Web3 is no longer just hype. Billions of dollars are flowing into blockchain infrastructure, DeFi, Web3 gaming, and tokenization. Governments are writing full digital asset laws, big brands are experimenting with NFTs and loyalty tokens, and developers are shipping tools that make blockchains feel almost invisible in the background.

We’ve spent months researching, analyzing market trends, dissecting on-chain data, and consulting the sharpest minds in Web3 to bring you something most prediction lists get wrong: not just what will happen, but why it will happen, and what it means for you.

Inside, you’ll find 18 bold web3 predictions—some that will surprise you, some that will validate what you’ve suspected, and a few that will make you rethink everything you thought you knew about where this is all going. From the rise of AI-powered prediction markets hitting $5.9 billion in weekly volume to the quiet revolution of tokenized real-world assets reshaping institutional investing to the decentralized social networks finally ready to challenge the tech giants—every prediction is grounded in data, backed by current momentum, and built to cut through the noise.

The next decade will separate the curious from the prepared. Which one are you? Let’s find out.

What is Web3?

Web3 is the next evolution of the internet, built on decentralized technologies such as blockchain, smart contracts, and peer-to-peer networks. Instead of relying on large companies to store data, manage transactions, or control online platforms, Web3 distributes this power across a network of users.

This shift gives individuals ownership of their digital identity, assets, and interactions. Web3 introduces new concepts like digital wallets, decentralized finance, NFTs, tokenized communities, and the metaverse. These tools allow people to participate in online systems without a central authority deciding what they can or cannot do. In simple terms, Web3 is the internet where users are in control, not corporations.

What Is Special About Web3?

Web3 stands out because it shifts control from corporations to users. The table below highlights the key factors that make Web3 unique.

| Aspect | Why It’s Special | Explanation |

|---|---|---|

| User Ownership | Users control their data and assets | Unlike Web2 platforms, individuals own their identity, files, tokens, and digital goods. |

| Decentralization | No single authority controls the network | Power is distributed across nodes, increasing security and reducing censorship. |

| Smart Contracts | Automated trust without middlemen | Agreements execute automatically based on code, eliminating the need for banks or intermediaries. |

| Token Economy | New ways to earn and participate | Users can earn tokens for contributing to a platform, creating a more equitable digital economy. |

| Transparency | Systems operate on open code | Anyone can audit blockchain transactions, increasing trust and reducing corruption. |

| Global Access | Financial tools without banks | Web3 enables borderless payments and financial |

