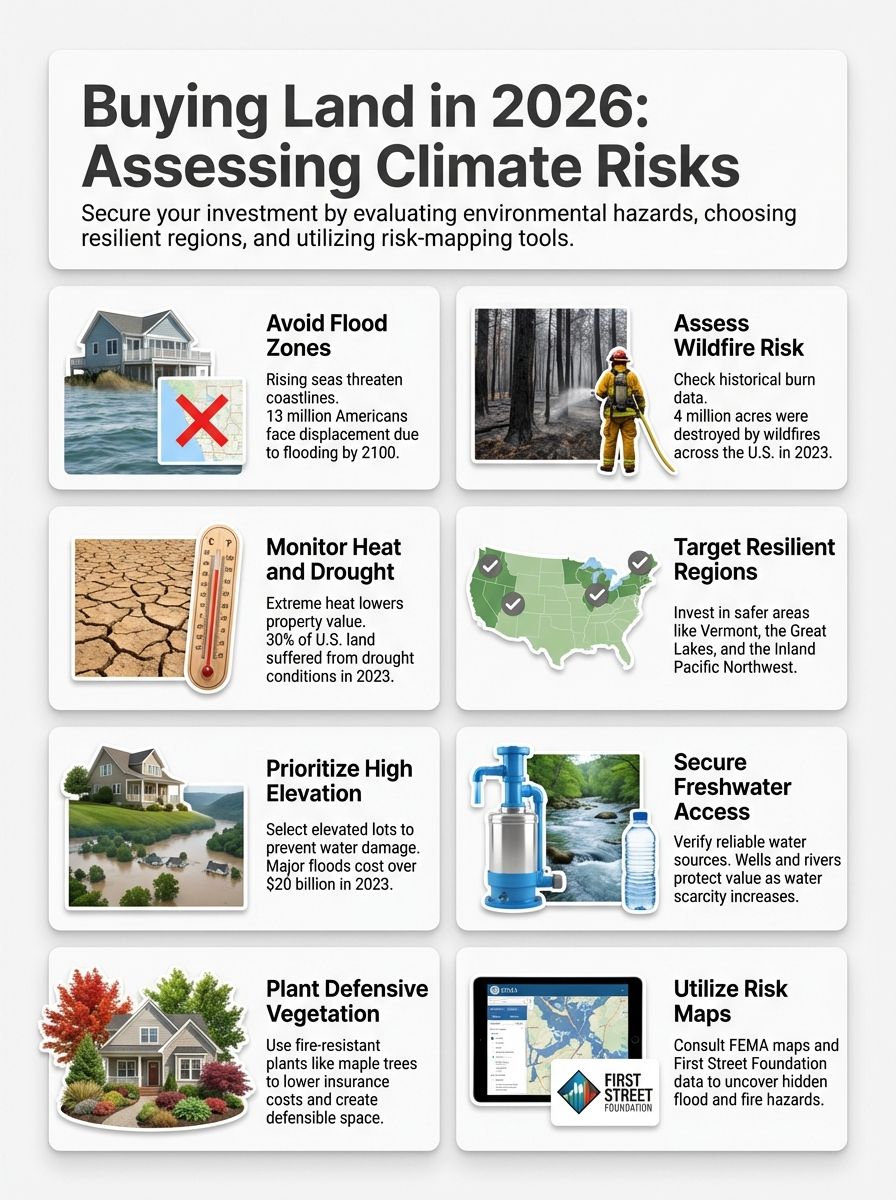

You know the feeling, you find a listing that looks perfect on paper, but then you see the news about another storm or wildfire, and you hesitate. Buying land in 2026 isn’t just about location and price anymore. It’s about asking, “Will this property still be safe and valuable in ten years?”

I’ve seen how quickly the market is changing. Insurance companies are sending out non-renewal letters, and flood zones are shifting faster than maps can keep up. In fact, some homeowners are now facing insurance premiums that have jumped 24% in just the last two years.

But here is the good news: you can still find incredible, safe places to build your dream if you know what to look for. It just takes a new set of questions. I’m going to walk you through the exact steps I use to spot the risks others miss. Let’s find you the Best Climate Safe Places to Buy Land that bring you peace of mind, not just a property deed.

Why Climate Risk Matters When Buying Land

Climate risk is no longer a distant problem; it is a financial reality that hits your wallet immediately. The biggest surprise for most buyers in 2026 isn’t the weather itself, but the cost of protecting against it.

