You know how most “new” organizational models fail for one boring reason: decision rights get messy, and nobody can tell who is accountable. That’s the real tension behind The Evolution Of DAOs: Are They Replacing Corporations? DAOs promise clean, visible governance, but they also expose every weakness in your rules, security, and legal setup.

We’ll define what DAOs are, show how blockchain and smart contracts enforce rules, then walk through real DAO evolution, advantages, tradeoffs, and where hybrid models often win in the digital economy.

Read on.

What Are DAOs?

Decentralized Autonomous Organizations (DAOs) are groups that run key decisions through smart contracts and community voting, instead of a traditional CEO-and-board hierarchy.

The big idea is simple: the rules live on a blockchain, and the community can verify what ha+ppened, when it happened, and what it cost.

In practice, most mature DAOs combine on-chain enforcement with off-chain discussion, plus strong treasury controls so that “community governance” does not become “community chaos.”

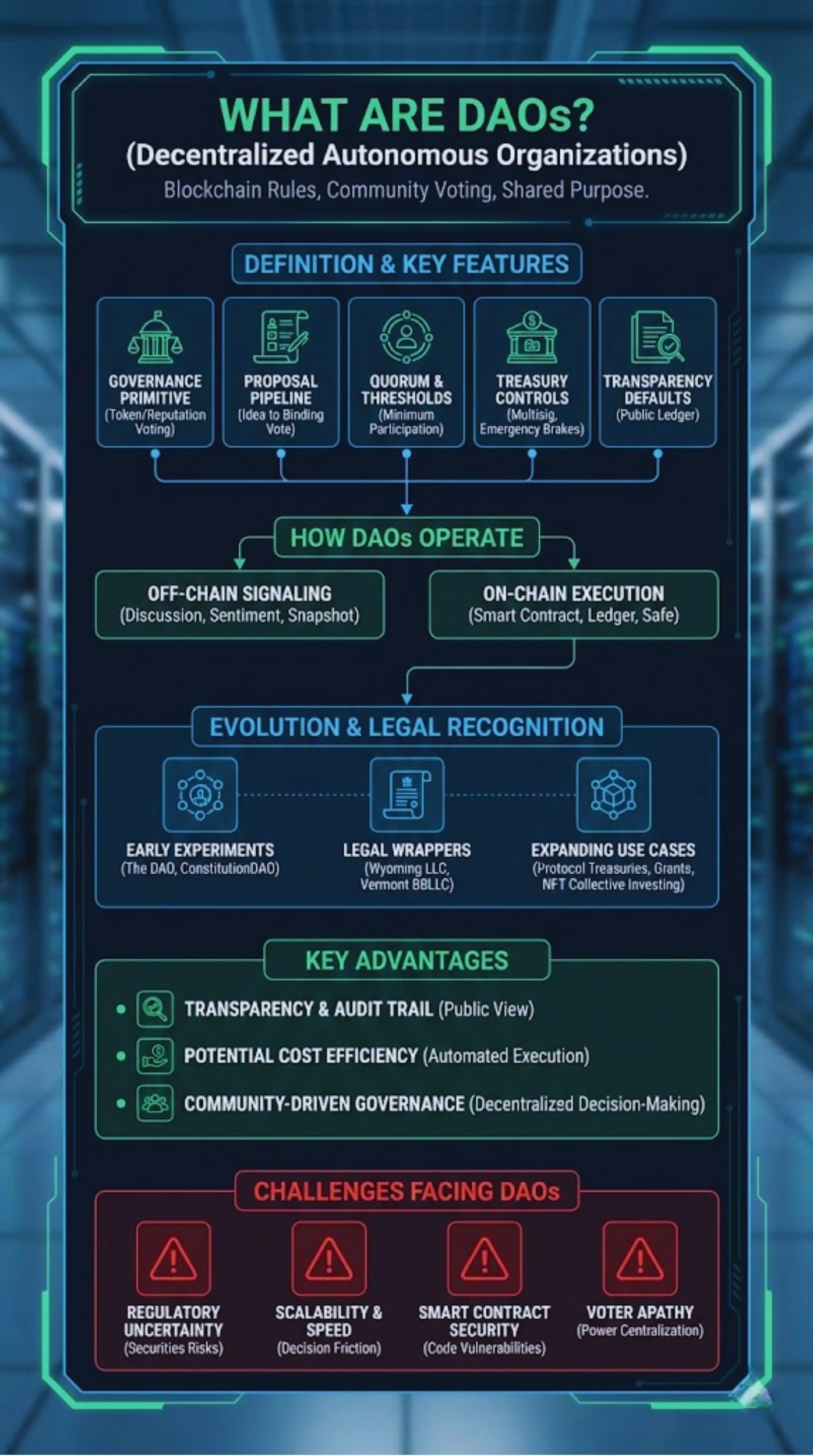

Definition and Key Features

A DAO is an organization where members coordinate through code and governance processes, usually tied to a token or a membership system. The DAO may not have a CEO, but it still needs clear roles, predictable voting, and a way to execute decisions.

If you’re evaluating a DAO model, focus on these features first, because they drive the day-to-day experience for members:

- Governance primitive: token voting, reputation voting, or one-person-one-vote for specific committees.

- Proposal pipeline: how ideas move from discussion to a binding vote.

- Quorum and thresholds: the minimum participation needed so a small group cannot pass major changes quietly.

- Treasury controls: who can move funds, how many approvals are required, and what “emergency brakes” exist.

- Transparency defaults: what is automatically public (votes, payouts, budgets) versus what stays private (sensitive negotiations).

One pitfall many readers miss: token-weighted voting can centralize power fast. A 2023 research paper that analyzed real governance found that concentrated voting power shows up across many DAOs, which is why delegation programs and participation incentives matter from day one.

How DAOs Operate Using Blockchain Technology

DAOs operate by putting governance rules into smart contracts, then using a blockchain ledger as the shared “system of record.” That ledger keeps votes and treasury movements visible and hard to rewrite after the fact.

Most DAOs split decisions into two layers:

- Off-chain signaling: discussions and “temperature checks” to gauge sentiment without forcing every voter to pay transaction fees.

