As we step into our golden years, financial planning becomes even more crucial. Managing expenses effectively ensures a comfortable lifestyle and peace of mind. One area where senior citizens can significantly cut costs is car insurance. With decades of driving experience under their belt, many seniors qualify for specialized car insurance discounts for senior citizens that reward their safe driving habits and limited mileage.

These discounts not only help reduce premiums but also enable seniors to maintain their independence without financial strain.

This article delves into the various ways seniors can leverage these discounts to make the most of their car insurance.

Why Choose Car Insurance Discounts for Senior Citizens?

Rising Insurance Costs for Seniors

Car insurance premiums often increase as drivers age due to perceived higher risks. Factors such as slower reflexes, vision changes, and the likelihood of medical emergencies can lead to higher rates.

Additionally, seniors are often placed in higher-risk categories despite decades of driving experience. This can result in increased premiums, even for those with excellent driving records.

Benefits of Discounts

Car insurance discounts for seniors help alleviate financial strain while rewarding safe driving habits. These discounts also encourage seniors to stay insured and maintain responsible driving behaviors.

By utilizing available discounts, seniors can save hundreds of dollars annually, making essential coverage more affordable. These savings are especially valuable for retirees living on a fixed income.

Common Eligibility Criteria

Most senior discounts require drivers to meet specific criteria, such as:

- Being above a certain age (e.g., 55 or 65).

- Maintaining a clean driving record.

- Completing safety courses or driving fewer miles annually.

Understanding these criteria can help seniors proactively prepare to claim available discounts.

Top 10 Car Insurance Discounts for Senior Citizens in 2025

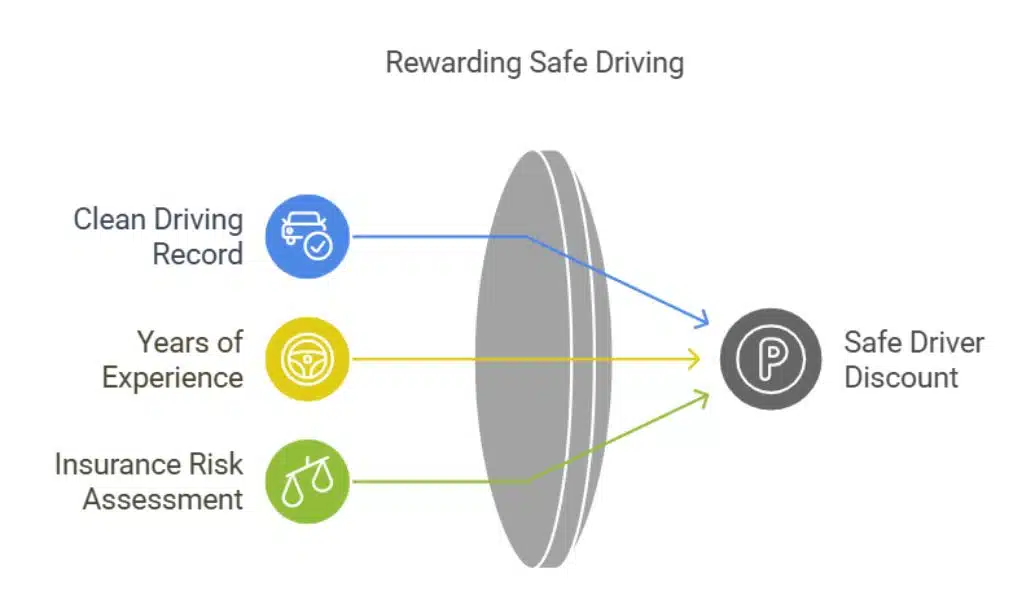

1. Safe Driver Discounts

This discount rewards seniors with a clean driving record. If you haven’t had any accidents or claims in recent years, you’re likely eligible.

Why It Matters:

Seniors often have years of driving experience, which can translate to lower risks for insurers. Recognizing this, companies reward accident-free drivers with significant savings.

Key Details:

- Eligibility: No accidents or violations within the last 3–5 years.

- Savings: Up to 20% off premiums.

Example:

XYZ Insurance offers up to 20% savings for seniors who maintain an accident-free record.

| Provider | Eligibility | Savings |

| XYZ Insurance | 3 years without accidents | Up to 20% |

| ABC Insurance | Clean record for 5 years | 15% |

2. Defensive Driving Course Discounts

Many insurers provide discounts for seniors who complete approved safety courses. These programs help refresh driving skills and teach defensive techniques.

Why It Matters:

Studies show that drivers who complete defensive driving courses are less likely to be involved in accidents. For seniors, these courses can improve confidence on the road.

Key Details:

- Eligibility: Completion of a certified defensive driving course.

- Savings: 5–15% off premiums.

- Additional Benefits: Some states mandate insurers to offer these discounts.

Example:

DEF Insurance offers a 10% discount to seniors who complete their state’s approved course.

| Provider | Course Requirement | Savings |

| DEF Insurance | State-certified course | 10% |

| GHI Insurance | Online or in-person training | 12% |

3. Low Mileage Discounts

Seniors who drive fewer miles annually can qualify for low mileage discounts. Insurers view low mileage as a reduced risk of accidents.

Why It Matters:

Many seniors drive less frequently after retirement. Lower mileage translates to fewer opportunities for accidents, which insurers reward with reduced premiums.

