Imagine a world where your home doesn’t just consume electricity, it acts as its own mini-power plant, trading excess solar energy with your neighbor’s electric vehicle while you sleep. This isn’t science fiction; it is the dawn of the Energy Internet, and it is being built right now.

At the heart of this revolution lies a critical technology: Blockchain in Energy Sector. As we move through 2026, this technology is transforming the global energy landscape from a physical commodity market into a high-speed digital network, allowing electrons to flow as freely as information on the web.

In this comprehensive guide, we will explore how blockchain is the “operating system” for this new decentralized grid, the massive shift toward peer-to-peer (P2P) trading, and the real-world projects like Power Ledger and SunContract that are proving this technology works today.

Key Takeaways

- Decentralization is Inevitable: The shift from centralized power plants to distributed solar/wind requires a decentralized management system.

- Blockchain is the Trust Layer: It allows strangers to trade energy without a middleman, lowering costs and increasing speed.

- AI is the Brain: Combined with blockchain, AI will balance the grid in milliseconds, preventing blackouts.

- The Prosumer is King: The passive consumer is dying. The future belongs to those who generate, store, and trade their own power.

The Great Shift: From Centralized Power to Digital Networks

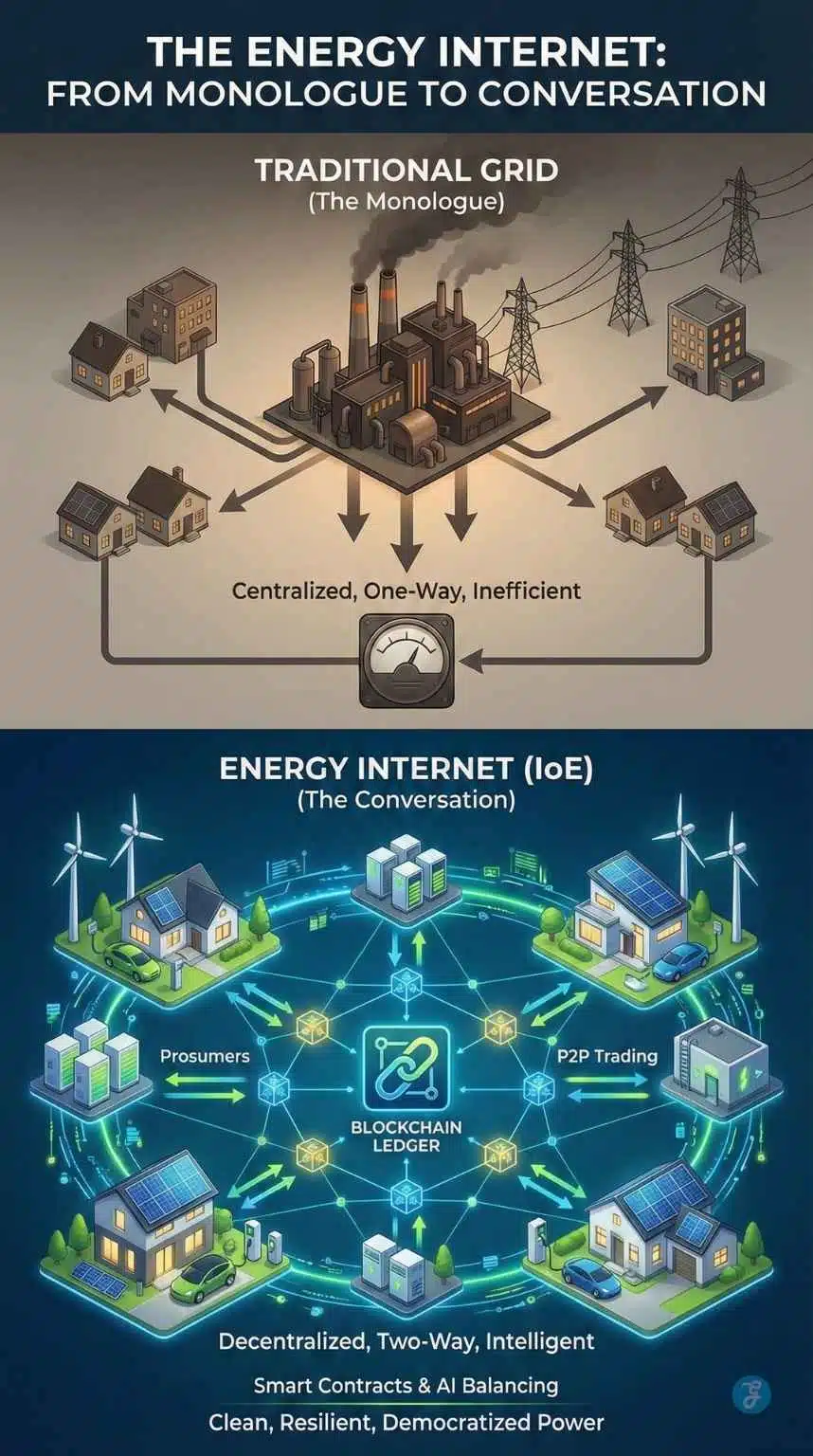

For over a century, our power grids have been “dumb” one-way streets. They were designed for a simple era: massive coal or nuclear plants pushed electricity down the line to passive consumers, and we paid whatever bill arrived at the end of the month.

However, that model is collapsing. The rise of Distributed Energy Resources (DERs), rooftop solar panels, wind turbines, and home battery storage has fundamentally broken the old hierarchy. We now have millions of small power generators at the “edge” of the grid.

This transition requires a new kind of infrastructure. We are moving from a “monologue” (Utility $\rightarrow$ Consumer) to a “conversation” (Consumer $\leftrightarrow$ Consumer). Just as the internet decentralized information, the Energy Internet is decentralizing power, creating a system where trust, transparency, and speed are the new currency.

What is the Energy Internet (IoE)?

To understand why blockchain is necessary, we first must understand the platform it serves: the Internet of Energy (IoE).

