A long-dormant Bitcoin whale, whose holdings trace back to the early years of cryptocurrency, reappeared this weekend and executed a massive sale of 25,000 BTC. This move followed closely on the heels of another sale just a week earlier when the same entity offloaded 24,000 BTC, equivalent to around $2.7 billion at the time.

Even after two successive waves of liquidation, the whale remains one of the largest holders in the market, still controlling approximately 152,874 BTC, valued at more than $17 billion. Analysts believe this pattern demonstrates partial liquidation and portfolio balancing, rather than a complete exit from the asset.

Flash Crash and Market Reaction

The sale caused immediate dislocation across exchanges. Within minutes, Bitcoin dropped from about $115,600 to nearly $110,700, wiping out more than $45 billion in market capitalization. At one point, Bitcoin briefly fell below $109,000, its lowest level since early July.

The sudden wave of selling pressure sparked cascading liquidations in the derivatives market. Hundreds of millions of dollars’ worth of leveraged long positions were forcibly closed as traders who had bet on price increases were caught unprepared. This liquidity crunch amplified volatility and magnified the crash.

Over the following 48 hours, Bitcoin remained unstable, trading in the $108,000–110,000 range, representing a decline of 3–5% over two days.

Market Fragility and Illiquidity

The timing of the whale’s transactions has been particularly destabilizing. Both sell-offs occurred in periods of thin liquidity, when fewer buy orders were in place to absorb supply. In such conditions, large transactions can have an outsized impact on prices.

On-chain data shows the wallet that moved the 25,000 BTC had been dormant for years, making the reactivation especially notable. Long-inactive wallets are often closely tracked by traders, since they can move huge amounts of coins accumulated cheaply in Bitcoin’s early history. When such wallets activate, it raises questions about motives, strategy, and potential future sales.

Ethereum Rotation Adds Pressure

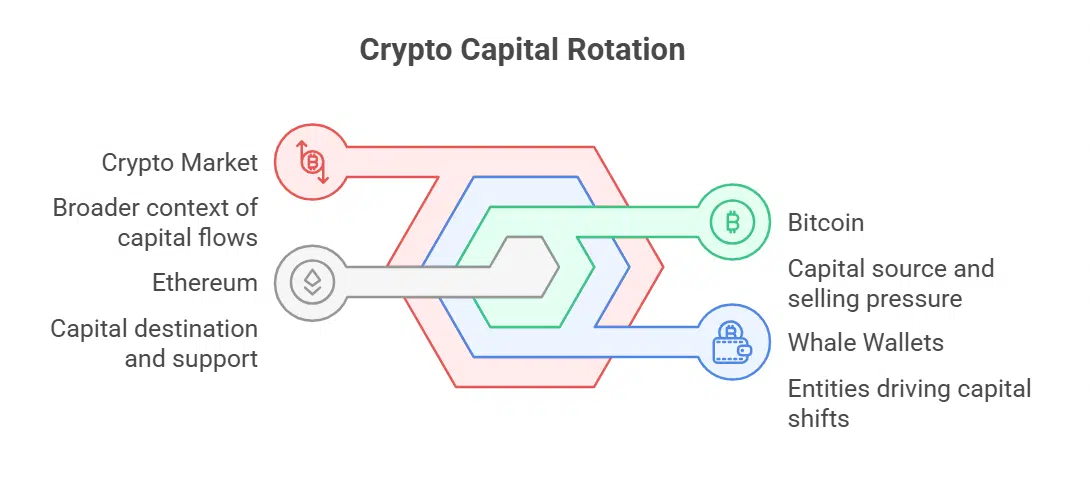

The weekend sell-off coincided with another significant shift in the crypto market: two additional whale wallets collectively swapped more than 90,000 BTC—worth about $1.4 billion—for Ethereum over a four-day span. Even after these swaps, each of those wallets still retained around $4 billion in Bitcoin.

The rotation of capital into Ethereum suggested a change in positioning among large holders. While Bitcoin faced selling pressure, Ethereum gained relative support, with ETH prices stabilizing despite turbulence elsewhere. Market strategists noted that capital flows between the two largest digital assets can create short-term divergences in performance, intensifying volatility in one while shoring up liquidity in the other.

Technical Levels at Risk

The dual impact of consecutive whale sales has pushed Bitcoin toward key technical thresholds. Analysts note that the failure to hold support at $110,000 puts the asset at risk of retesting levels closer to $100,000, a psychological round number that could attract additional attention.

Without renewed demand from institutional inflows, exchange-traded funds (ETFs), or macroeconomic drivers, Bitcoin’s near-term trajectory may be shaped largely by whale activity. Several investment firms have suggested that the market is now entering a phase of consolidation, likely to remain between $110,000 and $120,000 unless new catalysts emerge.

Impact on Traders and Liquidations

The two consecutive weekends of whale-driven volatility have resulted in extensive liquidations across the derivatives markets. The first wave, linked to the 24,000 BTC sale, erased nearly $900 million in leveraged futures positions, mostly longs. The second, larger wave created another round of forced selling, compounding losses for speculative traders.

Margin calls and cascading liquidations remain a recurring theme when whales act in illiquid environments. The speed of price movements prevents many traders from adjusting positions, leading to automatic liquidations and contributing to extreme volatility.

Long-Term Implications

Despite the shock to short-term prices, the broader Bitcoin outlook remains mixed rather than uniformly negative. The whale’s decision to sell in stages indicates that confidence in long-term Bitcoin value may remain intact, even as large holders rebalance exposure. Furthermore, the continued presence of 150,000+ BTC in the whale’s wallet suggests an ongoing commitment to the asset.

At the same time, these events highlight the risks of concentration in the crypto market. A handful of wallets control massive amounts of supply, and their movements can overwhelm normal trading dynamics. This vulnerability underscores why analysts stress the need for broader adoption, improved liquidity, and increased institutional participation to stabilize the market.

Key Metrics: Whale Impact on Bitcoin

| Category | Details |

|---|---|

| Whale Sale (Week 1) | 24,000 BTC (~$2.7B) |

| Whale Sale (Week 2) | 25,000 BTC |

| Remaining Whale Holdings | 152,874 BTC (~$17B) |

| Price Drop | $115,600 → $110,700 within minutes |

| Market Cap Loss | ~$45 billion |

| Lowest Price Since | Early July (~$109,000) |

| Derivatives Impact | Hundreds of millions liquidated |

| ETH Rotation | 90,000 BTC swapped for Ethereum (~$1.4B) |

Fragile Short-Term Outlook

Bitcoin’s sudden plunge underscores the outsized influence of whale wallets on market stability. While the long-term fundamentals of scarcity, adoption, and institutional participation remain supportive, concentrated selling has exposed structural weaknesses in liquidity and derivatives markets.

For now, Bitcoin hovers in a fragile range, with traders watching whale wallets, ETF flows, and macroeconomic indicators closely. Until additional demand returns to absorb supply, markets may continue to experience heightened volatility.