Biodiversity used to sit on the margins of business strategy. It appeared in CSR reports, conservation campaigns and side projects, but rarely in core financial plans. That is changing.

Today, companies recognise that healthy ecosystems underpin production, trade and finance. Pollinators support food systems. Forests regulate water, climate and soil. Oceans feed communities and supply key inputs. When these systems break down, supply chains falter, costs rise and entire markets become unstable.

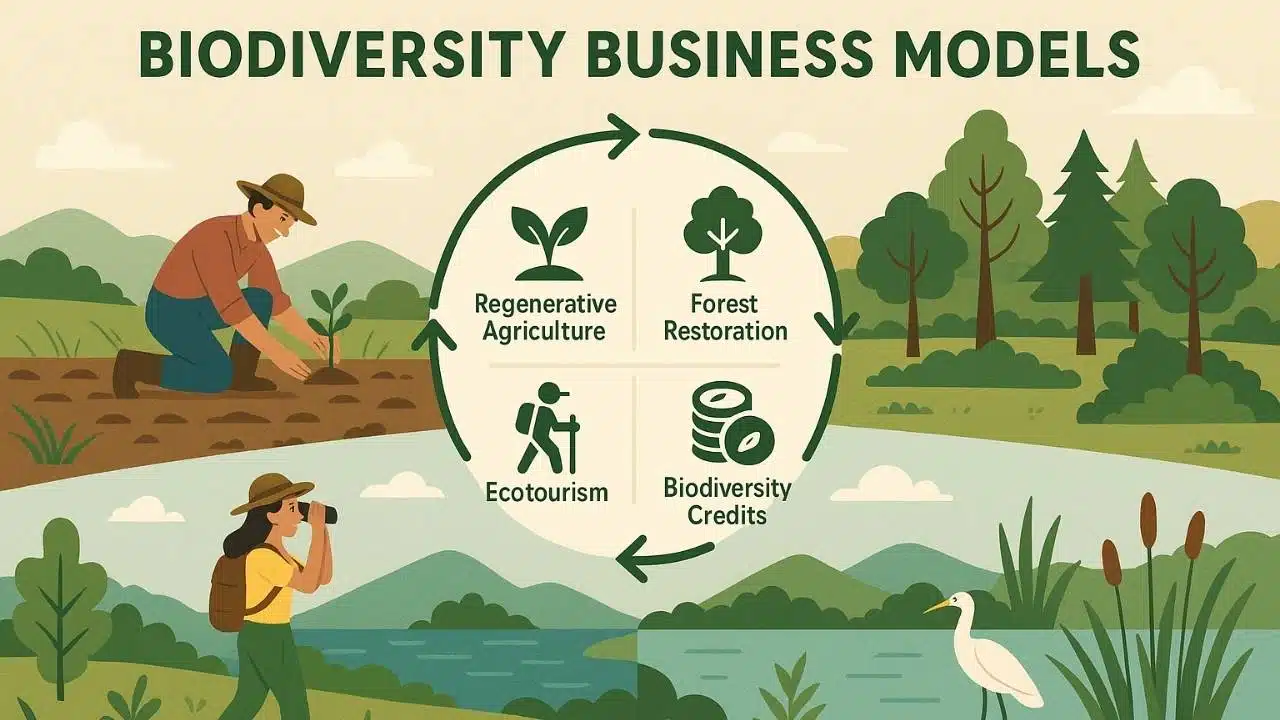

At the same time, a new wave of biodiversity business models is emerging. These models view nature not as a free, infinite resource, but as a critical asset base that must be managed, restored and valued. They sit at the intersection of ecology, technology and finance and form a central part of nature-positive business models worldwide.

This article explores 15 biodiversity-based business opportunities with particularly strong future potential. It looks at how each model works, why investors and companies are paying attention, and what will determine who succeeds as the nature-positive economy matures.

Why Biodiversity Business Models Are Moving Into the Mainstream

Biodiversity is no longer treated as a peripheral environmental issue. It has become a defining economic factor shaping supply chains, investment decisions and long-term business resilience. As ecosystems decline, companies face rising operational risks, regulatory expectations and shifting market pressures. At the same time, new opportunities are emerging in nature-based innovation, financing and data-driven ecological services—pushing biodiversity business models from niche experiments into central strategic frameworks.