Between 2020 and 2024, property insurance rates nationwide climbed by roughly 40%. In high-risk states like California and Florida, some major insurers like State Farm and Allstate have paused new policies entirely. If you buy in a “red zone,” you might find yourself unable to get a mortgage simply because you can’t get insurance.

Even if you can insure it, the value of the land itself is at stake. A recent study by First Street Foundation found that “climate abandonment” areas, neighborhoods where people are leaving due to flood or fire risk, are seeing property values stagnate while safer areas continue to appreciate. Choosing the wrong spot could mean buying an asset that loses value every time it rains.

“Mother Nature always bats last, but your bank account is usually the first to feel the hit.”

Understanding Climate-Resilient Land

So, what does a “safe” investment look like today? Climate-resilient land is property located in an area with naturally lower risks of extreme heat, flooding, and wildfire. These are often called “climate havens,” and they are becoming the hottest tickets in real estate.

Cities in the Great Lakes region, like Duluth, Minnesota, and Buffalo, New York, are gaining attention because they have access to massive freshwater reserves and cooler summers. Investors are looking for spots with “goldilocks” weather, not too hot, not too dry, and high enough above sea level to stay dry.

Local laws are catching up to this trend. For example, Connecticut recently became the first state to display detailed climate risk data for every single property on a public website. This level of transparency helps you, the buyer, see exactly what you are getting into before you sign.

Key Features of Resilient Markets

- Steady Insurance Markets: Areas where multiple carriers are still competing for your business.

- Modern Infrastructure: Towns that have upgraded storm drains and buried power lines.

- Water Security: Locations with reliable municipal water or healthy aquifers that aren’t depleting.

Key Climate Risk Factors to Assess

Risks can be invisible until it’s too late. Here is a breakdown of the specific hazards you need to check for in 2026, beyond just glancing at a generic map.

Flood Zones and Rising Sea Levels

Flooding is the most common and costly disaster in the U.S. Under FEMA’s new Risk Rating 2.0 system, flood insurance premiums are no longer flat rates; they are based on the unique risk of each specific building. For some properties in “Zone AE,” this has meant price hikes of 18% every single year until the rate matches the true risk.

You also need to watch out for regulatory changes. As of October 2024, Florida landlords must disclose a property’s flood history to tenants, and New Jersey has similar strict disclosure laws. These laws are great for transparency, but can hurt the resale value of older, flood-prone homes.

Pro-Tip: Don’t just ask if a property is in a flood zone. Ask for its “clamshell report” or CLUE report to see if any insurance claims for water damage were filed in the last seven years.

“High tide will become your biggest landlord if you don’t pick your spot wisely.”

Wildfire-Prone Areas

Wildfire risk isn’t just about losing a home; it’s about the cost of keeping it. In states like Arizona and California, the cost to “harden” a home against fire is rising. As of July 1, 2025, California sellers must disclose specific retrofits they have made, such as installing ember-resistant vents or enclosed eaves.

If you buy in these areas, you need to budget for “Zone 0” maintenance. This is the new safety standard that requires you to keep the first 0-5 feet around your home completely free of anything combustible, no mulch, no wooden decks, and no shrubs. Maintaining this defensible space can cost thousands per year in landscaping fees.

Drought and Water Scarcity

Water is becoming the new gold. In the Southwest, groundwater regulations are tightening. In parts of Arizona, new subdivisions have been paused because developers cannot prove a 100-year water supply. If you are buying raw land, this is critical.

Drilling a well is no longer a cheap backup plan. In 2025, the cost to drill a residential well in rocky terrain jumped to between $30 and $65 per foot. A complete well system can easily cost you $30,000 upfront. Always verify the water rights and the depth of the water table before you close the deal.

Extreme Heat Regions

We often underestimate heat, but it hits your monthly budget the hardest. In Phoenix, the average summer electric bill for a standard home now hovers between $200 and $250 a month, with larger homes seeing bills over $450. That is a “hidden tax” on your property.

Heat also delays construction. If you plan to build, know that extreme heat days (over 100°F) can legally stop outdoor labor, delaying your project by weeks and driving up contractor costs. Always check the “Cooling Degree Days” data for a region to estimate your future energy costs.

Best Climate-Resilient States for Land Investment in 2026

While no place is perfectly safe, some regions have a natural advantage. Smart buyers are moving their money to these areas to protect their long-term wealth.

