Living across borders turns “normal banking” into a constant tax on your time. You get paid in one currency, spend in another, withdraw cash in a third, and suddenly the hidden fees are everywhere. The right neobank helps you hold multiple currencies, spend abroad with fewer surprises, and control your card instantly if something looks off.

The goal is not to find a perfect bank. It’s to build a reliable setup: one account for everyday spending, one for getting paid, and a backup card so a random freeze does not ruin your month.

How We Picked Our 10 Best Neobanks for Digital Nomads and Expats

What we prioritized:

-

Signup reality: Where you can actually open the account (residency rules matter more than features).

-

Multi-currency strength: Hold, convert, and spend without painful markups.

-

Getting paid: Local account details (like USD/GBP/EUR) so clients can pay you like a local.

-

Travel usability: Card acceptance, ATM access, and clear fee rules.

-

Security controls: Virtual cards, freeze/unfreeze, spending limits.

Common deal-breakers:

-

Country restrictions: Apps that advertise “global” but only accept signups from limited regions.

-

FX surprises: Weekend markups, plan-based caps, or confusing conversion rules.

-

Transfer costs: SWIFT fees or unclear inbound/outbound transfer pricing.

Comparison Table

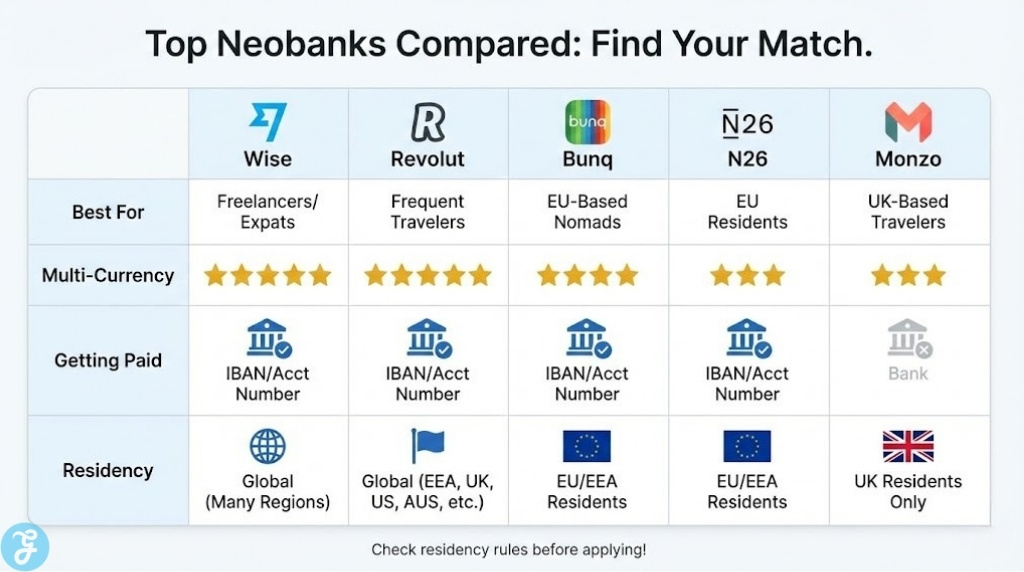

| Neobank | Best For | Multi-Currency | Getting Paid | Standout Advantage | Main Watch-Out |

|---|---|---|---|---|---|

| Wise | Paid in multiple currencies | Strong | Local account details | Great for receiving money like a local | Not a full bank for everyone |

| Revolut | All-in-one travel money | Strong | Varies by region | One app for FX + travel features | Plan limits and FX rules |

| bunq | EU-based expats/nomads | Solid | IBAN-focused | “Live abroad” friendly features | Plan/fee complexity |

| N26 | EU residents who travel | Moderate | Euro-first | Clean bank UX + travel-friendly | Residency-limited availability |

| Monzo | UK residents traveling | Limited | UK-first | Simple travel spending experience | UK-centric signup |

| Starling | UK residents traveling | Limited | UK-first | Travel-forward current account | UK-only signup |

| Monese | New expats in UK/EU | Moderate | UK/EU focus | Built for “on the move” users | Region-dependent features |

| Paysera | Transfers + utility features | Moderate | EU-friendly | Transparent fee documentation | Fee tables can be dense |

| ZEN.COM | EU travel spending | Moderate | EU focus | Multi-currency positioning | Plan/region differences |

| Backup account | Everyone | — | — | Reduces lockout risk | Requires setup discipline |

10 Best Neobanks for Digital Nomads and Expats

Here are the 10 Best Neobanks for Digital Nomads and Expats to manage money across borders with fewer fees and fewer headaches.