From environmental risk to strategic business reality

For decades, biodiversity loss was framed as a “green” issue. It was important, but it felt distant from balance sheets. That perception is fading quickly.

Businesses now see that their exposure to biodiversity loss is practical and immediate. Crop failures, fish stock collapses, water shortages and soil degradation translate directly into operational disruptions. When forests disappear, floods become more severe. When wetlands vanish, water treatment costs increase. When reefs erode, coastal infrastructure faces higher damage.

This shift in perception is driving demand for credible biodiversity business models that can both reduce risk and open up new revenue. Boards no longer ask only, “What is our impact on nature?” They also ask, “What is the impact of nature loss on our business?” and “Where do new nature-positive business models create competitive advantage?”

Policy, regulation and the rise of nature-positive business models

Regulation is another push factor. Governments are introducing targets to halt and reverse biodiversity loss, expanding protected areas and asking companies to assess and disclose their nature-related impacts and dependencies.

These policy moves influence procurement rules, permitting processes, public funding and financial supervision. Companies in land-intensive sectors—such as food, fibre, mining, infrastructure and tourism—face more scrutiny on how they use and restore ecosystems.

As a result, nature-positive business models are moving from voluntary initiatives to strategic obligations. Firms that can demonstrate credible biodiversity performance stand to benefit in public tenders, investor relations and consumer markets. Those that lag may encounter higher financing costs, reputational damage and stricter regulatory oversight.

Investor expectations and capital searching for nature-positive opportunities

Investors are increasingly aware that nature risk is financial risk. Asset owners and managers want to know how exposed portfolios are to ecosystem decline and what options exist for diversification and opportunity capture.

This is where biodiversity-based business opportunities come in. Investors are exploring funds, bonds, blended finance vehicles and project platforms that support nature-positive outcomes while targeting attractive risk–return profiles.

In the near term, these flows may appear modest compared with traditional infrastructure or energy. Yet the trajectory points toward rapid growth, especially as more data, standards and successful case studies emerge. For biodiversity business models, the key question is not whether capital will come, but which ventures will be ready to absorb it.

Technology, data and the ability to measure biodiversity

Finally, technology is changing what is possible. Remote sensing, environmental DNA sampling, bioacoustics, drones and AI make it far easier to measure and monitor changes in ecosystems.

Better measurement unlocks new biodiversity business models:

- Credits based on verified outcomes

- Performance-based contracts for ecosystem services

- Real-time monitoring for supply chain traceability

- Nature-related analytics for investors and insurers

As data improves, businesses can move beyond generic commitments and instead link payments and incentives to measurable, location-specific biodiversity results.

15 Biodiversity Business Models with Huge Future Potential

Below are 15 biodiversity business models that combine ecological impact with commercial potential. They differ by sector, geography and maturity, but they all contribute to a more nature-positive economy.

1. Biodiversity credit platforms and nature markets

Biodiversity credit platforms sit at the heart of a new class of biodiversity business models. They create units—biodiversity credits—that represent measurable positive outcomes for nature, such as restored habitats, species recovery or improved ecosystem functions.

In practice, these platforms:

- Work with project developers to design and implement restoration or conservation projects.

- Use agreed methodologies to quantify biodiversity gains relative to a baseline.

- Issue credits that companies, investors or institutions can buy to support nature-positive goals or compensate for residual impacts.

- Track ownership and retirement of credits on digital registries.

The future potential lies in integration. Biodiversity credits can sit alongside carbon credits, water rights and land-use agreements. They can form part of nature-positive business models in sectors such as real estate, mining and infrastructure, where developers need to demonstrate no net loss—or net gain—of biodiversity.

Success will depend on strong science, transparent governance, high integrity standards and clear social safeguards. Platforms that build trust with communities, regulators and buyers will set the tone for how nature markets evolve.

2. Payments for ecosystem services and watershed protection schemes

Payments for ecosystem services (PES) reward landholders for managing ecosystems in ways that provide benefits to others. These benefits might include:

- Clean and reliable water supply

- Reduced flood risks

- Erosion control and soil retention

- Enhanced pollination for nearby farms

In a typical watershed PES scheme, downstream users—such as water utilities, beverage companies or municipalities—pay upstream communities to preserve forests rather than clear them, or to adopt soil conservation practices instead of intensive cultivation.