Vermont and Northern New England

Vermont stays cooler than most of the country and has abundant water. While the state saw flooding in 2023, the higher-elevation land remains some of the safest real estate in the nation. The soil is fertile, and the risk of wildfire is significantly lower than out West.

Insurance markets here are relatively stable. You won’t see the massive carrier exits happening in Florida. However, winters are still tough, so you need to budget for heating and snow removal.

Great Lakes Region (Michigan, Wisconsin, Minnesota)

This area is often called the “Climate Belt.” Michigan and Wisconsin sit next to 20% of the world’s fresh surface water. Drought is almost non-existent here, and the summer heat is manageable without massive AC bills.

Cities like Madison, Wisconsin, and Grand Rapids, Michigan, are actively investing in climate infrastructure, making them smart plays for long-term growth. The property values here are steady, avoiding the boom-and-bust cycles of coastal markets.

Inland Pacific Northwest (Spokane, Boise)

If you love the West but fear the coast, look inland. Spokane and Boise offer high elevation and lower humidity. While smoke from distant fires can be an issue, the direct risk of property destruction is lower than in the dense forests of Oregon or California.

The key here is the specific location. Properties on the “bench” or higher elevations avoid flood risk, and the dry climate preserves home structures well. Just be sure to check the local aquifer levels, as population growth is putting pressure on water supplies.

Alaska

For the true pioneer, Alaska offers the ultimate hedge against warming. The land is vast and cool. However, it comes with unique challenges like permafrost melt, which can buckle roads and foundations. You must consult a specialized engineer before building on any land that relies on frozen soil stability.

Features to Prioritize in Climate-Safe Land

When you are walking a property, look for these specific features. They act like a natural insurance policy against wild weather.

Access to Freshwater Sources

Freshwater independence is your top priority. Look for land with a deeded spring, a verified well, or rights to a year-round creek. Relying solely on a municipal system in a drought-prone area is risky.

If you depend on a well, ask for a “pump test” record from the last year. This tells you how many gallons per minute the well produces. Anything under 5 gallons per minute might require you to install expensive storage tanks.

Elevated Land to Avoid Flooding

Elevation is everything. But it’s not just about being high up; it’s about being higher than the road. A “sloped” lot that drains water away from your future homesite is worth its weight in gold.

In coastal cities like Miami, a property that sits just two feet higher than its neighbor can command a premium of tens of thousands of dollars. Use a topographic map to check the specific elevation contour lines of the lot before you make an offer.

Fire-Resistant Vegetation

The plants on the land tell you a story about fire safety. You want to see “wet” trees like maples, poplars, or oaks rather than “oily” trees like eucalyptus or pines. Native succulents and high-moisture ground cover act as a natural firebreak.

If the land is covered in dry brush, you can negotiate the price down. Use the estimated cost of clearing that land, often $2,000 to $5,000 per acre, as a bargaining chip in your offer.

Tools and Resources for Climate-Smart Buyers

You don’t have to guess. There are powerful, free tools that professional investors use to de-risk their buys. Here are the ones I recommend.

Climate Risk Mapping Tools

Start with Risk Factor by the First Street Foundation. It’s a free tool where you can type in an address and get a risk score (1-10) for flood, fire, wind, and heat. It projects risks 30 years into the future, which is the lifespan of a typical mortgage.

Another essential stop is the FEMA Flood Map Service Center. Don’t just look at the current map; look for “Pending” or “Preliminary” maps. These show you where the flood zones are moving next, so you don’t buy a home that gets rezoned into a high-risk area next year.

Local Environmental Reports

Go to the local county planning office and ask for the “Hazard Mitigation Plan.” Every county is required to have one. It details exactly what risks the local government is worried about and where they plan to spend money on protection.

Also, check the EPA Superfund list. Toxic cleanup sites are more dangerous when flooded. You want to be sure your dream land isn’t downstream from an industrial cleanup zone.

Strategies for Investing in Land During the Climate Era

Smart investing is about turning these risks into opportunities. Here is how you can use the market shifts to your advantage.

