Selecting the best payroll services for small businesses 2026 is a pivotal decision for founders who want to automate compliance and focus on core operations. In the current year, payroll has evolved from a simple check-cutting process into a strategic hub for employee benefits and financial wellness. Choosing the right partner ensures your taxes are filed accurately and your team is paid on time across every state.

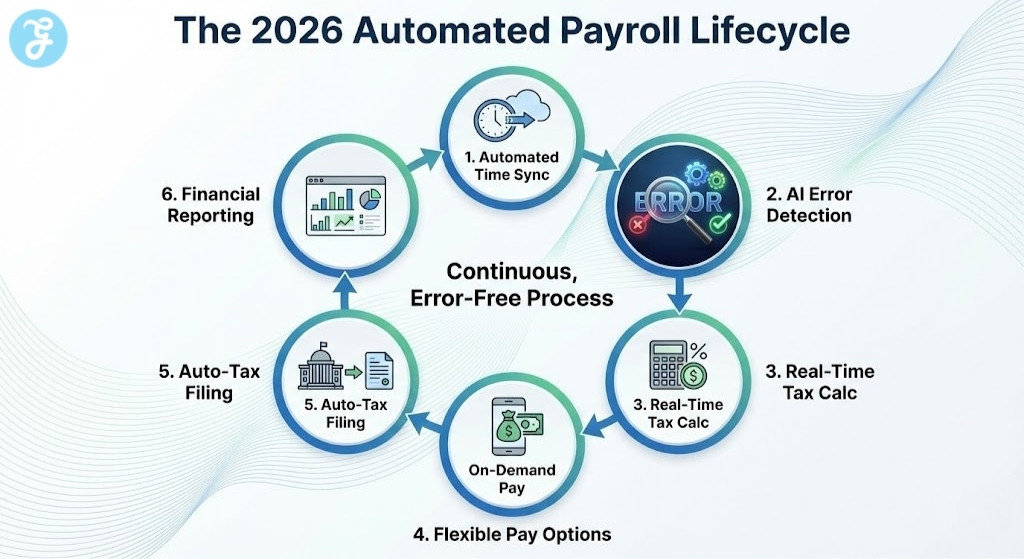

The 2026 business environment demands a platform that can handle remote work complexities and changing tax regulations without manual oversight. The best payroll services for small businesses 2026 use artificial intelligence to spot errors before the money leaves your bank account. By moving away from spreadsheets and into a unified cloud system, you protect your company from costly IRS penalties and administrative burnout.

Selection Criteria For Our Top Rankings

We evaluated over thirty payroll providers to find the most reliable and efficient solutions for smaller organizations. Our team prioritized platforms that offer a balance of transparent pricing and deep HR functionality. The following table highlights the weighting system we used to determine the top performers for this year.

| Criterion | Weighting |

| Automation & AI Accuracy | 35% |

| Tax Compliance & Filing | 30% |

| User Interface & Ease | 20% |

| Integration Ecosystem | 15% |

2026 Small Business Payroll Market Overview

The 2026 payroll market is characterized by a shift toward unified workforce management and on-demand pay options. Most top providers now offer “earned wage access” as a standard feature to help employees manage their personal finances better. This table compares the primary strengths of the leading service models in the current industry.

| Service Model | Primary Benefit | Best For |

| Full-Service Cloud | Total Automation | Fast-Growing Startups |

| Integrated Accounting | Seamless Bookkeeping | Solopreneurs & Micro-Teams |

| PEO / Co-Employment | Shared Liability | Teams Needing Enterprise Benefits |

Analyzing The 12 Best Payroll Services for Small Businesses 2026 For Growth

The following selections represent the most technologically advanced and user-friendly platforms available to small business owners this year. Each service offers unique capabilities designed to handle different team sizes and industry-specific requirements. These tools provide the peace of mind you need to scale your workforce with confidence.

1. Gusto

Gusto remains the gold standard for startups and small teams that value an intuitive and friendly user experience. It provides full-service payroll and automated tax filing across all 50 states with a setup process that takes less than thirty minutes. In 2026, Gusto features advanced financial wellness tools that allow employees to save and invest directly from their paychecks. It is an essential resource for founders who want “big-business” benefits at a small-business price point.

Special Features:

-

Automated tax calculations and filings for federal and state and local agencies

-

Integrated health insurance and 401(k) and commuter benefits management

-

Lifetime employee portal access for pay stubs and tax forms even after they leave

Things To Consider:

-

Phone support is only available during standard business hours on lower tiers

-

International payroll is currently limited compared to global-first competitors

Best For: Startups and small businesses looking for the best overall user experience

2. ADP RUN

ADP RUN is the most scalable option for businesses that expect to grow rapidly into mid-sized or large enterprises. It offers an exceptional combination of decades of payroll expertise and a modern cloud-based interface. The 2026 version of RUN includes AI-powered “Smart Audits” that flag payroll discrepancies before processing to prevent costly errors. It remains a reliable staple for organizations that require deep compliance resources and a massive ecosystem of add-ons.

