For decades, the global financial system has operated on a paradox: to get credit, you need a credit history. This structural flaw has left approximately 1.3 billion adults globally “unbanked” or “credit invisible.” These individuals—concentrated largely in emerging markets but also present in developed economies—pay rent, buy groceries, and manage households. Yet, because they lack a formal mortgage or credit card, they are invisible to traditional lenders.

AI Credit Scoring is the technological disruption solving this problem. By shifting from “credit history” (what you did 5 years ago) to “alternative data” (what you are doing today), AI is unlocking capital for millions who were previously deemed “unscoreable.”

Key Takeaways

- The Problem: 1.3+ billion people are excluded from finance simply because they lack a “credit file.”

- The Solution: AI Credit Scoring uses alternative data (telco, utility, behavior) to predict trustworthiness without traditional history.

- The Benefit: It lowers costs, automates decisions, and provides the first rung on the credit ladder for the unbanked.

- The Risk: Without regulation (like the EU AI Act), these systems can invade privacy and automate bias.

- The Future: A shift toward real-time, explainable, and cash-flow-based underwriting that makes financial inclusion a reality, not just a buzzword.

Understanding the Global Unbanked Challenge

Who Are the Unbanked and Underbanked?

The “unbanked” are adults without an account at a financial institution or mobile money provider. The “underbanked” may have a bank account but still rely on alternative financial services like money orders or payday loans.

- Demographics: The majority are women, individuals in rural areas, and workers in the gig economy.

- Geographic Concentration: According to the World Bank’s Global Findex 2025, over half of the world’s unbanked adults live in just seven economies, including China, India, Pakistan, and Nigeria. However, the issue persists in the West; in the US, “credit invisibles” often include recent immigrants and young adults.

Why Traditional Credit Systems Exclude Millions

Traditional models (like the FICO score) rely on lagging indicators. They look backward at verified financial history: credit card repayments, mortgage history, and auto loans.

- The Catch-22: If you have never had a loan, you have no history. If you have no history, you cannot get a loan.

- The “Thin-File” Problem: Even those with bank accounts may have “thin files”—insufficient data to generate a score. For a traditional bank, a thin file is synonymous with high risk, leading to automatic rejection.

What Is AI Credit Scoring?

