The Sunday Night Struggle. It’s a ritual as old as the checkbook itself. You sit down at your kitchen table, surrounded by a week’s worth of crumpled receipts, your banking app open on your phone, and a daunting spreadsheet staring back at you from your laptop screen. You spend the next hour categorized: Coffee. Gas. Groceries. Mystery Amazon charge. By the time you finish, you feel a sense of accomplishment, until you realize the data you just entered is already dead. It tells you what you did, not what you can do.

For decades, this manual friction was viewed as a virtue. Personal finance gurus preached that “feeling the pain” of typing every expense built financial discipline. But in 2026, this advice is not just outdated; it is dangerously inefficient. We have entered the era of Agentic AI and the mature Subscription Economy, where money moves faster than human hands can type. The manual spreadsheet is a relic of a slower time, a “lagging indicator” in a world that demands real-time intelligence.

In this comprehensive guide, we will explore why Automated Budgeting has officially replaced manual tracking as the gold standard for financial health.

The Evolution of Personal Finance [From Ledger to Agent]

To understand why we must abandon the spreadsheet, we must first understand how we got here. The tools we use to manage money have evolved in four distinct eras, each reducing friction and increasing intelligence.

Era 1: The Ledger Book [1900–1980]

- The Method: Pen and paper. The Kakeibo method.

- The Friction: Maximum. Every penny had to be physically written down. Math errors were rampant.

- The Result: High awareness, but extremely low data utility. You couldn’t “query” your notebook to see how much you spent on dining out last year without hours of work.

Era 2: The Spreadsheet [1980–2015]

- The Method: Microsoft Excel and Google Sheets.

- The Friction: Moderate. Calculation was automated, but data entry remained manual.

- The Result: The “Golden Age” of the control freak. This era birthed the myth that “if you don’t type it, you don’t control it.” However, it relied on the user remembering to log in. It was a reactive tool—great for post-mortem analysis, terrible for fraud prevention or real-time decision-making.

Era 3: The Aggregator [2015–2023]

- The Method: Early Mint.com, early YNAB.

- The Friction: Low, but frustrating. These tools used “screen scraping” to read bank data. Connections broke constantly. Categorization was dumb (e.g., checking a check deposit as “spending”).

- The Result: Skepticism. Users tried automation, found it unreliable, and retreated to spreadsheets. This era is responsible for the lingering distrust many still feel toward apps.

Era 4: The Agent [2024–Present]

- The Method: Agentic AI and Open Banking APIs.

- The Friction: Zero.

- The Result: This is where we live today. Apps no longer just “read” data; they understand context. They don’t just show you a chart; they offer to act. An AI agent in 2026 can detect that you are overpaying for insurance and offer to switch you, or move money from savings to cover a bill automatically. The tool has moved from a passive mirror to an active co-pilot.

Why Manual Tracking is “Lagging” and Obsolete

The primary argument against manual tracking in 2026 is simple: It relies on autopsy data. When you manually track expenses, you are performing a post-mortem on your wallet. You are analyzing money that has already left the building. In financial terms, this is a Lagging Indicator. It confirms a trend that has already happened.

Modern financial health requires Leading Indicators, data that tells you what will happen if you don’t change course immediately. Here is why the manual method fails to provide this.

1. The “Time Tax” of Manual Entry

Let’s look at the math. A diligent manual tracker spends approximately 20 minutes a week logging expenses and reconciling accounts. That is nearly 18 hours a year.

- If your hourly value is $50, you are spending $900 of your time effectively doing data entry work that a machine can do instantly for free.

- In 2026, this “Time Tax” is considered a waste of cognitive load. Your brain power should be spent on strategy (How do I increase my income? Should I refinance?), not administration (Did I spend $4.50 or $4.75 at Starbucks?).