The traditional power grid is a centralized hierarchy. A few large entities generate power, and millions of us buy it. However, the rise of Distributed Energy Resources (DERs), rooftop solar panels, wind turbines, and battery storage has broken this model. We now have millions of small power generators at the “edge” of the grid.

The Energy Internet connects these millions of devices into a unified, intelligent network. It transforms the grid from a monologue into a conversation.

The Rise of the “Prosumer”

The most vital actor in this new economy is the Prosumer (Producer + Consumer).

- Old Model: You buy power from the grid at $0.15/kWh.

- New Model: You generate power via solar. You use what you need, store some in a battery, and sell the rest.

However, the current infrastructure makes this difficult. Selling power back to the grid (Net Metering) is often inefficient, with utility companies paying prosumers pennies on the dollar. This is where Blockchain in Energy Sector enters the chat. It replaces the utility company’s ledger with a decentralized, automated, and fair ledger.

How Blockchain Powers the Decentralized Grid

Blockchain is often associated with cryptocurrency, but in the energy sector, it is a tool for trust and automation. The Energy Internet requires millions of micro-transactions to happen every hour. A centralized server at a utility company would struggle to manage the sheer volume and complexity of these trades securely.

The “Operating System” for Energy

Blockchain acts as the secure digital layer on top of the physical grid. Here is how the technical architecture functions in 2026:

| Component | Function in the Energy Grid |

| Distributed Ledger Technology (DLT) | Records every kilowatt-hour (kWh) generated and consumed on an immutable public record. No one can tamper with the data. |

| Smart Contracts | Self-executing code that automates the trade. Example: “If Solar Panel A produces 5kWh, sell to Neighbor B for $0.10.” |

| IoT Sensors (Smart Meters) | The physical hardware that measures energy flow and writes the data directly to the blockchain. |

| Tokens & Cryptocurrencies | The medium of exchange. Payments are settled instantly in stablecoins or utility tokens, rather than waiting 30 days for a bill. |

Why Blockchain is Better than Centralized Databases

- Elimination of Middlemen: In a standard grid, up to 40% of your bill pays for administrative overhead, grid maintenance, and profit margins of the utility company. Blockchain automates the administration, drastically lowering costs.

