Investing in crypto can feel like riding a rollercoaster. Prices swing wildly, making it hard to plan or save. Many people want the benefits of digital money without the stress.

Stablecoins fix this problem by staying steady. They tie their value to things like the U.S. dollar or gold. This keeps your money safe from sudden drops or spikes.

In this post, you’ll learn why stablecoins work better than other cryptos for daily use and savings. We’ll cover seven big perks, from fast transfers to low fees. Read on to see how they can help you take control of your money with less worry.

Here’s what makes them stand out.

7 Key Benefits Of Investing In Stablecoins

Crypto prices bounce around too much for comfort. One day you’re up, the next day down—it’s exhausting! People need something stable for payments and saving without all that drama.

Good news: stablecoins offer that calm in the storm with price stability pegged to real-world assets (think USD Coin). No more guessing games when buying coffee or paying bills globally through blockchain technology at lightning speed—and cheaper than banks charge!

This guide breaks down seven smart reasons these digital currencies beat traditional options hands-down—from cutting costs on cross-border payments right into decentralized finance apps safely using smart contracts…

Ready? Let’s get started straight away. Your wallet will thank ya later ;).

What Are Stablecoins?

Stablecoins are digital currencies pegged to stable assets like the U.S. dollar or gold. Unlike Bitcoin, they avoid wild price swings, making them ideal for everyday use. Stability is not a choice, it’s a necessity in finance,” as one expert puts it.

These tokens combine blockchain technology with financial stability, offering faster transactions and lower fees than traditional banks.

They come in different types—some backed by fiat currencies like USD Coin (USDC), others tied to precious metals like Tether Gold (XAUT). Stablecoins power decentralized finance (DeFi) apps, enabling yield farming and smart contracts without currency risks.

Businesses save up to 80% on cross-border payments using them—no surprise they’re gaining traction globally while keeping regulatory compliance tight.

Key Benefits of Investing in Stablecoins

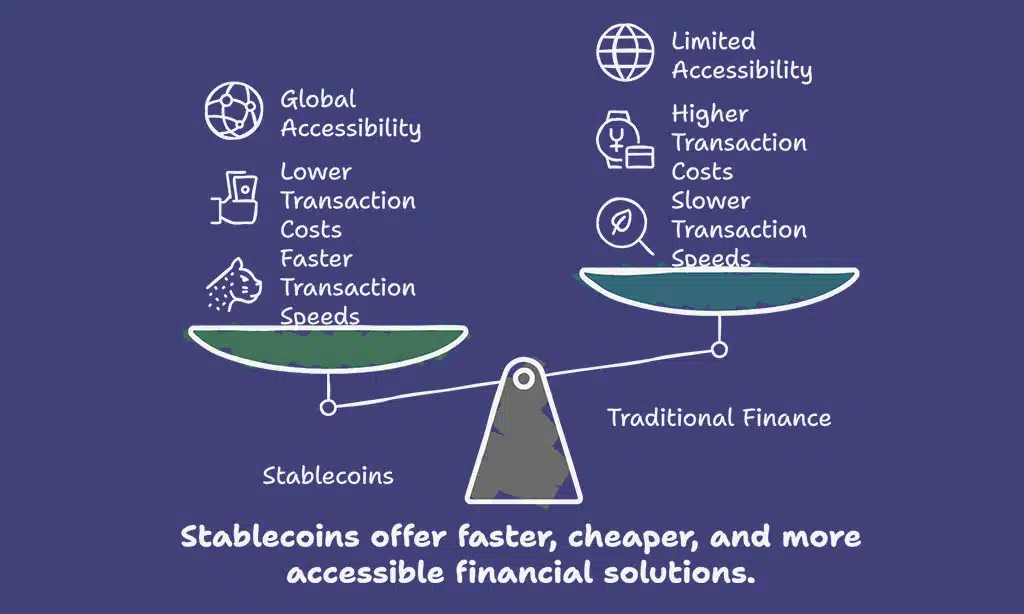

Stablecoins act like digital cash, letting you move money fast without wild price swings. They cut fees and red tape, making global payments as easy as sending a text message. The second sentence should flow naturally from the first.

Stablecoins remove the rollercoaster ride of crypto prices while keeping blockchain’s speed perks. These digital coins bridge old-school finance with DeFi apps, opening doors for small investors worldwide.

Price Stability and Reduced Volatility

Stable coins keep their value steady because they’re tied mostly fiat currencies like U.S dollars or commodities such as gold This makes them far less shaky compared wild swings seen Bitcoin Tether USDT USD Coin USDC good examples pegged real-world assets Investors tired unpredictable ups downs crypto markets often turn these safer options

Unlike regular cryptos which swing fast prices stay put thanks smart reserve management transparent audits Businesses save big too—studies show remittance costs drop nearly switching These coins work well global finance cross-border payments without worrying sudden drops Plus they fit easily existing payment systems digital wallets giving people quick access liquid assets No wonder folks see solid store value

Faster Transaction Speeds

Stablecoins move money faster than traditional banks. Transactions settle in minutes, not days. They cut through the slow, outdated banking system like a hot knife through butter.

