Ever wondered how some people build massive wealth? It’s like trying to solve a puzzle, right? Andre Hakkak net worth is $200 million. It is one such mystery that many want to crack. People often struggle to understand how successful entrepreneurs make their money and what sets them apart.

Andre Hakkak is a big name in the finance world. He co-founded White Oak Global Advisors, a company that manages billions in assets. This blog post will break down Hakkak’s path to success.

We’ll look at his career moves, smart choices, and the thinking behind his wins. Ready to learn some wealth-building secrets?

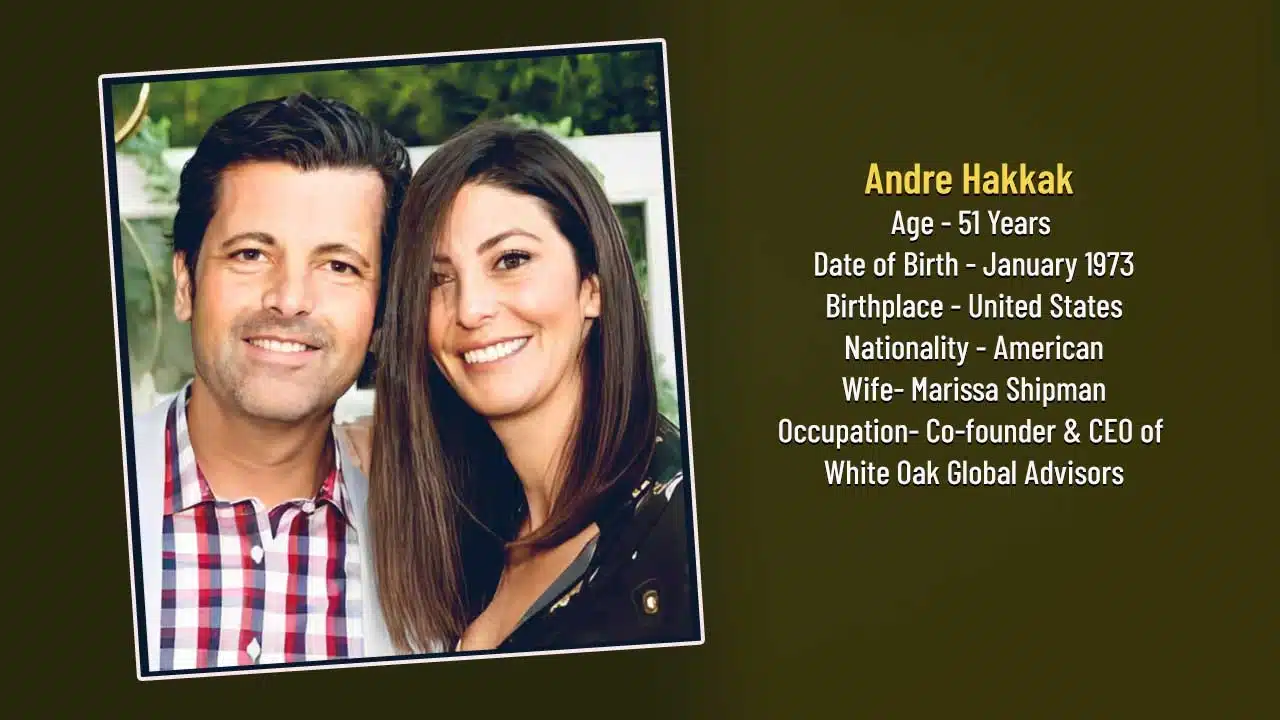

Who is Andre Hakkak?

Andre Hakkak is a finance industry heavyweight and co-founder of White Oak Global Advisors. He’s built his reputation on savvy investment strategies and a deep understanding of market dynamics.

Andre Hakkak net worth estimated between $200 million and $10 billion, his success stems from his expertise in alternative assets and risk management.

Hakkak’s journey began at the University of California, Berkeley, where he earned a Bachelor of Arts in Economics. This educational foundation paved the way for his career in investment banking and later, entrepreneurship.

As CEO of White Oak Global Advisors, he’s known for his visionary leadership and ability to spot lucrative investment opportunities in changing market conditions.

Early Life and Education of Andre Hakkak

Andre Hakkak net worth journey began with a strong foundation in economics. He earned his Bachelor of Arts in Economics from the University of California, Berkeley – a prestigious institution known for its rigorous academic programs.

This choice of study wasn’t random; Hakkak had shown a keen interest in business and finance from an early age.

His time at Berkeley laid the groundwork for his future success. The university’s challenging curriculum and diverse student body exposed Hakkak to various perspectives and ideas. This experience, combined with his natural aptitude for numbers and market trends, set the stage for his later achievements in the world of finance and investment management.

Andre Hakkak Net Worth: Professional Journey

Andre Hakkak net worth of $200 million means he is richest. His climb to success began in investment banking and led to founding White Oak Global Advisors. His path shows how hard work and smart choices can pay off big… Want to know more about his $200 million fortune?

