Choosing the right car insurance provider is a crucial decision that impacts both your finances and peace of mind. With so many options available, the debate often narrows down to big vs local car insurance providers pros and cons.

While big insurance providers offer broad coverage and advanced technology, local providers focus on personalized service and community involvement.

In this article, we will explore 15 pros and cons of using big vs. local car insurance providers to help you make an informed decision.

Understanding Big vs. Local Car Insurance Providers

Big car insurance providers are large companies with a nationwide or even global presence. These companies are known for their extensive marketing campaigns, diverse policy options, and financial stability. Examples include companies like Geico, State Farm, and Progressive.

Key Characteristics:

- Nationwide reach with a large network of agents and offices.

- Extensive marketing campaigns that enhance brand recognition.

- Wide variety of policy options to cater to diverse needs.

Example: State Farm, a major player, serves millions of customers across the U.S. and provides a wide range of coverage, including specialized options for high-risk drivers.

What Are Local Car Insurance Providers?

Local car insurance providers are smaller companies or agencies that operate within a specific region. They prioritize community involvement and personalized service, often building strong relationships with their clients.

Key Characteristics:

- Focused on a specific region or community.

- Personalized customer service with agents who know the local area.

- Policies tailored to regional needs and demographics.

Example: ABC Insurance, operating in the Midwest, offers custom policies suited to local weather patterns and driving conditions, making it a trusted choice for residents.

15 Pros and Cons of Big vs. Local Car Insurance Providers

Choosing the right insurance provider involves weighing the big vs local car insurance providers pros and cons. This section explores the advantages and drawbacks of both options, helping you understand which type of provider might suit your needs best. By evaluating their features, services, and limitations, you can make an informed decision that aligns with your priorities.

Pros of Big Car Insurance Providers

When considering the big vs local car insurance providers pros and cons, it’s essential to understand the specific advantages that big providers bring to the table. Their scale and resources enable them to offer unique benefits that cater to a wide range of customers.

Whether you prioritize extensive coverage options, advanced technology, or financial stability, big providers often stand out as a reliable choice. Below, we delve into the key pros that make big car insurance providers appealing to millions of policyholders.

1. Broad Coverage Options

Big insurance providers offer a wide range of coverage plans, including comprehensive, collision, and specialized options like ride-sharing insurance. This variety ensures that customers can find policies that match their unique needs.

| Feature | Big Providers Offerings |

| Basic Coverage | Liability, collision, comprehensive |

| Specialized Options | Ride-sharing, classic car, or umbrella insurance |

| Add-Ons | Roadside assistance, rental car reimbursement |

Actionable Tip: Before selecting a policy, use comparison tools provided by big providers to tailor a plan that suits your needs.

2. Financial Stability

Larger companies are often more financially secure, ensuring they can handle claims during major disasters. This stability provides peace of mind, knowing your provider can pay out claims when it matters most.

| Metric | Big Providers |

| Claim Payout Capacity | High (due to large reserves and reinsurance) |

| Customer Confidence | High (often rated highly by financial agencies) |

Example: In the aftermath of Hurricane Ian, large insurers like Allstate managed thousands of claims efficiently due to robust resources.

3. Technology and Resources

Big providers invest heavily in technology, offering user-friendly mobile apps, online claims processing, and advanced tools like AI-driven support. For example, Progressive’s app allows users to file claims, track progress, and even monitor safe driving habits.

| Technology Integration | Feature Examples |

| Mobile Apps | Claims filing, policy management, usage tracking |

| AI Tools | Virtual agents, predictive analytics for risk |

4. 24/7 Customer Support

Most big providers offer round-the-clock support through multiple channels, including phone, chat, and apps. This accessibility ensures help is available when you need it most.

Practical Insight: Many big providers offer multilingual customer service, which can be a crucial factor for diverse regions.

5. Discounts and Bundling Options

Customers can save by bundling policies, such as combining auto and home insurance, which is often not feasible with smaller providers. Nationwide, for instance, offers up to 25% savings for bundling.

| Discount Type | Savings Percentage |

| Multi-Policy Discount | 15%-25% |

| Safe Driver Discount | 10%-20% |

| Good Student Discount | 10%-15% |

Tip: Check for loyalty programs that reward long-term customers with additional savings. These programs can include benefits like premium reductions after a set number of claim-free years or exclusive discounts for renewing your policy consistently. They not only incentivize customer loyalty but also help you save significantly over time.

Cons of Big Car Insurance Providers

While big car insurance providers have significant advantages, there are notable drawbacks that may impact your experience as a policyholder. Understanding these downsides is essential when weighing the big vs local car insurance providers pros and cons. Below, we explore the challenges commonly associated with large insurance providers.

6. Less Personalized Service

Due to their scale, big providers may lack the personal touch smaller companies offer, leading to a less tailored customer experience.

