You know the feeling: You’ve closed the deal, sent the invoice, and then… you wait. Work with executives from New York to Dubai, the single biggest source of friction isn’t the negotiation itself—it’s the financial limbo that follows.

Right now, sending money internationally feels a lot like sending a letter in 1990. It’s opaque, surprisingly expensive, and leaves you wondering if it actually arrived.

But the script is flipping faster than most realize.

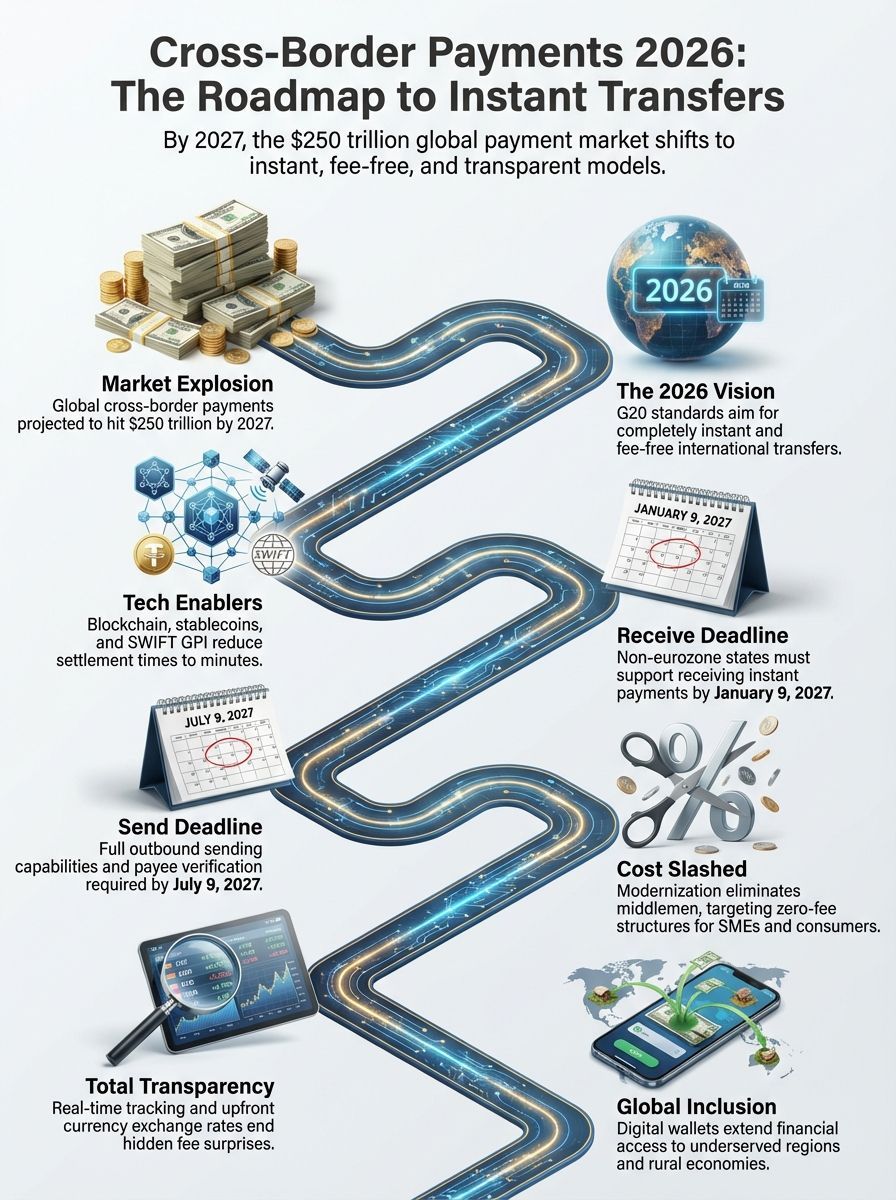

By 2026, we aren’t just looking at incremental updates; we are looking at a fundamental rewrite of how money moves. From stricter G20 targets to the massive ISO 20022 migration, the “wait and see” era is ending.

In this guide, going to break down exactly what’s changing, the specific deadlines you need to watch, and how to position your business to benefit from the shift toward instant, fee-free global finance.

What Are Cross-Border Payments?

