You have $1,000 sitting in your bank account. Maybe it’s a tax refund, a work bonus, or money you’ve carefully saved by cutting back on subscriptions. The big question is: What do you do with it now? Investing in 2026 looks different than it did just a few years ago. We’ve seen inflation stabilize, artificial intelligence move from “hype” to “everyday utility,” and interest rates settle into a new normal. The days of getting 0% on your savings are gone, but the easy money of the early 2020s tech boom has shifted into new sectors.

Whether you want to play it safe with guaranteed returns or take a calculated risk on the next big AI breakthrough, $1,000 is the perfect amount to start. It’s enough to buy a diversified portfolio, but not so much that you’ll lose sleep if the market dips.

This guide explores the 15 best ways to invest $1,000 in 2026, ranked from the safest bets to the highest growth opportunities.

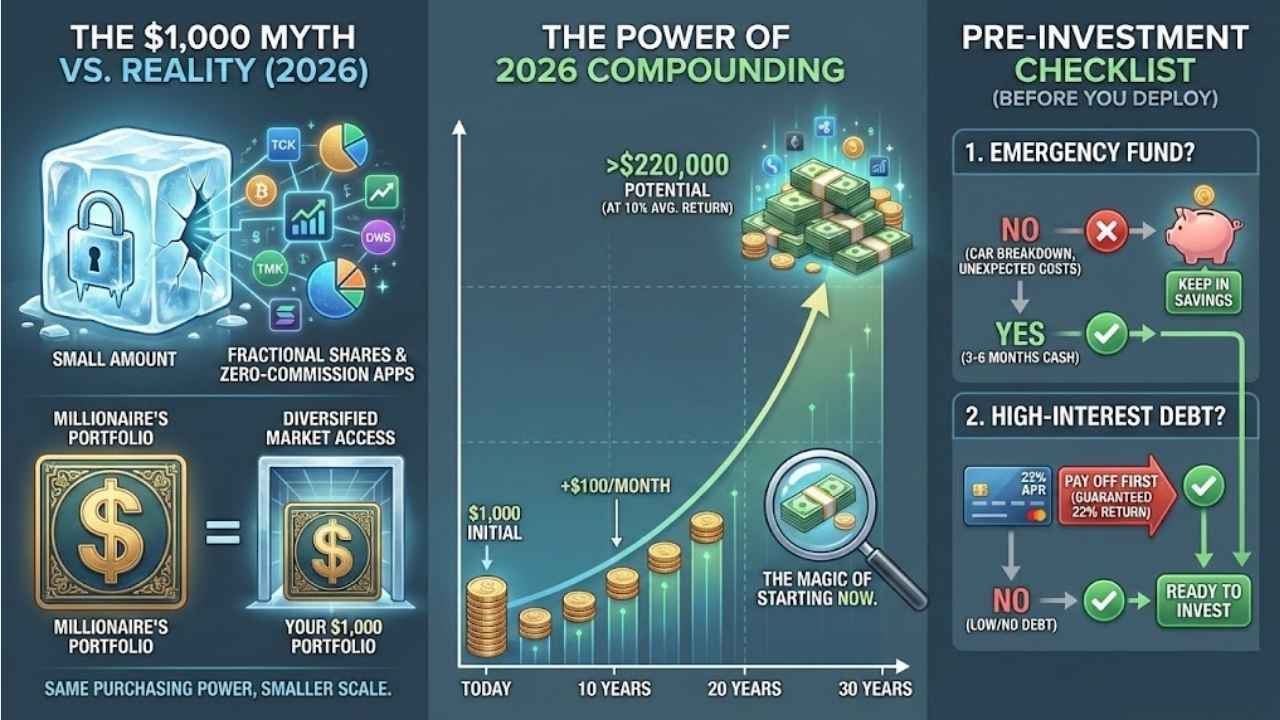

Why $1,000 is Worth More Than You Think in 2026

Many beginners freeze up because they think $1,000 isn’t “real” investing money. That is a myth. Thanks to fractional shares and zero-commission trading apps, your $1,000 today has the same purchasing power as a millionaire’s portfolio—just on a smaller scale.

The Power of 2026 Compounding

If you invest that $1,000 today and add just $100 a month into an S&P 500 fund (averaging 10% returns), in 30 years, you could have over $220,000. That is the magic of starting now.

The “Pre-Investment” Checklist

Before you deploy your capital, check these two boxes. If you can’t say “yes” to these, pause and fix them first:

- Do you have an emergency fund? If your car breaks down tomorrow, do you have cash to fix it? If not, keep this $1,000 in a savings account.