2. The Complexity of the Subscription Economy

In 1995, you had three monthly bills: Rent, Electricity, and Cable. It was easy to write them down. In 2026, the average consumer has 12 to 20 active recurring payments:

- Streaming (Netflix, Disney+, Spotify)

- Cloud Storage (iCloud, Google One)

- SaaS Tools (ChatGPT Plus, Canva, Office 365)

- Digital Services (DoorDash Pass, Amazon Prime)

- BNPL (Buy Now, Pay Later installments)

This is the “Vampire Economy.” These micro-transactions ($2.99 here, $9.99 there) are designed to be forgotten. A manual tracker inevitably misses one or two of these “ghost” charges. You might forget to log that annual renewal that hit your card at 3 AM. An automated system never sleeps and never forgets. It catches the vampire costs that human memory misses.

3. The “Decision Fatigue” Factor

Psychological research on Cognitive Load shows that human willpower is a finite resource. By forcing yourself to make micro-decisions about data entry (“Is this ‘Dining Out’ or ‘Entertainment’?”), You deplete the mental energy required for macro-decisions (“Should I buy this car?”).

By the time a manual tracker finishes entering their data, they are often too mentally exhausted to actually analyze it. Automation preserves your decision-making energy for the moments that actually matter.

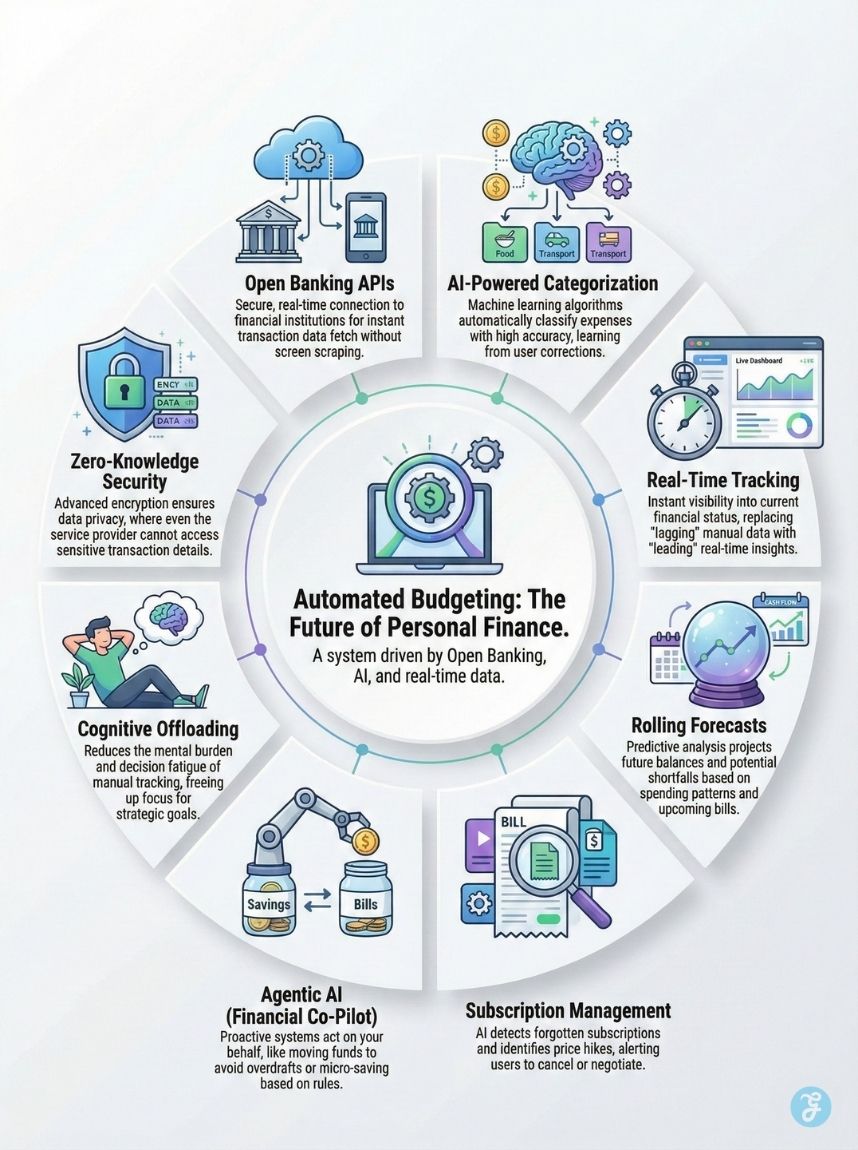

What is Automated Budgeting? [The Technical Deep Dive]

To trust automation, you need to understand how it works under the hood. It is no longer “magic”; it is a sophisticated stack of secure technologies.

