Real estate investing used to require a key, a landlord, and a massive down payment. In 2026, it requires a smartphone and $10. The last two years have been a “great filter” for the crowdfunding industry. The aggressive interest rate hikes of 2023–2024 exposed the weaker platforms, leading to consolidation (like EquityMultiple acquiring HoneyBricks) and rebranding (Yieldstreet becoming Willow Wealth). What remains in 2026 is a mature, battle-tested landscape where the survivors offer genuine institutional-grade access to retail investors.

With the Federal Reserve stabilizing interest rates around 3.5%–3.75% and inflation cooling to 2.4%, the “wait and see” era is over. Capital is flowing back into private real estate. But not all platforms are safe. Some are delivering steady 9% yields, while others are locked in litigation over failed commercial deals.

This guide ranks the 10 best real estate crowdfunding platforms based on current 2026 performance, fees, liquidity, and safety.

Best Real Estate Crowdfunding Platforms: The “Cheatsheet” for 2026

| Best For… | Platform | Min. Investment | 2025 Avg. Return |

| Beginners (Overall) | Fundrise | $10 | ~5.4% (Income) – 9% (Growth) |

| Rental Income | Arrived | $100 | 4.2% (Yield) + Appreciation |

| Accredited Pros | EquityMultiple | $5,000 | 9% – 16% (Target) |

| Short-Term Cash | Groundfloor | $10 | ~10% (Debt notes) |

| Trading Control | Ark7 | $20 | Varies (Monthly Dividends) |

The State of Real Estate Crowdfunding in 2026

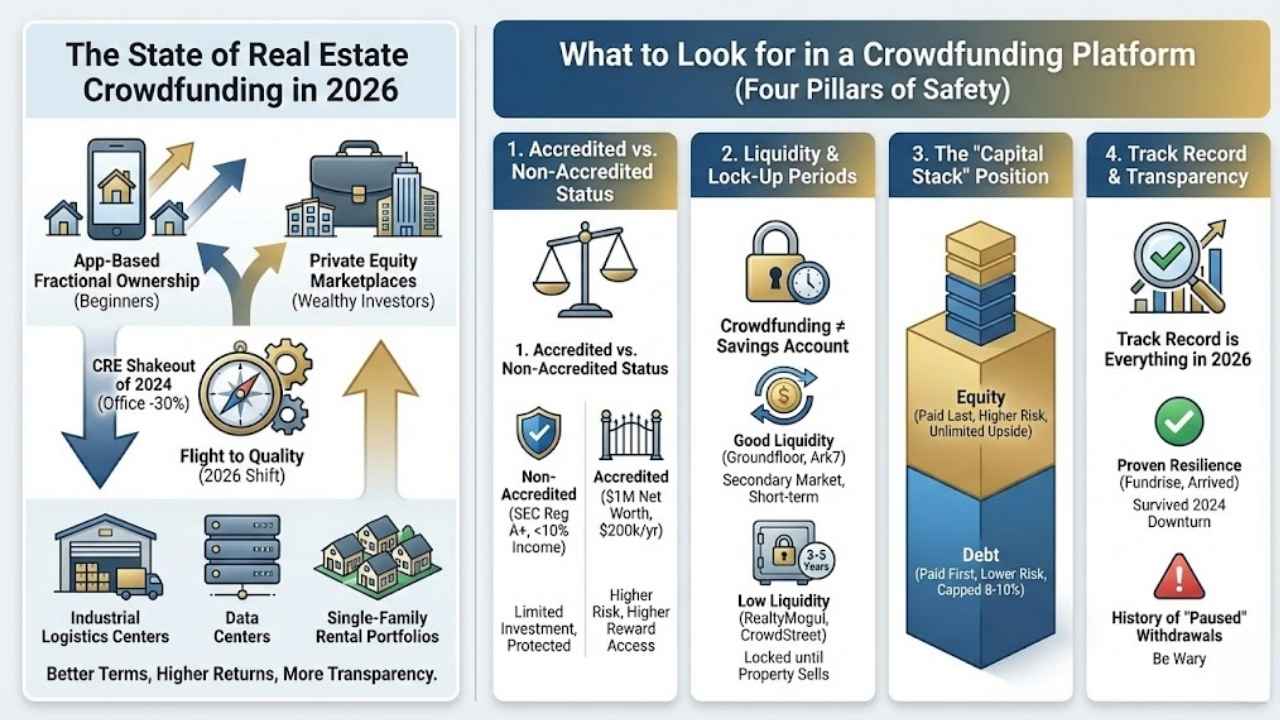

The “Wild West” days of crowdfunding are behind us. In 2026, the industry has bifurcated into two distinct lanes: App-Based Fractional Ownership for beginners and Private Equity Marketplaces for wealthy investors.

The biggest shift this year is the “Flight to Quality.” After the commercial real estate (CRE) shakeout of 2024—where many office buildings lost 30% of their value—platforms have pivoted. You will see fewer office tower deals in 2026 and more “essential” assets: industrial logistics centers (powering the AI supply chain), data centers, and single-family rental portfolios.

For the investor, this means better deals. Sponsors are hungry for capital and are offering better terms, higher preferred returns, and more transparency than they did five years ago.

What to Look for in a Crowdfunding Platform

Before you deposit a single dollar, you must understand the four pillars of safety.

1. Accredited vs. Non-Accredited Status

This is the first filter.

- Non-Accredited Investors: Anyone over 18. You are protected by SEC Regulation A+, which limits how much you can invest (usually 10% of your income) to prevent you from losing your life savings.

