Debt piling up? You’re not alone many people face money troubles at some point. Bills stack fast , leaving you stressed about what’s next.

Bankruptcy hurts your Credit Score , stays on your Credit Report years. But there’s hope other ways exist like Debt Consolidation or talking straight with creditors.

This guide shows Alternatives To Bankruptcy smarter fixes without wrecking finances long-term. Get ready learn real steps outta trouble fast !

Key Takeaways

- Credit counseling and debt management plans (DMPs) offer structured repayment options with lower interest rates, often through nonprofit agencies. DMPs typically last 3-5 years and may require closing credit cards, impacting your credit score short-term.

- Debt consolidation loans or 0% balance transfer cards can simplify payments. Balance transfers may offer up to 21 months interest-free but charge 3%-5% fees. Home equity loans or personal loans work for fair-to-good credit borrowers.

- Debt settlement programs negotiate with creditors to reduce debt amounts but charge 15%-25% fees. Skipping payments hurts your credit score, and creditors may refuse deals.

- Direct negotiations with creditors can cut debt by 30%-50% via lump-sum settlements. Creditors may lower interest rates or pause penalties under hardship rules under the Fair Debt Collection Practices Act.

- Side hustles or selling assets like stocks, cars, or unused items can boost income fast. Small savings add up, helping avoid bankruptcy while keeping your credit score intact.

Credit Counseling

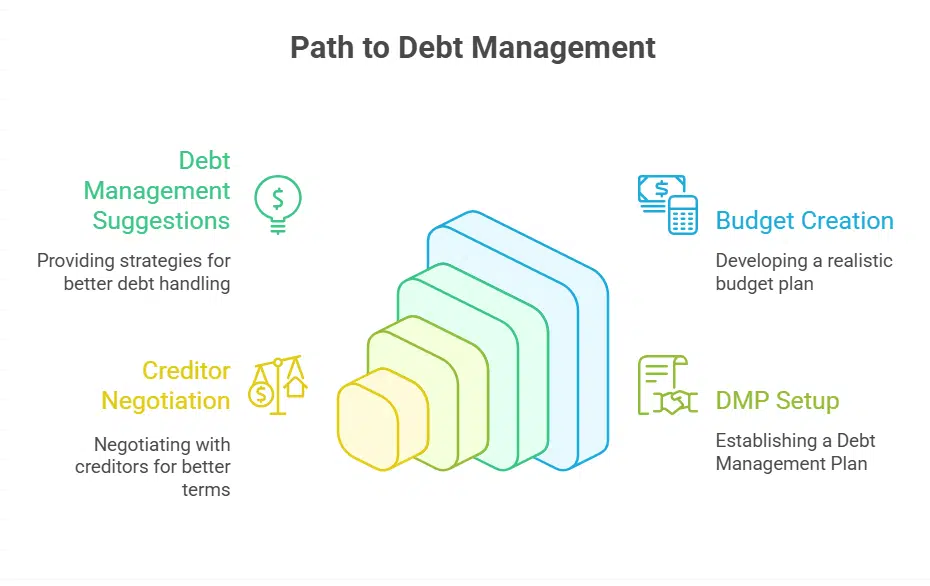

Struggling with debt? Credit counseling might help. Certified nonprofit credit counseling agencies work nationwide to review your finances, create budgets, and suggest ways to manage debt better.

They don’t just throw numbers at you; they sit down and plan a realistic way out of financial stress.

These agencies can also set up Debt Management Plans (DMPs). A DMP may lower interest rates or monthly payments by negotiating with creditors for you. It won’t erase debt like bankruptcy, but it makes repayments more manageable without wrecking your credit score.

Think of it as getting expert help to tackle bills before things spiral out of control.

Debt Management Plans

A debt management plan (DMP) can help you pay off unsecured debts, like credit card balances, without filing for bankruptcy. These plans typically last 3-5 years and are set up through a credit counseling agency.

Creditors may agree to lower interest rates or waive fees, making payments more manageable. Be aware, though, they often require closing your credit cards, which can hurt your credit score in the short term.

You’ll pay a small setup fee and monthly fees to the agency handling your DMP. Keep in mind that federal student loans and obligations like child support aren’t included. A structured repayment plan can ease financial stress, but always check terms carefully before committing.

Missing payments could cancel the agreement and leave you back where you started with debt collectors calling again.

Debt Consolidation Loans

Debt consolidation loans can simplify payments by combining multiple debts into one. They work best for fair to good credit borrowers who risk missing payments. Expect fixed monthly rates and terms from personal loans or home equity options.

A 0% interest balance transfer card may also help, offering up to 21 months interest-free. Watch for fees of 3%-5%. These loans protect your credit score better than late payments or bankruptcy.

Just keep the repayment plan tight to avoid more trouble down the road.

Debt Settlement Programs

Debt settlement programs offer a way out for those drowning in debt. Companies step in to haggle with creditors, aiming to slash what you owe. They might cut deals where you pay only part of your total debt.

Be ready for costs. These firms charge 15% to 25% of the settled amount. You may also face fees for holding your cash in a special account. Your credit score will take a hit, since you must stop payments to build up funds for settlements.

Keep in mind, there’s no promise creditors will agree to any deal. Some may refuse to negotiate at all.

If you’re considering this route, weigh the pros and cons carefully. It can lighten your debt load, but the impact on your credit history lasts years. Always explore other options like credit counseling or debt management first.

Balance Transfer Credit Cards

Balance transfer credit cards can be a strategic way to address high-interest debt without resorting to bankruptcy. These cards allow you to shift existing balances to a new card with 0% interest, often for as long as 21 months.