At its core, a cross-border payment is any transaction where the payer and recipient are based in different countries. While that sounds simple, the infrastructure behind it is a complex web of “correspondent banks” that pass your money along like a baton in a relay race.

For US businesses, this usually involves sending USD to a vendor in Europe or Asia, often requiring a currency exchange along the way. These payments power everything from migrant remittances to billion-dollar corporate mergers.

The scale here is staggering. According to J.P. Morgan, the total value of cross-border payments is projected to hit $250 trillion by 2027. That massive volume is why efficiency matters so much—even a 1% efficiency gain unlocks billions in liquidity.

“The ‘hidden’ cost of global payments isn’t just the fee—it’s the trapped capital. When funds take three days to clear, that’s three days you can’t use that money for growth.”

Key Use Cases

Different players use these rails for different reasons, and understanding the distinction helps you choose the right tool.

- B2B (Business-to-Business): This is the heavyweight category. Think of a US tech firm paying a software development agency in Poland. The priority here is high limits and data richness (invoice numbers, tax IDs).

- C2C (Remittances): This is the “heartbeat” of the global economy. A worker in California sending money to family in the Philippines via platforms like Wise or Remitly. Speed is the only metric that matters here.

- B2C (Mass Payouts): The gig economy runs on this. Companies like Airbnb or Uber paying hosts and drivers in 50+ countries simultaneously. They rely on “payment aggregators” to handle the complexity.

- C2B (E-commerce): When you buy a dress from a boutique in Paris using your credit card. The settlement happens in the background, but the fees (often 2-3%) are baked into the price.

Current Challenges in Cross-Border Payments

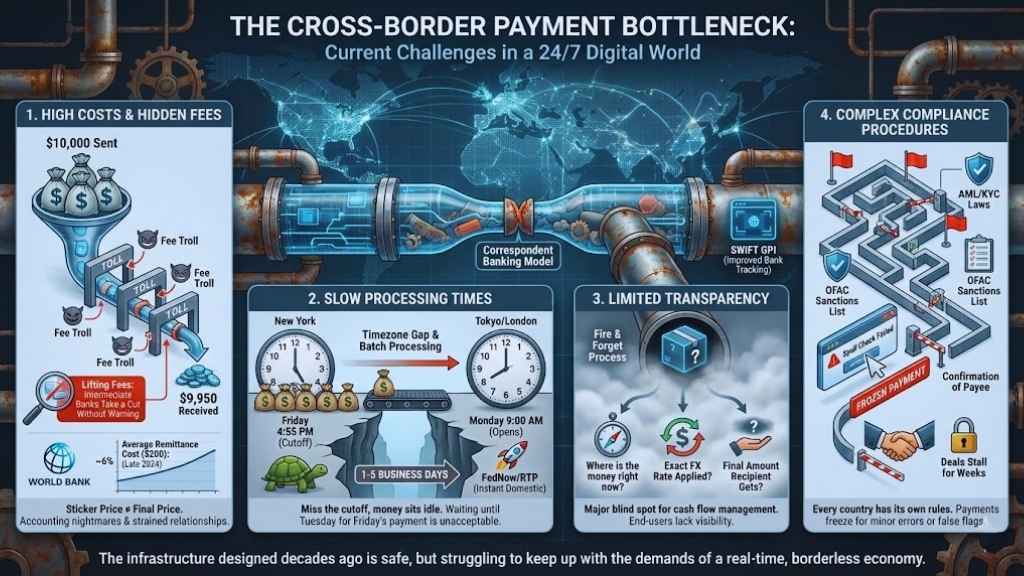

If you’ve ever felt frustrated by an international wire, you aren’t alone. The current system, largely built on the “correspondent banking” model, was designed decades ago. It’s safe, but it’s struggling to keep up with a 24/7 digital world.

High Costs and Hidden Fees

The sticker price is rarely the final price. The World Bank tracks remittance prices globally, and as of late 2024, the average cost to send $200 is still hovering around 6%. For businesses, it’s often worse due to “lifting fees”—charges deducted by intermediate banks without warning.

Imagine sending $10,000 to a supplier and them receiving only $9,950 because a bank in the middle took a cut. That $50 discrepancy creates accounting nightmares and strains relationships.

