Have you ever stared at a “pending” transaction notification and felt your stress levels rise? I certainly have. In my work exploring the intersection of career ambition and personal well-being, I treat financial energy just like physical energy; it needs to flow freely to be healthy. Waiting days for a simple payment feels outdated and draining.

By 2026, stablecoins are set to fix this by reshaping global payments. They offer instant settlement with much lower costs than banks. This guide will break down Stablecoin Trends in 2026, showing how these digital tools make transactions smoother, safer, and more open for everyone.

So, hold your curiosity, and let’s go through it together. I’ll show you everything you need to know.

Stablecoins as the New Global Settlement Layer

Stablecoins are stepping into the spotlight as safe, steady players in global payments. They make sending money across borders feel as easy as sending a text message. It is fast, simple, and always on.

Transitioning from niche to mainstream

Big banks, payment platforms, and even small shops now use stablecoins to move money worldwide. A prime example is Visa, which expanded its stablecoin settlement capabilities to the Solana blockchain. This allows merchant acquirers like Worldpay to settle billions of transactions with high speed and low fees.

PayPal also launched its own stablecoin, PYUSD, in 2023. By 2025, they integrated it with Xoom to allow users to fund cross-border money transfers without the usual friction. This helped many Americans try out crypto for the first time.

Market volume shows this shift is real. In 2022, monthly stablecoin settlements hit $700 billion. By 2026, experts predict that over $4 trillion will flow through these networks each month. As regulation grows clearer and people want faster service at lower costs, more companies jump in every day.

“A few years ago, only crypto fans knew about USDT or USDC,” says finance writer Mark Carney. “Now my grandma uses them to send money back home.”

Integration into global financial systems

Banks and payment providers now use stablecoins to settle trades in seconds instead of days. These digital assets connect directly with old-school banking systems like SWIFT and SEPA. Central banks start working with blockchain technology for faster payments across borders.

In 2026, almost 70% of cross-border remittances flow through cryptocurrency rails or tokenized payment networks. Large companies rely on USD stablecoins for instant settlements in global trade deals. Small businesses in Africa and Asia enjoy smoother access to funds without waiting for slow wire transfers.

Stablecoin networks tap into existing local clearing systems. This bridges the gap between digital currency and fiat money. This shift cuts costs and boosts liquidity. It makes international business as fast as a snap of your fingers.

Key Stablecoin Trends Shaping 2026

New forces are shaping how digital coins are used for global payments. Fresh advances in rules, technology, and money movement keep this field buzzing with excitement.

1. Enhanced regulatory clarity is driving adoption

Tighter financial rules make stablecoins safer for everyone. In 2026, new laws set clear paths for companies and users alike. Payments with blockchain technology now follow simple steps that banks and regulators understand.

In Europe, the full implementation of MiCA (Markets in Crypto-Assets Regulation) has set the global standard. It requires issuers to hold 1:1 reserves and follow strict transparency rules. This gives major players like Visa, Mastercard, and PayPal more confidence to use stablecoins every day.

Big countries now have stronger plans for digital assets too. The U.S., Europe, Singapore, and Hong Kong ask issuers to show proof of reserves. As a result, more people trust cryptocurrency for global settlements than ever before. Clear rules bring big money from institutional investors who value stability above all else.

“Clear rules are turning stablecoins into mainstream payment tools,” says Samir Patel of the Digital Currency Group.

2. Tokenized liquidity simplifying cross-border payments

Tokenized liquidity changes how people move money across countries. A business in Brazil can send stablecoins to a supplier in India within minutes. Automated systems match buyers and sellers using blockchain technology.

A leading example is BlackRock’s BUIDL fund. It tokenizes U.S. Treasury bills on the Ethereum blockchain. This allows investors to earn yield while keeping their assets liquid 24/7. It cuts out the middlemen who used to slow things down and charge high fees.

Stablecoins do not sleep. They settle payments 24/7. Imagine paying freelancers worldwide late at night. It gets done instantly with no questions asked. With more USD stablecoin use on global rails, settlements now work faster for everyone involved. Next up is instant settlement with popular USD stablecoins becoming the norm across markets.

3. Widespread use of USD stablecoins for instant settlements

USD stablecoins sweep across the world like a wave. People use them for quick payments in seconds. Businesses can send money to other countries without delay or high fees.