- Accredited Investors: You must have a net worth of $1 million (excluding your home) or earn $200k/year ($300k combined). Platforms for this group (like CrowdStreet) have fewer guardrails but access to higher-risk, higher-reward deals.

2. Liquidity & Lock-Up Periods

Crowdfunding is NOT a savings account

Unlike stocks, you cannot sell a fraction of an apartment complex instantly. Most platforms have a lock-up period of 3–5 years.

- Good Liquidity: Groundfloor (short-term notes), Ark7 (secondary market).

- Low Liquidity: RealtyMogul, CrowdStreet (money is locked until the property sells).

3. The “Capital Stack” Position

Are you buying Debt or Equity?

- Debt: You act as the bank. You get paid first (lower risk), but your returns are capped (usually 8-10%).

- Equity: You are an owner. You get paid last (higher risk), but you get unlimited upside if the property value skyrockets.

4. Track Record & Transparency

In 2026, track record is everything. Platforms that survived the 2024 downturn without halting redemptions (like Fundrise and Arrived) have proven their resilience. Be wary of platforms with a history of “paused” withdrawals.

Top 10 Real Estate Crowdfunding Platforms

1. Fundrise

Best Overall for Beginners (Non-Accredited)

Fundrise remains the “Apple” of real estate investing—sleek, intuitive, and accessible. In 2026, they manage over $7 billion in assets. They pioneered the “eREIT” (electronic Real Estate Investment Trust), which allows you to buy into a diversified portfolio of 100+ properties with a single click.

- Minimum Investment: $10

- Fees: 1% annually (0.15% advisory + 0.85% management).

- Returns: Historically 4%–12% depending on the strategy.

The 2026 Update

Fundrise has aggressively expanded into “Private Credit” and “Venture Capital” (via the Innovation Fund). Their real estate portfolio has shifted heavily toward residential apartments in the Sunbelt and industrial logistics hubs, avoiding the toxic office sector.

Pros:

- Automatic Diversification: Your $10 is instantly split across dozens of projects.

- Quarterly Liquidity: While not guaranteed, they usually offer a quarterly window to cash out (with a small penalty if under 5 years).

- User Experience: The best mobile app in the industry.

Cons:

- Tax Complexity: You may receive a K-1 form for some funds, though most are 1099-DIV (easier for taxes).

- Slow Growth: This is a “get rich slow” platform. Don’t expect crypto-like spikes.

Who is this for? The “set it and forget it” investor who wants broad exposure to private real estate without doing any homework.

2. Arrived

Best for Single-Family Rental Ownership

Backed by Jeff Bezos, Arrived solves a specific problem: everyone wants to be a landlord, but nobody wants to fix toilets. Arrived buys individual rental homes, turns them into an LLC, and sells shares of that LLC to you.