From Investment Banking to Entrepreneurship

Andre Hakkak’s journey from investment banking to entrepreneurship showcases his business acumen and drive for innovation. His early career at Robertson Stephens and Co. laid the groundwork for his future success.

In 1995, Hakkak took a bold step by founding Suisse Global Investment, marking his transition into the entrepreneurial world. This move allowed him to apply his financial expertise in a more dynamic and autonomous setting.

Hakkak’s entrepreneurial spirit continued to flourish. In 2000, he established Alpine Global Management LLC, further expanding his influence in the financial sector. These ventures paved the way for his most notable achievement – co-founding White Oak Global Advisors with Barbaros Kartal in 2007.

This firm has become a cornerstone of Hakkak’s success, contributing significantly to his estimated $200 million net worth. Through these ventures, Hakkak has demonstrated his ability to identify market opportunities and build thriving businesses in the competitive financial landscape.

Establishment of White Oak Global Advisors

Andre Hakkak co-founded White Oak Global Advisors in 2007, spotting a gap in the market for tailored financing solutions. The firm quickly made its mark by focusing on small and medium-sized enterprises (SMEs), an often overlooked segment.

With Hakkak at the helm, White Oak has grown to manage billions in assets, offering custom lending options to middle-market businesses.

White Oak’s success stems from its unique approach to credit financing. The company doesn’t just lend money – it crafts solutions that fit each client’s specific needs. This strategy has paid off, helping White Oak weather financial storms and grow steadily.

Under Hakkak’s leadership, the firm has become a go-to source for SMEs looking for flexible, innovative funding options.

Andre Hakkak Net Worth in 2024

Andre Hakkak net worth of $200 million stems from his savvy business moves and smart money choices. His wealth comes from different places – like running his company, making smart investments, and growing his assets over time.

Want to know more about how he built his fortune? Keep reading!

Andre Hakkak Net Worth: Sources of income

Andre Hakkak’s wealth stems from various streams, creating a diverse financial portfolio. His income sources reflect a strategic approach to wealth accumulation and management:

- White Oak Global Advisors: The primary driver of Andre Hakkak net worth, this asset management firm specializes in alternative investments. It caters to institutional investors and high-net-worth individuals, generating substantial revenue through management fees and performance-based earnings.

- Real Estate Investments: Hakkak has made significant property acquisitions, including a $13.6 million mansion. These real estate holdings contribute to his wealth through appreciation and potential rental income.

- Stock Market Ventures: Active participation in financial markets allows Hakkak to capitalize on market forces and economic growth. His stock portfolio likely includes a mix of blue-chip companies and growth stocks.

- Private Equity Investments: Involvement in private equity deals provides opportunities for high returns, particularly in early-stage technology companies and fintech startups.

- Asset-Backed Securities: Expertise in this area allows Hakkak to profit from structured financial products, leveraging his knowledge of complex financial instruments.

- Advisory Roles: Serving as a thought leader in finance, Hakkak may earn income through consulting, speaking engagements, or board positions in various companies.

- Venture Capital: Investments in promising startups offer potential for exponential growth, contributing to wealth creation through successful exits or IPOs.

- Alternative Asset Classes: Diversification into non-traditional assets like commodities, art, or cryptocurrencies may provide additional income streams and hedge against market volatility.

Andre Hakkak Net Worth: Strategic investments

Strategic investments form the backbone of Andre Hakkak’s financial success. These calculated moves have propelled Andre Hakkak net worth to an impressive $200 million.

- Diversification across sectors: Hakkak spreads his investments across technology, healthcare, and industrial fields. This approach minimizes risk and maximizes growth potential.

- Focus on alternative assets: White Oak Global Advisors, under Hakkak’s leadership, emphasizes non-traditional investment options. This strategy taps into markets often overlooked by mainstream investors.

- Long-term value creation: Instead of chasing quick profits, Hakkak’s investments aim for sustainable growth. This patience often leads to greater returns over time.

- Prudent risk management: Each investment decision is carefully weighed against potential risks. This caution helps protect assets during economic downturns.

- Adaptation to market trends: Hakkak’s portfolio evolves with changing market conditions. This flexibility allows for capitalizing on emerging opportunities.

- Technology startup investments: Backing promising tech companies has proved lucrative. These high-risk, high-reward ventures contribute significantly to Hakkak’s wealth.

- Strategic partnerships: Collaborations with other financial powerhouses expand investment reach. This network effect amplifies potential gains.

- Timing market cycles: Hakkak’s keen understanding of economic patterns informs investment timing. Buying low and selling high becomes more achievable with this insight.

Contributions and Achievements of Andre Hakkak

Andre Hakkak’s firm, White Oak Global Advisors, has made waves in the finance world. His smart choices and leadership have grown the company big-time. Want to know more about his wins? Keep reading!

Influence of White Oak Global Advisors

White Oak Global Advisors has made its mark in the financial world. With over $8 billion in assets under management, the firm has become a go-to partner for businesses needing financing.