1) Wise

Wise is a top pick if you get paid internationally or juggle multiple currencies because it’s built around local account details and multi-currency holding. It’s especially useful for freelancers who want clients to pay them without forcing conversion first.

-

Best For: Freelancers/expats receiving USD/GBP/EUR and spending internationally

-

Pros: Local account details for getting paid; strong multi-currency workflow

-

Cons: Not always a full replacement for a traditional bank (depends on your needs)

2) Revolut

Revolut works well if you want one app for spending, exchanging, and travel features in one place. It can be great for frequent movers, but you should understand plan-based caps and rules that can affect FX and ATM use.

-

Best For: Nomads who want one app for FX, card spending, and travel features

-

Pros: Strong travel workflow; broad feature set

-

Cons: FX/ATM rules can change by plan and region

3) bunq

bunq is a strong option if you’re EU-based and want a bank-like experience with travel-friendly features. It’s built around euro banking flows (IBAN), and it’s often chosen by expats who want modern controls with a more traditional “bank account” feel.

-

Best For: EU nomads who want a primary day-to-day account

-

Pros: Strong EU banking experience; good account controls

-

Cons: Pricing tiers and certain transfer fees can be confusing

4) N26

N26 fits nomads who live in an eligible European country and want a minimalist banking app that travels well. It’s best if your “home base” is in supported countries and you want a clean card-and-app setup.

-

Best For: EU residents who want simple, travel-friendly banking

-

Pros: Clean UX; straightforward day-to-day banking

-

Cons: Availability is residency-limited

5) Monzo

Monzo is popular for UK-based nomads who want a reliable spend card and strong app controls while traveling. It’s a great everyday account if you’re UK resident and want clarity about fees and how spending works abroad.

-

Best For: UK residents who travel often

-

Pros: Easy-to-use app; clear spending controls

-

Cons: UK-centric signup and account structure

6) Starling Bank

Starling is another UK favorite for travel spending, built around a current account that works smoothly abroad. It’s ideal if you want a dependable UK bank account that doesn’t make international spending feel complicated.

-

Best For: UK residents who want a travel-friendly debit card

-

Pros: Strong everyday banking features; travel-friendly positioning

-

Cons: UK-only signup limits usefulness for many expats

7) Monese

Monese is designed for people on the move, including foreign nationals, which makes it appealing for new expats who want an account without traditional bank friction. It can be a solid “bridge account” when you’re relocating and need something workable fast.

-

Best For: New expats in the UK/EU who want a quick mobile-first account

-

Pros: Built for expat/on-the-move use cases

-

Cons: Eligibility and features vary by country

8) Paysera

Paysera is a practical pick if you care about transfers, utility features, and fee transparency more than premium perks. It’s a “read the fees, use it smart” option that can work well for EU-leaning users who value clarity.

-

Best For: People who prioritize transfers and fee documentation

-

Pros: Transparent fee pages; useful transfer services

-

Cons: Fee tables can be detailed and take time to understand

9) ZEN.COM

ZEN.COM is a travel-leaning option with multi-currency positioning and a modern card-and-app experience. It’s best for EU-based travelers who want another flexible spending layer, especially as a secondary account.

-

Best For: EU travelers who want a multi-currency spending option

-

Pros: Travel-friendly positioning; modern app experience

-

Cons: Plan specifics and availability vary by market

10) Your Backup Neobank

This is the one most nomads forget until it’s too late. A second provider (even if you keep it mostly unused) reduces the risk of getting stuck if your primary card is frozen, lost, or flagged while you’re abroad.