These biodiversity business models work because they offer a cheaper and more flexible alternative to hard infrastructure, such as dams and treatment plants. As climate risks intensify and water becomes more variable, demand for natural water-regulating systems will grow.

Future development may include:

- Multi-buyer schemes that pool contributions from several beneficiaries.

- Long-term contracts that treat ecosystem services as a form of infrastructure.

- Digital tools that measure water quality and quantity, linking payments to actual performance.

When designed carefully, PES schemes can provide stable income to local communities while protecting biodiversity-rich landscapes.

3. Regenerative agriculture and soil health platforms

Regenerative agriculture is often mentioned in climate debates, but it is equally important for biodiversity. It emphasises practices that restore soil life, increase crop diversity and integrate trees and livestock in more circular ways.

Examples include:

- Crop rotations and cover crops that feed soil organisms.

- Reduced or no tillage to protect soil structure.

- Agroforestry systems that blend trees with crops or pasture.

- Precision input management to reduce excess chemicals.

Regenerative agriculture business models can take several forms:

- Brands that pay a premium for crops produced under regenerative standards.

- Platforms that offer advisory services, soil testing and digital tools to farmers.

- Input providers that sell biological alternatives to synthetic chemicals.

- Ventures that monetise ecosystem outcomes, such as carbon sequestration or biodiversity credits, alongside commodity sales.

For biodiversity, the benefits are clear: more diverse landscapes, healthier soils and fewer chemical pressures on ecosystems. For farmers and companies, the upside includes resilience against extreme weather, improved yields over time and stronger market positioning.

The main challenges involve transition costs, knowledge gaps and risk perception. Business models that help farmers manage these risks—through finance, insurance and long-term purchasing commitments—are likely to gain traction.

4. Restoration-as-a-service for degraded land and seascapes

Vast areas of land, freshwater and marine ecosystems are degraded but restorable. Restoration-as-a-service providers specialise in turning degraded areas into functioning ecosystems while delivering clear contractual value to clients.

These service providers typically:

- Assess ecological conditions and potential restoration pathways.

- Design restoration plans aligned with local social and environmental contexts.

- Implement interventions, such as reforestation, mangrove planting, wetland rehabilitation or reef restoration.

- Monitor outcomes over time and report against agreed indicators.

Clients may include governments, infrastructure developers, utilities, financial institutions and companies with land footprints. They may pay for restoration to comply with regulation, meet voluntary targets or access nature-related finance.

This biodiversity business model becomes especially powerful when restoration outcomes link to:

- Insurance benefits (lower physical risk).

- Credit enhancements for land-backed loans.

- Long-term revenue from sustainable harvesting or ecotourism.

- Nature and climate credits.

By offering turnkey solutions, restoration-as-a-service firms enable organisations to invest in biodiversity even when they lack in-house ecological expertise.

5. Bioeconomy ventures built on forest and marine biodiversity

The bioeconomy uses biological resources to produce food, materials, chemicals and energy. When it is biodiversity-aware, it can support conservation rather than depletion.

Bioeconomy ventures include:

- High-value ingredients from plants, fungi, algae or marine organisms for pharmaceuticals, cosmetics and nutraceuticals.

- Bio-based materials, such as biopolymers or fibre composites from sustainably managed forests.

- Innovative food products from underused species that help diversify diets and reduce pressure on a few dominant crops.

These biodiversity-based business opportunities leverage the richness of ecosystems without necessarily increasing land conversion. Instead, they depend on maintaining diverse and healthy habitats.

However, they also raise sensitive questions: Who owns genetic resources? How should benefits be shared with Indigenous peoples and local communities? How can companies avoid overharvesting or monoculture plantations that undermine biodiversity?

Ventures that address these questions transparently and embed fair benefit-sharing agreements will be better placed to build long-term, trusted brands in the nature-positive economy.

6. Urban nature-based solutions and green infrastructure

Cities are becoming laboratories for nature-positive innovation as urban planners search for resilient, low-cost ways to manage heat, flooding and pollution. This shift is driving strong demand for green infrastructure that can deliver measurable ecological and social benefits. Businesses are recognising that integrating nature into the built environment enhances property value, reduces climate risk and improves public health outcomes. As a result, urban nature solutions are evolving from optional design features into essential components of sustainable city development.

