Starting a business is often a leap of faith, but managing its finances requires solid ground. One of the most common pitfalls new entrepreneurs face is “commingling”—mixing personal grocery runs with business software subscriptions, or using a personal credit card to fund startup inventory.

While it might seem convenient in the early days, this financial tangle poses significant risks. It complicates your taxes, jeopardizes your personal asset protection, and makes it nearly impossible to build a standalone business credit profile.

The goal of this guide is to move you from a “blended” financial mess to a clean, professional separation. By the end, you will understand exactly how to separate your funds, why it protects you, and how to leverage that separation to build robust business credit that doesn’t rely solely on your personal score forever.

Why Separation Matters For Business Credit And Risk

Many business owners treat their company bank account like a second personal wallet. However, the separation of finances is not just about keeping your accountant happy; it is the legal and financial bedrock of your company.

1. The Corporate Veil and Liability

If you formed an LLC or corporation, you did so to limit your personal liability. This legal barrier—often called the “corporate veil”—protects your personal house, car, and savings from business lawsuits or debts.

If you treat your business account like a personal piggy bank, a court may decide you are “piercing the corporate veil.” This means they can treat you and the business as the same entity, potentially stripping away your personal asset protection.

2. Clarity in Cash Flow

When expenses are mixed, you cannot accurately gauge the health of your business. Are you actually profitable, or are you just floating the business with personal savings? Separation forces honest reporting on cash flow, revenue, and true operating costs.

3. Cleaner Bookkeeping and Tax Compliance

Come tax season, digging through twelve months of bank statements to identify which coffee purchase was for a client meeting and which was a personal latte is a nightmare. Distinct accounts allow for seamless integration with bookkeeping software, ensuring you capture every valid tax deduction without triggering an audit for aggressive estimation.

4. Funding Readiness

Lenders and investors want to see clean financial statements. If they see personal gym memberships on your P&L (Profit and Loss) statement, you look risky and unprofessional. Clean separation proves you run a disciplined operation.

Note: While separation is critical, keep in mind that for early-stage startups, lenders often look at both business and personal credit. However, you can’t build the former without separating the data first.