Key Details:

- Eligibility: Driving under insurer-specific mileage thresholds (e.g., 7,500 miles/year).

- Savings: Up to 15% off premiums.

Example:

ABC Insurance offers up to 15% savings for driving under 10,000 miles annually.

| Provider | Mileage Threshold | Savings |

| ABC Insurance | Under 7,500 miles/year | 15% |

| XYZ Insurance | Under 10,000 miles/year | 10% |

4. Multi-Policy Discounts

Bundling car insurance with other policies, such as home or life insurance, can lead to significant savings.

Why It Matters:

Insurers encourage policy bundling to retain customers. Seniors with multiple policies can benefit from simplified billing and lower combined rates.

Key Details:

- Eligibility: Having multiple policies with the same insurer.

- Savings: Up to 25% off combined premiums.

Example:

JKL Insurance offers a 20% discount for bundling auto and home insurance.

| Provider | Policies Bundled | Savings |

| JKL Insurance | Auto + Home | 20% |

| MNO Insurance | Auto + Life | 15% |

5. Affiliation or Membership Discounts

Membership in senior organizations, such as AARP, often qualifies drivers for exclusive discounts.

Why It Matters:

Organizations like AARP negotiate special discounts with insurers to provide members with added value. Joining these groups can lead to ongoing savings.

Key Details:

- Eligibility: Active membership in approved organizations.

- Savings: 10–15% off premiums.

Example:

PQR Insurance offers 10% savings for AARP members.

| Provider | Affiliation Requirement | Savings |

| PQR Insurance | AARP membership | 10% |

| STU Insurance | Senior club membership | 12% |

6. Loyalty Discounts

Insurers reward long-term policyholders with loyalty discounts, recognizing their continuous relationship.

Why It Matters:

Seniors often stay with the same insurer for years, making them prime candidates for loyalty rewards. These discounts strengthen customer-insurer relationships.

Key Details:

- Eligibility: Staying with the same insurer for several years.

- Savings: 5–15% off premiums.

Example:

GHI Insurance offers 15% savings for policyholders with over five years of loyalty.

| Provider | Years of Loyalty | Savings |

| GHI Insurance | 5+ years | 15% |

| ABC Insurance | 3+ years | 10% |

7. Hybrid or Electric Vehicle Discounts

Seniors who own hybrid or electric vehicles may qualify for eco-friendly discounts.

Why It Matters:

Hybrid and electric vehicles contribute to environmental sustainability, and insurers incentivize their use with discounts.

Key Details:

- Eligibility: Owning a qualifying vehicle.

- Savings: Up to $200 annually.

Example:

LMN Insurance offers up to $200 in savings for electric vehicle owners.

| Provider | Vehicle Type | Savings |

| LMN Insurance | Hybrid/Electric | $200/year |

| OPQ Insurance | Hybrid only | $150/year |

8. Pay-As-You-Drive Discounts

Telematics-based policies reward safe and low-mileage driving habits.

Why It Matters:

Telematics programs use technology to monitor driving behavior. Seniors who drive carefully and infrequently can enjoy substantial savings.

Key Details:

- Eligibility: Enrolling in a usage-based insurance program.

- Savings: Up to 30% off premiums.

Example:

RST Insurance offers 25% savings for seniors enrolled in telematics programs.

| Provider | Program Type | Savings |

| RST Insurance | Usage-based tracking | 25% |

| UVW Insurance | Safe driving program | 30% |

9. Senior-Specific Discounts

Some insurers offer direct discounts for seniors based on age.

Why It Matters:

Age-specific discounts acknowledge the unique needs of older drivers, offering tailored savings.

Key Details:

- Eligibility: Being above the insurer’s minimum age threshold (e.g., 55+ or 65+).

- Savings: 10–20% off premiums.

Example:

VWX Insurance offers 15% savings for drivers aged 65 and older.

| Provider | Age Requirement | Savings |

| VWX Insurance | 65+ | 15% |

| YZA Insurance | 55+ | 10% |

10. Family Plan Discounts

Adding seniors to a family insurance plan can reduce overall costs for all members.

Why It Matters:

Family plans simplify coverage management and provide collective savings for households with senior drivers.

Key Details:

- Eligibility: Being part of a family plan.

- Savings: 10–15% off premiums.

Example:

DEF Insurance offers 12% savings for family plans including seniors.

| Provider | Plan Type | Savings |

| DEF Insurance | Family insurance bundle | 12% |

| GHI Insurance | Multi-driver family plan | 15% |

How to Qualify for These Discounts

- Maintain a Clean Driving Record: Avoid accidents and violations.

- Complete Defensive Driving Courses: Enroll in certified programs.

- Verify Memberships: Provide proof of affiliations, like AARP membership.

- Ask About Discounts: Speak directly with insurance agents to identify eligible savings.

Takeaways

In conclusion, navigating the world of auto insurance as a senior citizen doesn’t have to be daunting. With the availability of car insurance discounts for senior citizens, there are ample opportunities to reduce costs while maintaining quality coverage. These discounts not only alleviate the financial burden but also ensure that seniors can stay mobile and independent. Whether it’s through safe driving rewards, defensive driving courses, or bundling policies, the potential savings are significant.

Take the time to explore your options, compare plans, and ask about age-specific benefits. By being proactive, you’re not just saving money—you’re gaining peace of mind, security, and the ability to enjoy your golden years with fewer financial worries.