Urban nature-based solutions might include:

- Green roofs and walls that manage temperature, stormwater and air quality.

- Restored river corridors that reduce flood risk and create recreation spaces.

- Constructed wetlands that treat wastewater and support biodiversity.

- Urban forests and parks designed for both people and wildlife.

Specialist companies design, install and maintain these systems, often under performance-based contracts. Their revenue may be linked to a mix of outcomes, including reduced flood damage, lower cooling costs, improved wellbeing or increased property values.

For biodiversity, urban green spaces provide vital habitats and ecological corridors. For businesses and cities, they offer cost-effective ways to meet climate adaptation and quality-of-life goals.

As more municipalities set explicit nature targets, demand for companies that can deliver integrated urban nature solutions will likely grow.

7. Biodiversity data, monitoring and analytics

As companies face increasing pressure to measure and disclose their nature impacts, demand for reliable biodiversity data is accelerating. Advanced tools like remote sensing, eDNA sampling and AI-powered ecological modelling are transforming how businesses track ecosystem change. This new data infrastructure allows organisations to move from broad assumptions to evidence-based decisions that shape strategy, investment and compliance. As nature markets expand, firms offering credible monitoring and analytics will become foundational players in the nature-positive economy.

This creates an expanding market for biodiversity data, monitoring and analytics firms that:

- Use satellite imagery, drones and sensors to track habitat change.

- Apply environmental DNA and bioacoustics to detect species presence.

- Build models that assess ecosystem integrity and fragmentation.

- Provide dashboards, risk scores and reporting tools for companies and investors.

These firms support biodiversity credits, PES schemes, restoration projects, supply chain assessments and investor disclosures. They often operate on subscription or service-based revenue models, with potential to scale through standardised products.

In the future, they may become part of critical digital infrastructure for a nature-positive economy, much like credit rating agencies or climate data providers in today’s financial system.

8. Nature-positive finance products and biodiversity-linked instruments

Nature-positive finance is emerging as one of the strongest enablers of biodiversity business models. Financial institutions are increasingly designing lending and investment products that reward measurable improvements in ecosystem health. These instruments link capital costs to biodiversity performance, directing money toward companies and projects that restore nature rather than degrade it. As disclosure requirements expand, biodiversity-linked finance is expected to move from niche innovation to a mainstream component of sustainable financial markets.

Examples include:

- Bonds that fund conservation, restoration or sustainable land-use projects.

- Loans whose interest rates adjust based on biodiversity performance indicators.

- Funds that invest in companies with strong biodiversity management or that operate in nature-based solutions.

- Blended finance vehicles that combine public and private capital to de-risk biodiversity projects.

For financial institutions, these models offer product differentiation, new client relationships and alignment with evolving regulations and investor mandates. For project developers, they provide access to capital that understands and values biodiversity outcomes.

The market is still young. However, as nature-related disclosure norms tighten and more data becomes available, nature-positive finance is likely to become a mainstream component of sustainable finance strategies.

9. Corporate biodiversity advisory and implementation services

Corporate biodiversity advisory firms help organisations understand, manage and act on their nature-related risks and opportunities. These service providers guide companies through biodiversity assessments, develop nature-positive strategies and design practical roadmaps for implementation. They also support the creation of measurable targets, stakeholder engagement plans and internal governance structures. As biodiversity becomes a mainstream business issue, demand for specialised advisory services continues to rise, making this one of the fastest-growing biodiversity business models today.

Their services often include:

- Materiality assessments for nature-related risks and opportunities.

- Mapping of dependencies and impacts across value chains.

- Strategy development for nature-positive transitions.

- Support for governance, target setting and internal accountability.

- Reporting and disclosure preparation under emerging nature frameworks.

Beyond advisory, some firms offer implementation support: building internal capacity, designing projects, sourcing partners and managing stakeholder engagement.

As biodiversity becomes a regular boardroom topic, demand for these services continues to expand. Firms that combine ecological expertise with sector-specific business knowledge are well placed to become long-term partners in the transition to nature-positive business models.

