Are you a factory owner in Brazil struggling to keep up with rising costs and slow production? Imagine: your team works hard, but machines break down often, and output lags behind global rivals.

It’s like running a race with one shoe untied, frustrating and inefficient. Many in manufacturing face this daily grind, especially with supply chains stretched thin after COVID-19 impact.

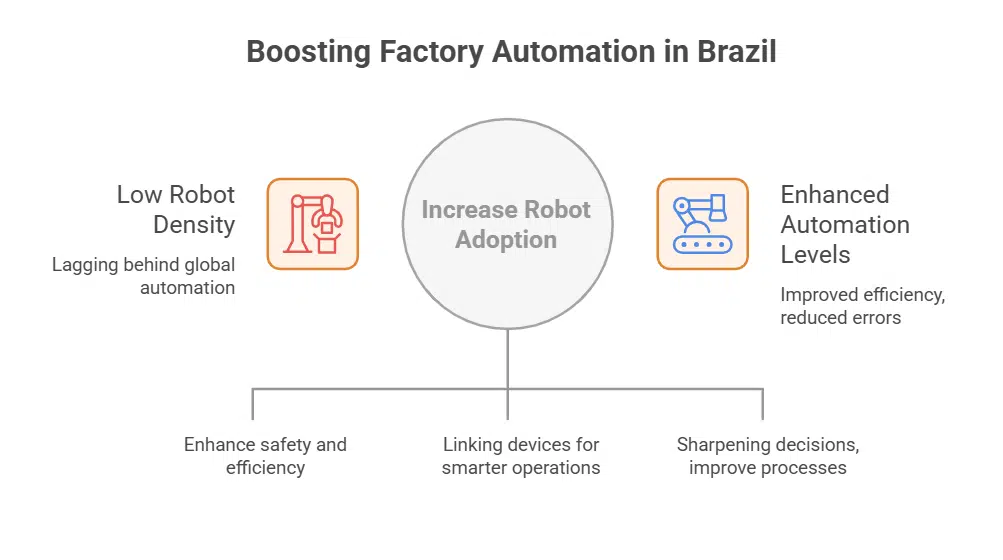

Here’s a key fact: Brazil ranks 12th in global GDP, yet only 20th in robot installations, per the International Federation of Robotics. That gap shows huge room for growth in industrial automation.

This blog post explores 6 Automation Trends In Brazilian Manufacturing. We’ll explore how artificial intelligence, internet of things, and industrial robots boost productivity in sectors like automotive industry and food and beverage industry.

Think of it as your roadmap to smarter factories, with tips on big data, analytics, and even collaborative robots for worker safety.

Ready to rev up your operations?

Key Takeaways

- Brazil ranks 20th in global robot installations with only 16 robots per 10,000 workers, compared to the world average of 141, per IFR data.

- In 2021, Brazil shipped 1,200 industrial robots, with a 7% growth rate versus the global 31% jump, and handling tasks make up 49% of working robots.

- Volkswagen Brazil uses AI for a 15-20% efficiency boost, and the automotive sector deploys 47% of robots, producing 2.256 million vehicles in 2021.

- Industrial accidents rose 30% in 2021 over 2020; Rockwell Automation partnered with Bravo Motor Company in June 2022 for EV manufacturing, projecting 2 million EV sales by 2030.

- Universal Robots shipped over 200 UR3e robots since 2018, training 2 million students; USIMINAS saved R$130,000 yearly with UR10e cobots.

Growth of Industrial Robotics in Manufacturing

Brazil sits at the 20th spot worldwide for robot installations, according to the IFR. That ranking shows room for growth in factory automation. Imagine this, folks, global robot setups jumped 31% in 2021, but Brazil only saw a 7% rise.

Ouch, that lag hurts, especially with just 16 industrial robots per 10,000 manufacturing workers here. Compare that to the world’s average of 141, and you see the gap. Handling tasks dominate, making up 49% of working robots and 59% of fresh installs in Brazil, per IFR World Robotics 2022 data.

Shipments hit 1,200 multipurpose industrial robots in 2021, fueling demand in industrial automation. Collaborative robots join the mix, boosting safety and efficiency on production lines.

Think about the automotive industry, where these machines shine. The Brazilian Factory Automation and Industrial Controls market eyes a 6.9% CAGR from 2025 to 2030. Industrial Internet of Things ties in, linking devices for smarter ops.

Programmable logic controllers guide these bots, cutting errors in tasks like welding or assembly. Data analytics from these systems sharpens decisions, much like a coach reviewing game tapes.

Volkswagen Brazil uses such tech to streamline car manufacturing. Energy efficiency improves too, saving costs in the long run. Market growth picks up steam in southeastern regions, where factories adopt more industrial controls.

Adoption of Artificial Intelligence for Process Optimization

Factories in Brazil now embrace artificial intelligence to make processes smoother, like a well-oiled machine that never skips a beat. Picture Volkswagen Brazil, they push for a 15-20% efficiency boost with AI and data analytics, turning data into gold for smarter decisions.