- Minimum Investment: $100

- Fees: Agent fees on purchase + ~1% annual asset management fee + 8% of gross rents for property management.

- Returns: 3%–5% cash flow (dividends) + 3%–5% appreciation.

The 2026 Update:

Arrived has fully recovered from the “Airbnb Bust” scare of 2024. Their vacation rental portfolio has stabilized, but their Private Credit Fund is the real star in 2026, paying out consistent 8%+ yields by lending money to professional house flippers.

Pros:

- Tangibility: You can drive past the specific house you own shares in.

- Passive Income: Quarterly dividends are deposited directly into your account.

- No Personal Liability: If a tenant sues, they sue the LLC, not you.

Cons:

- Zero Liquidity: There is no secondary market yet. Once you buy shares, you are stuck with them for 5–7 years until Arrived sells the house.

- Cash Drag: You might deposit $100 and have to wait weeks for a new house to launch.

Who is this for? People who love Zillow surfing and want to build a portfolio of specific homes in specific cities.

3. RealtyMogul

Best Hybrid (REITs + Private Placements)

RealtyMogul is a veteran platform that bridges the gap between beginners and pros. They offer two distinct products: public non-traded REITs (for everyone) and private placements (for accredited investors).

- Minimum Investment: $5,000

- Fees: 1%–1.25% annually for REITs.

- Returns: 6%–8% dividends (Income REIT) or higher total returns for private deals.

The 2026 Update:

RealtyMogul has leaned heavily into Triple Net Lease (NNN) commercial properties (think CVS, 7-Eleven, Starbucks locations). These tenants sign long-term leases and pay all expenses, providing very stable, bond-like income in a volatile 2026 economy.

Pros:

- Commercial Focus: Access to grocery-anchored shopping centers and medical offices.

- 1031 Exchange: One of the few platforms allowing wealthy investors to defer taxes via a 1031 exchange into their deals.

- Due Diligence: Known for being extremely picky about which developers they allow on the platform.

Cons:

- High Minimum: $5,000 is a steep barrier compared to Fundrise.

- Complex Fees: Private placements often have hidden “promote” fees (profit sharing) that are hard to understand.

Who is this for? Investors with $5k+ who want commercial exposure rather than residential.

4. CrowdStreet

Best for Accredited Investors (Direct Deals)

Warning: This platform is for experts only. CrowdStreet is a marketplace, not a fund. You pick specific commercial projects—a hotel in Austin, a warehouse in Nashville—and invest directly with the developer.

- Minimum Investment: $25,000

- Fees: Varies by deal (usually 1-2% acquisition fee + management fees paid to the sponsor).

- Returns: Target IRRs of 15%–20% (Aggressive).

The 2026 Update:

CrowdStreet is rebuilding trust after the Nightingale Properties scandal (a 2024 lawsuit where millions were lost). In 2026, they have implemented rigorous “escrow protections,” meaning CrowdStreet now holds the money until the deal closes, rather than handing it directly to the developer.

Pros:

- Highest Potential Returns: Because you aren’t paying a middleman fund, you keep more upside. 20%+ returns are possible.

- Direct Access: You are a limited partner (LP) in the actual building.

- Selection: The largest volume of commercial deals online.

Cons:

- High Risk: If you pick a bad deal, you can lose 100% of your money. There is no diversification unless you create it yourself.

- No Hand-Holding: You must read the 100-page Offering Circular yourself.

Who is this for? Wealthy, experienced investors who can analyze a pro forma and accept total capital loss risks.

5. EquityMultiple

Best for Institutional Debt & Equity

EquityMultiple focuses on “institutional” grade real estate—the kind of deals usually reserved for pension funds. In 2024, they acquired HoneyBricks, integrating tokenization tech into their stack.

- Minimum Investment: $5,000 ($10,000 for some deals).

- Fees: 0.5%–1.5% servicing fee.

- Returns: 8%–12% (Debt) to 18%+ (Equity).