- On-chain execution: a final, binding action where the smart contract enforces the outcome, such as moving funds or upgrading protocol settings.

To make this work in the real world, teams rely on a stack of specialized tools. For example, Snapshot is widely used for gasless voting via signed messages, and Safe is a common standard for treasury multisig controls and role-based approvals.

If you’re building a DAO, treat tooling choices like governance choices. Pick a governance framework that matches your risk profile. Aragon OSx, for instance, emphasizes modular governance plugins and permission controls, which helps teams evolve governance without rewriting the entire system.

The Evolution of DAOs

DAO history is not a straight line toward decentralization. It’s a series of experiments that forced the community to get serious about security, voting design, and legal wrappers.

The fastest lesson DAOs learned: “code is law” only works if the code is correct, upgradeable in a controlled way, and backed by an incident plan.

Early Experiments: From “The DAO” to Modern Implementations

Early DAO experiments proved that crowdfunding and governance can scale, but they also proved that governance is a security surface.

Here are the milestones worth knowing, and what you should do with each lesson:

- 2016: The DAO raised massive funding. Contemporary reporting put the raise at over $168 million, which showed peer-to-peer capital formation at a scale most startups could not touch.Action: If your DAO plans to hold serious value, budget for professional security review and operational controls before you launch.

- 2016: The DAO exploit exposed smart contract risk. Reporting at the time described about $50 million in value drained, which forced the ecosystem to confront what happens when “immutable” code breaks.Action: Require timelocks, staged rollouts, and clearly defined emergency actions for high-impact contract upgrades.

- 2017: U.S. securities attention arrived. The SEC’s 2017 investigative report on The DAO warned that DAO tokens can be treated as securities depending on the facts and circumstances.Action: If you are issuing a governance token, treat compliance as a design constraint, not an afterthought.

- 2021: ConstitutionDAO showed mass mobilization. The group raised about $47 million from roughly 17,437 contributors to bid on a U.S. Constitution copy, then refunded donors after losing the auction.Action: If your DAO will interact with the offline world (auctions, land, contracts), plan a legal entity pathway early so you can sign, bid, insure, and operate.

These events didn’t kill the DAO concept. They clarified what a “real DAO” needs: secure execution, resilient governance, and a plan for how the DAO touches real assets.

