Family Banking means handling money matters as a team, right at home. Families teach their kids how to save, spend, invest, and borrow by letting them practice with real dollars and cents. Have you ever felt like a walking ATM? You are not alone. Most parents have handed over a twenty-dollar bill and wondered if it would ever be seen again. The rise of digital apps makes it easier for children and teens to manage money today than ever before. Parents play the teacher’s role, showing kids that credit is not free money; it is borrowed cash you must repay.

Giving kids their own savings accounts or child-friendly debit cards can turn learning about budgeting into a game instead of a chore. I found that once my own kids saw their balances go up and down in real-time, the lessons finally clicked.

Parents can start with simple lessons like saving birthday cash or tracking spending in an app. As kids grow older, they try more complex tasks such as setting goals and using credit responsibly.

Even young children learn fast when grown-ups talk openly about smart habits: why we save first, spend wisely later, and think twice before borrowing.

Learning these skills does more than fill piggy banks; it builds financial confidence for life’s big steps ahead. Family Banking helps shape strong habits so one day your child will be ready to handle money on their own, with less worry down the road.

This story has lots more tips for making family banking work for every household, so keep reading!

What is Family Banking?

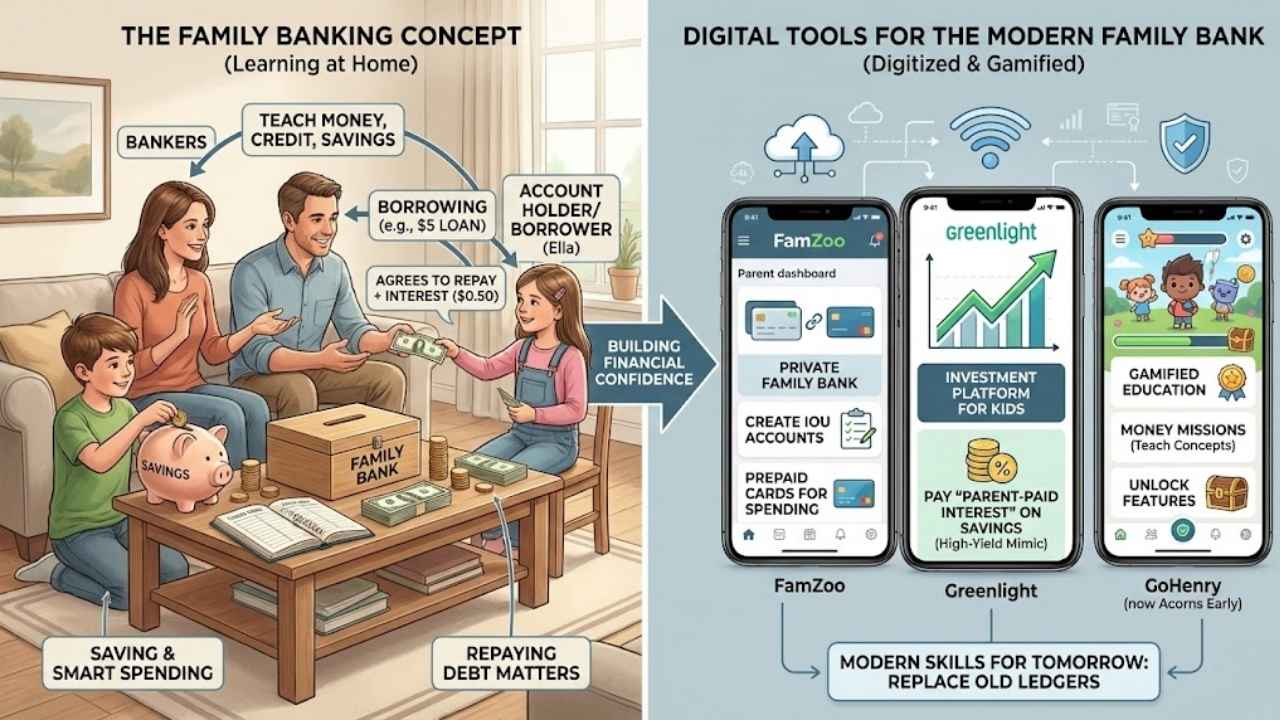

Family banking lets parents teach kids about money, credit, and savings right at home. They set up a simple family “bank,” where adults act as the bankers and children play the role of account holders or borrowers.

This setup uses real or pretend money to make learning fun and hands-on for every age group.

Kids can practice saving, borrowing, spending, and even paying back small loans with interest. For example, if Ella borrows five dollars from her dad’s “bank,” she agrees to pay it back plus fifty cents over time.