Stablecoins turn cross-border payments into a quick coffee run.

Built on blockchain technology, stablecoins like USDT and USDC skip middlemen. Payment processors and banks often add delays. With decentralized finance (DeFi), you send cash globally without waiting.

Businesses save time and slash costs—remittance fees drop by up to 80%. No more currency conversion headaches. Just fast, cheap money transfers.

Lower Transaction Costs

Stablecoins cut down on fees compared to traditional payment systems and even other cryptocurrencies. Businesses could slash remittance costs by up to 80% by using them, saving money on cross-border payments.

Transactions with coins like USDT or USDC skip high banking fees, making them a wallet-friendly alternative.

Blockchain technology keeps costs low by cutting out middlemen. Unlike credit card chargebacks or wire transfers, stablecoin payments settle fast with minimal transaction fees. They work well for decentralized finance (DeFi) apps, liquidity pools, and everyday spending without draining your funds in extra charges.

Global Accessibility and Financial Inclusion

Stablecoins break down barriers for unbanked populations. With just a smartphone and internet access, people can join the digital economy. No need for traditional banks. This opens doors to cross-border payments and financial services globally.

Businesses save up to 80% on remittance costs using stablecoins like USDT or USDC. These coins work fast with low fees, making them ideal for small transactions in developing countries.

Blockchain technology ensures transparency while keeping funds secure through decentralized exchanges and digital wallets. More people can now store value without fearing price swings of volatile assets like Bitcoin.

Integration with Existing Financial Systems

Stablecoins work smoothly with banks and payment systems. They bridge the gap between digital assets and traditional finance. Many businesses use them for cross-border payments, cutting costs by up to 80% compared to old methods.

Platforms like Binance support stablecoins such as USDT and USDC. These coins fit into existing financial markets without major changes. They also help with regulatory compliance, making them safer for everyday use.

Their stability makes them a reliable medium of exchange, unlike more volatile crypto assets like Bitcoin.

Security and Transparency

Stablecoin transactions run on blockchain networks, which offer strong security through encryption tools like two-factor authentication. Every transfer gets recorded publicly on-chain so anyone can verify balances without trusting middlemen—no shady business here!

Many top coins like USDT or USDC undergo regular reserve audits, proving they hold enough cash or assets backing each token’s worth—a big deal if you hate surprises! Plus smart contracts cut fraud risks since deals execute automatically under set rules—no human errors messing things up!

Diversification in Investment Portfolios

Stablecoins add balance to crypto investments by softening the shock of price swings. Unlike Bitcoin, which can swing wildly, coins like USDT and USDC stay steady because they’re tied to fiat currencies.

This makes them a solid hedge when other digital assets lose value.

By mixing stablecoins with riskier crypto holdings, investors protect their portfolios from major losses. They also open doors to DeFi tools like yield farming and liquidity pools without full exposure to volatility.

Businesses save up to 80% on remittance costs using stablecoins, proving their real-world utility beyond just trading. Adding gold-backed options like PAXG or Tether Gold further diversifies into commodities while keeping blockchain benefits intact.

Takeaways

Stable coins offer steady value without the unpredictable price swings seen in assets like Bitcoin, making daily spending more straightforward while significantly reducing cross-border fees quickly.

Their speed outperforms traditional banks and provides global access in areas where cash availability is limited, fulfilling high demand through DeFi tools like smart contracts that integrate smoothly into existing payment systems when necessary, often immediately.

For those seeking safer investments within crypto while balancing riskier opportunities, consider diversifying with USDC/USDT holdings when trading tokens via automated markets—this could lead to more secure and rewarding profits with every securely executed trade under careful reserve audits, ensuring trust remains intact from the beginning.

The noticeable shift toward more stable assets in digital finance indicates a promising, steady progression within the broader crypto landscape.

FAQs

1. What are stablecoins?

Stablecoins are digital assets pegged to fiat currencies like the U.S. dollar or backed by gold. They reduce price fluctuations common in crypto like BTC.

2. Why should I invest in stablecoins?

They offer price stability, low transaction fees, and work in decentralized finance (DeFi). You can use them for cross-border payments or yield farming.

3. Are stablecoins safe?

Most rely on reserve audits and smart contracts for financial stability. Some, like Tether (USDT) and USD Coin (USDC), follow anti-money laundering rules.

4. How do stablecoins help the unbanked?

They provide financial inclusion by letting unbanked populations access digital wallets and global payment systems without traditional banks.

5. Can stablecoins be used in smart contracts?

Yes. Algorithmic stablecoins and programmable money work with blockchain technology, enabling automated market makers and decentralized apps.