Legal Recognition: Examples of DAO LLC Laws

In the U.S., legal recognition has shifted from “almost nothing” to “a patchwork of workable options.” The key is choosing a wrapper that matches what your DAO actually does: investing, operating software, funding grants, or holding real-world assets.

Here’s a quick, decision-focused snapshot of commonly cited U.S. paths, based on state statutes and published legal guidance:

| State / Approach | What it gives you | Why it matters for a DAO |

|---|---|---|

| Wyoming DAO LLC (effective July 1, 2021) | LLC-style entity recognition for DAOs | Useful if you want a familiar corporate shell, but you must think through member identity and reporting realities. |

| Wyoming DUNA (effective July 1, 2024) | “Decentralized unincorporated nonprofit association” structure | Designed to give DAOs legal existence and limited liability features without forcing the DAO into a traditional LLC mold. |

| New Hampshire DAO law (RSA 301-B, effective July 1, 2025) | A distinct legal entity framework for DAOs, plus registered agent requirements | Helps a DAO receive legal notices, own assets, and define liability rules in bylaws that map to code. |

| Vermont blockchain-based LLC option (BBLLC, in statute since 2017) | An LLC that formally recognizes blockchain-based operations | Works for teams that want an LLC wrapper while explicitly leaning on blockchain in their operating model. |

If you do one thing before launching a token: decide whether you need a legal entity now, or you are willing to delay the real-world parts (bank accounts, payroll, contracts) until you have one.

Expanding Use Cases: Treasury Management, Protocol Governance, and Investments

Once DAOs proved they could coordinate people and money, the use cases expanded quickly. The best examples are not “DAOs as vibes,” they are DAOs as operating systems for digital assets and shared budgets.

Here are credible patterns you can copy, plus what each one teaches:

- Stablecoin and protocol treasuries: MakerDAO’s ecosystem (rebranded as Sky in 2024) shows how a DAO can manage collateral, vote on risk parameters, and steer a stablecoin strategy over years.Action: If your DAO touches financial risk, build specialized committees and require structured proposals with clear risk limits.

- Grants and ecosystem funding: Uniswap governance has backed major ecosystem funding plans, and Uniswap Foundation financial updates have described nine-figure grant allocations that run across multiple years.Action: Treat grants like an investment portfolio, define milestones, and publish periodic treasury reporting so the community can audit outcomes.

- NFT and collective investing: FlamingoDAO is a well-known investment collective. A 2022 CoinDesk report noted an early model where members contributed 60 ETH at inception in 2020, showing how DAOs can pool capital for niche asset strategies.Action: If your DAO invests, define entry rules, valuation practices, and a clear exit policy for members.

- Infrastructure governance: ENS DAO governs the Ethereum Name Service, with its own proposal flow, delegation culture, and public governance stats.Action: If your DAO governs infrastructure, prioritize upgrade safety, timelocks, and communication discipline because the blast radius is bigger.

Across these examples, the winning formula is consistent: make governance easy to follow, make treasury movements easy to audit, and make execution hard to exploit.

Key Advantages of DAOs

DAOs can be excellent at coordination across borders, time zones, and communities. If you set the rules right, they also create a kind of built-in transparency that traditional business models usually have to bolt on later.

That does not mean DAOs are “better corporations.” It means they are a different organizational structure that shines in specific conditions.

Transparency and Decentralized Decision-Making

A DAO’s strongest advantage is its audit trail. Votes, proposals, and many treasury transactions live in public view, which can reduce confusion and improve trust inside the community.

To make transparency usable, not noisy, strong DAOs standardize what gets published:

- A simple governance calendar: when votes open, close, and execute.

- A treasury dashboard: current balances, upcoming commitments, and past payouts.

- Decision logs: short summaries for non-technical readers explaining what changed and why.

- Delegation visibility: who votes, how often they vote, and what they support.

If you’re joining a DAO, check whether it publishes these basics. If it doesn’t, you’re signing up for governance you cannot easily verify.

Cost Efficiency Compared to Traditional Corporations

DAOs can reduce recurring administrative overhead by automating execution and recordkeeping. You spend less energy coordinating approvals and more energy shipping work.

