Imagine walking into a bistro in Paris. You order a steak frites and a glass of wine, the bill comes to €100, and you pay with your standard bank card. When you check your statement later, you haven’t paid $108 (the market rate)—you’ve paid $112.

Where did that extra $4 go? It vanished into Foreign Transaction Fees (FTF).

Most standard credit and debit cards charge a fee of roughly 3% on every single purchase made outside the United States. On a $2,000 trip, that’s $60 wasted in fees—enough for a nice dinner, a museum tour, or a taxi to the airport.

The solution is simple: Pack a card that waives this fee.

In this guide, we’ve analyzed the top No-Foreign Transaction-Fee Cards of 2026 to find the 10 best options that charge $0 in foreign transaction fees. Whether you are a luxury traveler seeking airport lounges or a student needing a simple no-fee card, there is a match for you below.

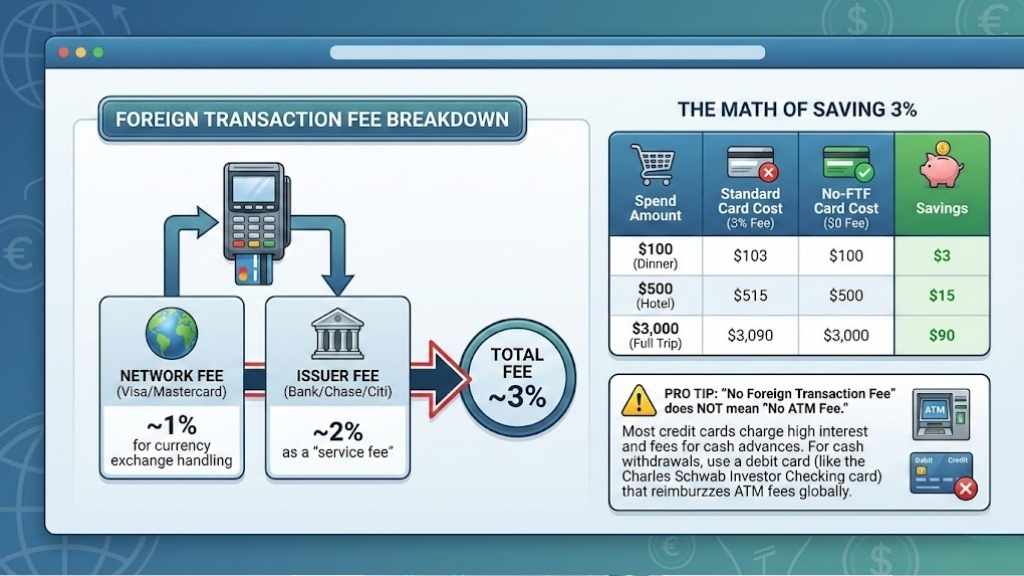

What is a Foreign Transaction Fee? (And Why You Should Avoid It)

Before we look at the cards, it is vital to understand what you are avoiding. A foreign transaction fee is a surcharge applied by your credit card issuer on transactions processed outside your home country.

It typically consists of two parts:

- Network Fee (~1%): Charged by Visa or Mastercard to handle the currency exchange.

- Issuer Fee (~2%): Charged by your bank (e.g., Chase, Citi, Wells Fargo) as a “service fee.”

The Math of Saving 3%

| Spend Amount | Standard Card Cost (3% Fee) | No-FTF Card Cost ($0 Fee) | Savings |

| $100 (Dinner) | $103 | $100 | $3 |

| $500 (Hotel) | $515 | $500 | $15 |

| $3,000 (Full Trip) | $3,090 | $3,000 | $90 |

Pro Tip: “No Foreign Transaction Fee” does not mean “No ATM Fee.” Most credit cards charge high interest and fees for cash advances. For cash withdrawals, use a debit card (like the Charles Schwab Investor Checking card) that reimburses ATM fees globally.

10 Best No-Foreign-Transaction-Fee Cards

We have categorized these cards by “User Intent”—helping you find the one that solves your specific travel problems.

1. Chase Sapphire Preferred® Card

Best For: Overall Travel Value & Beginners

The “Swiss Army Knife” of travel cards. It strikes the perfect balance between a reasonable annual fee and powerful rewards.

- Annual Fee: $95

- Rewards Rate: 5x on travel purchased through Chase, 3x on dining, 2x on other travel.

- Why It Wins: The points you earn are worth 25% more when redeemed for travel through Chase. Plus, you can transfer points 1:1 to partners like United Airlines and Hyatt.