Long-Term Value Considerations

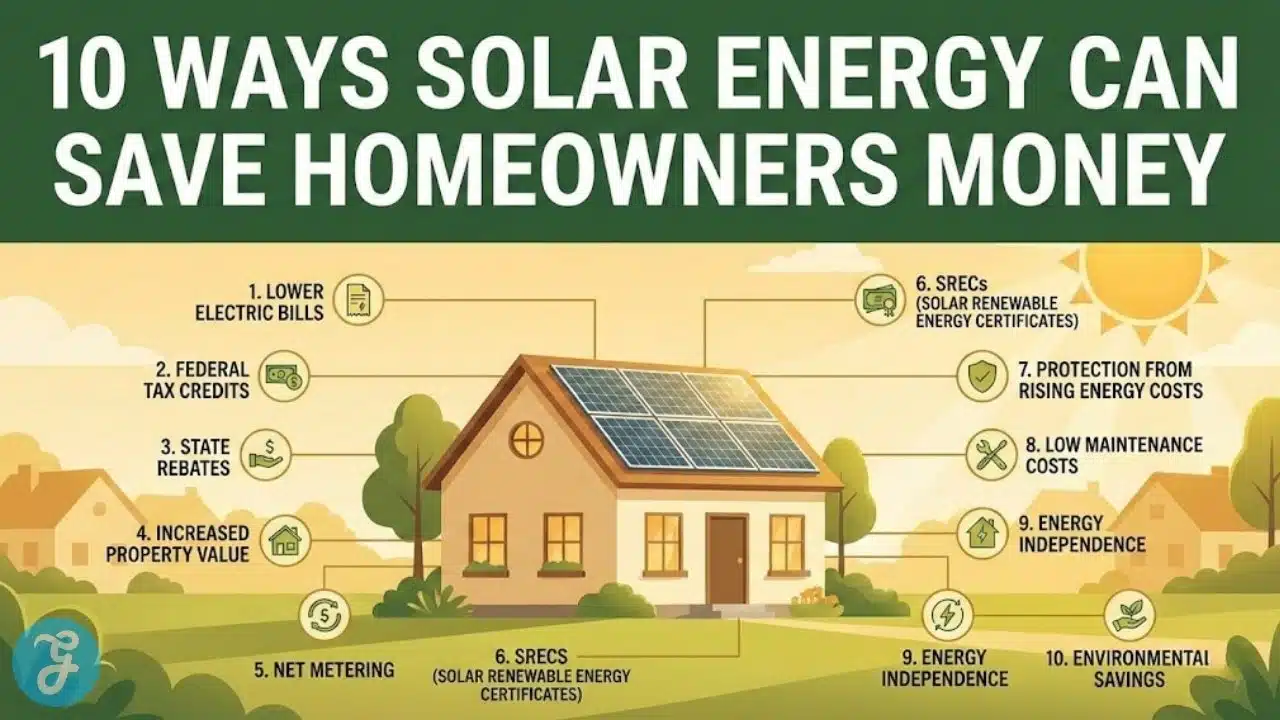

Think about resale value in 2036, not 2026. Properties with “passive survivability”, meaning they stay livable when the power goes out, will be the most valuable. This means homes with gravity-fed water, wood stoves, and excellent insulation.

Banks are noticing this, too. Fannie Mae now offers “Green Rewards” and “Green MBS” programs. If you build or buy a home with specific green certifications, you could qualify for a lower interest rate, often a discount of 0.1% (10 basis points). On a large loan, that saves you real money every month.

Balancing Cost and Climate Safety

Yes, safe land often costs more upfront. A lot in a non-flood zone might be 15% more expensive than the one down the hill. But you make that money back on insurance savings alone.

| Expense Category | Risky Property (Flood Zone AE) | Resilient Property (Zone X) |

|---|---|---|

| Annual Insurance Premium | $3,500+ (and rising 18%/yr) | $800 – $1,200 (stable) |

| Resale Demand | Shrinking buyer pool | High demand (Climate Haven) |

| Peace of Mind | Low | High |

Look for grants to help offset costs. Counties like King County, Washington, have offered “Community Climate Resilience Grants” to help residents prepare. Check with your local conservation district to see if they offer funds for fire-hardening or water conservation upgrades.

Wrapping Up

Best Climate Safe Places to Buy Land isn’t about fearing the future; it’s about preparing for it. You now know to check the insurance rates first, verify the water source, and use tools like Risk Factor to see what’s coming.

The smartest move you can make is to prioritize safety over scenery. A safe home builds wealth, while a risky one drains it. So, take these tips, do your homework, and go find that perfect piece of ground. Your future self, and your bank account, will thank you for it.