Still, “cheaper” depends on what you compare. A traditional entity may have predictable compliance costs, while a DAO often shifts cost into security, tooling, and governance operations.

| Cost area | Traditional company example (U.S.) | DAO reality check |

|---|---|---|

| Basic annual state-level fees | Delaware LLCs pay a $300 annual tax, and Delaware corporations face annual report fees and franchise tax rules (per Delaware state guidance). | A DAO without a legal wrapper may avoid some filings, but it also may struggle with bank accounts, contracts, and liability clarity. |

| Decision execution | Internal approvals can be fast, but they are not automatically auditable. | Smart contracts can execute instantly once approved, but you must design for safe upgrades and failure modes. |

| Security and incident risk | Cybersecurity matters, but core ownership logic rarely lives in one public, immutable contract. | Smart contract failures can be catastrophic. OpenZeppelin reported that over $9 billion has been compromised via smart contract hacks industry-wide, including $1.2 billion in 2024 alone. |

The practical takeaway: DAOs can be efficient, but you should measure efficiency across the full lifecycle, including audits, monitoring, and governance operations.

Community-Driven Governance Models

Community governance is the point of a DAO, but it only works if you engineer participation. Token voting alone does not create a healthy community, it just creates a mechanism.

Use this checklist to make community governance more than a slogan:

- Write plain-language proposal templates: problem, options, costs, risks, and success metrics.

- Use delegation on purpose: help passive holders delegate to trusted voters, so governance does not stall.

- Publish budgets before you spend: make it easy for members to spot drift.

- Separate “discussion” from “execution”: off-chain debate first, on-chain execution last.

- Reward governance work: reviewing proposals is labor, so treat it like labor.

In my experience, most governance failures come from unclear roles and poor proposal quality, not from the blockchain itself.

Challenges Facing DAOs

DAOs face a tough mix of legal ambiguity, security risk, and coordination friction. None of these are fatal, but each one requires deliberate design.

If you want decentralization without dysfunction, treat these challenges like product requirements.

Regulatory Uncertainty and Legal Risks

U.S. regulation is not “anti-DAO,” but it is very clear about one point: a DAO structure does not automatically protect you from liability or enforcement.

Two public signals made that clear:

- Securities framing: The SEC’s 2017 report on The DAO said token offerings can trigger federal securities laws, based on the facts and circumstances.

- Enforcement and accountability: In the Ooki DAO matter, the CFTC pursued the DAO as an unincorporated association and later announced a federal court default judgment in 2023 that included monetary penalties and permanent trading and registration bans.

Action steps that reduce legal risk without killing decentralization:

- Pick a jurisdiction early: do not wait until you need to sign a contract.

- Define who can bind the DAO: set clear signer roles and treasury approval thresholds.

- Document your governance: write bylaws or governing principles that match the code.

- Separate contributors from tokenholders: clarify who does work, who votes, and who holds fiduciary-like responsibilities.

Scalability and Decision-Making Speed

Decentralized governance trades speed for legitimacy. That’s fine, until a decision is time-sensitive and the vote pipeline is too slow.

Many DAOs use structured governance phases to manage this. For example, Uniswap’s published governance process includes a final on-chain phase with a voting period measured in days, a quorum measured in tens of millions of tokens, and a timelock before execution.

If you want to scale governance without losing decentralization, use levers like these:

| Governance lever | What it fixes | Common pitfall |

|---|---|---|

| Delegation | Improves participation without requiring everyone to vote | Delegates can become a new political class if reporting is weak |

| Working groups and councils | Speeds up operational decisions | Councils can drift into permanent leadership without accountability |

| Off-chain signaling + on-chain execution | Reduces vote fatigue and transaction friction | Off-chain votes can feel “fake” if execution rules are unclear |

| Quorum and proposal thresholds | Prevents spam and low-consensus changes | Thresholds set too high can lock out new contributors |

Track governance like you track a product: time-to-decision, turnout, proposal quality, and how often execution matches intent.

Security Concerns with Smart Contracts

Smart contract security sits at the center of DAO risk because governance and treasury logic often live in public, attackable code. A single bug can become an existential event.

OpenZeppelin has reported that smart contract hacks have compromised over $9 billion industry-wide, including $1.2 billion in 2024 alone. Use that as your baseline argument for why audits, monitoring, and safe upgrade paths are non-negotiable.