The Backbone: Open Banking APIs

In the past, apps asked for your bank username and password to “scrape” your screen. This was insecure and buggy. Today, we use Open Banking APIs (Application Programming Interfaces).

- How it works: When you connect your bank to an app (like Copilot, Monarch, or YNAB), you are redirected to your bank’s secure portal. You log in there, and the bank issues a secure “token” to the app.

- The Security: The app never sees your password. It only has “Read-Only” access. It cannot move money (unless you authorize it specifically) or change settings.

- Reliability: In 2026, API aggregators like Plaid, MX, and Yodlee have reached 99.9% uptime. Transactions appear in your budgeting app seconds after you swipe your card.

The Brain: Machine Learning Categorization

Early automated tools were dumb. They would see a charge from “AMZN MKTP” and categorize it as “Uncategorized.” Current Machine Learning (ML) models are trained on billions of transactions.

- The system knows that “SHELL OIL” is Gas.

- It learns that “TARGET” is usually Groceries for you, but shopping for your neighbor.

- Contextual Learning: If you correct the AI once (e.g., changing a specific restaurant from “Dining” to “Date Night”), it remembers that preference forever. The more you use it, the less you work.

The Shield: Zero-Knowledge Architecture

Skeptics often cite privacy as a reason to stick to Excel. However, modern fintech apps often use Zero-Knowledge Architecture. This means your data is encrypted on your device. Even the employees of the budgeting app company cannot see your specific transactions. Ironically, a password-protected Excel file on a cloud drive is often less secure than these encrypted, tokenized API connections.

Key Benefits of Automation in 2026

Why make the switch? Beyond saving time, automation unlocks capabilities that manual tracking simply cannot offer.

1. Real-Time “Safe-to-Spend” Balances

A manual budget tells you what you had at the start of the month. An automated budget tells you what you have right now.

Many 2026 apps feature a “Safe-to-Spend” metric. It looks at your bank balance, subtracts all upcoming bills (which it knows about because it scanned your history), subtracts your savings goals, and tells you: “You have $420 left for fun this week.”

This is the ultimate stress reliever. You don’t need to do mental math in the checkout line. You just look at the number.

2. Rolling Forecasts [Cash Flow Prediction]

Spreadsheets are static grids. Automated tools are time machines. Using predictive analytics, modern apps can generate a Rolling Forecast. They can project your bank balance 30, 60, or 90 days into the future.

- Scenario: The app sees you get paid on Friday, but your Rent, Car Note, and Insurance are all due on Thursday. It will alert you: “Risk of overdraft in 3 days.”

- A manual spreadsheet would show you have enough money total for the month, but it misses the timing mismatch. Automation saves you from liquidity crises.

3. The “Subscription Killer”

This is a feature exclusive to the AI era. Automated tools scan your transaction feed for recurring patterns.

- They identify “Zombie Subscriptions” (free trials that quietly converted to paid).

- They notice price hikes (e.g., “Your internet bill increased by $15 this month”).

- Some Agentic tools can even generate a cancellation letter or negotiate the bill on your behalf.

4. Cognitive Offloading

This is the most underrated benefit. When you trust the system to capture every penny, you stop carrying the mental burden of “remembering.”

You no longer wake up at night wondering if you logged that $300 target run. You know it’s there. This Cognitive Offloading reduces anxiety and improves your relationship with money. You move from a relationship of policing your spending to managing your wealth.

Manual vs. Automated: The Showdown

Let’s visualize the difference. Here is how the two methods stack up in the harsh light of 2026 standards.

| Feature | Manual Tracking (Spreadsheet) | Automated Budgeting (AI Apps) |

| Data Entry Time | 2-4 Hours / Month | 0 Minutes / Month |

| Data Freshness | Lagging (Days or Weeks old) | Real-Time (Seconds old) |

| Accuracy | Prone to typos & missed receipts | 100% Transaction Capture |

| Subscription Detection | Human memory dependent | Automated AI Detection |

| Forecasting | Requires complex custom formulas | Native, Predictive “Cash Flow” |

| Mobile Experience | Poor (Pinch-to-zoom on Excel) | Native, Swipe-based, Tactile |

| Psychological Effect | High Friction, “Chore” | Low Friction, “Gamified” |

| Cost | Free (Time is money) | $5 – $12 / Month |

The Verdict: Manual tracking wins on price (if you value your time at $0), but loses on every other metric of efficiency and utility.

