Do you know about Impact of Climate Change on Real Estate? Years analyzing lifestyle and market trends, Noticed a shift that goes beyond environmentalism: climate resilience is becoming a financial necessity. You know how we used to look at “good bones” or a “great school district” as the ultimate signs of property value? That conversation is changing. Today, the most critical asset a property can have might just be its ability to withstand the weather.

This isn’t just about rising temperatures; it’s about rising costs. Insurance premiums are climbing, and risk maps are being redrawn. The investors who ignore this data aren’t just missing a trend—they’re risking their capital.

The market is already reacting. We are seeing a distinct split between properties that are “future-proof” and those that are becoming liabilities. Let’s look at the data, what it’s actually telling us, and then explore a few practical ways to respond.

Climate Change and Its Effects on Real Estate

Climate change is shifting how we view homes and buildings, often in ways buyers and investors did not expect. These changes ripple across property values, shaping where people want to live—and where they do not.

Rising global temperatures and extreme weather events

Rising temperatures across the globe have set off more frequent extreme weather events. These can include severe heat waves, heavy floods, and intense storms. A March 2025 analysis by Zillow found that $17 trillion in U.S. residential real estate now faces major wind risk. This isn’t a niche issue; it affects more than half of the country’s GDP equivalent in property.

Erratic weather patterns damage buildings and create unsafe living conditions. In fact, First Street Foundation’s 2025 “Property Prices in Peril” report estimates that $1.47 trillion in real estate value is at risk of devaluation by 2055 due to these physical threats.

Investors worry about physical threats to their properties as billions of dollars’ worth of real estate stands at risk from projected impacts. These temperature spikes do not just hurt property value; they can also change geographic appeal and market trends in affected regions.

Rental income falls when tenants prefer safer areas with less environmental risk or fewer insurance claims caused by extreme weather events.

Increased frequency of natural disasters

Wildfires, hurricanes, and floods now happen more often than before. This change puts billions of dollars at risk across the real estate market. For instance, California regulators have had to intervene to prevent insurers from dropping coverage in wildfire-prone areas entirely.

Thirty-eight percent of homes there face some kind of climate risk that can hurt property value or even cause asset depreciation.

These extreme weather events damage buildings and lower rental income for owners. Properties in high-risk areas lose their geographic appeal; buyers look elsewhere for safer investments.

Real estate valuation needs to reflect these dangers since insurance costs rise fast after disasters strike again and again. The impact is clear, and environmental risk no longer feels like a far-off problem but one that shapes current economic loss in many urban planning discussions today.

Key Impacts on Real Estate Valuations

Changing weather patterns shape what people want—and where they choose to live. These shifts can quickly change the worth of homes and buildings, making property values less certain than before.