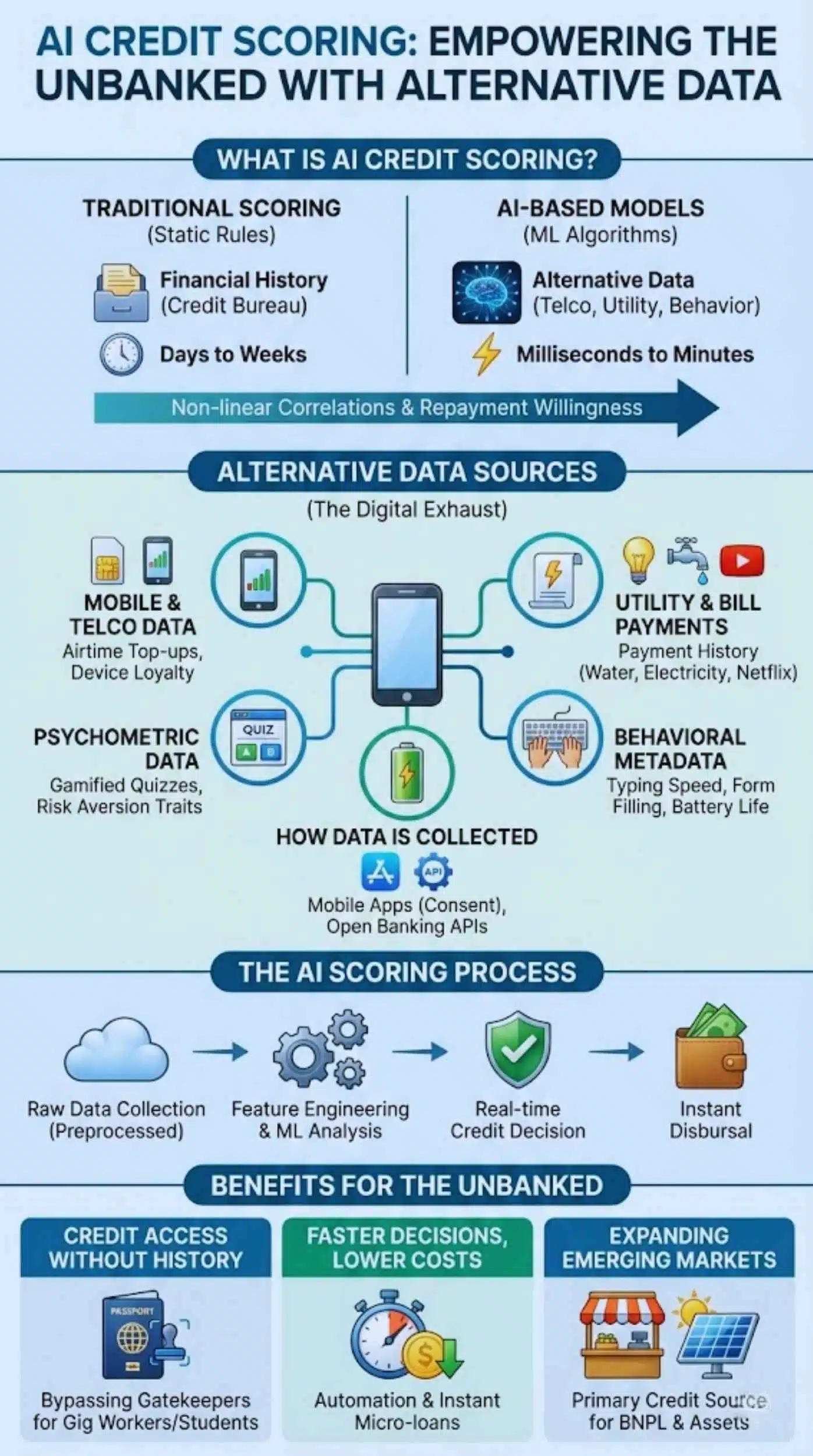

AI credit scoring is the use of machine learning (ML) algorithms to assess creditworthiness based on non-traditional data points. Unlike human loan officers who follow rigid rules, AI models find non-linear correlations between behavior and repayment willingness.

Traditional Credit Scoring vs. AI-Based Models

| Feature | Traditional Scoring (e.g., FICO) | AI Credit Scoring |

| Data Source | Financial history (Credit Bureau) | Alternative data (Telco, Utility, Behavior) |

| Methodology | Linear Regression (Static) | Machine Learning (Dynamic/Predictive) |

| Speed | Days to Weeks | Milliseconds to Minutes |

| Focus | “Can they pay?” (Capacity) | “Will they pay?” (Willingness & Behavior) |

Role of Machine Learning in Credit Risk Assessment

ML models, such as Random Forests or Neural Networks, can process thousands of variables simultaneously. They do not just check if a user has income; they analyze the stability of that income. They don’t just check if a bill was paid; they check how promptly it was paid relative to the due date.

What Is Alternative Data in Credit Scoring?

To score the unbanked, AI needs data that exists outside the credit bureau. This is “alternative data”—the digital exhaust we leave behind in our daily lives.

Types of Alternative Data Used

- Mobile & Telco Data:

- Airtime Top-ups: Regular, small top-ups indicate steady daily income (common in informal economies).

- Device Loyalty: Keeping the same SIM card or handset for years correlates with stability and lower default rates.

- Utility & Bill Payments:

- Payment history for water, electricity, and streaming services (e.g., Netflix) serves as a proxy for credit repayment discipline.

- Psychometric Data:

- Some lenders use gamified quizzes to measure traits like patience and risk aversion. A user who chooses a larger reward later over a smaller reward now is statistically more likely to repay a loan.

- Behavioral Metadata:

- Typing Speed & Form Filling: Users who take time to read Terms & Conditions often have lower default rates than those who scroll and click instantly.

- Battery Life: Controversial but effective—users who keep their phones charged are often more organized and conscientious.

How Data Is Collected and Analyzed

This data is typically scraped via mobile apps (with user consent) or accessed through Open Banking APIs. The raw data is preprocessed to remove noise, and feature engineering converts it into scoreable metrics (e.g., converting “raw SMS logs” into “monthly utility payment consistency score”).