10. Community-based ecotourism and conservation enterprises

Community-based ecotourism creates income streams that depend directly on keeping ecosystems healthy, giving local communities a strong incentive to protect biodiversity. These enterprises blend cultural heritage with conservation, offering nature-focused experiences that generate jobs and support local development. When communities manage tourism operations themselves, they maintain control over natural resources while ensuring that benefits remain within the region. As demand for responsible, low-impact travel grows, community-led ecotourism stands out as one of the most sustainable and socially grounded biodiversity business models.

Community-based ecotourism enterprises might:

- Run lodges, homestays or campsites in or near biodiversity hotspots.

- Offer guided wildlife viewing, trekking, birdwatching or cultural experiences.

- Manage protected areas or conservancies with clear rules and benefit-sharing.

- Invest part of revenue into conservation activities and social services.

These biodiversity business models create local employment and strengthen incentives to protect ecosystems. When communities hold decision-making power and share fairly in benefits, they are more likely to support long-term conservation.

Future growth will likely depend on:

- Partnerships with responsible tour operators and online platforms.

- Strong visitor management to avoid overtourism.

- Storytelling that connects travellers with the deeper value of biodiversity.

In a world where travellers increasingly seek meaningful, low-impact experiences, well-designed community enterprises can stand out.

11. Circular bio-based materials and nature-positive design

Circular bio-based materials aim to replace resource-intensive, fossil-based materials with alternatives sourced from regenerative, biodiversity-supporting systems. These materials reduce pressure on ecosystems by utilising agricultural residues, fast-renewing fibres and low-impact biological feedstocks. When paired with circular design principles—reuse, repair, recycling—they help keep resources in continuous flow rather than becoming waste. As companies shift toward nature-positive design, these materials become essential components of responsible product development.

These materials may come from:

- Agricultural residues that would otherwise be burned or wasted.

- Fast-growing, low-impact fibers grown in integrated agroforestry systems.

- Biopolymers derived from algae, waste streams or non-food crops.

The associated business models combine three pillars:

- Nature-positive sourcing – ensuring that feedstocks come from systems that maintain or enhance biodiversity, not from monocultures that replace natural habitats.

- Circular design – designing products for reuse, repair and recyclability so that materials circulate rather than ending up as waste.

- Traceability and storytelling – using data and communication to prove and explain the nature benefits embedded in each product.

Companies that get this right can appeal to both regulators and consumers, differentiating themselves in markets for packaging, textiles, construction materials and consumer goods.

12. Insurance products linked to ecosystem resilience

Insurers are beginning to recognise that healthy ecosystems function as natural infrastructure that reduces physical risk. Mangroves, coral reefs, wetlands and forests absorb storm surges, slow floods and stabilise soils—lowering potential claims and protecting high-value assets. This creates space for innovative insurance products that fund ecosystem restoration as a direct form of risk mitigation. As more data links biodiversity to measurable reductions in climate-related losses, insurance models that integrate nature will become essential tools for building long-term resilience in vulnerable regions.

New biodiversity business models in insurance include:

- Policies that fund restoration of natural barriers—such as reefs, mangroves or dunes—to reduce coastal flood risk.

- Parametric insurance triggered by ecological indicators, such as reef damage or deforestation rates.

- Premium discounts or better terms for clients that adopt nature-positive practices and reduce exposure to nature-related risks.

In these models, ecosystems function as risk-reducing infrastructure. By investing in natural resilience, insurers can lower long-term costs and expand their product range.

As more data links specific ecosystems to risk reduction, nature-based insurance models may become a standard part of risk management portfolios for coastal cities, agricultural regions and infrastructure owners.

13. Seed banks, genetic resources and climate-resilient breeding

Seed banks and genetic resource centres act as living libraries that preserve thousands of crop varieties, wild relatives and rare species that may hold traits crucial for future food security. These collections protect biodiversity that modern agriculture has largely overlooked—traits such as drought tolerance, salinity resistance, pest resilience and nutritional enhancement. As climate volatility intensifies, breeders and agritech companies increasingly rely on these genetic reservoirs to develop varieties capable of withstanding new environmental pressures. This biodiversity business model not only safeguards global food systems but also creates long-term economic opportunities through licensing, research partnerships and the development of high-value climate-resilient crops.