Concrete security practices that protect a DAO treasury:

- Independent audits before launch: treat this like a gate, not a checkbox.

- Timelocks on sensitive actions: slow down high-impact changes so the community can react.

- Multisig treasury controls: use a threshold of signers for payouts and upgrades, especially early on.

- Transaction simulation and approvals: simulate what a transaction will do before it executes.

- Incident playbooks: define what “pause,” “rollback,” or “migrate” means before you need it.

Voter Apathy and Power Centralization

Voter apathy is a governance tax. If most holders do nothing, a small group of active voters and large holders will shape outcomes, even in a DAO that claims to be democratic.

Research that measured governance behavior across many DAOs has found repeated patterns of concentrated decision power, including cases where a small set of participants can control outcomes. That’s why you should design against apathy, not complain about it.

Practical fixes that improve participation and reduce whale dominance:

- Delegate discovery: make it easy for holders to find reliable delegates with track records.

- Participation incentives: reward consistent voting, proposal review, and community moderation.

- Smaller, scoped votes: split giant proposals into smaller decisions with clear tradeoffs.

- Reputation signals: supplement token voting with contribution history where possible.

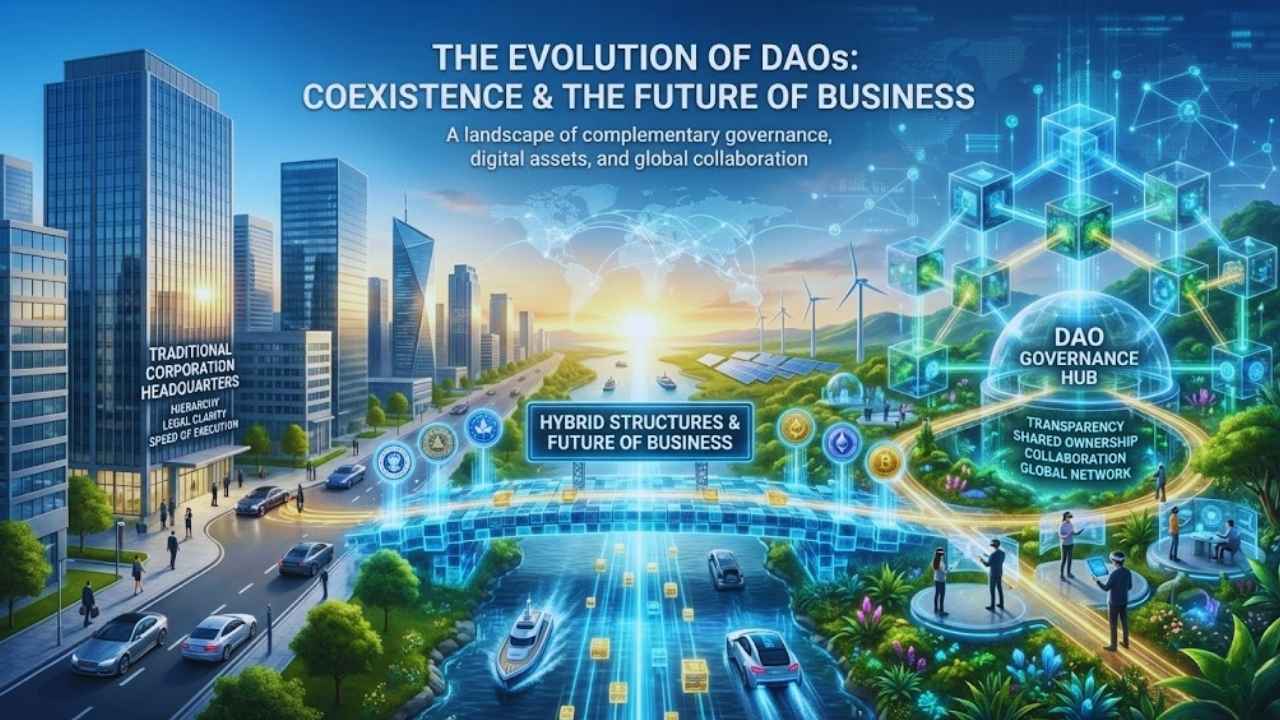

DAOs vs. Traditional Corporations: The Evolution Of DAOs: Are They Replacing Corporations?