- Transparency: You know exactly where your energy came from. Was it a coal plant or a wind farm? The blockchain provides a “proof of origin” for every electron.

- Security: Centralized grids are vulnerable to cyberattacks. A decentralized ledger, spread across thousands of nodes, is nearly impossible to hack.

Peer-to-Peer (P2P) Energy Trading: The Killer App

The most immediate and disruptive application of Blockchain in Energy Sector is Peer-to-Peer (P2P) trading.

In a P2P market, neighbors trade energy directly. If you are away on vacation, your solar panels can sell power to the local school or your neighbor’s EV charger. The price is determined by supply and demand, not by a government regulator.

Case Study: The “Microgrid” Revolution

A microgrid is a small, local grid (like a university campus or a neighborhood) that can disconnect from the main grid and operate independently.

- Scenario: A storm knocks out the main power lines.

- Result: The blockchain-enabled microgrid detects the fault, disconnects (islands) itself, and keeps the lights on by trading local solar and battery power among the residents.

Table: Traditional Grid vs. Blockchain P2P Grid

| Feature | Traditional Centralized Grid | Blockchain P2P Grid |

| Power Flow | One-way (Plant $\rightarrow$ Home) | Two-way (Home $\leftrightarrow$ Home) |

| Pricing | Fixed, regulated rates | Dynamic, real-time market rates |

| Settlement Speed | Monthly (30-60 days) | Instant (seconds) |

| Resilience | Prone to cascading blackouts | High (Microgrids can island) |

| Consumer Role | Passive payer | Active participant (Prosumer) |

Vehicle-to-Grid (V2G): Turning Cars into Mobile Power Plants

The rapid adoption of Electric Vehicles (EVs) has created an accidental but massive energy storage network. By 2026, millions of EVs will be sitting parked for 90% of the day. In the Energy Internet, these cars are not just transportation; they are “batteries on wheels.”

How Blockchain Enables V2G

Vehicle-to-Grid (V2G) technology allows an EV to discharge electricity back into the grid during peak hours. However, this creates a complex billing problem: If you plug your Ford F-150 Lightning into a charger at a friend’s house or a public mall to sell power, who gets paid? You, or the owner of the parking spot?

Blockchain solves this “Roaming” issue with a Universal Digital Wallet assigned to the car itself (Machine Identity).

- Plug & Trade: When you plug in, your car’s wallet automatically shakes hands with the charger’s wallet.

- Smart Negotiation: The car checks the grid price. If prices are high (e.g., during a heatwave), it offers to sell 20% of its battery. If prices are low, it charges up.

- Instant Settlement: The grid pays your car directly in stablecoins or utility tokens. You essentially earn money for parking.

Market Outlook

According to 2025 data from Mordor Intelligence, the V2G market is projected to reach $19.5 billion by 2030. New regulations, such as Maryland’s 2025 V2G interconnection rules, are finally mandating that utilities allow these mobile batteries to connect, effectively turning the national EV fleet into a massive Virtual Power Plant (VPP) that stabilizes the grid without building new power stations.

Key Trends Driving the Market

Research from late 2025 indicates the market for blockchain in energy is no longer just “pilot projects.” It has entered the infrastructure phase, valued at over $3.1 billion and growing at a CAGR of 32%.

Trend A: AI + Blockchain Integration

The synergy between Artificial Intelligence (AI) and blockchain is the defining trend of 2026.

- The Problem: Renewable energy is intermittent. The sun doesn’t always shine; the wind doesn’t always blow.

- The AI Solution: Deep learning algorithms analyze weather patterns and historical usage to predict energy supply and demand 24 hours in advance.

- The Blockchain Execution: Based on the AI’s prediction, Smart Contracts automatically pre-buy or pre-sell energy to balance the grid.

- Example: An AI predicts a heatwave for tomorrow afternoon. It triggers a smart contract to pre-purchase stored battery power from local prosumers to prevent a brownout.

Trend B: Tokenization of Real-World Assets [RWA]

Investing in energy used to require millions of dollars to build a plant. Now, companies are tokenizing energy assets.