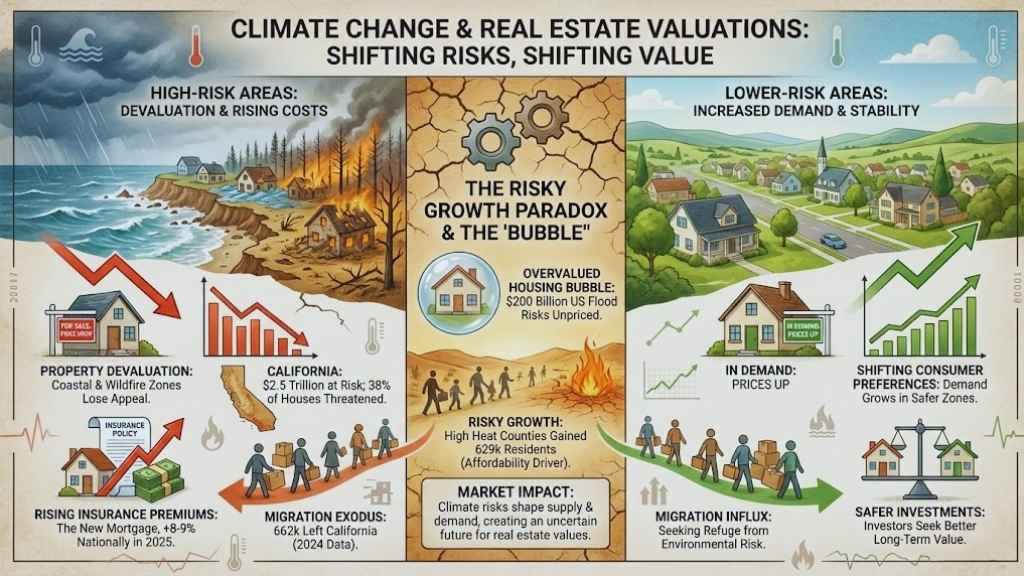

Property devaluation in high-risk areas

Rising global temperatures and extreme weather lower the value of properties in high-risk areas. Homes along coasts face threats from sea-level rise and storms. Wildfire-prone zones lose appeal due to frequent disasters.

In California, about $2.5 trillion in real estate faces climate risks, with 38 percent of the state’s houses at risk. A 2023 study published in Nature Climate Change warned that US housing markets were overvalued by over $200 billion because flood risks weren’t fully priced in. As these risks become public knowledge, that “bubble” could burst.

Investors grow hesitant to buy or hold assets where environmental risk might cause large losses. These changes push down property valuations and rental income across much of the affected real estate market.

Owners in such locations often see asset depreciation as buyers seek safer places that offer better long-term value.

Shifting consumer preferences and migration trends

Many people now look for homes in safer areas, away from floods and wildfires. Around 38 percent of houses in California face threats from climate change, pushing some families to move out of high-risk zones. Census data from 2024 shows a net exodus, with over 662,000 residents leaving California compared to about 408,000 moving in.

However, we are seeing a “Risky Growth” paradox. According to Redfin, counties with high heat risk actually gained 629,000 new residents in recent years, driven by affordability. This suggests a dangerous gap between where people can afford to live and where it is safe to live.

Migration patterns shape property value too. As trillions of dollars of property is at risk, investors look elsewhere for safer investments. Demand grows in regions with fewer environmental risks, while risky places may see their prices drop or stay flat.

This movement shapes both supply and demand dynamics across the entire real estate market each year.

Rising Insurance Premiums: The New Mortgage

Rising global temperatures and more extreme weather events are pushing insurance costs higher each year. For homes in high-risk zones, such as wildfire-prone parts of California or coastal areas facing flooding, premiums can spike by thousands of dollars.

Recent data from Insurify projects that home insurance rates will rise another 8-9% nationally in 2025. In high-risk states like Louisiana, that jump is expected to be as high as 27%.

“In some markets, the monthly insurance premium is competing with the mortgage payment itself. When coverage becomes this expensive, it directly eats into the buyer’s purchasing power.”

These soaring insurance rates affect real estate valuation and ownership costs at every turn. As protection becomes harder to afford, fewer buyers compete for these risky properties.

In states like California alone, $2.5 trillion worth of real estate faces losses tied to projected climate impacts. Owners struggle with both reduced property value and shrinking rental income since tenants often avoid costly locations or demand lower rent to offset living expenses linked to environmental risk factors.

Each jump in premium further strains affordability across the real estate market while making long-term investment planning much harder for everyone involved. Owners, buyers, and investors alike must rethink asset management strategies in light of evolving climate-driven financial pressures.

Vulnerable Areas and Regions

Some locations face more climate risk than others—this can shift property value fast. Certain regions may see fewer buyers and falling valuations as risks grow.

Coastal properties and sea-level rise risks

Coastal properties face big risks from rising sea levels. Higher tides, storm surges, and erosion can damage homes and buildings near the shore. In California alone, about $2.5 trillion worth of real estate is at risk from climate change impacts linked to rising seas.

Zillow’s 2025 analysis highlights that the New York City metro area has $593 billion in residential property at major flood risk, edging out even Miami. Thirty-eight percent of houses in California are exposed to these dangers.

Owners may see property value drop if floods or saltwater harm their land. Insurance costs often go up for homes near the water, making them harder to afford or sell. Investors now pay close attention to these risks before buying coastal property since even rental income can fall when people avoid high-risk areas.