This shift fits right into industry 4.0, where machine learning and computer vision spot flaws before they grow into big problems. Intelligent automation mixes robotic process automation with tools like natural language processing, optical character recognition, and machine learning, creating a powerhouse for tasks.

In manufacturing, this means fewer errors and faster output, almost like giving your factory a brain upgrade. Brazil’s aerospace sector, worth USD 12 billion alongside Mexico, uses AI and computer vision to keep planes safe and production tight.

Factories adopt these techs for smart manufacturing, cutting waste and boosting speed, you know, like dodging traffic in a busy city with a smart GPS.

This adoption spreads across sectors, from finance to healthcare, retail, government, and of course, manufacturing in Brazil. Benefits pile up fast: increased efficiency slashes costs, improves customer experiences, and hands out competitive advantages, like aces up your sleeve in a high-stakes game.

Imagine machine learning predicting machine breakdowns through condition monitoring, saving big on repairs. Artificial intelligence optimizes workflows, much like a coach tweaking plays for the win.

In the automotive industry, car manufacturers like Volkswagen Brazil integrate AI for better demand forecasting and simulation. They use programmable logic controllers and distributed control systems to keep lines humming.

Industrial internet of things connects devices, feeding data to AI for real-time tweaks. Factories see reduced expenses and higher profit margins, proving AI as the secret sauce for staying ahead.

Increased Use of IoT for Smart Factories

Brazilian factories push forward with the Industrial Internet of Things, or IIoT, to build smart factories. Think of it like giving machines eyes and ears, so they talk to each other without a hitch.

Yokogawa rolled out new pressure and temperature sensors for its Sushi Sensor wireless IIoT solution. These gadgets make monitoring a breeze in tough spots. ABB jumped in too, launching the PxS 100 pressure transmitter series.

It stands up to harsh environments, boasting IP66 to IP69K ratings, perfect for Brazil’s diverse industries like oil and gas or chemical and petrochemical sectors. Digital pressure sensors gain ground fast, thanks to their low power use, cutting costs in factory automation.

The COVID-19 impact shook things up, forcing companies to rethink strategies and lean on automation for safety. Imagine a production line humming along, sensors spotting issues before they blow up, like a watchful friend averting disaster.

This shift sparks digital transformation in Brazil factory automation, weaving in Internet of Things (IoT) for real-time insights. Picture collaborative robots, or cobots, teaming up with IoT devices in the automotive industry, say at Volkswagen Brazil plants.

They boost efficiency, much like a well-oiled machine. Industries from food and beverage to pharmaceutical embrace this, using programmable logic controllers (PLCs) and distributed control systems (DCS) tied to IIoT.

Field devices, relays and switches, all connect seamlessly. The pandemic highlighted automation’s role in occupational health and safety, keeping workers safe amid chaos. Big data analytics pair with machine learning (ML) here, predicting downtime like a fortune teller reading tea leaves.

Brazilian manufacturers see growth rates climb, turning factories into smart hubs that adapt on the fly.

Expansion of Data-Driven Automation with Big Data and Analytics

Factories in Brazil embrace data-driven automation like a ship captain uses stars to guide the way. Big data collects info from machines and sensors, turning raw numbers into smart choices.

Analytics tools spot patterns fast, cutting waste and boosting output. Think of it as giving your factory a brain boost with industrial IoT devices. These connect everything, from field devices to industrial control systems.

Artificial intelligence steps in too, predicting issues before they hit. Brazilian firms in the automotive industry, like Volkswagen Brazil, lead this charge. They use computer vision and machine vision to check quality on the fly.

Collaborative robots work alongside humans, fueled by real-time data. This digital transformation sparks efficiency, like flipping a switch to light up profits.

Picture big data as the fuel in your factory’s engine, revving up processes in the chemical and petrochemical industry. Analytics dive deep, offering insights that slash downtime. Industrial internet of things ties it all together, creating smart factories that hum with precision.

Oil and gas industry players adopt this to monitor logistics without a hitch. Pharmaceutical industry folks track batches with ease, dodging errors. Food and beverage industry uses it for dynamic pricing and inventory wins.

Relays and switches get smarter, responding to data flows. Factory automation in Brazil grows, blending AI with big data for a seamless ride. E-commerce ties in too, as retailers use similar tech for loyalty programs and sales jumps.

This trend feels like finding hidden treasure in your own backyard, making operations slick and sharp.

Advancements in Automation for the Automotive Sector

Brazil’s automotive industry pushes hard for industrial automation. It leads with 47% of operational industrial robots deployed right there. Think of it like a busy beehive, where collaborative robots work side by side with humans to boost output.

Vehicle manufacturers produced 2.256 million motor vehicles in 2021. They face big challenges, like worker safety. Accidents and deaths jumped 30% in 2021 compared to 2020. Ouch, that stings, doesn’t it? Companies adopt artificial intelligence (AI) and machine vision to cut risks.