- Do you have high-interest debt? If you have credit card debt at 22% interest, paying that off is a guaranteed 22% return on your money. No stock can beat that consistently.

Low-Risk / Guaranteed Returns (The “Safe” Bucket)

These investments are for people who want to sleep soundly at night. You won’t get rich overnight, but you won’t lose your principal either.

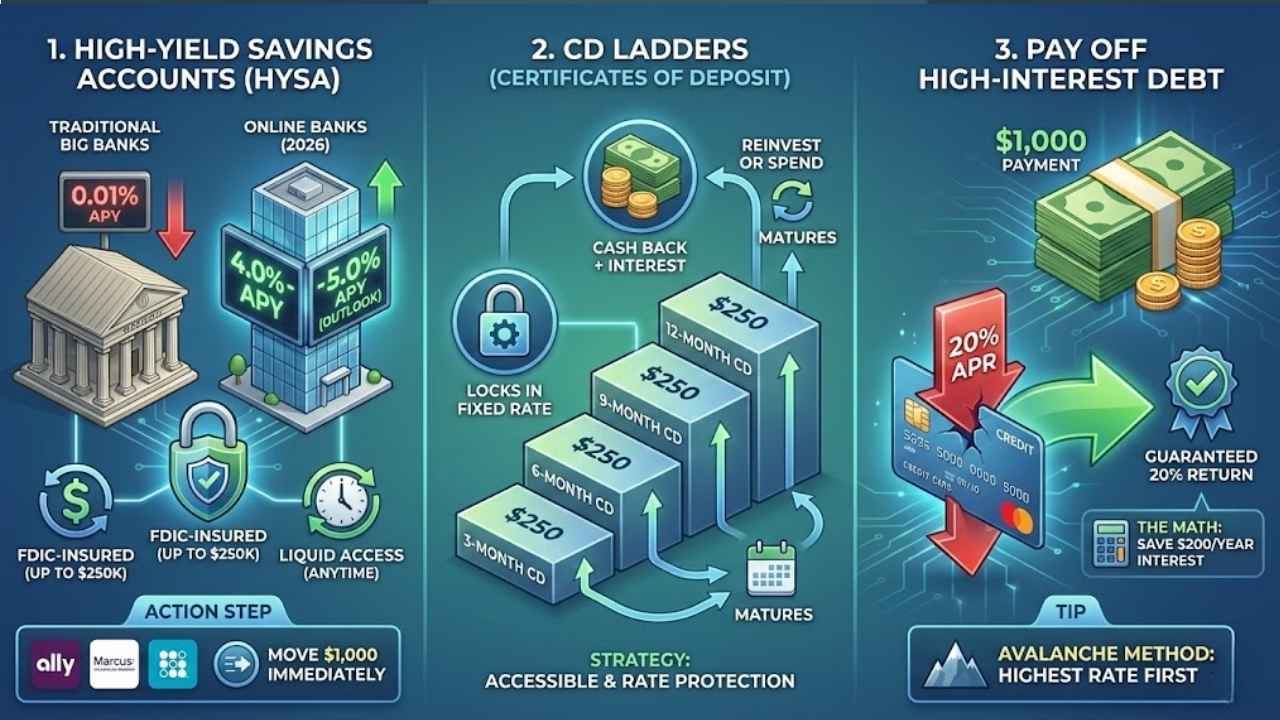

1. High-Yield Savings Accounts (HYSA)

In 2026, High-Yield Savings Accounts remain the king of flexibility. Unlike traditional big banks that might still offer a pitiful 0.01%, online banks are fighting for your deposits.

- Why it works: Your money is FDIC-insured (safe up to $250k) and liquid (you can withdraw it anytime).

- 2026 Outlook: With interest rates stabilizing, look for HYSAs offering APYs in the 4.0% to 5.0% range. This is essentially “free money” just for parking your cash in the right place.

- Action Step: Check banks like Ally, Marcus, or SoFi. Move your $1,000 there immediately to start earning interest daily.

2. CD Ladders (Certificates of Deposit)

If you know you won’t need the money for a while, a Certificate of Deposit (CD) locks in a fixed interest rate for a set time.

- The Strategy: Instead of putting all $1,000 in one CD, build a “ladder.”

- Put $250 in a 3-month CD.

- Put $250 in a 6-month CD.

- Put $250 in a 9-month CD.

- Put $250 in a 12-month CD.

- Why do this? As each CD matures, you get cash back (plus interest). You can either spend it or reinvest it into a new higher-rate CD. It keeps your money somewhat accessible while locking in today’s rates before they potentially drop.