Real estate practitioners must know how extreme weather and environmental factors affect market valuation along coastlines.

Wildfire-prone regions and their declining appeal

Wildfire-prone regions have lost much of their former appeal. More frequent wildfires, fueled by rising global temperatures and extreme weather events, make these areas risky for both homeowners and investors.

In California alone, $2.5 trillion dollars in real estate is at risk from climate-related impacts. Thirty-eight percent of houses in the state face threats from wildfire and other dangers linked to climate change.

Market valuation drops as people look for safer places to live or invest. Insurance premiums soar, making it harder for many families to afford homes in these zones. Commercial real estate owners and investors now see more asset depreciation because properties can lose value fast after disaster strikes.

The economic impact stretches beyond property value; rental income drops when renters avoid high-risk locations due to environmental risk concerns.

Economic Implications for the Real Estate Market

Higher costs and shifting risks now shape how investors view property. These changes push buyers and sellers to rethink their plans, as climate risk becomes harder to ignore.

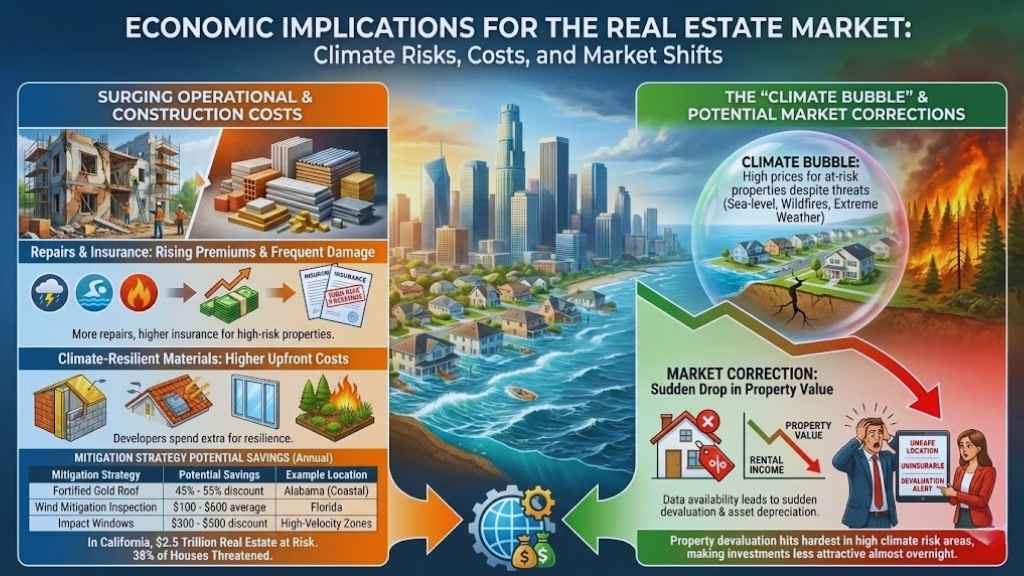

Surging operational and construction costs

Rising global temperatures and extreme weather have driven up operational and construction costs for the real estate market. More buildings now need regular repairs after storms, floods, or wildfires.

Insurance for properties in high-risk areas has also become more expensive. Owners may pay higher premiums to protect against damage. To give you a concrete example of how mitigation affects these costs, look at the savings available for fortified homes.

| Mitigation Strategy | Potential Savings (Annual) | Example Location |

|---|---|---|

| Fortified Gold Roof | 45% – 55% discount | Alabama (Coastal) |

| Wind Mitigation Inspection | $100 – $600 average | Florida |

| Impact Windows | $300 – $500 discount | High-Velocity Zones |

In California alone, $2.5 trillion of real estate faces threats from climate change impacts. Materials that resist natural disasters often cost more than traditional ones. Developers must spend extra money to make homes climate-resilient, especially since 38 percent of houses in California sit at risk due to environmental factors.

These growing expenses affect property value and can reduce rental income over time as the cost burden grows for both owners and tenants.

The “climate bubble” and potential market corrections

Many experts warn about a “climate bubble” in the real estate market. This happens when buyers and investors continue to pay high prices for properties at risk from extreme weather, sea-level rise, or wildfires.