Biodiversity business models in this area include:

- Seed banks that conserve a wide range of varieties and provide them to breeders and farmers.

- Companies that specialise in breeding crops or livestock with traits suited to future conditions, such as drought tolerance or pest resistance.

- Partnerships that connect traditional knowledge on local varieties with modern breeding tools.

To remain nature-positive, these business models must respect access and benefit-sharing rules and recognise the rights of communities that have developed and maintained genetic resources over generations.

Done well, they support both biodiversity conservation and food security, while creating recurring revenue from seeds, licences and associated services.

14. Digital marketplaces for smallholder participation in nature markets

Digital marketplaces are transforming how smallholders access biodiversity credits, carbon markets, and ecosystem service payments. These platforms reduce barriers by standardising documentation, simplifying monitoring, and aggregating many small landholdings into investable project portfolios. They also provide tools for mapping, verification and transparent benefit-sharing. As these marketplaces expand, they can unlock fair economic opportunities for communities while scaling high-integrity nature-positive projects.

Digital marketplaces aim to close this gap by:

- Aggregating many small projects into a portfolio that can be offered to buyers.

- Standardising documentation, contracts and monitoring to reduce transaction costs.

- Providing tools for mapping, measuring and verifying nature outcomes.

- Facilitating payments and benefit-sharing in a transparent way.

These biodiversity-based business opportunities can make nature markets more inclusive. They allow companies and investors to support a diverse range of small projects while dealing with a single platform.

The success of these models will depend on digital accessibility, local support, fair contracts and strong safeguards for rights and land tenure. If those elements are present, they can turn small-scale nature stewardship into a recognised and rewarded economic role.

15. Integrated climate–biodiversity project developers

Integrated climate–biodiversity project developers design and manage projects that generate simultaneous climate and biodiversity benefits at scale. These developers blend ecological science with finance, technology and community engagement to create projects that go beyond single-outcome models. They structure initiatives that restore landscapes, support local livelihoods and unlock diversified revenue—such as carbon credits, biodiversity credits, sustainable commodity premiums and resilience payments. As markets increasingly value nature-positive outcomes, these integrated models are becoming essential to large-scale restoration and long-term ecosystem recovery.

Typical projects include:

- Landscape-scale reforestation that restores native ecosystems and sequesters carbon.

- Regenerative agriculture programmes that reduce emissions, improve soils and increase habitat diversity.

- Peatland or mangrove restoration that protects coasts, stores carbon and supports fisheries.

These developers assemble the full package:

- Feasibility and stakeholder engagement

- Project design and governance

- Monitoring and verification of multiple benefits

- Revenue stacking from carbon, biodiversity credits, sustainable commodities, insurance and resilience payments

Because they work across climate, biodiversity and community development, these nature-positive business models can unlock blended finance at scale. They also help companies and investors avoid narrow, single-metric approaches that risk unintended consequences.

Design Principles for Scalable Nature-Positive Business Models

Building biodiversity business models that can grow and deliver consistent impact requires clear design principles. Scalable nature-positive models rely on scientific credibility, fair partnerships and financially sound structures. They also depend on strong governance and transparent reporting that investors and communities can trust. When these foundations are in place, nature-positive business models move from experimental projects to long-term, investable systems capable of driving real ecological change.

Science-based baselines and robust biodiversity metrics

All serious biodiversity business models rely on credible science. That means:

- Clear baselines that describe the “before” condition of ecosystems.

- Indicators that capture meaningful aspects of biodiversity, not just simplified proxies.

- Monitoring systems capable of detecting change over relevant timescales.

- Independent verification where public claims or financial products depend on results.

Businesses that invest early in sound metrics build trust with regulators, partners and communities. They also position themselves to adapt as standards evolve, rather than constantly playing catch-up.

Fair value sharing with local and Indigenous communities

Biodiversity is not evenly distributed. The richest ecosystems are often found in territories managed by Indigenous peoples and local communities. Fair partnerships are therefore not only ethical, but also practical.

Nature-positive business models should:

- Recognise the rights, knowledge and priorities of local communities.

- Share benefits transparently through agreed mechanisms.

- Involve communities in decision-making, not just as labour or “beneficiaries”.