- The Catch: It doesn’t offer luxury perks like airport lounge access.

2. Capital One Venture X Rewards

Best For: Premium Perks (Lounge Access)

This card has redefined the premium market by paying for itself.

- Annual Fee: $395

- Rewards Rate: 10x on hotels/rentals (via Capital One Travel), 5x on flights, 2x on everything else.

- Why It Wins: You get a $300 annual travel credit and 10,000 anniversary miles (worth $100). Mathematically, Capital One pays you $5 to keep this card. It also includes unlimited access to Capital One Lounges and Priority Pass.

- The Catch: The $395 fee is charged upfront, which can be a hurdle for some budgets.

3. Wells Fargo Autograph Journey℠ Card

Best For: No Annual Fee Rewards

A powerhouse for earning points without paying a dime in yearly fees.

- Annual Fee: $0

- Rewards Rate: 5x on hotels, 4x on airlines, 3x on restaurants and other travel categories.

- Why It Wins: It covers a wide range of “travel” categories (including campgrounds and cruises) that other cards miss.

- The Catch: The transfer partners are newer and less robust than Chase or Amex.

4. Capital One Savor Cash Rewards

Best For: Foodies & Dining Abroad

If you eat your way through Italy or Japan, this is your card.

- Annual Fee: $0

- Rewards Rate: 3% cash back on dining, entertainment, popular streaming services, and at grocery stores (excluding superstores like Walmart/Target).

- Why It Wins: “Dining” is broadly defined, covering everything from Michelin-star restaurants to street food stalls in Bangkok.

- The Catch: You need excellent credit to qualify.

5. Bilt Mastercard®

Best For: Renters & Urban Travelers

The only card that lets you earn points on rent without a fee.

- Annual Fee: $0

- Rewards Rate: 1x on rent (up to 100k points/year), 3x on dining, 2x on travel.

- Why It Wins: It has arguably the best transfer partners (including American Airlines and Hyatt). Earning points on your biggest monthly expense (rent) is a game-changer.

- The Catch: You must make 5 transactions per statement period to earn any points. Forget this, and you earn zero.

6. Bank of America® Travel Rewards

Best For: Students & Simplicity

A straightforward, “set it and forget it” card.

- Annual Fee: $0

- Rewards Rate: Unlimited 1.5 points per $1 spent on all purchases.

- Why It Wins: No categories to track. If you are a Bank of America Preferred Rewards member, your earning rate can jump up to 2.62x.

- The Catch: The base rate of 1.5x is lower than the 2x offered by competitors like Capital One Venture.

7. The Platinum Card® from American Express

Best For: VIP Status & Luxury

The ultimate status symbol for the heavy traveler.

- Annual Fee: $695 (Rising to $895 in 2026 for some users—check latest terms)

- Rewards Rate: 5x on flights booked directly with airlines or Amex Travel.

- Why It Wins: Unrivaled lounge access (Centurion Lounges are top-tier), hotel elite status (Hilton & Marriott Gold), and huge credits for Uber and airline fees.

- The Catch: Acceptance. Amex is not accepted everywhere in Europe or Asia. You must carry a Visa or Mastercard backup.

8. Chase Sapphire Reserve®

Best For: Travel Insurance & Peace of Mind

If you worry about flight cancellations, this card is your safety net.

- Annual Fee: $550

- Rewards Rate: 3x on travel and dining (immediately).

- Why It Wins: It offers industry-leading trip delay, cancellation, and baggage insurance. If your trip goes wrong, this card can save you thousands.

- The Catch: The $550 annual fee is steep, though offset by a $300 annual travel credit.

9. Discover it® Miles

Best For: Cashback Match (First Year)

A unique offer that doubles your rewards.

- Annual Fee: $0

- Rewards Rate: 1.5x miles on every purchase.

- Why It Wins: Discover matches all the miles you’ve earned at the end of your first year. This effectively makes it a 3% cash back card for the first 12 months.

- The Catch: Like Amex, Discover has lower acceptance rates internationally compared to Visa/Mastercard.

10. Capital One Quicksilver Cash Rewards

Best For: Simplicity

No categories, no math, just savings.

- Annual Fee: $0

- Rewards Rate: Flat 1.5% cash back on every purchase.

- Why It Wins: It’s incredibly easy to use. You can redeem cash back for any amount, at any time.

- The Catch: 1.5% is a basic rate. Inflation and premium cards have made 2% the new standard for “good” returns.