How AI Credit Scoring Helps the Unbanked

Credit Access Without Formal History

For a gig worker in Nairobi or a student in Jakarta, AI scoring serves as a digital passport. It allows them to bypass the “gatekeepers” of traditional banking. By proving reliability through phone usage or utility payments, they can access micro-loans to start businesses or cover emergencies.

Faster Loan Decisions and Lower Costs

Manual underwriting is expensive. It costs a bank roughly the same administrative effort to process a $100 loan as a $10,000 loan, making small loans unprofitable.

- Automation: AI reduces the marginal cost of underwriting to near zero.

- Instant Disbursal: Decisions happen in real-time. A user can download an app, apply, and receive funds in their mobile wallet within 5 minutes.

Expanding Credit in Emerging Markets

In regions like Southeast Asia and Sub-Saharan Africa, AI lending is not just an alternative; it is the primary source of credit. It powers Buy Now, Pay Later (BNPL) models at point-of-sale, allowing unbanked consumers to purchase essential assets like smartphones or solar panels.

Real-World Use Cases and Industry Examples

Fintech Lenders Using Alternative Data

- Tala (Global): Operates in Kenya, Philippines, Mexico, and India. Tala scrapes device data (with permission) to score users who have no credit history, offering loans ranging from $10 to $500.

- MNT-Halan (Egypt): Uses transactional data from its ecosystem (ride-hailing, delivery) to offer micro-finance to unbanked Egyptians.

- Petal (USA): Uses “Cash Flow Underwriting.” Instead of a credit score, Petal analyzes a user’s bank account to see if they earn more than they spend, offering credit cards to those with no FICO score.

Impact on Financial Inclusion

These platforms report approval rates significantly higher than traditional banks for the same demographic. Crucially, they report repayment behavior to formal credit bureaus, allowing users to eventually “graduate” to the formal financial system.

Risks, Bias, and Ethical Concerns

While promising, AI scoring introduces new systemic risks.

Algorithmic Bias and Fairness Issues

- Redlining 2.0: If an AI learns that “users who live in Zip Code X” default more often, it may deny everyone in that area, effectively automating discrimination against low-income neighborhoods.

- Proxy Discrimination: Even if race is removed from the data, the AI might find proxies for it (e.g., shopping habits or dialect patterns in text data).

Privacy and the “Black Box” Problem

- Invasive Data: Critics argue that analyzing who you call or how you type is an invasion of privacy.

- Explainability: If a user is denied, they deserve to know why. “The computer said no” is not a valid explanation, yet deep learning models are often opaque “black boxes” that are difficult to interpret.

Regulation and Compliance in AI Credit Scoring

Global Regulatory Landscape (2025/2026 Context)

- EU AI Act: The European Union has classified AI systems used for credit scoring as “High-Risk.” This means they are subject to strict conformity assessments, data governance requirements, and human oversight.

- CFPB (USA): The Consumer Financial Protection Bureau has emphasized that “complex algorithms” are not an excuse for violating fair lending laws. Lenders must be able to provide specific reasons for adverse actions (denials).

Explainability and Transparency Requirements

Regulators are increasingly mandating XAI (Explainable AI). Lenders must use tools (like SHAP values) to explain exactly which variable lowered a user’s score.

- Example: “Your score was lowered because your airtime top-ups have been irregular for 3 months,” rather than just “Risk too high.”

The Future of AI Credit Scoring

Open Banking and Real-Time Credit Models

As Open Banking mandates spread (requiring banks to share data with third parties upon user request), AI scoring will become even more accurate. We will move toward Networked Credit Scores—where your score is a live, breathing metric that updates instantly with every transaction, rather than a static monthly report.

Responsible AI and Inclusive Finance

The future lies in Hybrid Models: AI for speed and data processing, combined with human oversight for ethics and edge cases. The goal is to build a system that is not just efficient, but equitable—ensuring that the algorithm is a ladder for the poor, not a trap.

Final Thoughts: The End of Financial Invisibility?

As we move deeper into 2026, the debate around AI credit scoring is no longer about if it works—the data proves that it does. The debate is now about how we govern it.

We are witnessing the end of the “Credit Bureau Monopoly.” For a century, three or four giant companies held the keys to financial destiny. AI and alternative data have democratized this power. Now, a ride-sharing app, a telecom provider, or an e-commerce platform can know more about a borrower’s risk than a bank ever could.