Special Features:

-

Robust compliance alerts and state-specific HR handbook wizards

-

Dedicated 24/7 live support from certified payroll professionals

-

Seamless transition to ADP’s enterprise platforms as your business scales

Things To Consider:

-

Pricing is not transparent and usually requires a custom quote from a sales rep

-

The platform can feel overly complex for a very small team with simple needs

Best For: Growing businesses that prioritize depth and long-term scalability

3. Rippling

Rippling has redefined the industry by unifying payroll and HR and IT into a single modular platform. This allows you to onboard a new employee and ship them a laptop and set up their payroll in one single click. In 2026, Rippling features an “Automatic Compliance” engine that monitors local labor laws in real-time and updates your policies automatically. It is a masterclass in operational efficiency for modern, remote-first companies.

Special Features:

-

Global payroll engine that supports workers in over 50 different countries

-

Automated device management and software provisioning for new hires

-

Highly customizable workflows and approval chains for every department

Things To Consider:

-

Costs can increase quickly as you add more modules like IT or finance

-

Some features might be “overkill” for a local business with few employees

Best For: Fast-growing tech companies and distributed global teams

4. OnPay

OnPay stands out as the best value choice because it offers a single flat-fee plan that includes every feature without hidden tiers. It provides full-service payroll and multi-state tax filing and basic HR tools at a price that is easy for small budgets to manage. The 2026 platform includes specialized features for niche industries like agriculture and healthcare and professional services. It simplifies the bridge between cost-efficiency and professional-grade performance.

Special Features:

-

Transparent pricing with all features included in the base monthly fee

-

Free data migration and professional setup assistance for new clients

-

Integrated HR document storage and automated onboarding workflows

Things To Consider:

-

Does not offer a native time-tracking tool within the platform

-

No automatic payroll option—you must manually click “Run” each cycle

Best For: Small businesses that want clear pricing and great customer support

5. QuickBooks Payroll

QuickBooks Payroll is the premier choice for businesses already using QuickBooks Online for their accounting and bookkeeping. It provides the tightest integration on the market, ensuring your payroll expenses flow directly into your financial statements in real-time. The 2026 Elite plan includes “Tax Penalty Protection” where Intuit pays up to $25,000 if they make an error on your filings. It is a vital resource for owners who want a unified financial ecosystem.

Special Features:

-

Same-day direct deposit available on Premium and Elite subscription levels

-

Automated tax calculations and forms that sync instantly with your books

-

Integrated 401(k) and health benefits provided through trusted partners

Things To Consider:

-

The software works best when bundled with a QuickBooks Online subscription

-

Customer support response times can vary depending on the time of day

Best For: Existing QuickBooks users who want a seamless and unified workflow

6. Rippling Unity (formerly Rippling HR)

Rippling Unity focuses on the employee lifecycle by connecting payroll data with performance and training metrics. This allows you to see how your labor costs correlate with team output and individual growth. The 2026 edition features “Instant Global Transfers,” allowing you to pay international contractors in their local currency without high bank fees. It helps bridge the gap between simple salary payments and strategic human capital management.

Special Features:

-

Real-time labor cost reporting by department and location and project

-

Automated “New Hire” checklists that cover both payroll and cultural onboarding

-

Deep integration with over 500 third-party apps for a custom HR stack

Things To Consider:

-

Requires a bit more initial setup time than simpler tools like Gusto

-

The modular nature means you need to be careful with which add-ons you pick

Best For: Data-driven managers who want to optimize their workforce spending

7. Paychex Flex

Paychex Flex is the best choice for small businesses that want the support of a dedicated payroll specialist and local expertise. It offers a comprehensive suite of services that goes beyond payroll to include business insurance and retirement planning. In 2026, Paychex features a high-fidelity mobile app that allows both managers and employees to handle HR tasks from any device. It provides a great user experience for teams that value a traditional service model.

Special Features:

-

Personalized onboarding and a dedicated point of contact for every account

-

Robust benefits administration including health and 401(k) and life insurance

-

Integrated “Employee Retention Credit” (ERC) tracking for tax savings

Things To Consider:

-

Pricing can be less transparent and often includes various per-item fees

-

The interface is functional but can feel a bit dated compared to modern startups

Best For: Companies that want a dedicated representative and comprehensive HR

8. Justworks

Justworks operates as a Professional Employer Organization (PEO), meaning they act as a “co-employer” to give you access to enterprise-grade benefits. This allows even a 5-person startup to offer the same health insurance and perks as a massive corporation. In 2026, Justworks has streamlined its compliance engine to handle the most complex multi-state hiring requirements automatically. It is a masterclass in reducing the administrative burden on small business owners.