In 2025 alone, over $9 trillion flowed through stablecoin blockchains. Workers in Africa and Asia get paid faster with cryptocurrency stablecoins than old bank wires ever managed.

Banks are jumping onto this train, too. Big names such as PayPal now offer their own USD-backed coins. This brings even more trust for everyday users. Shops online accept these tokens just as they would dollars or euros. With blockchain technology handling cross-border settlement around the clock, markets stay open while dawn breaks on another side of the globe.

4. Growth of stablecoin-to-local-rail connectivity

Stablecoin-to-local-rail connectivity keeps growing fast. People can send digital assets across borders. Then they cash out straight to local bank accounts or mobile wallets.

In 2026, big companies and banks use blockchain rails to move stablecoins between countries. They settle payments in minutes instead of days. That is a sea change for workers sending money home or small businesses trying to pay suppliers in other places.

Apps like Strike and Valora now help users swap stablecoins for pesos, rupees, or naira across many markets. In Nigeria alone, stablecoin-powered transactions topped $56 billion last year using these payment systems. Stripe also reintroduced crypto payments in late 2024. This lets merchants accept USDC and settle in fiat automatically.

Financial technology firms link crypto with national payment systems more each month. This lets people skip old banking limits that once slowed things down. This wave creates faster remittances and easier shopping online worldwide.

Regional Drivers of Stablecoin Adoption

Each region brings its own flavor to stablecoin growth. Keep reading to see how places across the map are shaping the future of digital payments.

Latin America’s leadership in cross-border payment adoption

Latin America moves fast in using stablecoins for cross-border payments. People send billions of dollars home every year. In 2023, remittances to the region topped $150 billion. Many choose digital assets like USDC and USDT because they are quick and cost less than banks or old money transfer services.

Crypto wallets grow more popular than regular bank accounts in places like Argentina, Mexico, and Brazil. Stablecoins help protect money from inflation, too. In high-inflation economies, platforms like Bitso have seen massive growth by allowing users to hold USD stablecoins to preserve their savings.

New payment apps make it easier for families and workers to access their wages right away. This brings real change, as you can see on the streets of Rio or Buenos Aires.

Asia’s focus on market expansion and innovation

Asia leads with fast action. Big cities like Singapore, Hong Kong, and Seoul race to launch new blockchain solutions. Their governments support digital currency projects and encourage partnerships between banks and technology startups.

Singapore’s Project Guardian is a standout initiative. It tests asset tokenization with major banks like JP Morgan and DBS. South Korea tests stablecoin payments for public transit. This shows how daily life connects with financial technology.

China invests heavily in its own digital yuan as well as stablecoins tied to local currencies. Japan’s regulators give clear rules for payment tokens to bring safety for consumers and businesses alike. Cross-border settlement grows fast across the region thanks to new rails linking Asian markets directly with the US dollar.

North America’s regulatory advancements are enabling enterprise adoption

Clear rules from the U.S. Securities and Exchange Commission in 2024 made it easier for companies to use stablecoins. Banks and big payment firms now trust digital assets more. Stablecoin projects need strong know-your-customer checks. This ensures fewer risky deals slip through the cracks.

Canada followed similar steps. They gave financial technology startups simple rules for tokenization. Clear boundaries make cross-border payments faster and less costly. Big businesses can move funds using blockchain with fewer legal worries or roadblocks slowing them down.

As a result, North America has become a leader in safe, large-scale, stablecoin adoption for enterprise settlements and digital payments.

Europe’s prioritization of security and risk mitigation

North America has cleared the path for enterprise adoption by shaping regulations that fit digital assets. Across the Atlantic, Europe picks a different route. Safety stands front and center in European stablecoin policy.

The EU’s MiCA rules set tight controls on who can issue stablecoins and how they must operate. Every issuer faces strict checks before winning approval. For instance, Société Générale launched its own euro-pegged stablecoin, EUR CoinVertible, to comply fully with these new safety standards.

European governments focus hard on risk reduction, too. These laws push issuers to keep reserves safe, block hacks, and track transactions closely. One slip could mean stiff fines or losing access to all of Europe’s markets. Compared to other regions chasing fast growth, Europe bets slow and steady wins the race.

Infrastructure and Technology Innovations

Big changes in infrastructure are speeding up how we use digital money. Fresh technology tools bring smoother, safer payments for everyone. This makes old methods look slow.