Slow Processing Times

Domestic payments in the US (thanks to the FedNow service and RTP network) can be instant. Yet, move that money across a border, and you hit a wall. Most traditional SWIFT transfers still take 1-5 business days to settle.

Why? Because of the “timezone gap” and batch processing. If you miss the cutoff time in New York, your money sits idle until banks open in London or Tokyo. In a world of instant gratification, waiting until Tuesday for a payment sent on Friday is becoming unacceptable.

Limited Transparency

For years, sending money abroad was a “fire and forget” process. You sent it, and you hoped it arrived. You often didn’t know:

- Where the money was right now.

- The exact foreign exchange (FX) rate applied.

- The final amount the recipient would get.

While SWIFT GPI (Global Payments Innovation) has improved tracking for banks, many end-users still don’t get that visibility in their banking portals. It’s a major blind spot for CFOs trying to manage cash flow.

Complex Compliance Procedures

This is the necessary evil. Every country has its own Anti-Money Laundering (AML) and Know Your Customer (KYC) laws. Banks must screen every transaction against sanctions lists (like the OFAC list in the US).

If a name is slightly misspelled or matches a flagged entity, the payment gets frozen. I’ve seen deals stall for weeks simply because a “confirmation of payee” check failed due to a missing middle initial.

Emerging Innovations in Cross-Border Payments

The good news? The cavalry is coming. A mix of regulatory pressure and fintech innovation is forcing the old guard to evolve. Here are the tools changing the game in 2026.

Real-Time Payment Interlinking (Project Nexus)

This is the most exciting development for anyone watching global trends. Instead of sending money bank-to-bank, countries are linking their domestic instant payment systems directly.

The BIS Innovation Hub has been leading Project Nexus, which successfully connected the instant payment systems of Singapore, Thailand, Malaysia, the Philippines, and India. In 2026, we expect to see this model expand, potentially allowing a US bank account to send funds instantly to a wallet in Southeast Asia via linked real-time rails.

Blockchain and Stablecoins

Forget the speculative crypto trading; I’m talking about utility. Major financial institutions are now using blockchain for the “rails,” not the asset.

J.P. Morgan’s Onyx network and Circle’s USDC are prime examples. They allow for 24/7 settlement, bypassing the “banking hours” problem entirely. For an executive managing a global team, paying contractors in USDC can mean settlement in seconds for pennies, rather than days for $30 a pop.

Proprietary Networks vs. Aggregators

You no longer have to rely solely on your bank. A new class of providers has built their own “closed-loop” networks.

| Type | Key Players | Why You’d Use It |

|---|---|---|

| The Network Builders | Visa B2B Connect, Ripple | High-Value B2B: Bypasses correspondent banks for a direct, predictable path. ideal for large supplier invoices. |

| The Aggregators | Wise Platform, Airwallex | SME & Mid-Market: They hold local accounts in 50+ countries. You pay them locally; they pay your vendor locally. Fast and cheap. |

| The Traditionalists | SWIFT GPI | Universal Reach: Every bank uses it. Best for obscure corridors where fintechs haven’t gone yet. |

The G20 Roadmap for Cross-Border Payments

This isn’t just businesses innovating in a vacuum; global regulators are cracking the whip. The G20 has set ambitious targets that central banks and the Financial Stability Board (FSB) are racing to meet by 2027.

Goals for 2027: The “One Hour” Rule

The headline target is bold: 75% of cross-border payments should be credited to the beneficiary within one hour.

Think about that. The goal is to make an international wire as fast as a Venmo transaction. To achieve this, the industry is migrating to ISO 20022, a data standard that acts as a “common language” for global finance. The hard deadline for this migration is November 2025, meaning 2026 is the first full year we will see the benefits of rich, structured data.

The EU Mandate (And Why US Firms Should Care)

You might have seen the date “January 9, 2027” floating around. This refers to the EU’s Instant Payments Regulation. It mandates that payment providers in non-eurozone EU countries (like Poland or Sweden) must be able to receive instant euro payments by this date.

Why this matters to you: If you are a US company doing business with European partners, your vendors will soon expect—and be legally equipped for—instant settlement. The bar for “acceptable speed” is being raised globally, not just domestically.

Benefits of Modernizing Cross-Border Payments

Why go through all this trouble? Because the payoff extends far beyond saving a few dollars on transaction fees.