These lessons help kids see that using credit means spending borrowed money, not their own, and that repaying debt matters just as much as smart shopping or saving for a new toy.

With digital tools changing how young people handle cash today, these skills build stronger financial confidence for tomorrow. Modern tools have replaced the old ledger book.

Top Apps for the Modern Family Bank

You do not need to rely on pen and paper anymore. Several apps have digitized the “Bank of Mom and Dad” experience:

- FamZoo: This app is a favorite for parents who want total control. It functions like a private family bank where you can create IOU accounts for loans or prepaid cards for spending.

- Greenlight: Famous for its investment platform for kids, Greenlight allows you to pay “parent-paid interest” on savings, mimicking a high-yield savings account to encourage hoarding cash.

- GoHenry (now Acorns Early): This platform focuses heavily on gamified education, using “Money Missions” to teach concepts before kids can unlock certain features.

Why Teach Kids Financial Literacy Through Family Banking?

Kids learn best by doing, and family banking turns money lessons into real-life practice. Watch their confidence grow as they handle dollars, cents, goals, and even a little bit of credit in your own living room.

Building responsible financial habits

Giving children hands-on practice with money helps them build responsible financial habits. A piggy bank or a kid’s savings account turns saving into a daily activity, not just a one-time lesson.

Research confirms that starting early is critical. A landmark study by the University of Cambridge found that money habits are typically set by age seven. This means the window to influence your child’s attitude toward spending and saving closes much earlier than most parents realize.

Parents who show how to track spending help youth spot the difference between wants and needs. For example, setting up simple budgets, one for snacks and another for toys, teaches planning and patience.

Many parents use tools like debit cards designed for kids, which provide real-time lessons on banking in our digital age.

Using credit as part of family banking makes understanding borrowed money clear from an early age. Children learn fast that paying back what you borrow builds trust and opens new chances later in life.

Experts agree that children who manage pocket money or small loans grow into adults with strong financial responsibility skills. Setting these habits early supports youth finance education and prepares kids to face bigger decisions down the road. Think of it as building muscles before running a race!

Encouraging savings and budgeting skills

Small steps, like opening a kid’s savings account or giving an allowance, can spark a child’s interest in money management. Set up clear goals together: Maybe your child wants to buy a toy or save for camp by summer.

Show how saving even $1 each week can add up to $52 by year’s end, as kids love watching their balances grow.

Use apps and digital tools because today’s kids see most money as numbers on screens. Have talks about needs versus wants while creating simple budgets side-by-side. Explain that using credit means borrowing, not spending their own cash, so it must be paid back.

Data from Greenlight’s 2025 report shows the average weekly allowance for kids in the U.S. is now around $12.98. However, this varies by age, with 6-year-olds averaging about $6 and 17-year-olds receiving closer to $21. Knowing these benchmarks can help you set a realistic budget for your own family bank.

This hands-on experience helps kids build strong financial habits early, making budgeting and saving as natural as brushing teeth or riding a bike.

Understanding the value of credit

Credit means borrowing money you must pay back. Kids need to know that credit is not free cash or a magic card, but a loan. Parents can explain this with something simple, like letting their child borrow five dollars for ice cream at the park and expecting them to pay it back later from their allowance.

Many kids see adults use real cards instead of coins or bills in stores. They might think it’s endless money, but it isn’t.

Learning about credit helps children grow into financially responsible adults. Using family banking tools can show kids how purchases made on credit require payment, often with interest added if not paid quickly.

Financial education early on prepares kids for digital finance decisions they will face as teens and young adults. With hands-on examples at home, children start to connect spending choices with debt and repayment responsibilities, which are skills everyone needs for life outside childhood piggy banks.

Benefits of Using Credit as a Teaching Tool

Teaching kids about credit gives them a head start on smart money skills. Curious how? Keep reading!

Learning about interest and repayment

Kids learn fast that credit is borrowed money, not their own cash. Suppose a parent lets them borrow $10 from the family bank to buy a game. Every week, that child might need to pay back $2 with extra cents added for interest.

This simple lesson shows them that loans come with rules and costs.

Interest teaches kids patience and smart planning. If they repay late, they owe more next time, just like in real life with bank loans or credit cards. Digital tools can track these payments too, making it easy for kids and parents to follow along together.

For older teens needing a formal loan for a car or laptop, you might even reference the IRS Applicable Federal Rate (AFR). As of February 2026, the short-term rate is approximately 3.56%. While you may not charge your child this exact rate, explaining that “official” loans have minimum interest rates set by the government adds a layer of real-world authority to your lesson.

