Listen to Podcast:

Learning how to save money after the age of 30 requires a different set of skills than when you were younger. All of a sudden, the future supersedes the present in terms of importance, and we are required to handle it in accordance with its elevated status.

For this reason, it is without a doubt absolutely necessary to have some concept of how to handle our financial matters.

Read More: How to Start Financial Plan for Your Family?

Even though you are aware that the most important thing is to avoid spending money on things that aren’t really necessary, we will nevertheless provide you with a list of important measures that you need to take if you want to save money for your future.

1. Set a Specific Goal

After the age of 30, we have a tendency to have a clearer vision for the future, whether in the near term or in the far future. This can help you set precise goals, which in turn will prompt you to analyze your finances and take action to reach those goals.

The purchase of a home, relocation to another city or country, the establishment of a business, the provision for the future of any children you may have, and preparation for retirement are among the most typical and significant life decisions made at this age.

Whatever it is, you will need to construct a spending and savings plan to ensure that you save that money without fail every week or every month by setting a number and a date to reach it, which will need you to set a figure and a date to accomplish it. You will be able to avoid spending money unnecessarily if you keep this objective at the forefront of your mind in this manner.

2. Save for Emergencies

We are aware that, for many people, the 30s are the new 20s; nonetheless, the fact of the matter is that this is the age at which we should begin putting money aside for unexpected expenses. Because you never know when you or a member of your family might experience a medical emergency, when an accident might occur, or even if you might lose your job, it is essential to have some savings put away.

Read Also: Plan Better for Retirement

You can decide to save up for an emergency fund as a goal, but you can also make it a habit to save money regularly. This will be helpful in the future in the event that you become ill or have any other type of emergency that requires financial assistance. It is the portion of the savings that nobody should forget to take advantage of.

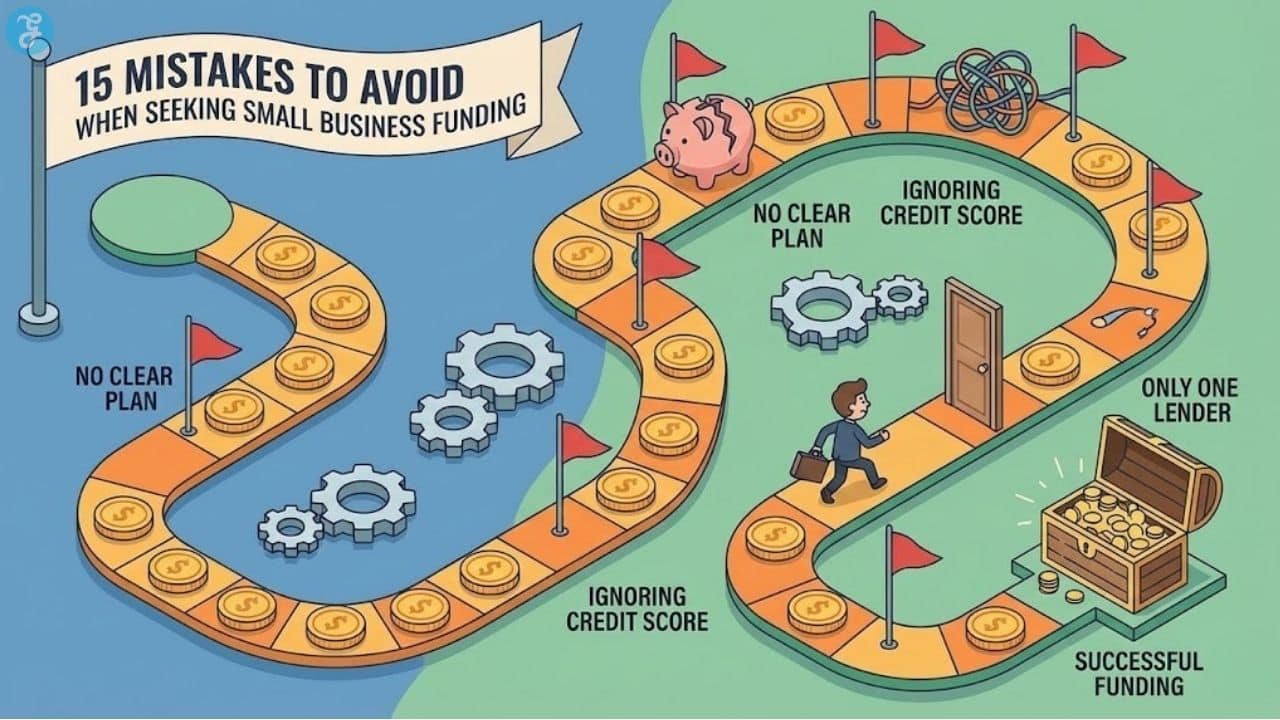

3. Avoid any Debt

You might have racked up some debt by this point if you used your 20s to have a lot of fun or if you worked in a company that received financial backing from other people. In point of fact, having a credit card and making use of it indicates that you are already in financial trouble.

This can prevent you from saving money and will continually affect your income, so the best thing to do, particularly if you are in your early 30s, is to get rid of all of your debt and utilize your credit card in a responsible manner.

It is advisable to save up for the items you want to buy and to keep your spending under control in order to avoid incurring debt for purchases that can be made without accruing interest for a period of months.

4. Think about Investments

Investing in stocks is one piece of advice that is commonly given by industry professionals; nevertheless, if carried out irresponsibly, this may be a big source of risk. If you are interested in investing in a firm, you should prepare yourself by educating yourself beforehand and giving serious consideration to the investments that you intend to make. A financial adviser can assist you to gain a better understanding of how you can maximize the return on investment (ROI) for the money you have available to invest. It is essential to acquire knowledge in order to avoid making decisions based on a lack of awareness because diversification is an essential component, as is the future of various businesses.

Also Read: Elon Musk Master Plan

On the other hand, keep in mind that there are many different kinds of investments, and it is not required that you point specifically to the stock market. Many people believe that spending money on one’s education and one’s future is the most intelligent investment that one can make.

5. Consider Retirement Savings

In the last section, we discussed the many financial objectives that are possible to set in your thirties. One of the most important things to consider when thinking about your future is whether or not you will have enough money saved for retirement.

Even if you have the choice to keep working if you so choose, starting and contributing to a retirement savings fund is a good way to assure that you will one day be able to retire without having to worry about how you will support yourself financially. By acting in this manner, you will prevent a number of issues that are associated with advanced age, and at the very least, you will have that money saved up to enjoy the rest of your days.