-

Best For: Anyone crossing borders regularly

-

Pros: Major reduction in lockout risk; more resilience while traveling

-

Cons: Requires setup and a little discipline

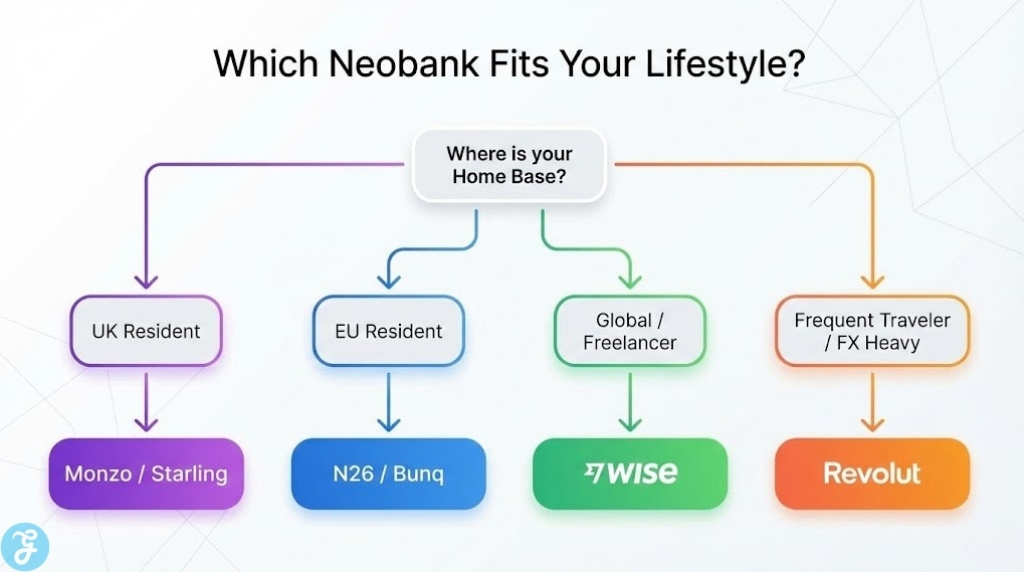

How to Choose the Right Neobank as a Nomad

Quick Checklist

-

Eligibility: Can you open it with your current residency and documents?

-

Getting paid: Do you need local account details (USD/GBP/EUR) for clients/employers?

-

FX cost: What’s the real conversion cost (rate, markup, weekend rules, plan caps)?

-

Cash needs: How often will you withdraw, and what are the limits/fees?

-

Backup plan: Do you have a second card ready if something gets flagged?

Small Decision Table

| Your Situation | Best Setup Direction |

|---|---|

| Paid by international clients | Wise-style “get paid” account + separate spend card |

| Constant travel + frequent FX | Revolut-style travel wallet + backup card |

| EU-based expat | bunq or N26 as primary + Wise for getting paid |

| UK-based nomad | Monzo or Starling as primary + Wise for multi-currency |

Common Mistakes to Avoid

-

Single point of failure: Using one card for everything with no backup

-

FX traps: Accepting “pay in your home currency” at checkout (DCC)

-

ATM surprises: Not checking limits and third-party ATM operator fees

-

Support risk: Not testing customer support responsiveness before you rely on it

Setup Tips for Nomads

Here are 3 tips:

A simple 2-account strategy

-

Account A: Get paid (local account details + multi-currency holding)

-

Account B: Spend + backup (separate provider and separate card)

Card Safety Basics

-

Subscriptions: Use virtual cards for subscriptions and trials

-

Controls: Set spending limits and freeze/unfreeze quickly

-

Separation: Keep your backup card somewhere different than your main wallet

Getting Paid Internationally

-

Local details: Best when clients want to pay “like a local”

-

Transfers: Useful when you’re moving larger amounts or paying rent abroad

-

Rule of thumb: Optimize “get paid” first, then optimize “spend”

The Verdict

The best neobank for digital nomads isn’t the one with the flashiest perks. It’s the one that stays boring when your life isn’t. You want predictable FX, reliable card acceptance, easy ways to receive money, and controls that let you lock things down in seconds when you’re moving.

Build it like a system: start with a strong “get paid” foundation, add a travel-ready spend account, and set up a backup provider before you need it. Do that once, and you stop “managing money abroad” and start simply living abroad.