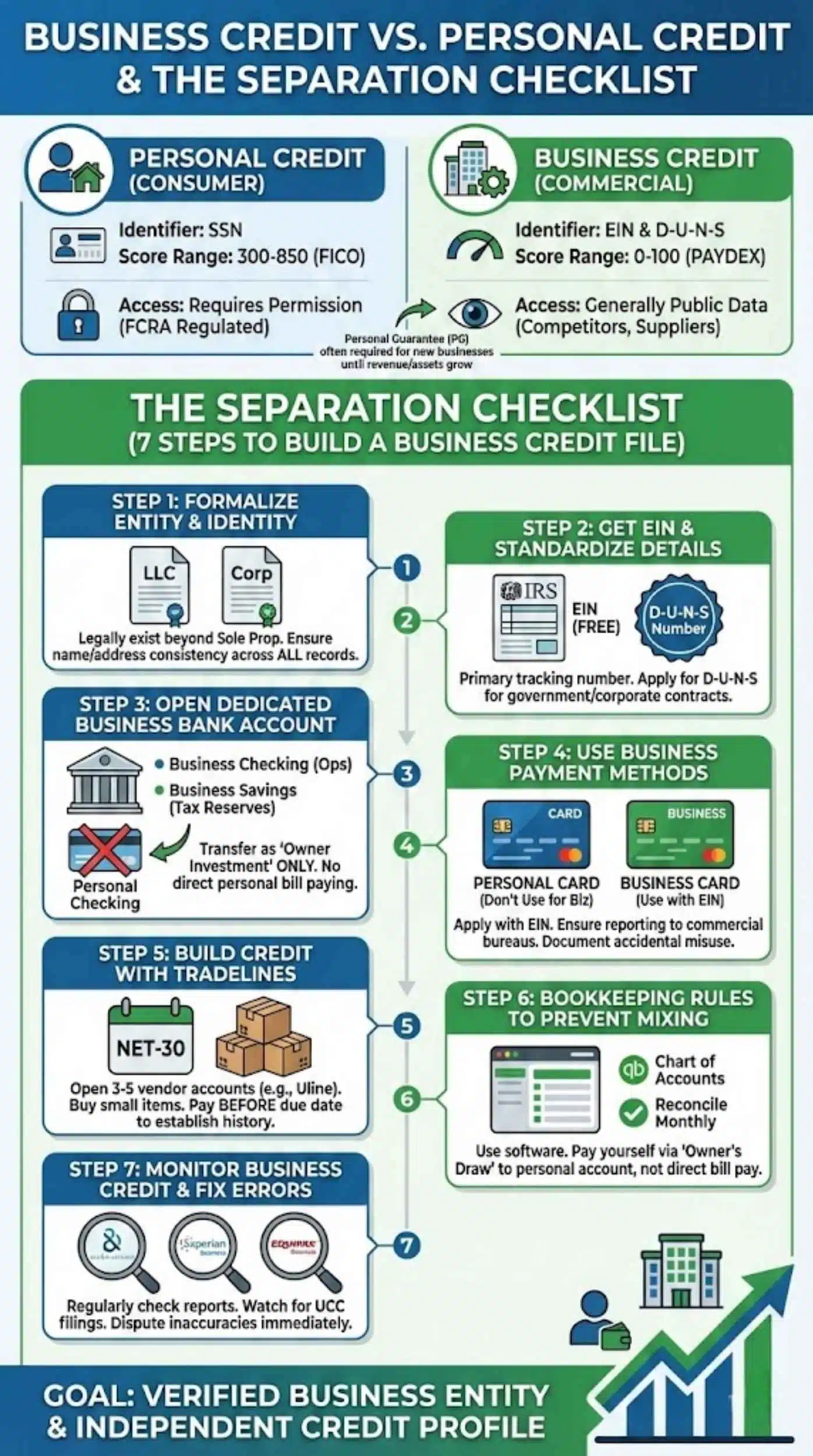

Business Credit vs Personal Credit (What’s Actually Different)

Most people understand their FICO score, but business credit is a different beast entirely. Understanding the mechanics of how business credit bureaus operate is the first step toward mastering them.

How Business Credit Reports Work (And Who Can See Them)

Consumer credit is heavily regulated by laws like the FCRA (Fair Credit Reporting Act), which restricts who can access your personal data and requires your permission.

Business credit is different.

Business credit reports are generally considered public data. Anyone willing to pay for a report—competitors, suppliers, potential partners, or customers—can view your business credit history. There is no “privacy” in the same sense. Bureaus like Dun & Bradstreet, Experian Business, and Equifax Business scrape data from public records (UCC filings, liens) and collect payment data from vendors to build your file.

Common Business Credit Scores And Ranges

Unlike personal credit, which typically ranges from 300 to 850, business scores use different models and scales.

| Feature | Personal Credit | Business Credit |

| Primary Identifier | Social Security Number (SSN) | EIN & D-U-N-S Number |

| Score Range | 300 – 850 (FICO) | 0 – 100 (PAYDEX) |

| Main Factor | Payment history, Utilization | Payment speed (Early vs. Late) |

| Access | Requires Permission | Generally Public |

- PAYDEX (Dun & Bradstreet): Scores range from 1 to 100. A score of 80 is the “gold standard,” essentially meaning you pay bills on the dot. To get a score over 80, you often have to pay early.

- Intelliscore Plus (Experian): Predicts the risk of serious delinquency.

- FICO SBSS: A hybrid score used heavily by the SBA (Small Business Administration) that mixes personal and business data.

When Personal Credit Still Shows Up In Business Financing

A common myth is that building business credit immediately “deletes” the need for personal credit.