3. Pay Off High-Interest Debt

This is the “anti-investment” that beats almost everything else.

- The Math: Let’s say you have $1,000 on a credit card with a 20% APR. That debt costs you $200 a year in interest.

- The Return: If you use your $1,000 to pay it off, you instantly save that $200. That is a guaranteed, tax-free 20% return.

- Tip: Start with the “Avalanche Method”—pay off the debt with the highest interest rate first.

Moderate Risk / Passive Income (The “Build” Bucket)

This is the sweet spot for most investors. You are accepting some market volatility in exchange for higher long-term growth.

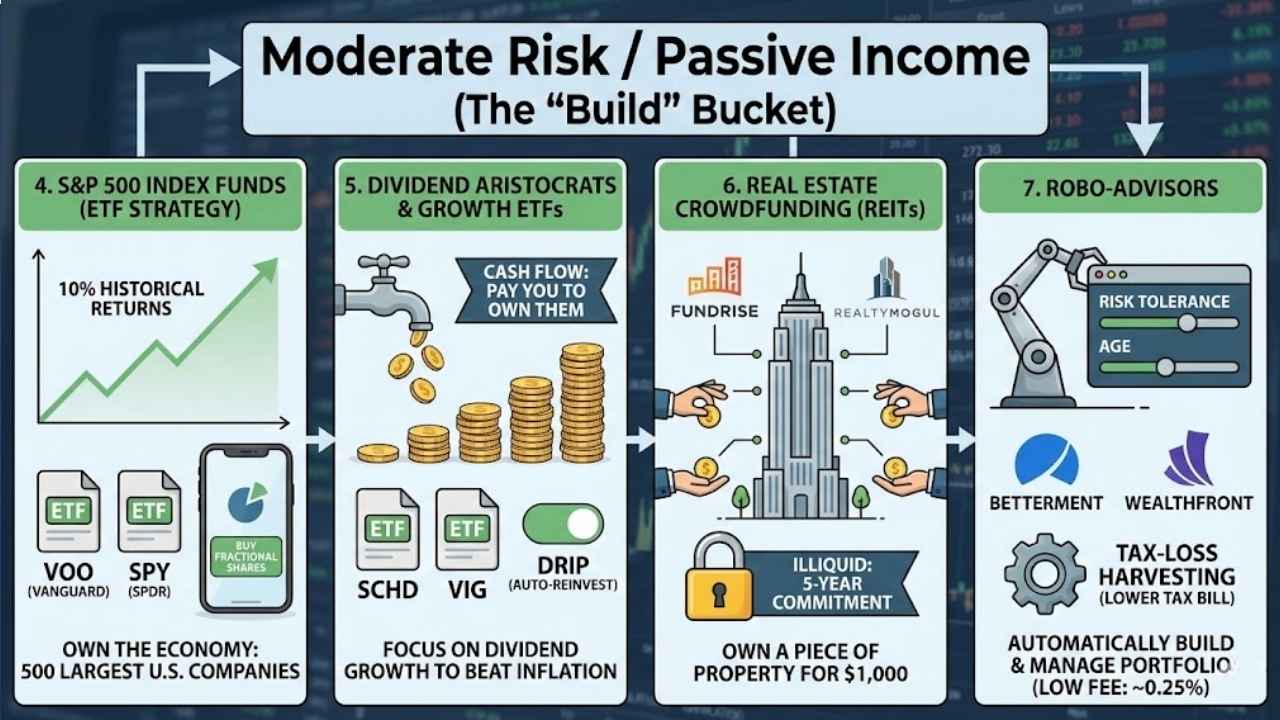

4. S&P 500 Index Funds (ETF Strategy)

If you want to “own the economy,” this is how you do it. The S&P 500 tracks the 500 largest publicly traded companies in the U.S. (think Apple, Microsoft, Amazon).

- Why it wins: You don’t have to pick winners. If one company fails, you have 499 others to back you up. Historically, this index has returned about 10% annually over long periods.

- Best Tickers for 2026: Look for low-cost ETFs like VOO (Vanguard) or SPY (SPDR).

- Action Step: Open a brokerage account (Fidelity or Schwab), search for “VOO,” and buy $1,000 worth. If the price is high, buy fractional shares.

5. Dividend Aristocrats & Growth ETFs

Do you want cash flow? Dividend investing is about buying companies that pay you to own them.

- What are Aristocrats? These are companies that have increased their dividend payouts for at least 25 consecutive years (e.g., Coca-Cola, Johnson & Johnson). They are stable and boring—in a good way.