7. Higher Premium Costs

The overhead of large-scale operations and marketing can result in higher premiums compared to local providers.

| Cost Comparison | Big Providers | Local Providers |

| Average Premiums | $1,500/year | $1,200/year |

8. Claims Can Be Complex

With larger networks and systems, claims processing may involve more bureaucracy and delays, frustrating customers during critical times.

Pros of Local Car Insurance Providers

Local car insurance providers bring a unique set of advantages to the table that cater to individuals looking for a more tailored and community-focused experience. These providers excel in building long-term relationships with their clients, often delivering services that are specific to regional needs.

Below, we dive into the key benefits that make local car insurance providers a compelling choice for many policyholders.

9. Personalized Customer Experience

Local providers excel in offering personalized service, often assigning dedicated agents who understand your unique needs. They often build long-term relationships with customers, ensuring a sense of trust and reliability.

| Feature | Local Providers Offerings |

| Customer Focus | Personalized attention and dedicated agents |

| Community Connection | Understanding of local regulations and conditions |

| Tailored Policies | Customized to individual and regional needs |

10. Community Involvement

Local insurers are deeply rooted in their communities, often contributing to local causes and fostering strong relationships. For example, XYZ Insurance sponsors local sports teams and community events.

Case Study: In a small coastal town, a local provider offered discounted flood insurance policies, addressing the specific needs of residents.

11. Competitive Pricing

Local providers may offer more affordable premiums, especially for customers with clean driving records or specific coverage needs. For instance, small-town insurers often charge lower rates due to fewer overhead costs.

12. Faster Claims Processing

Smaller operations can mean quicker turnaround times for claims, as there are fewer layers of bureaucracy. Customers often enjoy streamlined processes and direct communication with decision-makers.

| Claims Processing Time | Big Providers | Local Providers |

| Average Time | 15-30 days | 7-14 days |

Cons of Local Car Insurance Providers

Local car insurance providers, while offering many benefits, are not without their drawbacks. These limitations often stem from their smaller scale and resources compared to larger companies. When considering the big vs local car insurance providers pros and cons, it’s crucial to evaluate these potential challenges to determine whether a local provider aligns with your insurance needs.

Below, we examine some of the most common downsides of choosing local car insurance providers.

13. Limited Coverage Options

Local providers may not offer the same variety of policies as their larger counterparts, making it challenging for those with unique needs.

14. Financial Stability Concerns

Smaller insurers might lack the financial resources to handle large-scale claims during widespread disasters, posing a potential risk.

15. Limited Technology

Local providers may not invest as much in digital tools, resulting in fewer online resources and app functionalities. Customers might miss out on conveniences like mobile claims filing or usage-based insurance.

Big vs. Local Car Insurance Providers: Which Is Right for You?

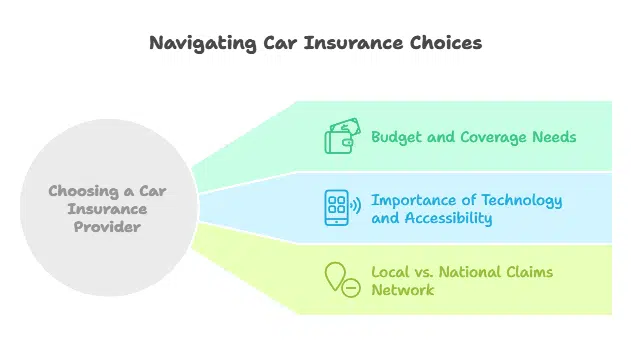

Choosing between big and local car insurance providers can feel overwhelming, but breaking it down into your specific priorities makes the process much easier. Whether you’re focused on budget, coverage, customer service, or advanced tools, there’s a provider to suit your needs.

Let’s explore the critical factors to help you decide which provider aligns with your lifestyle and insurance goals.

Budget and Coverage Needs

Assess your financial situation and coverage requirements to determine which provider aligns best with your needs.

Importance of Technology and Accessibility

If you value advanced tools like mobile apps and online claims, a big provider might be a better fit.

Local vs. National Claims Network

Consider the convenience of accessing a claims network, whether it’s through a national system or a local office.

| Feature | Big Providers | Local Providers |

| Coverage Options | Extensive | Limited |

| Customer Service | Impersonal | Personalized |

| Claims Processing | Slower | Faster |

| Premium Costs | Higher | Competitive |

| Technology Integration | Advanced | Basic |

Takeaways

Choosing between big vs local car insurance providers pros and cons ultimately depends on your personal preferences and needs. Big providers offer extensive coverage, financial stability, and technological convenience, while local providers excel in personalized service, community involvement, and competitive pricing.

Evaluate your priorities and make a choice that aligns with your lifestyle and budget.