can outweigh brand history. That is why new entrants can win quickly.

What Chinese Brands Often Do Well In This Area

Many Chinese models focus heavily on cabin tech. They design for:

- Large screens and clean layouts

- Strong camera systems for parking

- Feature bundling that feels premium

- Digital controls that reduce button clutter

In some cases, this produces a more “modern” feel than competitors in the same price bracket. That can be a decisive advantage in short test drives.

Still, buyers should evaluate stability. Some systems are excellent. Others can feel rushed. It depends on the model and the local software version.

The Legacy Automaker Challenge

Legacy brands have strengths: reliability history, deep service networks, and resale stability. But software is a different kind of challenge. It requires rapid iteration, UI talent, and connected services management.

Some incumbents are improving quickly. Others are moving slower. The gap is visible to buyers who test drive across brands.

This is why the competition is not only about EV motors. It is about experience, and experience is now a major buying factor.

Software Advantage And Buyer Checks

| Feature Area | Why It Sells | What To Verify Before Buying |

| Infotainment speed | Feels premium instantly | Lag, bugs, long-term updates |

| Camera systems | Easier parking in cities | Repair cost if damaged |

| Connected apps | Convenience and control | App support in your country |

| Driver-assist tech | Comfort and safety feel | Local calibration and service skill |

Reason 5: Dealer Expansion, Marketing, And Financing Are Removing Adoption Friction

Even the best product fails if buyers cannot access it. Chinese brands have moved quickly to build distribution and reduce purchase barriers.

They are using modern retail tactics. They place cars in malls. They run frequent test drive events. They push online-to-offline sales funnels. They support aggressive financing options in many markets.

This creates a “try it first” environment. Once buyers try, the feature-rich experience and competitive pricing can do the rest.

The result is fast diffusion. Brands that were unknown become common within a short period, especially in large cities.

But this is also where long-term trust is tested. After-sales service must catch up with sales volume. Otherwise, early problems can damage reputation quickly.

Visibility Plays: Showrooms, Pop-Ups, Test Drives

Visibility is not only advertising. It is physical presence and repeated exposure. Pop-ups in high-traffic locations accelerate familiarity.

This strategy works well in Southeast Asia because:

- Cities have heavy mall traffic

- Buyers like to see and touch cars before buying

- Word-of-mouth spreads fast through social networks

- New EVs generate curiosity and discussion

When people see a model repeatedly, it starts to feel “normal.” That changes purchase psychology.

Financing And Fleet Deals Accelerate Market Share

Financing is often the real battleground. If a brand can offer better monthly terms, it can steal buyers from older preferences.

Fleet deals also change perception quickly. A model used for business fleets becomes a moving billboard. It signals that the car is “usable,” not just “interesting.”

Fleet growth can also push service readiness faster, because fleets demand uptime and structured maintenance.

After-Sales Networks Are Catching Up

Service quality is the make-or-break factor. Buyers will forgive small issues if service is fast, honest, and predictable. They will not forgive long waits, unclear warranty decisions, or parts shortages.

A smart buyer will ask:

- How many service centers are within reach?

- What is the usual parts wait time?

- Is there roadside assistance?

- Are technicians trained specifically for EV high-voltage systems?

Brands that scale service well will turn early adoption into repeat customers.

Ecosystem Drivers

| Ecosystem Lever | What It Changes | Buyer Impact |

| Dealer footprint | Access and convenience | Easier purchase and service |

| Financing offers | Monthly affordability | More buyers can upgrade |

| Test-drive campaigns | Confidence | Faster adoption for new brands |

| Service expansion | Ownership satisfaction | Protects reputation and resale |

Country-By-Country: Where The Momentum Is Strongest

Southeast Asia’s “takeover” story is not uniform. Some markets move fast. Others move slower due to incentives, taxes, and infrastructure.

Thailand is often the EV spotlight. Indonesia is the long-term volume engine. Singapore is the high-visibility quality signal. Malaysia, Vietnam, and the Philippines each have different constraints.

If you want to understand the regional pattern, focus on what each country “rewards.” Some reward low cost. Some reward local production. Some reward infrastructure readiness.

This country variation also shapes brand strategy. A brand might lead in one country and struggle in another.

Thailand: The EV Beachhead And Manufacturing Hub

Thailand has long been a major automotive manufacturing base. That industrial strength makes it naturally attractive for EV investment and assembly.

In Thailand, competition is intense. EV models compete hard on price, features, and delivery availability. Buyers compare across brands quickly. That pushes the market forward but also creates price pressure.

Thailand also acts as a “regional stage.” If a brand wins in Thailand, it often gains credibility in nearby markets. That is why so many launches happen there first.

Over time, production and export strategies can reshape pricing across the region.

Indonesia: The Big Prize Market

Indonesia is the volume prize because of its size and long-term growth potential. It is also a policy-driven market where local investment can unlock advantages.

Chinese brands see Indonesia as a place to plant roots, not just sell imports. Local assembly and production plans matter here.

Indonesia’s EV growth may move in waves, tied to incentives and charging expansion. When it accelerates, it could shift regional leadership.

For buyers, Indonesia’s scale also means second-tier cities matter. Service reach will be a key test.

Singapore: A High-Visibility Signal Market

Singapore is smaller in unit sales but big in influence. It has stronger charging readiness and a market culture that responds quickly to EV value and new tech.

When a brand performs well in Singapore, it sends a signal. It tells the region that the brand can compete in a highly regulated environment where buyers compare carefully.