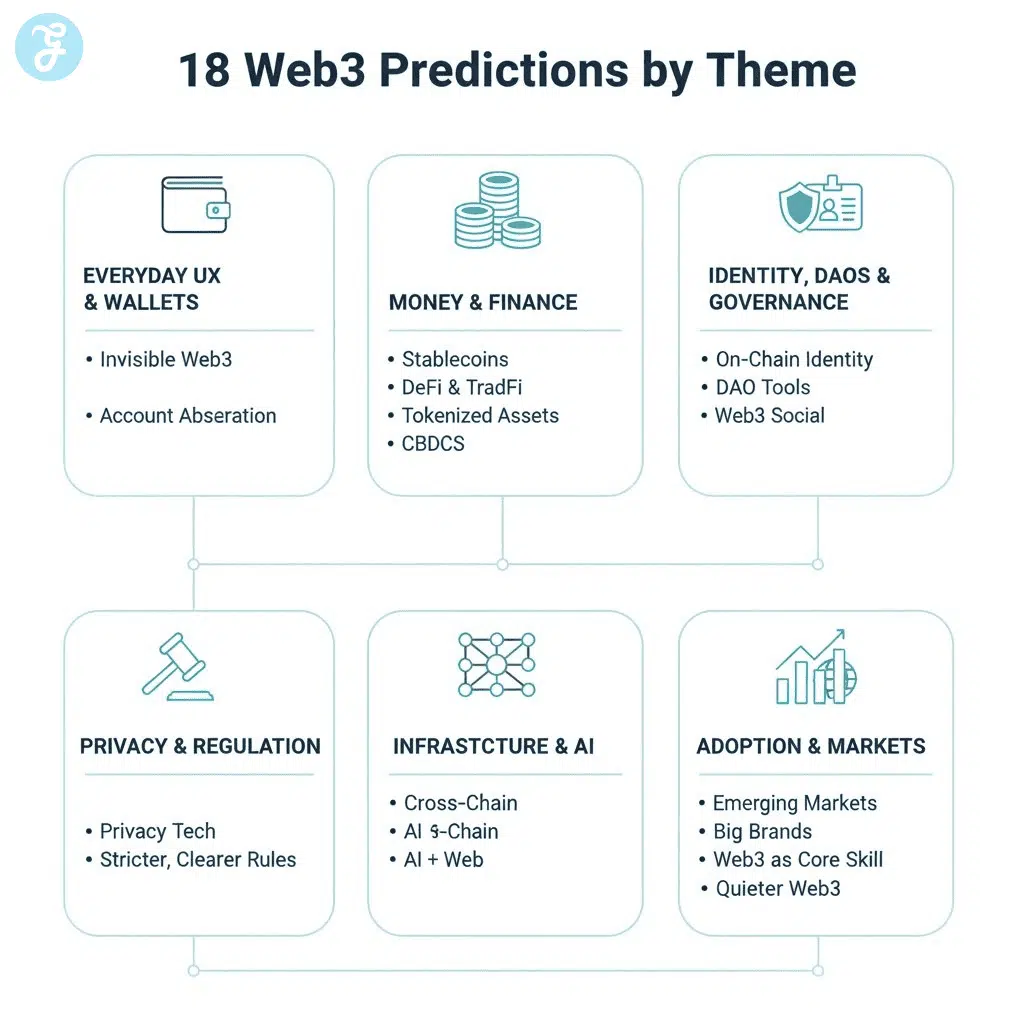

Here are 18 bold Web3 predictions for the next decade, explained in clear language so you can see where opportunities and risks might appear.