This hands-on approach helps build smart youth finance habits long before adulthood rolls in.

Developing credit responsibility early

Starting early with credit helps kids see that borrowing money is not the same as using their own cash. Parents can set up small “loans” at home, maybe $10 for chores or a toy. The child agrees to pay it back, maybe one dollar each week from allowance.

Kids learn about paying on time and how interest works in simple ways, like owing an extra quarter if they are late.

Digital tools make these lessons feel real for children and teens. Many banking apps now offer features just for youth finance education, allowing parents to monitor spending and repayment together on a screen. “Payment history makes up 35% of a FICO credit score. Teaching your teen to pay you back on time is the single most valuable lesson for their future creditworthiness.”

Being hands-on teaches kids financial responsibility before they ever touch a real credit card, helping them avoid costly mistakes later in life. Starting young builds habits that will last well into adulthood, setting the stage for smart future choices with money management.

Preparing for future financial independence

Kids who manage their own savings accounts and make spending choices build strong money management skills. Parents can show children how to set simple goals, like saving $20 per month, or sticking to a weekly budget for snacks and toys.

Small lessons about credit help kids learn borrowed money must be paid back. Most young children do not realize that using credit means using someone else’s money, so these discussions matter.

Digital tools shape how kids think about financial education today. By teaching smart spending habits with debit or starter credit cards at home, parents give kids confidence with digital finance before adulthood arrives.

Simple routines around allowance, tracking expenses on paper or apps, and talking through real-life purchases can lay the groundwork for future independence and smart decision-making as adults.

Tools and Strategies for Family Banking

Think of family banking like a game night, but with dollars and cents instead of dice. Try simple tricks to make money talk fun for the kids, and watch their eyes light up as they learn.

Setting up a family bank structure

Set up a family bank by playing the role of the lender. Name your “bank” together, set opening hours at the kitchen table, and make deposits part of your weekly routine. Use real money, digital banking apps, or even Monopoly bills for practice.

Hand each child a small ledger or use a shared spreadsheet to track savings, spending, loans, and payments just like banks do for adults.

Assign different accounts for savings and spending goals such as new shoes or video games. Make interest rates simple but clear; five percent per month gives quick feedback on saving and borrowing habits.

If a child borrows from the family bank instead of their allowance, explain that this is using credit, and means they owe money back with interest added on top. Guide each “customer,” help them budget birthday cash or save toward big-ticket wish items like bicycles or tablets.

Encourage honest talks about choices so kids see how smart financial habits can lead to fun rewards, and fewer regrets, down the road.

Using debit and credit cards for kids

Kids see plastic cards used for everything. Parents can use debit and credit cards to teach real money skills early.

| Feature | Greenlight | FamZoo | Step |

|---|---|---|---|

| Best For | All-in-one family management | Strict budgeting & loans | Teens building credit history |

| Cost (2025) | ~$5.99/mo (Core plan) | ~$5.99/mo (Family plan) | $0 (Free basic plan) |

| Key Feature | Parent-paid interest on savings | IOU accounts for loans | Reports to credit bureaus |

- Debit cards made for kids link directly to a savings account or prepaid balance, making it easy for parents to track spending together.

- Many banks offer youth accounts with parental controls; in 2025, apps like Greenlight and GoHenry remain top choices for managing these digital allowances.

- Credit cards for teens work differently; these often connect as authorized users on a parent’s card, with limits set by adults.

- Children learn that spending with credit is borrowing money, not using their own; this is the most important lesson about credit understanding.

- Apps and digital banking tools let parents give instant allowances, freeze lost cards, or set budgets right from their phones.

- Teens who manage small amounts of borrowed funds from family learn repayment and interest can affect future money management decisions.

- Using kid-friendly debit and credit products encourages smart habits around budgeting and avoiding overspending before adulthood begins.

- Kids get real-world experience with digital finance, which builds confidence as they get older and need financial independence.

Establishing savings and spending goals

Setting savings and spending goals helps children understand how to manage money. They learn to balance wants and needs, which is a key part of financial education.

- Start with small, clear goals for both saving and spending, such as choosing a toy or planning a family outing.

- Use the “Three Jars” method popularized by experts like Dave Ramsey: Label jars “Spend,” “Save,” and “Give” to physically separate cash for different purposes.

- Talk about the difference between short-term wishes like candy and long-term goals like a bike.

- Encourage tracking progress on a simple chart; seeing money grow motivates kids to save more.

- Discuss real-world examples, such as how adults budget for rent or vacations, making lessons feel relevant.