In reality, most small business loans, lines of credit, and corporate cards will require a Personal Guarantee (PG), especially if your business is under two years old.

A PG means that even if the business is the borrower, you personally promise to pay the debt if the business defaults. Therefore, until your business has substantial revenue and asset depth, your personal credit score remains a key factor in approval, even if the loan doesn’t report to your personal credit profile.

The Separation Checklist (Step-By-Step Setup)

To stop mixing money and start building a credit file, follow this sequential checklist. This is your roadmap from “hobbyist” to “verified business entity.”

Step 1 — Formalize The Business Entity And Identity

You cannot build a credit file for a business that doesn’t legally exist.

- Move beyond Sole Proprietorship: While you can get an EIN as a sole proprietor, credit bureaus and lenders prefer formal structures like an LLC or Corporation. These entities have a distinct legal existence separate from the owner.

- Consistency is King: Ensure your business name, address, and phone number are identical across every single document (Secretary of State filing, IRS records, website footer). Even a small variance (e.g., “Main St.” vs “Main Street”) can cause fragmentation in credit bureau files.

Step 2 — Get An EIN And Standardize Business Details

The Employer Identification Number (EIN) is essentially the Social Security Number for your business.

- Apply for free: You can get this instantly via the IRS website.

- The Credit Link: Your EIN is the primary tracking number used by business credit bureaus.

- D-U-N-S Number: Once you have your entity and EIN, apply for a D-U-N-S number from Dun & Bradstreet. This is effectively your “file number” in their database and is mandatory for many government contracts and corporate credit applications.

Step 3 — Open A Dedicated Business Bank Account

This is the single most important operational step. You must have a “central nervous system” for your business cash.

- What you need: Articles of Organization (LLC), EIN letter, and personal ID.

- Checking vs. Savings: Start with a business checking account for operations. As you accumulate retained earnings, open a business savings account to hold tax reserves.

- The Trap: Never pay business bills from your personal account “just this once.” If you must inject cash, transfer it from Personal Checking → Business Checking, label it “Owner Investment,” and then pay the bill.

Step 4 — Put Business Expenses On Business Payment Methods

Stop using your personal credit cards for business inventory. It skews your personal credit utilization and fails to build business history.

- Business Credit Cards: Apply for a card using your EIN. Even if it requires a personal guarantee, ensure the issuer reports to commercial credit bureaus (like Dun & Bradstreet or Experian Business).

- Separation enforcement: If you accidentally use the wrong card, document it immediately as a “Reimbursement Due” to keep the books clean.

Step 5 — Build Credit With Reporting Tradelines

You can’t have a credit score without data. In the consumer world, you get a card and buy groceries. In the business world, you use Net-30 accounts or trade credit.

- What are Net-30s? Vendors (like Uline, Grainger, or Quill) allow you to buy supplies now and pay in 30 days.

- The Strategy: Open 3–5 of these vendor accounts. Buy small items you need (office supplies, safety gear). Pay the invoice before the due date.

- The Payoff: These vendors report your payment history to the business bureaus, establishing your initial credit file and PAYDEX score.

Step 6 — Bookkeeping Rules That Prevent Mixing

Software like QuickBooks, Xero, or Wave is non-negotiable.

- Chart of Accounts: Set up specific categories for your expenses (Marketing, Travel, Supplies).

- Owner’s Draw: When you need to pay yourself, do not pay your personal mortgage directly from the business account. Instead, write a check or transfer funds to your personal account labeled “Owner’s Draw.” Pay your personal bills from there.

- Reconcile Monthly: At the end of every month, match your bank statement to your bookkeeping records. If there are mystery transactions, investigate immediately.

Step 7 — Monitor Business Credit And Fix Errors

Just like you check Credit Karma, you must monitor your business profile.

- Check the Big Three: Dun & Bradstreet, Experian Business, and Equifax Business.