- Fractional Ownership: A $10 million solar farm can be split into 10 million tokens valued at $1 each.

- Democratization: Retail investors can buy $100 worth of “solar tokens” and receive dividends from the electricity that the farm generates.

- Liquidity: Unlike a physical power plant, these tokens can be traded instantly on global markets.

Trend C: The Shift to High-Speed Chains [Solana & Layer 2]

Early energy projects struggled with Ethereum’s slow speeds and high gas fees. In 2025, we saw a massive migration to high-throughput blockchains.

- Solana Integration: Leading projects like Power Ledger migrated to the Solana mainnet to handle tens of thousands of transactions per second (TPS) with near-zero fees, essential for real-time energy data.

Top Blockchain Energy Projects & Case Studies [2026 Update]

To write an authoritative article on Blockchain in Energy Sector, we must look at the leaders who are actually deploying this tech.

1. Power Ledger [Australia / Global]

Power Ledger remains the titan of the industry. Their platform, TraceX, is used by governments and utilities worldwide to trade Renewable Energy Certificates (RECs).

- Latest Development: Power Ledger’s migration to Solana has allowed them to scale their P2P trading platform to entire cities. They are now piloting “loyalty peer-to-peer” programs where retailers can offer excess solar energy to their loyal customers as a reward.

2. SunContract [Europe]

SunContract focuses heavily on the retail user experience. They created a seamless marketplace where you can choose exactly who you buy power from: your neighbor, a local farm, or a specific wind turbine.

- The NFT Marketplace: In a groundbreaking move, SunContract launched an NFT marketplace for real-world solar panels. Users can buy an NFT representing a specific physical panel at a solar farm. The energy produced by that panel is credited directly to their personal account (wallet), drastically reducing their electricity bill. This bridges the digital and physical worlds perfectly.

3. Energy Web Token [EWT]

The Energy Web Foundation (EWF) is building the open-source standard for the industry. They focus on Identity.

- Digital Passports: EWF assigns a digital identity (DID) to every device on the grid—every Tesla Powerwall, every solar inverter, every smart thermostat. This allows these devices to authenticate themselves and participate in the market securely without human intervention.

The End of Greenwashing: Blockchain’s Role in Carbon Markets

One of the most critical applications of blockchain in the energy sector is solving the “trust crisis” in carbon credits. For years, the voluntary carbon market (VCM) has been plagued by “Greenwashing” and “Double Counting”, where the same renewable energy certificate (REC) is sold to two different companies, allowing both to claim they are “carbon neutral” when only one unit of green energy was actually produced.

In 2026, blockchain introduced a concept known as ReFi (Regenerative Finance) to fix this.

Tokenized Carbon Credits

By moving carbon credits onto a blockchain (Tokenization), we create a “Digital Twin” of the environmental asset. This ensures three things:

- Immutability: Once a credit is “retired” (claimed by a company to offset emissions), it is burned on the blockchain. It effectively ceases to exist and cannot be resold.

- Digital MRV (Measurement, Reporting, and Verification): Instead of relying on manual paper audits, which can take months, 2026 projects use Satellite Data and IoT sensors to measure reforestation or solar output in real-time. This data is written directly to the blockchain.

- Traceability: A consumer buying a “Green Product” can scan a QR code and see the exact hash on the blockchain representing the solar farm that offsets that product’s manufacturing footprint.

Leading Protocols:

- Toucan Protocol: A bridge that brings off-chain carbon credits onto the blockchain, creating “Base Carbon Tonnes” (BCT) that are liquid and tradable.

- KlimaDAO: A decentralized autonomous organization that sweeps floor-price carbon assets from the market to drive up the cost of pollution, incentivizing companies to reduce emissions rather than just offsetting them.

Technical Deep Dive: Smart Contracts and Grid Balancing

For the tech-savvy readers, let’s look under the hood. How does a Smart Contract actually balance the grid?

The “Oracle” Problem

Blockchains can’t “see” the outside world. They don’t know if the sun is shining. They need Oracles, trusted data feeds that bridge the physical world and the digital ledger.