1. Most Users Will Not Know They Are Using Web3

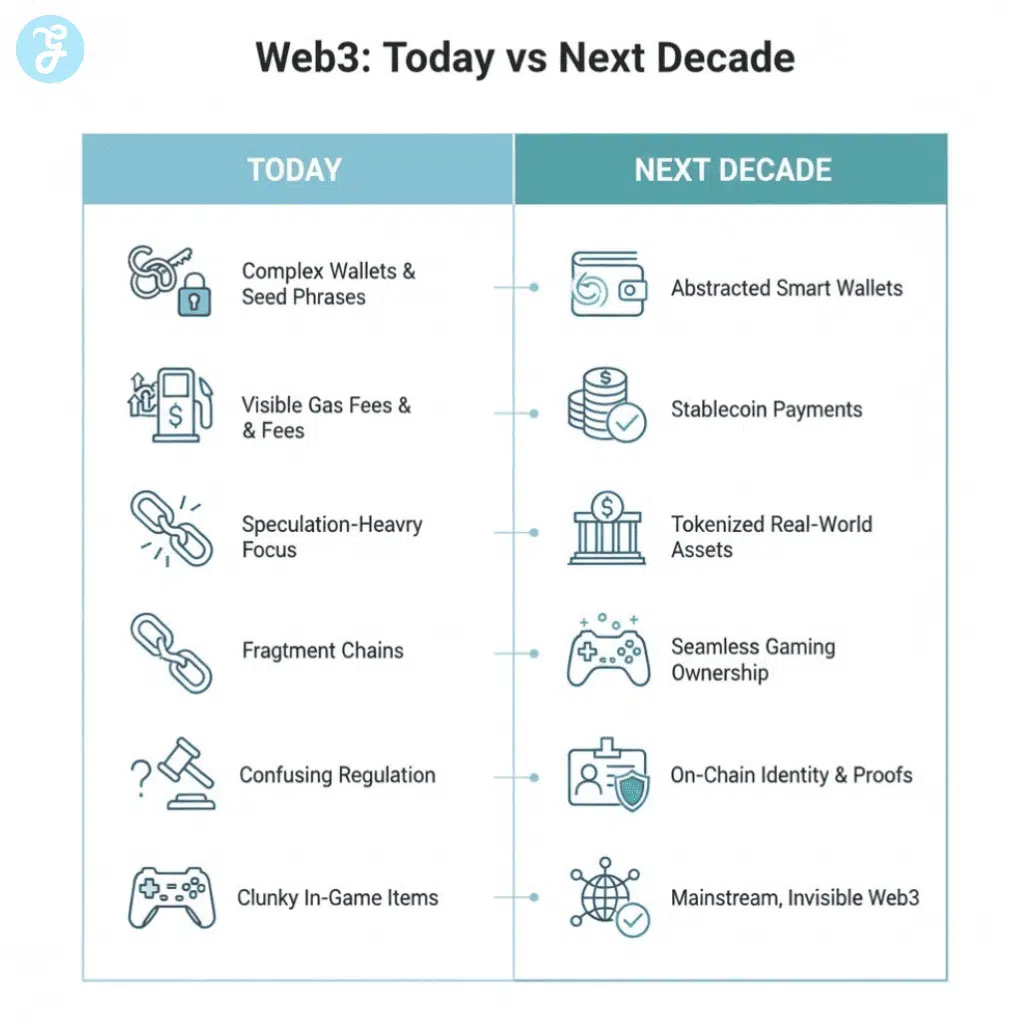

In the early days, people had to understand wallets, seed phrases, and gas fees. Over the next decade, much of that complexity will move under the hood.

You will sign up for an app with email or phone, and behind the scenes, it will create a smart wallet. You will earn points, rewards, or items that are actually tokens, but the app will show them as simple balances or badges.

Web3 will feel less like “using crypto” and more like using a normal app with better ownership and portability.

| Aspect | How it looks to users | What is happening under the hood |

| Sign up | Email, phone, or social login | Smart contract wallet created in the background |

| Fees | “Free” or bundled into app pricing | Gas paid by relayers or abstracted across networks |

| Assets | Points, badges, items | ERC tokens held in a non-custodial wallet |

| Recovery | Simple reset or social recovery | Account abstraction rules, guardians, or multisig |

2. Stablecoins Will Become Everyday Payment Tools

Stablecoins are already a huge part of crypto. In 2024, they facilitated more than 35 trillion dollars in transfers, and the total stablecoin supply grew from about 138 billion to around 225 billion during the year.

Over the next decade, stablecoins will move deeper into daily payments. You might:

- Pay freelancers abroad in dollar stablecoins inside messaging apps

- Use stablecoin rails for cross-border ecommerce

- See payroll experiments where part of the salary is paid in regulated stablecoins.

Banks, neobanks, and payment companies will plug regulated stablecoins into their pipes, especially in regions with high remittance costs or weaker local currencies.

| Trend | What changes | Who benefits |

| Cross-border payments | Faster, cheaper transfer of value | Migrant workers, exporters, online freelancers |

| Merchant settlement | Stablecoins used for FX and settlement | Global merchants, payment processors |

| Banking integration | Stablecoins in fintech and bank apps | Retail users who want dollar exposure |

| Regulation | Clearer rules for reserve quality and risk | Serious issuers and compliant platforms |

3. Governments Will Issue More Serious CBDCs, But Web3 Will Evolve Separately

Many central banks are testing or launching digital currencies. Some will be retail; others will be limited to banks and payment providers. In practice, CBDCs will feel like upgraded versions of online banking rather than true Web3 tools. They will sit alongside public networks instead of replacing them.

Users and businesses will mix both. CBDCs for regulated, domestic payments. Public Web3 networks for programmable money, open finance, and global interactions.

| Money type | Who controls it | Likely use case |

| CBDC | Central bank | Domestic retail payments, interbank settlement |

| Bank deposits | Commercial banks | Salaries, savings, loans |

| Stablecoins | Private issuers | Trading, DeFi, cross-border payments |

| Public crypto assets | Decentralized networks | Long-term investment, collateral, alternative money |

4. Tokenized Real-World Assets Will Become a Major On-Chain Category

Tokenization of real-world assets is moving fast. One on-chain data study estimated tokenized RWAs (excluding stablecoins) at about 24 billion dollars by mid-2025, almost double the level at the end of 2024. Another market forecast that counts broader tokenization platforms valued the RWA segment at roughly 297.7 billion dollars in 2024, with expectations of rapid growth through 2030.