In California alone, $2.5 trillion worth of real estate is in danger because of climate change impacts. Up to 38 percent of homes there face these risks.

As more data on environmental factors become available, sudden drops in property value can happen fast. Market corrections may follow as people realize certain locations are unsafe or too expensive to insure.

Property devaluation and asset depreciation hit hardest in areas with high climate risk, making some investments much less attractive almost overnight.

Adaptation Strategies in Real Estate

Smart investors now view climate adaptation as key to property value. New trends push the market toward safer, smarter spaces for buyers and renters alike.

Resilient building materials and designs

Builders now choose materials that can stand up to harsh weather. Concrete mixes with fibers, metal roofs, and hurricane-rated windows keep properties safer from storms. Some homes in California already use fire-resistant walls and vents to reduce wildfire damage.

Over $2.5 trillion in real estate is at risk there, so construction choices matter. Innovations like mycelium insulation (which is fire-resistant) and green steel are gaining traction in 2025 as sustainable, durable alternatives.

Homes near the ocean use raised foundations and treated wood that hold up against rising seawater. Builders think about future floods, heat waves, or strong winds while planning each project.

New designs help lower repair costs after extreme weather events hit. Using these climate adaptation strategies protects property value even as risks go up across the real estate market.

Incorporating climate data into property valuations

Strong climate data gives real estate appraisers a clearer view of risks. With about $2.5 trillion in California real estate exposed, using up-to-date weather and hazard maps is key for accurate property valuation.

New information on sea-level rise, wildfire zones, or flood-prone areas can shift values quickly. Professional appraisers and investors are now using advanced platforms like Cotality and Archipelago to assess physical risks at a granular level.

- Pro Tip: Before you buy, check the property’s ClimateCheck score or First Street Foundation risk factor. These consumer tools can reveal flood or heat risks that standard listings might miss.

- For Sellers: If you have made resilience upgrades, document them. Providing a recent “Wind Mitigation Inspection” report can be a major selling point.

- For Investors: Look for “Climate Resilient” certifications. These assets often trade at a premium because they promise lower operating costs.

For example, 38 percent of homes in California face climate risk that could lower their market valuation and rental income. Buyers and investors use this climate risk data to judge long-term appeal.

Insurance companies also factor these details into rising premiums, changing the affordability picture for both owners and renters. Smart investors now demand environmental risk reports before finalizing deals; it helps with better decision-making in today’s unpredictable market trends.

Role of Government Policies and Regulations

Government rules shape how cities grow and where people want to live. Smart policies can help protect property values against climate risk—readers may want to see what changes are coming next.

Zoning laws and climate mitigation efforts

Zoning laws play a big part in climate adaptation. Cities now set rules that keep homes and buildings away from risky spots like flood zones or wildfire areas. For example, 38 percent of California’s houses face climate dangers such as sea-level rise and wildfires.

As a result, stricter zoning can limit building near the coast or force higher safety standards. FEMA’s Risk Rating 2.0 is also phasing in more accurate flood insurance pricing, which leads to an 18% annual increase for many policyholders until they reach their full risk rate.

Climate mitigation efforts include green building codes and incentives for eco-friendly materials. These changes help protect property value by lowering risk from extreme weather events or environmental factors.

Real estate owners must follow these new rules to reduce asset depreciation and avoid economic loss in markets faced with rising global temperatures, more natural disasters, or shifting consumer needs for safer locations.

Incentives for sustainable construction and retrofitting

City and state governments now offer many incentives for sustainable construction. Tax credits, rebates, and grants help property owners upgrade buildings with energy-efficient materials or install solar panels.

In places like California, where $2.5 trillion worth of real estate faces climate risk, these benefits can give investors a reason to act fast. A prime example is the Strengthen Alabama Homes program, which offers grants of up to $10,000 for homeowners to retrofit their roofs to the Fortified standard.

Some insurance companies reward properties that meet green standards with lower premiums. Banks may also provide better mortgage rates for homes built to withstand extreme weather events such as floods or wildfires.