- Introduce the idea of setting aside at least 10% of any allowance or gift money for savings, echoing tried-and-true financial habits.

- Teach the benefit of delayed gratification, explaining that waiting often results in greater rewards, much like planting seeds now means enjoying fruit later.

- Give small rewards for reaching milestones so children connect hard work with positive outcomes.

- Help them split birthday or holiday money into savings and spending portions, giving hands-on practice in decision-making.

- Make sure kids consider needs before wants; use everyday trips to stores as teaching moments about sticking to a plan.

Steps to Introduce Family Banking to Kids

Kids soak up lessons best through real-life practice, so quick games and small money tests can work wonders. With a bit of guidance, even the youngest family members start picking up smart financial habits before you know it.

Start with basic financial concepts

Children learn best through clear examples and real-life practice. Give them coins or set up a digital piggy bank to show the difference between saving and spending. Money, for most younger kids, is just paper or numbers until they buy something themselves.

Explain that each dollar has a job; some go in savings, some for spending on fun things, and some are set aside for emergencies.

Show how credit works using simple words: “Using credit means borrowing money to pay for things now and paying it back later.” Share with them that if they borrow $10 from you today, they will need to give back $10 tomorrow, sometimes even a bit more because of interest.

A 2024 survey by Junior Achievement found that 42% of teens are “terrified” they won’t have enough money for the future. You can reduce this anxiety by demystifying these concepts early. Use stories about how parents once saved up for months before buying big items instead of swiping a card at every checkout line.

Encourage questions about where money comes from, what happens when you run out, or why people use both cash and cards. A child who knows these basics early stands a better chance at growing into an adult who makes smart choices with their own budget one day.

Financial education grows stronger each time you talk openly about saving goals or explain your own decisions on bills and purchases as part of daily life.

Create real-world money management scenarios

Hand your child $10 and ask them to plan a small family movie night. They can decide how much to spend on snacks, tickets, or streaming. Give simple “credit” by offering an extra $5 if they want more, but explain it needs repayment from their next allowance, with “interest,” even just fifty cents! This way, kids learn the value of credit and how borrowing works before using digital finance tools as teens.

Set up a pretend store at home with toys or treats priced with play money. Ask your child to save for something bigger or decide between spending now versus later. Let them use a debit or credit card made just for kids—many banks offer options tied to parental accounts—to track real savings and spending goals.

Practicing these scenarios builds good financial habits early and turns everyday moments into youth finance education lessons that stick like peanut butter on bread.

Monitor and guide their financial decisions

Kids need help to make wise choices with their own money, especially with digital finance tools everywhere. Parents should watch spending habits and talk openly about what works and what doesn’t.

For example, if a child uses a debit card for snacks instead of saving up for something bigger, it’s time for a chat about priorities. Teach them the difference between using savings and borrowing credit, since younger kids often mix these concepts up.

Set clear limits before giving access to kid-friendly cards or accounts. Show how every swipe means either spending personal funds or borrowing through credit. Discuss real-world situations together—like choosing between a toy now or saving for next month’s trip—and break down the smart move step by step.

This approach prepares children for financial independence later on and builds solid economic literacy early in life.

Long-Term Advantages of Family Banking

Family banking plants seeds today that help kids make smarter money choices for life, and aren’t we all a bit curious how those seeds grow? Read on.