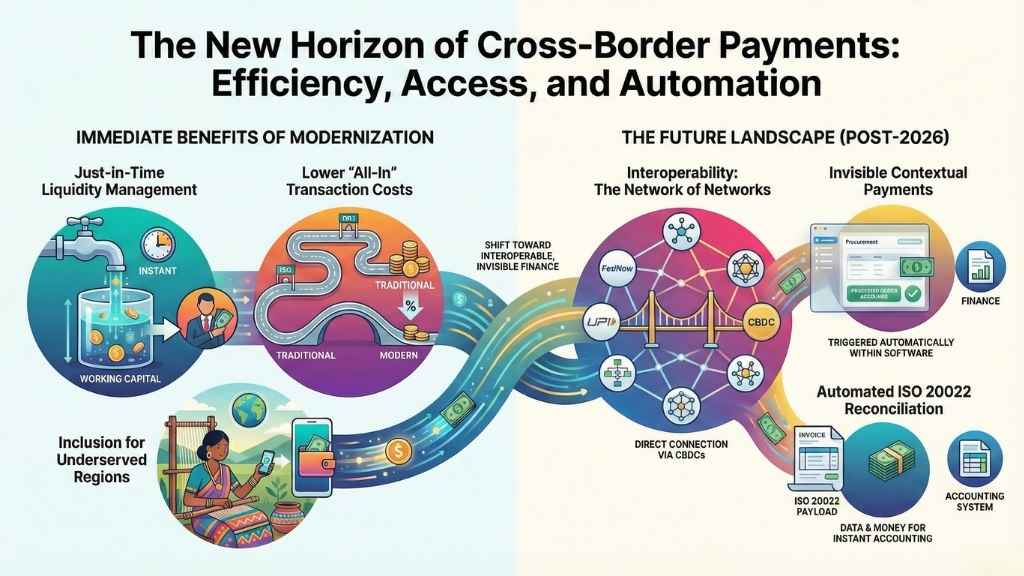

Enhanced Speed and Liquidity

For a CFO, speed equals liquidity. If you pay a supplier instantly, you can hold onto your cash for 30 more days rather than sending it early “just in case” it gets delayed.

This “just-in-time” liquidity management allows businesses to optimize their working capital. You aren’t parking millions in foreign bank accounts just to ensure you can make payroll; you fund it when you need it.

Cost Savings for Businesses

Competition is finally driving prices down. With fintechs like Revolut Business and Wise offering mid-market exchange rates, traditional banks are being forced to lower their spreads.

Pro-Tip: Always check the “all-in” rate. A bank might advertise “zero fees” but pad the exchange rate by 2%. Compare the total amount received, not just the upfront fee.

Improved Access for Underserved Regions

This is the human side of the story. For regions like Sub-Saharan Africa or Southeast Asia, these modern rails are lifelines. They allow small artisans to sell to US buyers and get paid instantly into a digital wallet, bypassing the need for a traditional (and often inaccessible) bank account.

The Future of Cross-Border Payments

So, where is this all heading? If we look past 2026, two major trends will define the landscape.

Interoperability: The “Network of Networks”

We are moving away from a world of “walled gardens.” The future is about connecting different systems—linking the US FedNow system with India’s UPI or Europe’s TIPS. Projects like mBridge are already testing how central bank digital currencies (CBDCs) can settle trades directly, removing the need for the US dollar as a middleman in every transaction.

The Rise of “Contextual” Payments

Payments will become invisible. Instead of logging into a bank portal to send a wire, the payment will happen automatically inside your procurement software (like SAP or Oracle) the moment an invoice is approved. The data payload (ISO 20022) will carry the invoice details with the money, allowing for automatic reconciliation at the other end.

Final Thoughts

Cross-border payments are shedding their reputation as the dinosaur of the financial world. By 2026, the convergence of the G20 roadmap, the ISO 20022 standard, and relentless fintech innovation will make “instant and fee-free” a realistic target, not just a marketing slogan.

For modern leaders, the takeaway is clear: audit your current payment providers. If your bank is still taking three days and charging 3% to move money, it’s time to look at the alternatives. The tools to reclaim your time and capital are already here; you just have to use them.

Keep reading to stay updated on how these shifts will impact your business strategy in the coming year.