Its influence extends globally, having raised multiple funds and expanded its reach across borders.

White Oak’s impact goes beyond numbers. The firm has helped countless businesses weather financial storms, including the 2008 crisis. By providing capital and strategic guidance, it’s played a crucial role in job creation and economic growth.

This approach has earned White Oak trust and respect in the financial landscape.

Key milestones and recognitions of Andre Hakkak

Andre Hakkak’s journey with White Oak Global Advisors has been marked by notable achievements. His leadership has propelled the firm to new heights, earning recognition in the financial industry.

- Founding of White Oak Global Advisors (2007): Hakkak co-founded the company, setting the stage for its future success.

- Asset growth: The firm secured billions in assets under management, showcasing its rapid expansion and client trust.

- Global expansion: White Oak established multiple offices worldwide, broadening its reach and influence.

- Media recognition: Hakkak featured in leading financial publications, cementing his status as an industry expert.

- Speaking engagements: Invited to speak at industry conferences, sharing insights on alternative asset management.

- Net worth milestones: Hakkak’s estimated net worth grew from $500 million in 2016 to $5 billion in 2023, reflecting his business acumen.

- Navigating financial crises: The firm’s resilience during economic downturns, including the 2008 crisis, highlighted Hakkak’s strategic leadership.

- Technological innovation: Implementing cutting-edge tech in financial management, positioning White Oak as an industry innovator.

- Diversification success: Expanding into various sectors, including technology startups and venture capital, broadening the firm’s portfolio.

- Philanthropic initiatives: Hakkak’s commitment to charitable causes, balancing business success with social responsibility.

Personal Life and Philanthropy of Andre Hakkak

Andre Hakkak keeps a low profile in his personal life, but his giving nature shines through his support for various causes… Want to know more about this generous mogul?

Privacy aspects

Andre Hakkak keeps a low profile, shielding his personal life from public scrutiny. Despite Andre Hakkak net worth of $200 million, he rarely appears in the media or attends high-profile events.

This discretion extends to his family life – details about his marriage to Marissa Shipman, CEO of Balm Cosmetics, are scarce. Their $13.6 million mansion purchase made headlines, but the couple maintains tight control over information about their home and lifestyle.

Hakkak’s commitment to privacy doesn’t hinder his professional success. He focuses on his role at White Oak Global Advisors, letting his business achievements speak for themselves.

This approach aligns with many top investors who prefer to stay out of the limelight, concentrating on their work rather than building a public persona. For Hakkak, this balance between professional visibility and personal privacy seems to be a key part of his wealth management strategy.

Commitment to charitable causes

Andre Hakkak’s philanthropic efforts stand out as a cornerstone of his life. He’s poured resources into expanding healthcare facilities and bolstering education programs. His commitment isn’t just talk – it’s backed by real action.

Hakkak has thrown his support behind various charitable organizations, making tangible differences in people’s lives.

Environmental preservation is another cause close to Hakkak’s heart. He actively participates in initiatives aimed at protecting our planet. This multi-faceted approach to giving back showcases a deep-seated desire to create positive change across different sectors of society.

It’s clear that for Hakkak, success isn’t just about personal gain – it’s about lifting others up too.

Andre Hakkak Net Worth: Takeaways

Andre Hakkak net worth in 2024 is $200 million. It stands as a testament to his financial acumen and leadership. His journey from investment banking to founding White Oak Global Advisors showcases the power of vision and strategic thinking.

Hakkak’s success story inspires aspiring entrepreneurs and investors alike. It reminds us that with the right mix of skills, innovation, and determination, remarkable achievements are possible in the business world.

His legacy extends beyond wealth, encompassing philanthropy and a commitment to making a positive impact on society.

References

- https://gossips.blog/andre-hakkak-net-worth/

- https://www.englandtimes.uk/andre-hakkak-net-worth/

- https://netizensreport.com/unravelling-success-andre-hakkaks-journey-to-a-200-million-net-worth/

- https://mwcd.in/andre-hakkak-net-worth/

- https://arkblogs.com/index.php/2024/06/09/andre-hakkak-net-worth-500-million-financial-success-story/

- https://englishloom.com/andre-hakkaks-journey-and-net-worth/ (2024-05-19)

- https://whiteoaksf.com/team-member/andre-a-hakkak/

- https://www.gazete5.com/andre-hakkak-net-worth/ (2024-06-13)

- https://businesstosky.com/andre-hakkak-net-worth-a-closer-look-at-his-financial-standing/ (2024-06-20)

- https://www.wispwillow.com/lifestyle/andre-a-hakkak-the-remarkable-journey/

- https://agtalk.org/andre-hakkak-net-worth-a-journey-to-wealth-and-achievement/

- https://kvaerkebyfriskole.skoleporten.dk/sp/220186/iframe?address=http%3A%2F%2Fvoicebandsax.ru/rrfe439guk5iz

- https://habitadvisors.com/andre-hakkak-net-worth/