- UCC Filings: Watch out for unexpected UCC filings (liens) from lenders, which can drag down your score.

- Dispute Errors: If a vendor reports a late payment that was actually on time, dispute it immediately. Business data is more prone to error than consumer data.

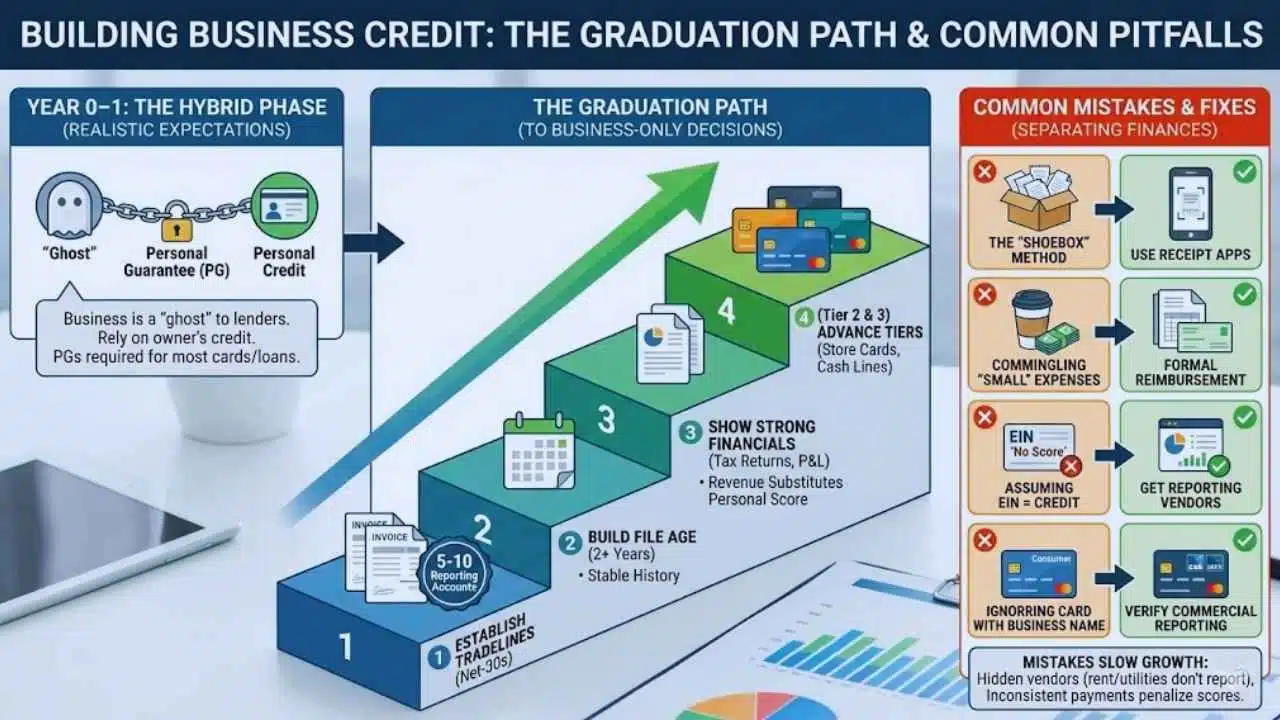

How To Build Business Credit Without Relying On Personal Credit Forever

The “holy grail” for many entrepreneurs is obtaining credit based solely on the business’s revenue and merit, with no personal liability. This is possible, but it is a graduation process, not a starting point.

What’s Realistic In Year 0–1

In the first year, your business is a “ghost” to lenders. It has no history. Consequently, banks rely on the owner’s creditworthiness.

- Expect PGs: Almost every major business credit card and bank loan will require a Personal Guarantee during this phase.

- The “Hybrid” Phase: You are using your personal credit to unlock business accounts, but you are using those business accounts to build business data.