Over the next decade, you can expect:

- Government bonds and money market funds are issued as tokens

- Tokenized private credit, invoices, and revenue share deals

- Real estate and infrastructure projects are represented on the chain.

Most users will interact through familiar interfaces such as “tokenized treasury” funds in a brokerage app, while institutions use tokenization to improve settlement speed and collateral management.

| Asset type | How tokenization helps | Who is likely to use it |

| Bonds and treasuries | Faster settlement, 24/7 markets | Asset managers, treasuries, DeFi protocols |

| Private credit | Fractional access, better tracking | Funds, family offices, accredited investors |

| Real estate | Fractional ownership, secondary trading | Developers, investors, crowdfunding platforms |

| Invoices and receivables | Financing and tracking in real time | SMEs, supply chain financiers |

5. Web3 Gaming Will Normalize Digital Ownership

The Web3 gaming market was valued at around 4.6 billion dollars in 2023 and is projected to reach nearly 28.9 billion dollars by 2030, with a compound growth rate of nearly 30 percent.

The first wave of play-to-earn models was messy and often unsustainable. The next decade will focus less on speculation and more on:

- True ownership of in-game items

- Interoperable assets within publisher ecosystems

- User-generated content that earns revenue through tokenized rights

Players will not talk about “NFTs.” They will talk about items they can trade, lend, or use across experiences. Game studios that design carefully around fun first and tokens second will define this era.

| Element | Old model | Web3 gaming model |

| In-game items | Locked to one account, one game | Tokenized assets that can be traded or reused |

| Player economy | Mostly controlled by the studio | Mixed economy of studio and player markets |

| Progress and identity | Stuck inside one game | Portable progression and identity across titles |

| Revenue for players | Limited or banned | Opt in to earn from trading or contributions |

6. DeFi Will Blur With Traditional Finance

As of 2025, DeFi protocols held about 123.6 billion dollars in total value locked, with more than 14.2 million unique wallets interacting with DeFi platforms, and Ethereum still hosting more than 60 percent of DeFi activity.

Over the next decade, lines between DeFi and traditional finance will blur. You may see:

- Banks sourcing liquidity from on-chain pools for specific assets

- Regulated funds that allocate part of their portfolios to DeFi yields

- Treasury systems that automatically choose between on-chain and off-chain routes based on fees and risk

DeFi will still face hacks and governance issues, but the idea of open, programmable financial contracts will seep into the mainstream.

| Area | DeFi contribution | Traditional finance reaction |

| Lending | Transparent, overcollateralized loans | Banks’ study on on-chain collateral and pricing |

| Trading | Automated market making, 24/7 markets | Brokers and exchanges copy certain models |

| Derivatives | On-chain options and perpetuals | Institutional wrappers around DeFi primitives |

| Risk and analytics | Public data for all positions | New services for monitoring and compliance |

7. Account Abstraction Will Make Wallets Feel Normal

Traditional wallets depend on a single private key. Lose it, and you lose control. Smart contract wallets and account abstraction change this model. ERC-4337 and related standards started rolling out in 2023, and adoption has been climbing across EVM networks.

In the next decade, you will see wallets with:

- Social recovery using trusted contacts or devices

- Session keys for specific apps and time periods

- Built-in spending limits and time locks

This makes wallets feel more like secure accounts with rules, not fragile key pairs.

| Feature | What the user sees | What powers it technically |

| Social recovery | Friends or devices can help restore access | Smart contract with guardian logic |

| Gas abstraction | “No fee” or app-paid transactions | Bundlers and paymasters handling gas |

| Spending controls | Limits on daily transfers by default | Contract rules are enforced on the chain |

| Multiple signers | Shared control for families or teams | Threshold signatures or multisig contracts |

8. On Chain Identity Will Become A Quiet Default

Identity and compliance are major missing pieces today. Over the next decade, verifiable credentials and on-chain proofs will become common. Instead of uploading full documents each time, you will share proofs such as “over 18,” “passed KYC with provider X,” or “member of organization Y.”