- 2026 Strategy: Focus on “Dividend Growth” ETFs like SCHD or VIG. These funds hold companies that don’t just pay dividends, but grow them, helping you beat inflation.

- Pro Tip: Turn on “DRIP” (Dividend Reinvestment Plan) in your brokerage settings. This automatically uses your dividend payments to buy more shares, accelerating your compounding.

6. Real Estate Crowdfunding (REITs)

You used to need $50,000 for a down payment to invest in real estate. In 2026, you can own a piece of a skyscraper or an apartment complex for $1,000.

- How it works: Real Estate Investment Trusts (REITs) or crowdfunding platforms pool money from thousands of investors to buy properties.

- Platforms: Apps like Fundrise or RealtyMogul allow you to start with as little as $10 to $500.

- The Catch: Your money is often illiquid. You might not be able to pull it out instantly like a stock. Treat this as a 5-year commitment.

7. Robo-Advisors

If reading stock charts sounds like torture, let a robot do it.

- What they do: Robo-advisors (like Betterment or Wealthfront) ask you a few questions about your age and risk tolerance. Then, they automatically build and manage a portfolio for you.

- 2026 Features: Many now include “tax-loss harvesting” automatically, which can lower your tax bill by selling losing investments to offset gains.

- Cost: They typically charge a small fee (around 0.25% of your account balance), which is much cheaper than a human financial advisor.

High Growth / Trends of 2026 (The “Aggressive” Bucket)

These investments carry higher risk. The goal here is aggressive growth—doubling your money rather than just getting 8%. Only invest money here that you are willing to see drop in value temporarily.

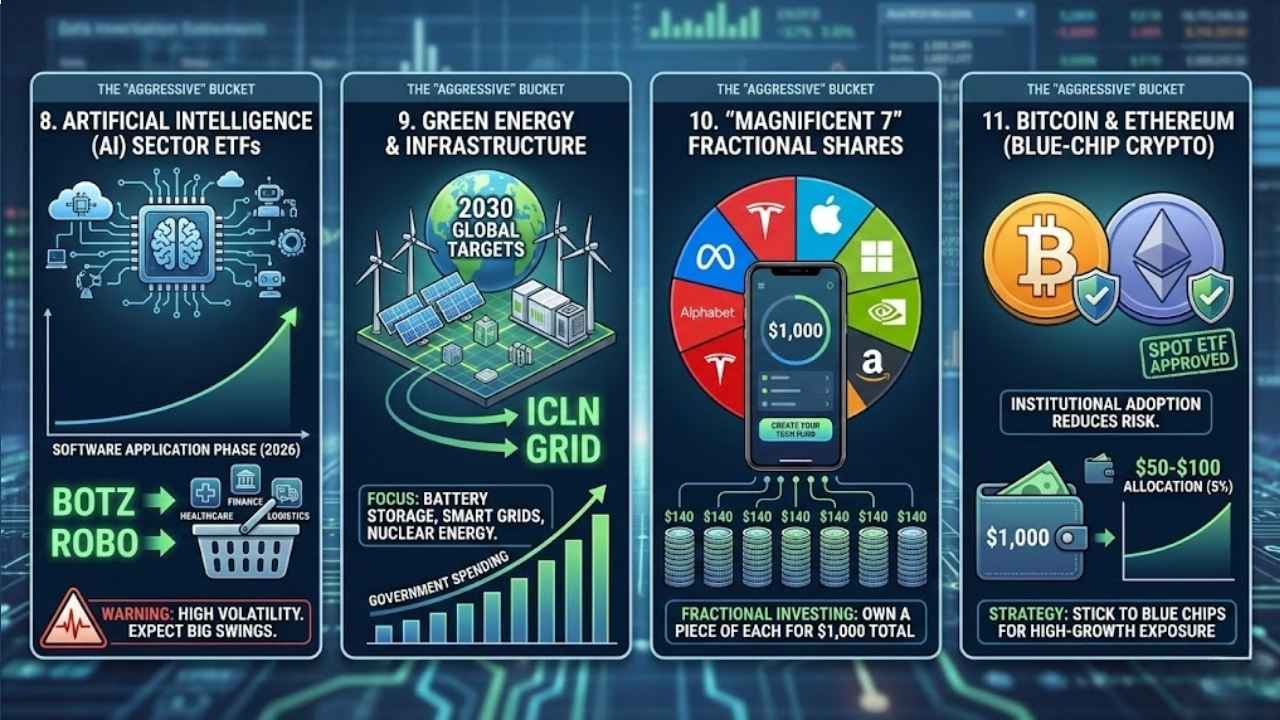

8. Artificial Intelligence (AI) Sector ETFs

By 2026, AI has moved past the initial hardware boom (chips) into the “application phase.”