Enterprise-grade infrastructure driving operational efficiency

Banks and payment networks now use high-speed blockchain technology. Transactions that took hours finish in seconds. This saves banks billions of dollars each year on cross-border payments. Stablecoin platforms run 24/7 with no breaks for holidays or weekends.

Automation cuts down on manual checks and errors. Companies do not need large teams to check transactions by hand anymore. Software catches most mistakes fast.

In 2026, more businesses plug into digital assets using secure APIs. Chainlink’s CCIP (Cross-Chain Interoperability Protocol) is a key tool here. It allows different blockchains to talk to each other securely, ensuring that a payment sent from a bank chain arrives correctly on a public chain.

- 24/7 Operations: Money moves on weekends and holidays.

- Automated Compliance: Smart contracts handle verification instantly.

- Global Reach: APIs connect local banks to global ledgers.

Large financial groups like Visa and Mastercard have already tested stablecoin settlement rails. This shows how the future of global finance is scaling up through better infrastructure.

Improved security measures are unlocking greater scale

Digital asset platforms now use stronger encryption and smart contracts to protect stablecoin payments. These upgrades stop hackers, boost payment reliability, and help speed up cross-border settlements on blockchain networks.

Companies can move larger sums because these improved measures lower fraud risks. Firms like Fireblocks provide the secure custody technology that institutions need to hold billions in digital assets safely. Big financial institutions trust stablecoins more for global settlement as a result.

As digital currencies become safer, businesses expand their operations without the fear of losing funds or information.

Integration with decentralized finance (DeFi) ecosystems

Stablecoins now connect easily to decentralized finance (DeFi) platforms. People use them on blockchains like Ethereum, Solana, and Avalanche for different things. Swapping tokens, earning yield, or even borrowing money against digital assets all happen in seconds with stablecoins.

In 2026, billions move daily through these payment systems without old-school banks stepping in. Smart contracts keep the process open and fair for users around the world. Traders can settle fast using cryptocurrency while keeping fees low.

Protocols like Aave allow users to lend their stablecoins, such as PYUSD or USDC, to earn interest rates that often beat traditional savings accounts. As stablecoins link with DeFi tools, more people solve real problems, such as faster payments or better access to liquidity, every day.

Benefits of Stablecoins in the Global Economy

Stablecoins are shaking up how people move money worldwide. They make payments faster and cheaper for everyone. Stick around to see what this could mean for you.

Faster, cheaper cross-border transactions

Sending money across borders used to take days and cost a lot. Now, with stablecoins and blockchain technology, people can move funds in minutes. It often costs less than a dollar per transaction.

In 2026, businesses rely on digital assets like USDC or Tether for instant settlements. For example, a worker in the US sends dollars back home to their family in Mexico using cryptocurrency instead of old banking networks. The transfer is near-instant without high fees.