The “Graduation Path” To More Business-Only Decisions

To eventually drop the personal guarantee, you need to build a credit file that is “thick” enough to stand on its own.

- Volume of Tradelines: You need 5–10 reporting tradelines (vendor accounts, fleet cards, business credit cards) showing consistent payment history.

- Age of Credit: A business file usually needs to be at least 2 years old to be considered stable.

- Financials: Lenders will eventually ask for tax returns and P&L statements. Strong revenue can substitute for a high personal credit score.

- Tier 2 and Tier 3 Credit: Once you have established Net-30s (Tier 1), move to store credit cards (Tier 2) and eventually unrestricted cash credit lines (Tier 3).

Mistakes That Slow Business Credit Growth

- Hidden Vendors: Paying rent or utilities often does not help your business credit because landlords and utility companies rarely report to business bureaus unless you use a third-party reporting service (like eCredable).

- Inconsistency: Paying one invoice 10 days early and the next one 5 days late hurts your score significantly. Business scoring models heavily penalize inconsistency.

Common Mistakes When Separating Finances (And How To Fix Them)

Even well-intentioned owners slip up. Here are the most common errors and how to course-correct.

1. The “Shoebox” Method

- The Mistake: Stuffing receipts in a box (or a chaotic digital folder) and hoping to sort it out at tax time.

- The Fix: Use a receipt capture app (often included with bookkeeping software) to snap photos of receipts immediately. Link them to the transaction in your bank feed.

2. Commingling “Small” Expenses

- The Mistake: “It’s just a $5 coffee for a client, I’ll use my personal cash.”

- The Fix: If you use personal funds, submit a formal expense report to your company for reimbursement. Write a check from the business back to yourself. This creates a paper trail proving it was a business expense.

3. Assuming EIN = Credit

- The Mistake: Getting an EIN and assuming you automatically have a credit score.

- The Reality: An EIN is just a number. Until a vendor reports payment activity attached to that EIN, you have a “thin file” or no file at all.

4. Ignoring Specialized Credit Cards

- The Mistake: Using a “consumer” credit card that has your business name on it but reports to your personal credit report.

- The Fix: Verify the reporting policy of the card issuer. You want cards that report to commercial bureaus (D&B, SBFE) so the debt stays off your personal utilization ratio (unless you default).

Quick Decision Guide: Who Should Do What Next?

Not sure where to start? Find your current status below for your immediate next step.

1. The “Brand New” Entrepreneur (Pre-Revenue)

- Focus: Legitimacy.

- Action Plan: Form your LLC. Get your EIN. Open a business checking account. Do not spend a dime until that account is open. Deposit your initial “seed money” there.

2. The “Messy” Operator (Operating, but Commingled)

- Focus: Cleanup and Separation.

- Action Plan: Stop using personal cards immediately. Open a business account this week. Go back through the last 3–6 months of bank statements and categorize every transaction as “Business” or “Personal.” Reimburse yourself for business expenses paid personally.

3. The “Growth” Seeker (Needs Funding Soon)

- Focus: Optimization and Reporting.

- Action Plan: Check your business credit reports on Nav or D&B. Ensure your address is correct. Open 3 new Net-30 vendor accounts to thicken your file. Ensure your credit utilization on existing business cards is low before applying for loans.

Final Thoughts

Building a wall between your personal wallet and your business treasury might feel like tedious administrative work, especially when you are focused on making sales. However, this separation is the single most significant signal you can send to the financial world that you have graduated from a hobbyist to a serious operator.

Remember, business credit is an asset. Just like inventory or equipment, you have to build it and maintain it. By handling your bookkeeping with discipline and leveraging your EIN for credit early on, you aren’t just making tax time easier—you are building a safety net that protects your personal family assets and creating a lever that can lift your business to its next stage of growth.

Don’t wait until you desperately need a loan to start this process. The best time to build credit is when you don’t need it. Start today, even if it’s just opening that separate checking account. Your future self (and your accountant) will thank you.