Singapore can also highlight strengths and weaknesses early, especially around software, service quality, and customer experience.

Country Differences

| Country | Key Driver | What Buyers Should Watch |

| Thailand | EV momentum and industrial base | Pricing trends, service depth |

| Indonesia | Scale and localization incentives | Factory ramp-up, parts pipeline |

| Singapore | EV readiness and high scrutiny | Service quality, software polish |

| Malaysia/Vietnam/Philippines | Mixed constraints | Incentives, charging pace, taxes |

What This Means For Buyers

Buyers are the real winners in many ways. More competition usually means better pricing, more features, and faster innovation. But buyers also face more complexity, because brand history is shorter and resale patterns are still developing.

The smart approach is simple: do not buy based on hype. Buy based on fit. That means checking service coverage, warranty terms, and real-world owner experiences in your area.

If you are buying an EV, add charging reality to your checklist. If you are buying a tech-heavy model, add repair costs and parts timing to your thinking.

You can get an excellent deal today if you do basic homework.

A Smart Buyer Checklist Before Choosing

Ask these questions before you commit:

- How many authorized service centers are near me?

- What is the warranty length, and what does it exclude?

- What is the battery warranty, and does it cover degradation?

- What do local owners say about parts wait times?

- Are repairs expensive due to sensors, cameras, or screens?

- Is insurance higher for this model?

- What is the resale trend for this specific model?

Also check comfort basics. A great screen does not matter if the seats, air-conditioning, or ride comfort do not fit your daily life.

Who Benefits Most Right Now

These buyers often gain the most value:

- City commuters who want lower running costs

- First-time new-car buyers upgrading from used cars

- Families wanting a tech-rich SUV at a manageable price

- Fleet operators focused on total cost of ownership

These groups care less about “legacy brand history” and more about present-day value.

Who Should Be Extra Cautious

Some buyers should take extra care:

- Rural drivers far from service centers

- Buyers who swap cars often and depend on strong resale

- People who prefer simple cabins with fewer electronics

- Anyone uncomfortable being an “early adopter” of a new model

Caution does not mean “avoid.” It means “verify more.”

Buyer Fit Guide

| Buyer Type | Why It Works | Key Risk To Check |

| Urban EV buyer | Low running costs, modern features | Charging access, battery warranty |

| Budget-conscious family | Strong value for money | Service coverage, safety features |

| Fleet operator | Financing and operating cost logic | Uptime, parts supply consistency |

| Rural driver | Possible if service exists | Distance to service, repair delays |

What This Means For Legacy Automakers

Legacy automakers still have major strengths in Southeast Asia. They have trust, broad dealer networks, and strong used-car ecosystems. That matters a lot in value-sensitive markets.

But the new competition is forcing them to respond faster. Buyers now compare features and pricing more aggressively. EVs also weaken old loyalty patterns because EV platforms and experiences feel newer across the board.

Legacy brands must win on both technology and experience, not only reliability. That is a big shift.

We are likely to see incumbents:

- Launch more affordable EVs and hybrids

- Improve feature packaging at lower trims

- Invest more in software and connected services

- Strengthen EV service training across dealer networks

This competitive pressure can be good for consumers, because it pushes everyone to improve.

Incumbent Response Paths

| Legacy Strength | New Pressure | Likely Response |

| Service networks | New brands expanding quickly | EV technician training, service upgrades |

| Brand trust | EV buyers less loyal | Stronger warranties, new campaigns |

| Resale ecosystems | Used market uncertainty | Certified programs, value guarantees |

| Manufacturing base | New EV investments arriving | Plant shifts, local production strategy |

Final Thoughts: What To Watch Next

The rise of Chinese car brands in Southeast Asia is not a single-wave event. It is a multi-factor shift driven by pricing, EV timing, localization, software-led experiences, and fast distribution strategies.

The big question is durability. Can these brands maintain quality, service consistency, and resale stability as volumes grow? The next few years will answer that.

Watch these signals:

- Service expansion outside capital cities

- Parts availability and repair turnaround times

- Resale value trends after the first ownership cycles

- Policy changes that reshape incentives and import rules

- How quickly incumbents close the tech and EV gap

If service quality keeps improving and local production scales smoothly, the momentum will likely continue. If service or reliability gaps widen, growth could slow.

Either way, the market is already more competitive than it was a few years ago. And for most buyers, more competition usually means better deals, better cars, and faster innovation—especially as Chinese car brands in Southeast Asia keep raising expectations.

FAQs

Which Chinese car brands are most popular in Southeast Asia right now?

Popularity varies by country, but buyers often compare brands like BYD, MG, Great Wall Motor, Chery, and Wuling-linked models. The strongest visibility is usually in EVs and compact SUVs.

Are Chinese cars reliable for long-term ownership?

Some models perform very well, while others are still building a track record. Reliability depends on the specific model and how strong the local service network is. Always check warranty terms and owner feedback in your city.

Why are Chinese EVs often more affordable than rivals?

Scale production, intense competition, and mature EV supply chains can lower costs. Many brands also bundle features aggressively, which increases value at a given price.

Do Chinese brands offer good after-sales service in ASEAN countries?

Service quality differs by brand and location. Major cities often have stronger coverage than smaller towns. Before buying, confirm service center distance and typical parts wait times.

Will resale value improve over time?

It can, especially if local production grows and service networks become consistent. But rapid model refresh cycles can keep used prices volatile in the short term.

What is the safest way to choose among new brands?

Test drive multiple models, compare warranties line by line, and check local owner communities for service experiences. Choose based on fit, not hype.