This helps reduce the economic impact on both owners and renters in high-risk areas. Choosing sustainability often means protecting both property value and rental income from future climate risks linked to rising temperatures or storms.

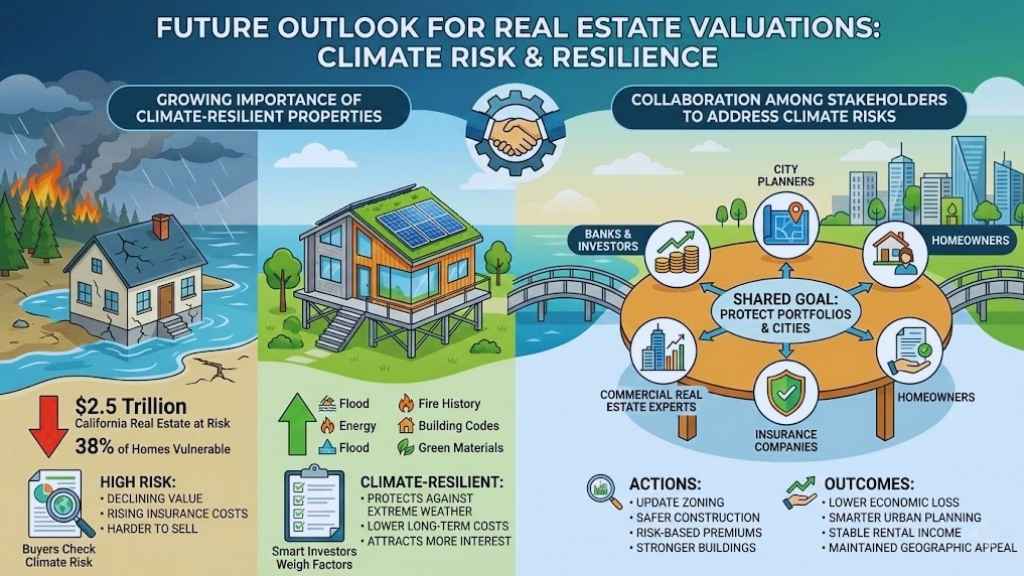

Future Outlook for Real Estate Valuations

Climate risk is changing how people judge a property’s long-term value. Smart investors now study environmental factors before making big moves—those who do not may face greater losses down the line.

The growing importance of climate-resilient properties

Property buyers now check for climate risk before investing. Many notice that $2.5 trillion worth of California real estate faces harm from future storms and fires. About 38 percent of homes in California could lose value because of rising sea levels or wildfire damage.

These facts push people to pick safe, climate-resilient properties over risky ones.

Smart investors weigh factors like flood zones, fire history, and new building codes. Insurance rates keep going up for high-risk spots, making some homes hard to afford or sell. Properties built with strong, green materials attract more interest since they protect against extreme weather and lower long-term costs.

People want safer places to live and work so demand grows fast for real estate that can handle environmental threats.

Collaboration among stakeholders to address climate risks

Banks, investors, city planners, and homeowners all play a role in dealing with climate risk. Working together helps protect real estate portfolios and cities. Commercial real estate experts need to understand physical risks from rising global temperatures and more extreme weather events.

California offers a strong example; here, $2.5 trillion worth of property faces threats tied to climate change impacts.

Cities can update zoning laws or set rules for safer construction in flood-prone regions or wildfire zones. Insurance companies may raise premiums or refuse coverage in high-risk areas, leading many owners to look for solutions together.

Making buildings stronger and choosing better sites lowers economic loss and asset depreciation due to environmental factors. Collaboration supports smarter urban planning, keeps rental income stable, and maintains geographic appeal even as environmental conditions shift.

Final Thoughts

Climate change is reshaping real estate values with risks like floods, fires, and rising costs. Smart investors can use climate data, focus on strong buildings, and follow new rules to keep their property safe and valuable.

Have you checked if your home or investments are ready for these changes? Staying alert now can save lots of money and stress in the future. Growth comes from action, so start learning more about climate risk in real estate today to make smarter choices tomorrow.