Special Features:

-

Access to large-group health insurance rates that are usually unavailable to SMBs

-

Automatic handling of state unemployment insurance and workers’ compensation

-

24/7 support from certified HR consultants to help with difficult people issues

Things To Consider:

-

Higher monthly cost per employee compared to standard payroll-only software

-

Requires the business to enter into a co-employment legal relationship

Best For: Small teams that want the best possible benefits and total compliance

9. Square Payroll

Square Payroll is the undisputed champion for retail and restaurant businesses already using the Square Point of Sale system. It allows you to sync your employees’ hours and tips and commissions directly from the register into the payroll run. The 2026 version includes a “Cash App” integration that allows employees to receive their pay instantly on payday. It reveals the intent behind “simple” by connecting your sales floor and back office perfectly.

Special Features:

-

Automatic tip and commission calculation based on real-time sales data

-

Flat-rate pricing for contractors with no monthly base fee for those months

-

Integrated workers’ compensation insurance that is paid per pay period

Things To Consider:

-

Limited HR and benefits features compared to standalone platforms

-

Only supports U.S.-based employees and contractors at this time

Best For: Retail and hospitality businesses using the Square POS ecosystem

10. Deel

Deel is the leading platform for small businesses that rely heavily on international talent and global remote contractors. It automates the complex legal requirements of hiring in over 150 different countries while ensuring you stay compliant with local tax laws. In 2026, Deel features a “Compliance Risk” scanner that alerts you if a contractor should be reclassified as a full-time employee. It is a futuristic addition for any founder building a borderless company.

Special Features:

-

One-click global payroll in over 120 different local currencies

-

Automated generation of compliant local contracts and tax documents

-

Flexible withdrawal options for employees including crypto and local bank transfer

Things To Consider:

-

Not as strong for domestic-only U.S. payroll as specialized tools like Gusto

-

The pricing is based on a “per-contractor” model which can be expensive for large groups

Best For: Remote-first startups and companies hiring global talent

11. Patriot Payroll

Patriot Payroll is the best choice for budget-conscious owners who want a straightforward and reliable system without unnecessary “bloat.” It offers a very clean interface and a “three-step” payroll process that is easy for anyone to learn in minutes. The 2026 Full Service plan includes a guarantee that Patriot will handle all federal and state tax filings accurately. It provides a great user experience by focusing on the core essentials of payroll processing.

Special Features:

-

Extremely affordable base fees and per-employee costs for small teams

-

Free U.S.-based customer support that consistently receives high ratings

-

Integrated accounting software available for a unified financial view

Things To Consider:

-

Lacks advanced HR features like performance reviews or applicant tracking

-

The “Basic” plan requires the owner to file their own taxes manually

Best For: Cost-sensitive small businesses with 1 to 15 employees

12. SurePayroll

SurePayroll is a specialized service owned by Paychex that focuses on micro-businesses and “household” employers like nannies or caregivers. It provides a simplified interface designed specifically for those who only have one or two employees to manage. In 2026, it remains one of the only platforms with a dedicated “Nanny Tax” compliance feature that handles all domestic employment filings. It reveals the intent behind “niche” by solving a very specific problem perfectly.

Special Features:

-

Specialized “Nanny Tax” service that handles all household employer filings

-

Easy-to-use mobile app for running payroll on the go in under two minutes

-

Guaranteed tax filing accuracy and full handling of all agency notices

Things To Consider:

-

Does not offer the scalability of major platforms like Gusto or ADP

-

Advanced reporting and HR add-ons are significantly limited

Best For: Household employers and micro-businesses with under 5 employees

How To Choose The Right Payroll Partner

Selecting the right payroll service depends on whether you prioritize “Software Ease” or “Managed Compliance.” You should audit your future hiring plans to see if you will need international support or enterprise-grade benefits within the next year. This comparison matrix helps you align your specific business goals with the most appropriate payroll software.

| Business Goal | Recommended Service | Primary Advantage |

| Simple & Modern | Gusto | Intuitive Interface |

| Max Scalability | ADP RUN | Global Depth |

| Accounting Sync | QuickBooks Payroll | Ecosystem Unity |

| Top Benefits | Justworks | PEO Model |

Final Thoughts

Winning the administrative battle in 2026 means using a payroll system that removes the fear of compliance errors. The best payroll services for small businesses 2026 provide the tools needed to pay your team accurately while giving you the data needed to make smart financial decisions. By selecting a partner that grows with your needs, you can create a more stable and professional foundation for your company.