These credentials can be stored off-chain and linked to wallets through privacy-preserving methods, including zero-knowledge proofs.

| Identity element | Old pattern | Web3 pattern |

| Age verification | Sharing full ID repeatedly | Sharing a reusable cryptographic proof |

| KYC for every service | Repeating checks and forms | Reusing credentials from trusted providers |

| Reputation | Centralized profiles on platforms | On-chain or verifiable badges and scores |

| Privacy | Over-sharing personal details | Selective disclosure of strictly necessary data |

9. DAO Tools Will Influence How Normal Organizations Work

Few companies will become pure DAOs. However, DAO tooling will influence everyday organizational design. Shared treasuries, transparent budgets, and structured voting can improve trust inside communities and teams.

Over the next decade, you can expect more:

- On-chain treasury dashboards for clubs, co-ops, and nonprofits

- Token- or badge-based voting on specific decisions

- Public logs of how funds were used

Traditional boards and executives will still exist, but they will mix in participatory layers inspired by DAOs.

| Tool or concept | How organizations can use it | Benefit |

| Shared treasury | The community sees balances and transactions | Greater trust and easier audits |

| Proposal voting | Members vote on defined decisions | Clear mandate for changes or funding |

| Role tokens | Badges that grant access or authority | Flexible, programmable access control |

| Public governance log | Decisions and rationales recorded on the chain | Better accountability over time |

10. Web3 Social Networks Will Coexist With Big Platforms

Large social platforms will not vanish. However, Web3 social networks will offer new patterns where you own your handle, social graph, and sometimes your content.

You might:

- Log in to several apps with the same on-chain social identity

- Move your followers from one interface to another.

- Monetize posts or communities with tokens, tips, or shared revenue

Even if Web3 social stays smaller in raw user numbers, it will influence how big platforms treat creators and data rights.

| Social feature | Centralized platforms today | Web3 social approach |

| Username and handle | Controlled by the platform | Owned as a token or record by the user |

| Followers and graph | Locked in each app | Portable across compatible apps |

| Monetization | Platform-controlled ad revenue | Tokens, tipping, and protocol-level rewards |

| Moderation | Closed, app-specific rules | Mix of protocol rules and client moderation |

11. Privacy Tech Will Become Mainstream, Not Suspicious

Zero-knowledge proofs and other privacy tools are improving quickly. At the same time, regulators are demanding better anti-money laundering controls. The next decade will focus on privacy that works within legal frameworks.

Users will expect:

- Ability to keep routine transactions private from the general public

- Selective disclosure for banks, auditors, or regulators when required

- Wallet settings that allow private or public modes

Privacy will be treated like encryption on messaging apps. At first controversial, then standard.

| Area | Current situation | Likely future |

| Transaction privacy | Mostly public on popular chains | Optional privacy layers in mainstream wallets |

| Compliance | On-chain transparency vs off-chain checks | Zero-knowledge-based compliance proofs |

| User expectations | Mixed understanding of privacy trade-offs | Clearer tools and education in mainstream apps |

| Business adoption | Hesitation due to regulatory concerns | Regulated privacy services for enterprises |

12. Cross-Chain Infrastructure Will Make Chains Less Visible

Today, people talk about which chain is best. Tomorrow, users will simply use apps while infrastructure decides which chain or rollup to use.