- Data Input: A smart meter (IoT device) measures that User A has sent 10kWh to the grid.

- Oracle Verification: The oracle cryptographically signs this data to prove it hasn’t been tampered with.

- Settlement: The transaction is added to the block, and the ledger is updated.

- Smart Contract Execution: The contract receives the data.

“Code: IF input_energy > 0 THEN transfer (Price_Per_kWh * input_energy) FROM Liquidity_Pool TO User_A_Wallet”.

Virtual Power Plants [VPP]

This automation allows for the creation of Virtual Power Plants. A VPP is not a single physical building. It is a cloud-based aggregation of thousands of home batteries.

When the grid is under stress, the VPP aggregates the stored energy from 5,000 homes and discharges it all at once, acting like a massive gas peaker plant but with zero emissions. Blockchain tracks exactly how much each home contributed and pays them instantly.

Cybersecurity and Privacy: The “Zero-Knowledge” Solution

As we connect our homes, cars, and thermostats to the Energy Internet, a valid fear arises: Privacy. If a utility company (or a hacker) can see exactly when your smart meter spikes, they know when you wake up, when you cook, and when you are on vacation.

To make the decentralized grid safe, the industry is adopting Zero-Knowledge Proofs (ZKPs), a cryptographic method that allows you to prove something is true without revealing the underlying data.

How ZKPs Protect Prosumers

- The Scenario: To sell energy to the grid, you must prove you are a compliant resident and that your energy is green.

- The Old Way: You upload your ID, address, and raw energy logs to a central server (High risk of data breach).

- The ZKP Way: Your local device generates a cryptographic “proof” that certifies “Yes, this user is valid” and “Yes, this energy is solar.” The grid verifies the proof, not the data. Your personal habits and exact location remain encrypted on your device, never touching the public ledger.

Why This Matters in 2026

With data sovereignty laws like GDPR becoming stricter and cyberattacks on infrastructure rising, ZKPs (specifically zk-SNARKs and zk-STARKs) are becoming the standard for “Zero-Knowledge Compliance.” They allow the grid to be transparent about energy flows while remaining opaque about user behavior, solving the privacy-transparency paradox that held back early smart grid adoption.

Regulatory Challenges and The Path Forward

Despite the technology being ready, Blockchain in Energy Sector faces significant hurdles.

The “Utility Death Spiral”

Traditional utility companies are monopolies. In many jurisdictions, it is illegal to buy electricity from anyone other than the state-sanctioned provider. P2P trading threatens their business model.

- Regulatory Sandboxes: Forward-thinking countries like Australia, Thailand, and parts of the EU have created “sandboxes” where these laws are temporarily suspended to allow innovation.

- Grid Defection: As battery costs drop, more users might choose to go “off-grid” entirely if utilities refuse to modernize, leading to a “death spiral” where fewer users are left to pay for the aging infrastructure.

Scalability & Energy Consumption

- The Myth: “Blockchain wastes energy.”

- The Reality: This critique applies mostly to Bitcoin’s Proof-of-Work. Energy blockchains use Proof-of-Stake (PoS) or Proof-of-Authority (PoA), which use 99.9% less energy. In fact, by optimizing the grid, these blockchains save vastly more net energy than they consume.

Future Outlook: The Grid of 2030

Where is this heading? By 2030, the concept of a “Utility Company” will be unrecognizable. We will likely see the rise of Energy DAOs (Decentralized Autonomous Organizations). Imagine a neighborhood that collectively pools money to buy a community solar farm and battery storage.

The infrastructure is owned by the DAO. Voting on the price of energy or maintenance upgrades is done via governance tokens. The grid becomes a community asset, managed by code, serving the people.

Final Thoughts: The Democratization of Power

The Energy Internet is about more than just technology; it is about freedom. For the first time in history, individuals have the power to generate their own essential resources and trade them freely. Blockchain in Energy Sector provides the digital rails for this revolution.

As we move through 2026, the question is no longer if this technology will be adopted, but how quickly regulators will step out of the way to let it happen. The future of energy is green, distributed, and cryptographically secure.