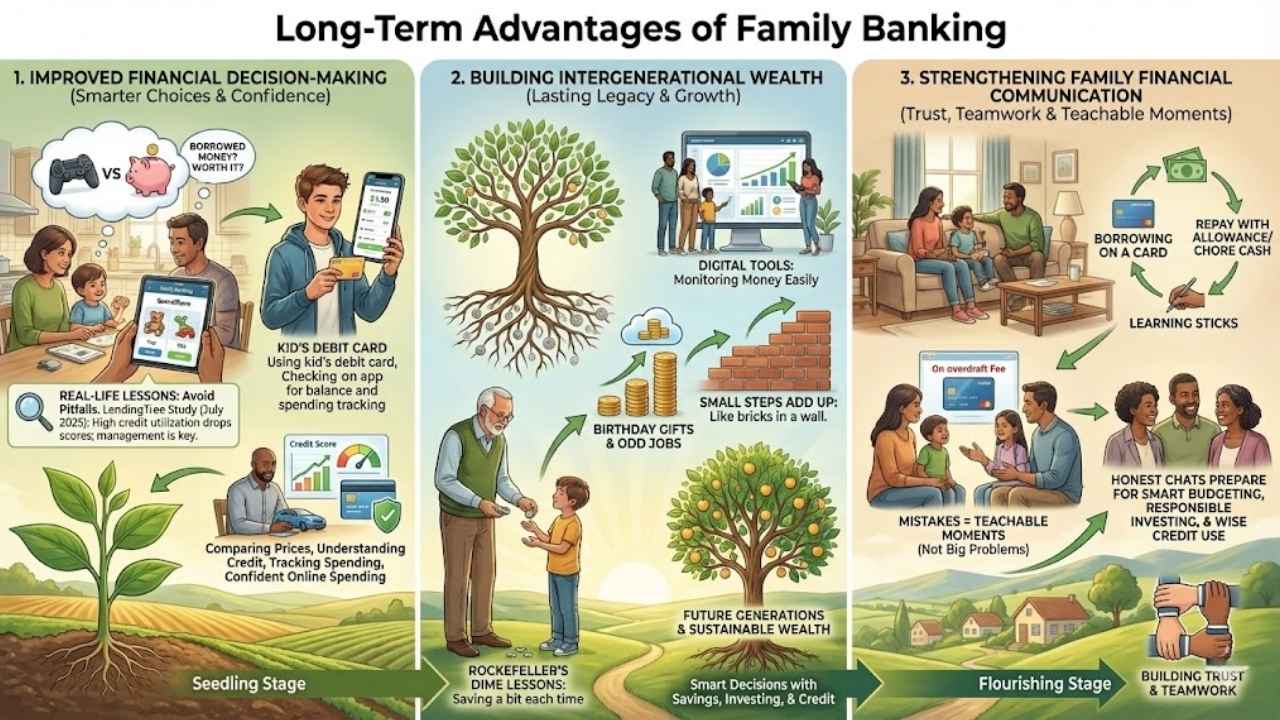

Improved financial decision-making

Kids who practice financial skills at home make smarter choices with money later in life. For example, a child may learn to compare prices before buying a toy or think twice before spending allowance on games.

By understanding that credit is borrowed money, not their own cash, children pause and ask themselves if a purchase is really worth it. They start to see why paying off what they owe matters as much as saving.

Parents can use family banking ideas like giving kids their own savings account or debit card. These tools show kids how digital finance works today and highlight the value of checking balances often, setting limits, and tracking spending through apps.

Real-life lessons prepare them for big decisions down the road, like getting a car loan or picking the right student credit card in college, so they avoid common pitfalls that many teens face. A LendingTree study from July 2025 highlighted that authorized users with high credit utilization actually saw their scores drop. This proves that access to credit isn’t enough; knowing how to manage utilization is the real skill.

Kids become more confident about handling cash, using credit wisely, and finding safe ways to spend online as they grow into adults who are smart with money.

Building intergenerational wealth

Teaching kids about money today can help families build wealth that lasts for generations. Family banking blends real-life lessons and hands-on practice, showing how smart decisions with savings, investing, and credit shape the future.

Parents who set up simple family banks give children a safe place to learn about good spending habits and budgeting skills.

John D. Rockefeller started his grandson’s financial journey by giving him dimes as allowance, then teaching him the value of saving just a bit each time. A kid with their own savings account might watch it grow from birthday gifts or odd jobs around the house.

Over time, these small steps add up like bricks in a wall, as layer after layer creates strength for years to come. Digital tools now make monitoring money easy, so young people gain confidence using technology while learning key financial education skills needed in modern life.

Strengthening family financial communication

Families who talk openly about money build trust and teamwork. Kids learn important concepts like credit, saving, and spending in real life and not just from books or apps. Setting up a family bank at home turns tricky topics into simple conversations.

A child can see how borrowing on a card works, then repay what is owed with allowance or chore cash, which makes learning stick.

Parents often find that regular talks help kids ask more questions about digital finance tools too. Mistakes become teachable moments instead of big problems down the road. For example, if a teen buys extra online games with their kid’s debit card and faces overdraft fees, families can talk through what went wrong together.

Honest chats prepare children for smart budgeting, responsible investing choices, and even using credit wisely as adults one day.

Final Thoughts

Teaching kids about money starts at home, and family banking offers simple tools that build real-life skills. Kids learn to save, budget, spend wisely, and even understand how credit works when you introduce these lessons early. These steps are practical for busy families and fit right into daily life, with no fuss or fancy apps needed.

Why not let your child try making a spending plan or track their savings this week? Helping kids form smart habits now can lead to financial confidence as they grow up. Family talks around money shape future choices for the better, one small step at a time. For more ways to spark young minds on finance, plenty of kid-friendly books and online games exist if you want extra ideas. Give your child the chance to practice with money today, and their future selves will thank you for it!