Cross-chain messaging, shared security, and routing protocols will spread liquidity and workloads across multiple networks. Developers will design for “any chain” rather than “only this chain.”

| Layer | Role in the experience | What users see |

| Base chains and rollups | Provide settlement and execution | Not visible, abstracted away |

| Bridges and routers | Move value and messages between chains | Simple “transfer” or “swap” actions |

| Aggregator apps | Choose the cheapest or fastest route automatically | Single interface, unified balance view |

| Liquidity layers | Combine liquidity from many sources | Better prices and lower slippage |

13. AI And Web3 Will Merge In Practical Ways

Both AI and Web3 are large trends. Over the next decade, some concrete intersections will stick. For example:

- AI agents that manage on-chain tasks for you under strict rules

- Decentralized networks that pay people for computing or data used in AI training

- On-chain records of how models were trained and where outputs came from

Web3 brings incentives and verifiable records. AI brings intelligence and automation. Together, they can create new types of marketplaces and services, although not every “AI plus Web3” pitch will be useful.

| Use case | AI role | Web3 role |

| Portfolio automation | Analyze risk and rebalance based on rules | Execute trades and track positions on the chain |

| Data marketplaces | Learn from shared datasets | Pay contributors transparently with tokens |

| Model provenance | Explain training sources | Store hashes and logs for verification |

| Agent marketplaces | Provide smart services to users | Handle payments, identity, and reputation |

14. Regulation Will Be Stricter But Clearer

As adoption grows, regulators will not ignore Web3. In 2024 and 2025, many jurisdictions started drafting dedicated rules for stablecoins, exchange licensing, and disclosure standards.

The next decade will bring:

- Clear categories such as payment tokens, utility tokens, and securities

- Licensing frameworks for DeFi front ends and key infrastructure providers.

- International cooperation around stablecoins and cross-border risks

The result will be fewer outright “wild west” spaces but better conditions for serious builders. Smaller teams may gravitate to friendlier hubs or work through compliant intermediaries.

| Regulatory area | Likely direction | Impact on Web3 builders |

| Stablecoins | Reserve, disclosure, and risk rules | Stronger focus on fully backed, transparent issuers |

| Exchanges and brokers | Licensing, segregation, and reporting standards | Higher compliance costs, more robust platforms |

| DeFi access | Rules for interfaces and marketing | Some geofencing, more compliant front ends |

| Taxation | Clearer rules on gains and income | Easier planning for users and businesses |

15. Web3 Will Become A Core Skill In Many Careers

Web3 skills will not be limited to “crypto jobs.” As tokenization, on-chain payments, and Web3 gaming grow, many roles will quietly require a basic understanding of wallets, addresses, and tokens.

Marketing teams will run token-based loyalty programs. Finance teams will field questions about tokenized assets. Product managers will evaluate Web3 integrations.

Given that more than half a billion people already hold crypto and that adoption keeps rising, Web3 literacy will look more and more like general digital literacy.

| Role type | Example Web3 touchpoint | Useful skills |

| Marketing and growth | Token-based rewards or NFT campaigns | Wallet basics, NFT logic, user education |

| Finance and treasury | Stablecoin use or tokenized assets | On-chain settlement, risk assessment |

| Product and UX | Wallet connections and Web3 login flows | Signing flows, gas handling, and abstraction |

| Legal and compliance | Licensing and disclosure for Web3 features | Token categories, cross-border considerations |

16. Emerging Markets Will Lead In Real World Web3 Use

Reports show that crypto adoption is often highest in emerging markets, where people face currency instability, capital controls, or weak banking infrastructure. Countries in Asia, Africa, and Latin America dominate many “grassroots adoption” rankings.

Over the next decade, you can expect:

- Savings and payroll apps built on dollar stablecoins

- Local merchant tools that accept both local money and tokens

- Cross-border gig platforms that use crypto for fast settlement

These regions will not just consume Web3 products. Founders from these markets will build tools optimized for their own realities first, which will later spread globally.

| Region focus | Typical challenges | Web3 use cases that fit |

| High inflation markets | Currency instability | Stablecoin savings, remittance tools |

| Underbanked populations | Limited access to traditional accounts | Wallet-based payments, P2P trading |

| Export and gig work | Cross-border payment friction | Crypto payouts, global marketplaces |

| Diaspora communities | Costly remittances | Stablecoin transfers through mobile apps |

17. Big Brands Will Treat Web3 As Infrastructure, Not Gimmicks

The first wave of brand NFTs had many one-off collectibles. The next wave will focus on long-term value. Brands will use tokens as infrastructure for loyalty, ticketing, and membership rather than short campaigns.