The Role of AI: From “Tracker” to “Financial Co-Pilot”

We are witnessing a shift from “Passive AI” (which just categorizes data) to “Generative & Agentic AI”. This is the game-changer for 2026.

Generative AI: The Financial Chatbot

Imagine having a CFO in your pocket. With Large Language Models (LLMs) integrated into finance apps, you can now query your data using natural language.

- Old Way: Filter spreadsheet by “Category: Travel”, Sum Column E, Filter by “Date: Last Year”.

- New Way: Ask the app, “How much did I spend on my trip to Japan last year, and how does that compare to my savings for this year’s trip?” The AI retrieves the data, performs the comparative analysis, and gives you a written summary.

Agentic AI: The Proactive Guardian

Agentic AI refers to AI that can take action.

- Proactive Defense: Instead of just sending a notification that you overspent, Agentic AI can (with permission) automatically move funds from a “Rainy Day” category to cover the overage, keeping your budget balanced.

- Smart Savings: These agents analyze your daily spending velocity. If they see you are spending less than usual, they will “micro-save”, sweeping small amounts ($5, $12) into your investment account automatically. They capitalize on your good days instantly.

Overcoming the “Loss of Control” Myth

The biggest barrier to adoption isn’t technology; it’s psychology. Many people cling to manual tracking because they believe automatic means unaware.

“If I don’t type the number, I won’t feel the pain of spending it.”

This is a valid concern, but the solution is not manual entry. The solution is Active Verification. In a modern automated workflow, you don’t type the data, but you do approve it.

- The Workflow: The app imports the transactions. You open the app once a day (or week). You see a list of “New Transactions.” You swipe right to approve them, or tap to recategorize.

- The Effect: You still see every dollar. You still “feel” the spending. But you have eliminated the drudgery of data entry. You get the mindfulness of manual tracking with the speed of automation. This is the Hybrid Model, and it is the sweet spot for financial awareness.

How to Choose the Right Automated Tool

Not all automation is created equal. In 2026, the market will be segmented into different philosophies. Choose the one that matches your brain.

1. For the “Zero-Based” Planner: YNAB [You Need A Budget]

- Best For: People who want to give every dollar a job.

- The Tech: heavily automated bank imports, but requires you to actively assign money to categories. It strikes the perfect balance between automation and intention.

2. For the Data Visualizer: Monarch Money

- Best For: Households, couples, and high-net-worth individuals.

- The Tech: incredible dashboarding. It shines at tracking “Net Worth” across all accounts (Real estate, Crypto, Investments, Cash). It is less about “budgeting $5 for coffee” and more about “are we getting richer?”

3. For the AI Native: Copilot

- Best For: Tech-savvy users who want maximum “set it and forget it.”

- The Tech: Best-in-class Machine Learning. It guesses your categories with frightening accuracy. It uses “recurrence detection” better than almost any other tool.

4. The Spreadsheet Hybrid: Tiller Money

- Best For: The spreadsheet die-hard who wants automation.

- The Tech: Tiller connects to your bank and feeds the data directly into Google Sheets or Excel. You get the automated data feed, but you keep your custom spreadsheet cells. It is the bridge between the two worlds.

Final Thoughts: Future-Proofing Your Wallet

The transition from manual to automated budgeting is not just a change in software; it is a change in mindset. It is a declaration that your time is too valuable to be spent doing the work of a database script.

In 2026, financial success is not defined by how well you can log the past; it is defined by how well you can engineer your future. Automated budgeting gives you the windshield view, the real-time data, and the cognitive freedom to focus on what truly matters: living your life, not just tracking it.

The spreadsheet served us well for 40 years. But it’s time to hit “Save,” close the file, and let the agents take over.