- Respect cultural values, not only economic interests.

Models that ignore these principles risk conflict, legal challenges and reputational damage. Those that embrace them can create durable alliances that protect biodiversity and support local development.

Blended finance and risk-sharing

Many biodiversity projects face high upfront costs, long time horizons and uncertain revenue streams. Blended finance offers ways to spread and manage these risks.

In a blended structure:

- Public or philanthropic capital can absorb early-stage risks or provide guarantees.

- Commercial investors can participate at more attractive risk–return levels.

- Technical assistance funds can support project preparation and capacity building.

For biodiversity business models, blended finance is often the bridge between pilot projects and scalable investment pipelines. It helps demonstrate proof of concept, build track records and unlock mainstream capital over time.

Digital infrastructure, open standards and interoperability

Digital tools underpin most modern biodiversity business models, from monitoring to marketplaces. However, fragmented systems and inconsistent standards can drive up costs and reduce trust.

To scale, the nature-positive economy will benefit from:

- Shared data formats and protocols that allow systems to talk to each other.

- Open methodologies for measuring and reporting biodiversity outcomes.

- Platforms where innovators can build new services on top of existing data layers.

Companies that contribute to this infrastructure—rather than building rigid, closed systems—are likely to play central roles as the market matures.

How Companies Can Start Pivoting Toward Biodiversity Business Models

Companies looking to transition toward biodiversity business models must begin with clarity, commitment and a structured roadmap. The shift requires more than isolated projects—it demands alignment across strategy, operations, finance and partnerships. As nature becomes a core economic variable, companies that adapt early will gain resilience, regulatory readiness and new growth pathways. This pivot is not only about managing risks but also about unlocking long-term value in a nature-positive economy.

Map nature dependencies and impacts across the value chain

The first step for most companies is diagnostic. They need a clear picture of where they depend on nature and where they affect it.

This mapping should consider:

- Direct operations, such as production sites and facilities.

- Upstream supply chains—especially land-use, water use and raw materials.

- Downstream impacts from product use and end-of-life.

- Physical, regulatory, market and reputational risks linked to biodiversity.

The output is not just a risk register. It is also a map of where biodiversity-based business opportunities might arise: new products, services, partnerships and finance structures.

Build a portfolio of near-term and long-term moves

Not every company will launch a biodiversity credit platform or a seed bank. But most can create a balanced portfolio of actions:

- Near-term moves: pilot regenerative sourcing, invest in urban green infrastructure at own sites, partner on small PES schemes, test biodiversity metrics in reporting.

- Long-term bets: invest in data platforms, support emerging nature markets, explore bioeconomy ventures or integrated project development.

This portfolio approach spreads risk and allows learning. It also signals to investors and regulators that the company is taking biodiversity seriously, beyond short-term campaigns.

Integrate biodiversity into strategy, governance and disclosures

For biodiversity business models to thrive inside organisations, they must be embedded in core systems, not added as isolated projects.

That means:

- Board-level oversight of nature-related risks and opportunities.

- Clear responsibilities in management teams.

- Integration of biodiversity indicators into performance metrics and incentives.

- Alignment between public commitments, lobbying positions and internal decisions.

- Transparent reporting on progress, challenges and next steps.

Companies that treat biodiversity as a strategic theme—linked to innovation, risk and competitiveness—will find it easier to attract partners, talent and capital in the emerging nature-positive economy.

Looking Ahead: From Niche Innovation to Normal Business

Biodiversity loss is often described as a crisis, but it is also a profound pivot point for business. As awareness, policy, data and finance converge, biodiversity business models are moving from the frontier into the mainstream.

The 15 biodiversity-based business opportunities outlined here are not speculative concepts. Many already operate at meaningful scale. Their future potential lies in deeper integration, better metrics, fairer partnerships and stronger digital infrastructure.

Over the coming decade, the distinction between “traditional” and nature-positive business models may blur. For many sectors, working with biodiversity will simply be part of doing business well.

For now, companies and entrepreneurs have a window to shape how these markets develop. Those who engage early—with humility, scientific rigour and long-term commitment—are likely to play defining roles in the next chapter of the global economy, where thriving ecosystems and thriving businesses reinforce each other rather than stand in conflict.