These tools spot dangers fast, like a hawk eyeing its prey. Rockwell Automation teamed up with Bravo Motor Company in June 2022. They focus on EV and battery manufacturing in Brazil.

This partnership sparks digital transformation in factory automation. Over 8,500 hybrid and electric vehicles roll on Brazilian roads now. Projections show electric vehicle sales hitting 2 million by 2030.

Wow, that’s a game changer.

Industrial Internet of Things (IIoT) connects machines in smart ways. It helps with process tweaks on the fly. Brazil factory automation grows in the automotive sector, thanks to COVID-19 impact pushing for safer setups.

Picture a digital twin mirroring a real production line; it tests changes without halting work. Volkswagen Brazil uses such tech to streamline operations. Computer vision scans parts for flaws, quick as a flash.

Industrial controls and field devices keep everything humming. Relays and switches automate tasks that once tired out workers. The chemical and petrochemical industry learns from this, but automotive leads the charge.

Food and beverage industry watches closely too. Oil and gas industry adapts similar trends. Pharmaceutical industry eyes these advancements for precision. Market segments expand as prices drop for tech like the UR3e robot.

Supermarket chains even automate logistics, inspired by automotive wins. Porter’s five forces analysis shows strong competition driving innovation. Translation software bridges language gaps in global teams.

Google Translate helps, but real progress comes from hands-on automating.

Integration of Cyber-Physical Systems in Production Lines

Cyber-physical systems blend machines with digital brains, and they transform production lines in Brazilian factories. Think of them as smart teams where computers chat with physical tools in real time.

Nokia joined forces with SENAI-SP to roll out Industry 4.0 tech at a training center, sparking this shift. Accenture snapped up Pollux in March 2021, boosting digital manufacturing skills across the board.

At the USIMINAS steel plant, workers installed the UR10e collaborative robot. This move cut paint costs by R$130,000 each year and made jobs safer, like dodging a bullet on the factory floor.

Since 2018, Universal Robots has shipped over 200 UR3e industrial robots to SENAI. These machines trained more than 2 million students and pros in Brazil factory automation. SESI bought over 20 cobots for schools in Minas Gerais State.

Kids from 7 to 17 now tinker with them, building skills for tomorrow’s jobs.

Rockwell Automation grabbed Plex Systems in September 2021, strengthening its smart manufacturing setup. This ties into cyber-physical systems, linking industrial controls with big data for smoother runs.

In the automotive industry, firms like Volkswagen Brazil use these systems to speed up lines. Picture robots and sensors working hand in glove, spotting issues before they bite. Artificial intelligence powers machine vision here, checking parts with eagle eyes.

For the chemical and petrochemical industry, or even oil and gas, these setups handle tough tasks safely. During the COVID-19 impact, such digital transformation kept factories humming without crowds.

Collaborative robots, or cobots, team up with humans, making work less like a grind and more like a dance. Industrial automation thrives on relays and switches, field devices that connect everything seamlessly.

Takeaways

Brazil charges ahead in automation, folks, turning factories into smart powerhouses with robots and AI leading the charge. Automotive giants like Volkswagen Brazil team up with collaborative robots, boosting output while keeping workers safe and happy.

Join this wave of digital transformation, and watch sectors from food to pharma soar with IoT and big data analytics. As Brazil builds its edge in industrial controls, major players like Rockwell Automation drive the growth.

Stay tuned; the future looks bright for this South American leader.

FAQs on Automation Trends In Brazilian Manufacturing

1. Hey, what’s driving the digital transformation in Brazilian manufacturing these days?

Well, picture this, factories in Brazil are jumping on board with industrial automation to boost output, and it’s all thanks to trends like artificial intelligence and machine vision that make everything run smoother. Collaborative robots, or cobots as folks call them, team up with workers in places like the automotive industry, turning old-school lines into smart setups. Yeah, it’s like giving your factory a brain upgrade, no kidding.

2. How did COVID-19 impact factory automation in Brazil?

COVID-19 shook things up big time, pushing companies to adopt industrial robots faster to keep folks safe and lines moving. In the food and beverage industry, for instance, it sped up the use of field devices and relays and switches to cut down on close contact.

3. Which sectors are leading in Brazil factory automation?

The automotive industry, think Volkswagen Brazil, leads the pack with heavy use of industrial controls. Don’t forget the chemical and petrochemical industry, plus oil and gas industry, they’re all in on it too, weaving in computer vision for better checks. And the pharmaceutical industry? It’s riding the wave with AI to stay ahead.

4. What about artificial intelligence in Brazilian manufacturing trends?

Artificial intelligence, or AI as we say, is a game-changer, helping predict machine fails before they happen in spots like the industrial controls market. It’s like having a crystal ball for your factory floor, you know?

5. Can you tell me about industrial robots in these automation trends?

Sure thing, industrial robots are exploding in Brazil, especially collaborative ones that work side by side with humans without the fuss. In market research, we see them popping up in the food and beverage industry and even with Rockwell Automation gear, making tasks quicker and safer. It’s almost funny how these bots are becoming the new best friends on the job.