Australia’s Inflation Conundrum Persists!

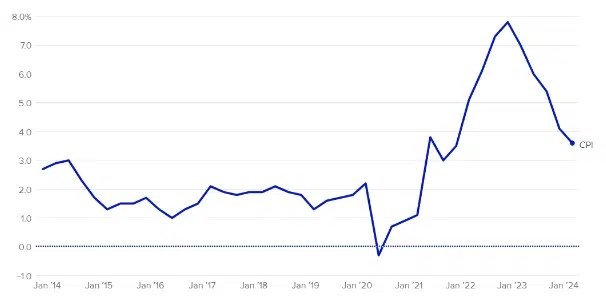

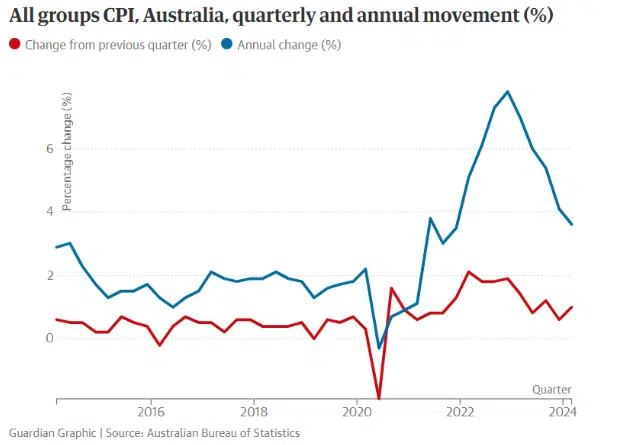

New quarterly inflation data from the Australian Bureau of Statistics (ABS) shows consumer prices in Australia remain persistently high, surpassing expectations and dashing hopes for interest rate cuts by the Reserve Bank of Australia (RBA) later this year.

The higher-than-anticipated figures underscore the challenges still facing policymakers in their battle to tame escalating living costs.

The Unsettling Numbers

In the March 2024 quarter, overall consumer prices rose 1% — higher than the 0.8% increase forecast by economists.

This pushed the annual inflation rate to 3.6%, down from 4.1% in the previous quarter but still above the 3.5% level anticipated by analysts. While moderating from its peak of 7.8% in December 2022, inflation remains well above the RBA’s 2-3% target range.

Core Inflation Also Elevated

Even more concerning for the central bank, the measures of underlying or core inflation that strip out volatile items remained elevated.

(Source: Australian Bureau of Statistics, Consumer Price Index, Australia)

The RBA’s preferred trimmed mean gauge showed prices rising 4% from a year earlier, down only slightly from 4.2% in the December quarter.

Australia is not alone in grappling with entrenched inflation pressures. While many major economies have seen price growth slow from pandemic peaks, the persistence of core inflation has proven stubbornly difficult to stamp out globally amid tight labor markets and residual supply constraints.

Contributors to the High March Reading

According to the ABS data, the largest drivers of the March quarter inflation spike were housing costs — particularly rents and new home prices for owner-occupiers — as well as increased prices for insurance premiums, childcare, education, health services, and pharmaceutical products.

Insurance premiums skyrocketed 16.4% year-over-year, marking the strongest annual rise in over two decades. Childcare expenses climbed 3.9% for the quarter, offsetting some of the benefits of recently increased government subsidies as providers passed through higher operating costs.

Pharmaceutical prices jumped 7.1%, which the ABS attributed to the annual January resetting of the Medicare Safety Net and Pharmaceutical Benefits Scheme patient cost thresholds.

Annually resetting out-of-pocket maximums drives a predictable spike in drug prices early each year.

“While pharmaceuticals normally rise solidly in the March quarter and subsequently fall over the following quarters, this was the largest increase in more than a decade,” said Commonwealth Bank economist Stephen Wu.

One Bright Spot: Recreation and Culture

On the positive side, recreation and culture prices dipped 0.1% for the quarter and were essentially flat over the year.

However, this reprieve was overshadowed by ongoing elevated costs across many other consumer baskets.

Services Inflation Accelerating

Perhaps most vexing for the RBA was an acceleration in non-tradeable or services inflation for the quarter.

With wage pressures mounting amid a tight labor market, economists worry the upward momentum in services prices like rents, education, insurance and other domestic services could be difficult to reverse.

“What’s quite concerning is that services inflation has actually accelerated on a quarterly basis, and non-tradeable inflation is still running too high as well, and they will certainly be in focus for the RBA,” said ANZ senior economist Catherine Birch.

Rate Cut Timing Pushed Back

In light of the stubbornly high March quarter figures, most economists now agree the RBA will be unable to start lowering interest rates until late 2024 at the earliest. Prior expectations had centered on potential rate cuts as soon as September.

“We now expect the first rate cut to occur after the November meeting, rather than September as previously expected,” said former RBA official and current Westpac chief economist Luci Ellis.

Callam Pickering at global job site Indeed said the data shows “inflation remains a key challenge for the economy” and makes potential rate cuts this year “even more uncertain.”

He noted the figures suggest inflation will likely exceed the RBA’s own expectations through mid-year.

Cost of Living Relief on Budget Agenda

The higher-than-expected March quarter CPI print comes just weeks before the federal government presents its annual budget on May 14.

Treasurer Jim Chalmers said while the data showed “progress” in easing inflation from last year’s peak, the 3.6% annual rate is “still too high” amid heightened global uncertainty.

Chalmers reiterated the budget will aim to balance fighting inflation with supporting economic growth.

He pointed to the looming Stage 3 tax cuts set to begin July 1 as providing cost of living relief while leaving the door open to additional measures “if affordable” and able to “help take some of the edge off inflation.”

However, some economists like Harry Murphy Cruise at Moody’s Analytics caution that while helpful for households, the tax cuts could work at cross-purposes with RBA rate policy aimed at cooling demand.

They may necessitate higher rates for longer to offset the inflationary impact.

Australia’s path to taming inflationary pressures remains difficult, with rate cut relief likely still months away. Policymakers face tough tradeoffs in delivering cost-of-living support without sacrificing hard-won disinflationary progress.