DAOs and corporations solve different coordination problems. A corporation optimizes for clear management authority and legal clarity. A DAO optimizes for transparent governance, shared ownership, and open collaboration.

The more useful question is not “which is better,” it’s “which constraints matter most for your business models and economic activity.”

Differences in Governance and Operational Models

Here’s a plain comparison you can use to decide what fits:

| Dimension | DAO | Traditional corporation |

|---|---|---|

| Governance | Proposal + vote, often token-weighted | Board authority, executive management, shareholder votes on limited items |

| Transparency | High by default on-chain | Often internal, disclosed selectively |

| Speed | Can be slower, depends on voting windows and quorum | Usually faster due to hierarchy |

| Accountability | Diffused unless roles are explicit | Clear reporting lines and fiduciary duties |

| Global collaboration | Native, borderless contributor model | Possible, but often limited by payroll, compliance, and HR structure |

| Execution | Smart contracts can execute automatically | Humans execute decisions through internal processes |

If you value community legitimacy and transparent rule enforcement, a DAO can be a strong fit. If you need fast decision-making and predictable legal structure, the corporation still dominates.

Complementary and Hybrid Structures in Business

Hybrid structures are common because they let teams use decentralization where it helps, without losing operational control where it is required.

A practical hybrid blueprint usually looks like this:

- Corporate wrapper for real-world operations: contracts, payroll, insurance, and compliance.

- DAO governance for shared decision rights: budgets, grants, protocol changes, and community policy.

- Multisig and timelocks for treasury safety: especially during early growth.

- Clear separation of duties: contributors execute work, tokenholders steer priorities.

Hybrid models are also a realistic bridge for firms trying to participate in the digital revolution without rewriting their entire organizational structure overnight.

The Future of DAOs in Business

DAOs will keep pushing new governance patterns into the mainstream, especially in crypto-native sectors. The biggest change may be cultural: readers will increasingly expect transparency, community input, and public accountability for digital-first projects.

Corporations will adapt, and DAOs will adapt too. The winners will be the organizations that treat governance like a product, not a philosophy.

Adoption in Web3, DeFi, and Emerging Sectors

DAO adoption is strongest where digital assets are native and where peer-to-peer networks create real value. You can already see the playbook across DeFi, infrastructure, and community-led products.

If you’re exploring adoption, start with use cases that benefit from transparency and shared ownership:

- DeFi treasuries: publish budgets, vote on incentives, and standardize reporting so tokenholders can audit spending.

- Protocol governance: use off-chain signaling for discussion, then on-chain execution for binding upgrades.

- Gaming and creator economies: share rewards, fund events, and give players a vote on roadmap priorities.

- Nonprofits and public goods: make donor flows visible and let stakeholders vote on funding allocations.

- Hybrid businesses: keep a legal entity for compliance, and use DAO voting for community direction and grants.

The practical constraint is always the same: as you expand participation, you must also expand governance usability and security discipline.

Potential for Coexistence with Traditional Corporations

DAOs are unlikely to fully replace corporations. They will coexist, influence corporate governance, and carve out territory where tokenization and open collaboration make sense.

The simplest forecast is coexistence: corporations stay the default for legal and operational clarity, while DAOs become a common governance layer for digital assets, communities, and shared treasuries.

If you’re deciding what to do next, use this quick decision filter:

- Choose a DAO-first approach if your product is inherently on-chain, your community creates value, and transparency is a feature.

- Choose a corporation-first approach if you need fast execution, clear liability boundaries, or heavily regulated operations.

- Choose a hybrid if you want community governance without giving up real-world operating capacity.

Final Thoughts

This article traced the evolution of decentralized autonomous organizations, from early experiments to growing legal recognition in parts of the U.S. You saw how blockchain, smart contracts, and tokenization reshape governance, transparency, and community power.

Here is the real benefits, such as auditable decision-making and new community-led business models, along with the hard risks, like security exploits, voter apathy, and regulatory uncertainty. The honest answer to The Evolution Of DAOs: Are They Replacing Corporations? is no, not fully. DAOs are changing what corporations copy, and where hybrid models make sense. If you’re planning a DAO or a hybrid structure, start with governance design, treasury controls, and a legal path that fits your real-world needs.