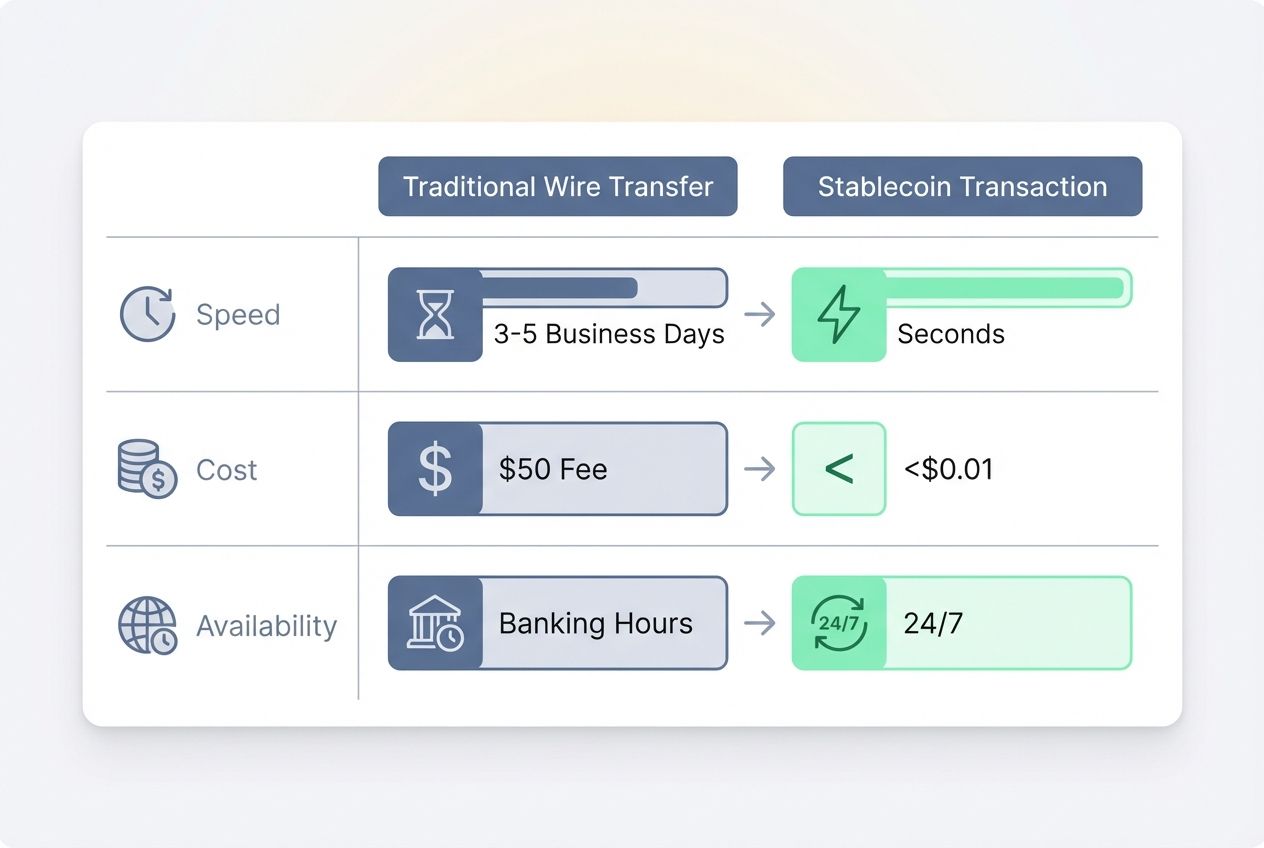

| Feature | Traditional Wire Transfer | Stablecoin Transaction |

|---|---|---|

| Speed | 3-5 Business Days | Seconds to Minutes |

| Cost | $25 – $50 Average Fee | <$0.01 to $1.00 |

| Availability | Banking Hours Only | 24/7/365 |

Banks also use stablecoins as settlement layers to process payments between countries quickly. Tokenized liquidity pools let companies pay suppliers from Asia or Europe anytime. As more payment systems connect local banks to these digital rails, cross-border payments become smoother and less expensive everywhere.

Increased financial inclusion in underserved regions

Lower remittance costs start opening doors for millions. People in rural Africa now use stablecoins on their phones. This lets them skip long waits at banks. In 2023, over $800 billion was sent home by workers worldwide. High fees ate up much of that flow.

Fast-forward to 2026, with digital currency and blockchain technology in play, more funds reach families directly. Stablecoin payments help street vendors in Latin America accept money without needing a bank account at all. Digital assets can bring refugees safe savings, even if they have no papers or fixed homes.

Access to decentralized finance (DeFi) tools lets women farmers get small loans. They grow their businesses more easily than before. Little by little, financial inclusion grows where it once seemed out of reach.

Reduced reliance on traditional banking systems

People can now send money quickly with just a smartphone and an internet connection. Stablecoins break down barriers. You do not always need a regular bank account for payments or remittances.

In 2026, over 30 percent of global cross-border settlements may flow through digital assets like USD stablecoins instead of wire transfers or SWIFT. Many small businesses use blockchain technology to pay suppliers in other countries faster and at lower costs.

It frees up cash flow for them. This means less waiting time compared to old banking hours or fees that eat into profits. New financial rails connect stablecoins directly to local payment systems across Latin America and Asia. This makes by-the-minute access the new norm.

Wrapping Up

Stablecoins have moved from obscurity to a prominent role. They make payments smoother and faster across borders. Clear rules help more businesses join in, while tech upgrades boost safety and make daily use easy.

Latin America leads in using stablecoins for remittances. Asia keeps pushing new ideas. North America sets clearer rules, and Europe secures transactions. You do not need fancy tools or jargon to benefit. Sending money now avoids the slow process with banks.

Staying open-minded can turn small steps into big wins. Sometimes I look at my own quick wallet transfers and chuckle at how far we have come since paper checks!