You may see:

- Loyalty points that live on public or semi-public chains

- Tickets minted as NFTs to reduce fraud and enable richer experiences.

- Interoperable rewards across partner brands, built on shared token standards

Users will care less about the term “NFT” and more about smoother experiences, better rewards, and real ownership of passes or collectibles.

| Brand use case | How Web3 improves it | User experience gain |

| Loyalty programs | Tokens that work across apps and partners | Easier tracking, more flexible redemptions |

| Ticketing | NFT tickets with provenance and a secondary market | Less fraud, simpler resale, richer add-ons |

| Membership clubs | Token-gated access to products or content | Clear proof of membership and transferability |

| Co-branded campaigns | Shared token rails across brands | Unified rewards, cross promotion |

18. Web3 Will Still Be Here, Just Less Loud

A final prediction. Web3 will still exist in ten years, but people will talk about it less. It will sink into the stack, like cloud computing or databases. Most users will care about what apps do, not whether they use a blockchain.

What should remain are the core features that make Web3 interesting:

- Digital assets that users actually own

- Open, composable financial and data systems

- Shared infrastructure for value and identity that anyone can build on

The winners will not be the loudest promoters, but the teams who quietly make Web3 feel normal, safe, and genuinely useful.

| Today’s picture | Ten years from now |

| Loud debates about chains and tokens | Quiet use of apps that rely on them |

| Complex wallet setup | Smooth, abstracted onboarding |

| Speculation-heavy focus | Practical use in finance, gaming, and identity |

| Confusing regulation | Clearer rules, more stable ecosystems |

Practical Next Steps For The Next Decade Of Web3

Choose the option that best describes your needs:

If You’re A Builder Or Product Team

-

Design for “invisible Web3.” Prioritize email/social login, embedded wallets, and default recovery flows so users never touch seed phrases.

-

Treat compliance as a feature. Build flexible identity and disclosure layers early (selective KYC, audit trails, permissioned pools).

-

Ship with security limits by default. Use spending caps, session keys, and time locks to reduce the blast radius of mistakes.

-

Plan for multi-chain from day one. Assume routing, bridging, and liquidity aggregation will sit underneath the UX.

If You’re An Investor Or Operator

-

Focus on rails, not narratives. Stablecoin infrastructure, custody, identity tooling, and settlement systems tend to outlast hype cycles.

-

Track adoption signals, not token price. Look for growth in active wallets, retained users, transaction share, and real revenue.

-

Assume regulation will shape winners. Projects that can operate under licensing and disclosure regimes will have an edge.

If You’re An Everyday User

-

Learn wallet safety once, then automate it. Turn on 2FA where possible, use social recovery, and avoid storing secrets in screenshots.

-

Use stablecoins for a real purpose. Try low-stakes use cases like remittances, freelancer payments, or cross-border subscriptions.

-

Keep your “experiment budget” small. Treat new protocols like beta software until they prove reliability.

What To Watch: A Simple Checklist

| Theme | What “Progress” Looks Like | What You Should Watch |

|---|---|---|

| Invisible UX | Users onboard without seed phrases | Smart wallets, account abstraction adoption, recovery success rates |

| Stablecoin payments | More real commerce flows | Merchant tools, payroll pilots, regulated issuers, settlement volume |

| Tokenized RWAs | Trad assets settle on-chain | Tokenized treasuries, private credit issuance, secondary liquidity |

| DeFi x TradFi | Hybrid finance products | Compliant DeFi front ends, institutional participation, audit standards |

| Identity + privacy | Proofs replace document uploads | Verifiable credentials, ZK compliance, selective disclosure tooling |

| Cross-chain plumbing | Chains become less visible | Routing quality, bridge security, unified liquidity layers |

Wrap-Up: Web3 Becomes Normal, Not Noisy

Web3’s biggest shift over the next decade is not a single breakthrough. It is the slow disappearance of friction: wallets feel like accounts, tokens feel like points, and blockchains fade into the background. The teams that win will be the ones that make ownership, payments, and identity safer and simpler than today—not louder than everyone else.