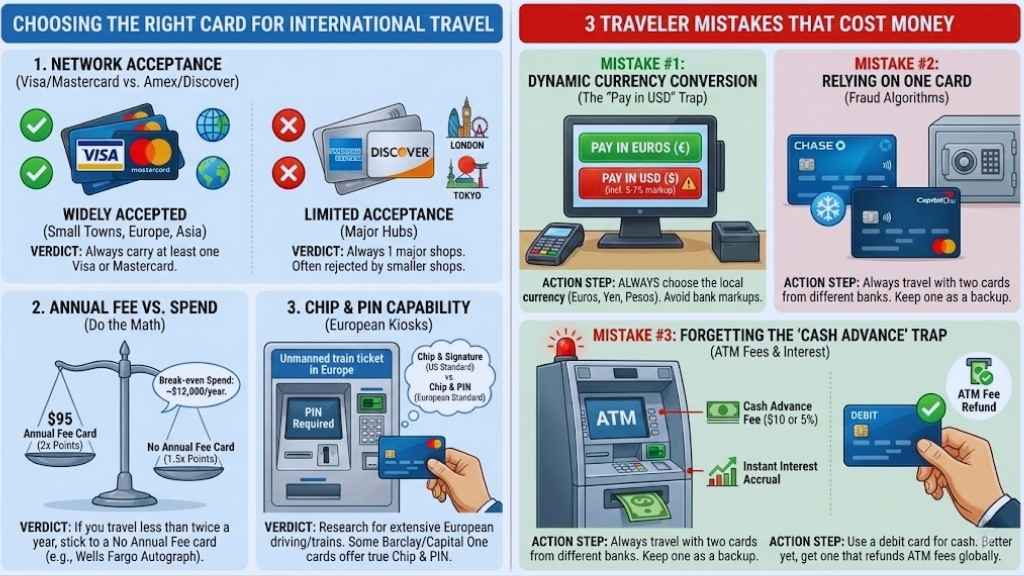

How to Choose the Right Card for International Travel

Don’t just pick the card with the highest bonus. Consider these three factors:

Network Acceptance (Visa/Mastercard vs. Amex)

If you are traveling to smaller towns in Europe, South America, or Asia, you need a Visa or Mastercard. Amex and Discover are widely accepted in major tourist hubs (London, Tokyo), but often rejected by “Mom and Pop” shops due to higher merchant fees.

- Verdict: Always carry at least one Visa or Mastercard.

Annual Fee vs. Spend

Do the math. If a card has a $95 annual fee but earns 2x points, and a free card earns 1.5x points, you need to spend roughly $12,000 a year to break even on the fee.

- Verdict: If you travel less than twice a year, stick to a No Annual Fee card like the Wells Fargo Autograph.

Chip & PIN Capability

In many European train stations and toll booths, you encounter unmanned kiosks that require a “Chip & PIN” card. Most US cards are “Chip and Signature.”

- Verdict: Barclays and some Capital One cards offer true Chip & PIN capability. If you plan on driving or taking trains extensively in Europe, research this feature.

3 Traveler Mistakes That Cost Money (Even With These Cards)

Even with a “No Foreign Transaction Fee” card, you can still get ripped off if you aren’t careful.

Mistake #1: Dynamic Currency Conversion (The “Pay in USD” Trap)

When you insert your card in a machine abroad, it may ask: “Pay in Euros or Pay in USD?”

ALWAYS choose the local currency (Euros, Yen, Pesos).

If you choose USD, the merchant’s bank performs the conversion at a terrible rate (often adding a 5-7% markup). This is called Dynamic Currency Conversion (DCC). Your bank can’t save you from this because you technically agreed to the transaction in dollars.

Mistake #2: Relying on One Card

Banks have fraud algorithms that can be aggressive. If you buy coffee in New York and then lunch in Istanbul 10 hours later, your card might get frozen.

Action Step: Always travel with two cards from different banks (e.g., one Chase, one Capital One). Keep one in your hotel safe as a backup.

Mistake #3: Forgetting the “Cash Advance” Trap

Never use your credit card at an ATM to get cash. You will be hit with:

- A Cash Advance Fee (usually $10 or 5%).

- Instant interest accrual (no grace period).

Action Step: Use a debit card for cash. Better yet, get a debit card that refunds ATM fees.

Final Thoughts

Traveling is about experiences—the food, the culture, the sights—not about worrying if your bank is nickeling and diming you. By choosing one of the 10 cards above, you automatically save 3% on your entire trip. For a family vacation costing $5,000, that is $150 back in your pocket just for using the right piece of plastic.