The trade-off is an upfront fee of 3%-5%, but the savings on interest often make up for this cost. Lower rates mean more of your payment goes toward the principal, helping you clear debt more efficiently.

Additionally, it streamlines payments by consolidating multiple debts into one monthly bill. Keep in mind, this approach works best if you can pay off the balance before the promotional period ends—otherwise, higher rates take effect and reverse your progress.

Using balance transfers wisely can also improve your credit score. Transferring debt can lower your overall credit utilization ratio, which lenders prefer to see below 30%. A mix of different credit types—like adding a new card—can also positively impact your score.

Just be cautious not to max out the new card or miss payments; these actions can cause more harm than benefit. If you have a steady income and decent credit (usually above 670), this approach provides a better alternative to compounding interest from old debts or high-risk payday loans without involving court processes like Chapter 7 or Chapter 13.

Negotiating Directly With Creditors

Skip the middleman and talk straight to your creditors before bankruptcy becomes the only option. Many lenders prefer partial payments over none, so they might lower interest rates or settle for less than what you owe.

The Fair Debt Collection Practices Act stops collectors from harassing you, giving you room to negotiate without fear. Keep records of all calls and offers in case disputes arise later.

Creditors often accept lump-sum settlements as low as 30–50% of the debt if paid fast. Offer a realistic payment plan backed by proof of income—they’ll listen if it beats getting nothing in court.

Mention financial hardship honestly but avoid emotional pleas. Some may pause penalties or freeze interest while you pay, making it easier to dig out of debt without wrecking your credit score like bankruptcy would.

Stay firm but polite; desperation weakens your position.

Liquidating Non-Essential Assets

Selling extra stuff can free up cash fast. Unneeded items like cars, stocks, or bonds can turn into quick money. This cash can pay off credit card debt or shrink loan balances.

Liquidating assets avoids drastic steps like bankruptcy. It cuts clutter and debts in one move. Think of it as a spring cleaning for your finances. The extra cash helps regain control without court filings.

Increasing Income Through Side Hustles

Side hustles can boost your income fast. A part-time job, freelancing gig, or selling unused items puts extra cash in your pocket. More money means quicker debt repayment without filing for bankruptcy.

Diversify your income to stay financially stable. Drive for rideshare apps, tutor online, or flip thrift finds for profit. Even small earnings add up over time and help tackle credit card debt or other bills.

Every dollar counts when digging out of financial difficulties.

Adjusting Lifestyle and Budgeting Habits

Small changes in daily spending can free up cash for debt repayment. Cutting unnecessary expenses, like eating out or subscriptions, helps tighten the budget fast. Tracking every dollar highlights where money leaks happen.

A clear budget puts you back in control of finances. Simple tools like apps or spreadsheets make it easier to stay on track. Cutting small luxuries today can prevent big money troubles tomorrow, keeping your credit score healthy and avoiding bankruptcy.

Focus on needs first, then slowly rebuild financial stability with smarter habits.

Seeking Legal Advice for Debt Relief Options

Hitting a financial wall can feel scary, but legal help can guide you through the mess. A bankruptcy attorney or debt relief lawyer knows the tricks of the trade, like how Chapter 7 wipes out unsecured debts, or how Chapter 13 sets up a payment plan.

They can explain if you pass the means test for Chapter 7 bankruptcy, or if settling with creditors makes more sense.

Legal pros also spot shady moves, like when debt collectors break the Fair Debt Collection Practices Act. They might suggest debt counseling or negotiating with a collection agency before jumping into bankruptcy filings.

Court rules change, so having someone who knows the latest bankruptcy laws can save you big headaches. Whether it’s stopping a foreclosure or tackling credit card debt, the right advice keeps you from drowning.

Exploring Judgment Proof Debtor Status

Being “judgment proof” means creditors can’t take your income or assets. If you have very little money and rely on essentials like government benefits, debt collectors may not touch them.

Your home, car, and basic wages are often protected by law.

Some people avoid wage garnishment or losing property because their resources are exempt. Knowing legal rights helps stop collection agencies from pushing too hard. If most of what you own is essential, bankruptcy might not be needed.

Check state laws to see if this status fits your situation.

Takeaway

Bankruptcy isn’t the only way out when debt feels overwhelming. You’ve got options, like debt management plans, side gigs, or even selling stuff you don’t need. Smart moves now can save your credit score and ease financial stress down the road.

Stay proactive—your future self will thank you for dodging that bankruptcy bullet. Keep it simple, take action today!

FAQs on Best Alternatives to Bankruptcy

1. What are the best alternatives to bankruptcy in 2025?

Instead of filing for Chapter 7 or Chapter 13 bankruptcy, consider debt settlement, credit counseling, or a debt management program. These options can help you avoid hurting your credit history while still tackling financial difficulties.

2. How does debt consolidation work as an alternative to bankruptcy?

Debt consolidation combines multiple debts, like credit card debt or payday loans, into one payment. It simplifies debt repayment and may lower interest rates, making it easier to regain financial stability without filing bankruptcy petitions.

3. Can a home equity loan help me avoid bankruptcy?

Yes, if you have equity in your home, a home equity loan or mortgage loan can provide funds to pay off secured and unsecured debts. Just be careful, because if you default, your home could be foreclosed.

4. Is credit counseling better than filing for bankruptcy?

Credit counseling offers financial education and debt negotiation strategies. A credit counselor can help you create a realistic debt repayment plan, which might keep your credit scores from dropping as badly as a Chapter 11 bankruptcy would.

5. What happens if I choose debt settlement instead of bankruptcy?

Debt settlement companies negotiate with creditors to reduce what you owe. Some forgiven debt may be taxable, but it’s often less damaging than a bankruptcy discharge. Just watch out for scams, and always get everything in writing.