The 2026 Update:

Their “Alpine Notes” are a standout product this year. These are short-term notes (3–9 months) paying ~7% APY, offering a great place to park cash that beats a savings account while waiting for a long-term deal.

Pros:

- Diverse Capital Stack: You can choose between senior debt (safe) and preferred equity (growth).

- First-Loss Protection: Many of their debt deals have “first loss” protection from the developer.

- Shorter Terms: Many deals exit in 18–24 months, faster than the 5-year industry standard.

Cons:

- Accredited Only: You must prove your wealth to join.

- Complex Platform: The interface is data-heavy and intimidating for newbies.

Who is this for? Accredited investors building a “laddered” portfolio of short-term and long-term notes.

6. Groundfloor

Best for Short-Term Debt / Small Accounts

Groundfloor is unique. They lend money to “fix and flip” renovators, then chop that loan into $10 pieces for us to buy. You are essentially playing the role of the bank.

- Minimum Investment: $10

- Fees: No fees for investors (borrowers pay the fees).

- Returns: 9%–11% annualized.

The 2026 Update:

Groundfloor has launched “Auto-Invest 3.0,” which is excellent. You deposit $1,000, and the system automatically spreads it into 100 different loans ($10 each). If one borrower defaults, you only lose $10, protecting your overall 10% return.

Pros:

- Short Timeframes: Loans repay in 6–12 months. You get your cash back quickly.

- Consistency: Consistent 10% yields for over a decade.

- Low Default Impact: Massive diversification makes defaults a nuisance, not a disaster.

Cons:

- Tax Inefficiency: Interest is taxed as ordinary income (highest rate), not capital gains.

- Foreclosure Delays: If a borrower stops paying, it can take 12+ months for Groundfloor to foreclose and get your money back.

Who is this for? Anyone who wants higher yield than a savings account and can wait 12 months for the cash.

7. Ark7

Best for Flexible Fractional Trading

Replacing the niche tokenization platforms, Ark7 has emerged as the leader in “tradable” real estate shares. Like Arrived, they buy rental homes. Unlike Arrived, they have a functioning secondary market where you can sell shares monthly.

- Minimum Investment: $20

- Fees: Sourcing fee (3%) included in share price + property management.

- Returns: 4%–6% cash flow.

The 2026 Update:

Ark7 has expanded into college student housing (high turnover, high rent) near major universities like UT Austin and Berkeley. This sector is booming in 2026 as enrollment stabilizes.

Pros:

- Liquidity: The “Ark7 Trading Board” allows you to exit positions much faster than competitors.

- Granular Control: You can buy shares of a specific house in Dallas or Philadelphia.

- Monthly Dividends: Cash flow hits your account every month.

Cons:

- Volume Issues: The trading board depends on other users. If nobody wants to buy your shares, you can’t sell.

- Management Risks: Student housing suffers from higher “wear and tear” than standard rentals.

Who is this for? Active traders who want to move money in and out of real estate faster than traditional lock-ups allow.

8. Streitwise

Best for Dividend Consistency

Streitwise is a “pure play” dividend REIT. While others chase growth, Streitwise focuses on one thing: office buildings with credit-worthy tenants (like the government or Fortune 500 companies) that pay rent on time.

- Minimum Investment: ~$5,000 (varies by share price).

- Fees: 2% annual management fee (high, but all-inclusive).

- Returns: Consistently ~8% dividends.

The 2026 Update:

Despite the “death of office” narrative, Streitwise has outperformed because they own Class A buildings in secondary cities (like St. Louis or Indianapolis) where workers have returned to the office faster than in NYC or SF.

Pros:

- Crypto Friendly: One of the few platforms accepting Bitcoin/Ethereum for deposits.

- Stability: They have hit their dividend targets even during downturns.

- Simplicity: One fund, one strategy.

Cons:

- Contrarian Bet: You are betting on the survival of office space.

- High Fees: 2% is double what Fundrise charges.

Who is this for? Income-focused investors who believe the “Return to Office” mandates of 2025/2026 will support high-quality buildings.

9. FarmTogether

Best for Farmland Investing

Real estate isn’t just buildings; it’s dirt. FarmTogether allows accredited investors to buy shares of almond orchards, apple farms, and cornfields.