- The Shift: While chipmakers are still crucial, the real growth in 2026 is likely in software companies using AI to revolutionize healthcare, finance, and logistics.

- How to invest: Instead of betting on a single startup that might fail, buy a basket of AI leaders. Look for thematic ETFs that focus on robotics and artificial intelligence.

- Warning: This sector is volatile. Expect big swings up and down.

9. Green Energy & Infrastructure

With global targets for 2030 approaching, governments and corporations are pouring billions into renewable energy and grid modernization.

- The Trend: It’s not just about solar panels anymore. It’s about battery storage, smart grids, and nuclear energy.

- Investment Avenue: Look for ETFs focusing on “Clean Energy” or “Global Infrastructure.” These funds capture the spending required to upgrade the world’s power systems.

10. “Magnificent 7” Fractional Shares

The tech giants (historically Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta, Tesla) continue to dominate because they have the most cash to invest in new tech.

- Fractional Investing: A single share of some of these companies can cost hundreds of dollars. With your $1,000, you can create your own “Tech Fund.”

- Example Allocation: You could put $140 into each of the 7 companies. If one has a bad year, the others may balance it out.

11. Bitcoin & Ethereum (Blue-Chip Crypto)

By 2026, crypto has matured significantly. With the approval of Spot ETFs, institutional money (pension funds, banks) is involved, reducing some of the “Wild West” risks.

- The Strategy: Stick to the “Blue Chips”—Bitcoin (BTC) and Ethereum (ETH). These have the longest track records and highest security.

- Allocation: A common rule of thumb is 5% of your portfolio. With $1,000 to invest, putting $50-$100 into crypto offers exposure to high growth without risking your financial future.

Alternative & Skills Investments (The “You” Bucket)

Sometimes the best return on investment (ROI) doesn’t come from the stock market. It comes from your own hustle.

12. Peer-to-Peer (P2P) Lending

Play the role of the bank. P2P platforms match you with borrowers who need personal loans.

- How it works: You lend small amounts (e.g., $25) to many different people. As they pay back their loans with interest, you earn money.

- Risk: If a borrower defaults, you lose that money. Diversification is key—lend $25 to 40 people, not $1,000 to one person.

13. Reselling & Flipping

This is the only method on this list where you can realistically double your money in a month.

- The Process: Go to thrift stores, garage sales, or clearance aisles. Buy underpriced items (vintage clothes, electronics, sneakers) and resell them on eBay, Poshmark, or Facebook Marketplace.

- 2026 Twist: Use AI tools to instantly check prices and write product descriptions from photos, speeding up your listing process.

14. Upskilling & Certifications

Investing in your earning power often yields the highest ROI.

- Idea: $1,000 buys a lot of education.

- Google Career Certificates: (Data Analytics, UX Design) typically cost under $300.

- AI Prompting Courses: Learn how to leverage advanced AI models to work faster.

- The Payoff: If a $500 course helps you negotiate a $5,000 raise, that is a 1,000% return in one year.

15. Start a Side Hustle (Service Arbitrage)

Use the $1,000 as seed capital for a service business.

- Low-Cost Ideas:

- Pressure Washing: Rent or buy a washer and market to neighbors.

- Digital Agency: Use the money for a website, domain, and subscription to SEO or design tools, then sell services to local businesses.

- Why invest money? Using paid tools (like premium Canva or ChatGPT Plus) makes you look professional faster than trying to do everything for free.

How to Choose: A Quick Decision Framework

Confused by the 15 options? Use this table to match your choice to your personality and goals.

| If you are… | And you need the money in… | Your Best Bet is: | Risk Level |

| Cautious | < 1 Year | HYSA or CD Ladder | Very Low |

| Balanced | 5+ Years | S&P 500 or Robo-Advisor | Moderate |

| Income Seeker | 3+ Years | Dividend ETFs or REITs | Moderate |

| Risk Taker | 10+ Years | AI ETFs or Crypto | High |

| Hustler | Immediate Cash Flow | Reselling or Side Hustle | Effort-Based |

Final Thoughts

Investing $1,000 in 2026 is about more than just the money; it’s about building the habit of ownership. Whether you choose the safety of a high-yield savings account or the excitement of the AI sector, the act of deploying that capital puts you ahead of the majority of people who leave their cash sitting idle.