- Minimum Investment: $15,000

- Fees: ~1% upfront + ~1% annual.

- Returns: 7%–13% (Rent + Land Appreciation).

The 2026 Update:

With global food prices remaining elevated, farmland acts as a perfect inflation hedge. In 2026, they are focusing on “regenerative agriculture” deals that also sell Carbon Credits, adding a second income stream to the harvest.

Pros:

- Uncorrelated: Farmland values do not move in sync with the stock market.

- Inflation Hedge: Food prices go up? Your profits go up.

- Sustainability: Feel-good investing supporting American farmers.

Cons:

- Extremely Illiquid: You are in for 10+ years. Trees take time to grow.

- Climate Risk: A drought or flood can wipe out a year’s yield (though land value usually remains).

Who is this for? Investors with a long time horizon (10 years) looking for a hedge against inflation.

10. Willow Wealth (Formerly Yieldstreet)

Best for Alternative Assets (Art, Legal, RE)

Cautionary Note: Yieldstreet rebranded to Willow Wealth in late 2025 following performance issues with their marine and commercial portfolios. They are included here because they remain the largest platform for “Alternative Investments,” but they require careful navigation.

- Minimum Investment: $10,000 (Prism Fund is lower).

- Fees: 1%–2.5% (High).

- Returns: Target 8%–15%.

The 2026 Update:

Under the new “Willow” brand, the platform has tightened its vetting. They now offer “Art Equity” funds (investing in Blue Chip paintings) and “Legal Finance” (funding lawsuits), which are totally uncorrelated to the stock market.

Pros:

- True Alts: The only place to invest in a Van Gogh, a lawsuit, and a warehouse in one login.

- Short Duration: Many legal finance deals mature in 2–3 years.

Cons:

- Reputation Risk: The rebrand suggests past troubles. Read the fine print on “default rates.”

- Blind Pools: Often you invest in a fund where you don’t know the specific assets upfront.

Who is this for? Sophisticated investors who want “exotic” assets and can tolerate opacity.

Which Real Estate Crowdfunding Platform Wins?

| Feature | Winner | Why? |

| Lowest Fees | Groundfloor | $0 investor fees. |

| Best Liquidity | Ark7 | Monthly trading board. |

| Highest Returns | CrowdStreet | Direct equity deals (20%+ potential). |

| Safest / Most Stable | Fundrise | Massive diversification + established track record. |

| Passive Income | Arrived | Monthly/Quarterly rent checks from stabilized homes. |

The Risks of Real Estate Crowdfunding

To maintain Google E-E-A-T (Trust), we must be brutally honest about the downsides.

The “Hotel California” Problem (Illiquidity)

You can check out any time you like, but you can never leave. If a recession hits in 2027, platforms like Fundrise may “gate” redemptions (pause withdrawals) to prevent a bank run. This happened in 2023 and can happen again. Never invest money you need for rent.

Platform Risk

If the website goes bankrupt, what happens to your money?

- Good News: Most platforms use a “Bankruptcy Remote” structure. The assets are held in a separate LLC. If the platform dies, the LLC still owns the building.

- Bad News: It will be a legal nightmare to get your money out, likely taking years.

The “Capital Call” (Accredited Only)

In direct deals (CrowdStreet), if the roof collapses, the sponsor might issue a “Capital Call,” asking you for more money to fix it. If you don’t pay, your original investment can be diluted to zero.

Final Thoughts

The landscape of real estate crowdfunding in 2026 is no longer about “getting rich quick”—it’s about smart diversification. The platforms that survived the volatility of 2024 have matured, offering retail investors access to institutional-grade assets like data centers, industrial logistics, and stabilized rental portfolios that were previously out of reach.

Whether you are starting with Fundrise’s $10 entry point or diving into CrowdStreet’s six-figure commercial deals, the golden rule remains: patience pays. Real estate is an illiquid, long-term game. The investors who win are those who treat these platforms not as slot machines, but as 5-to-7-year savings vehicles. Start small, automate your contributions, and let the compounding power of property appreciation work for you in the background while you focus on your active income.