You know the feeling when you look at your bank statement and wonder where it all went? Imagine navigating that for the first time as a teenager. That’s the challenge and the massive opportunity banks are racing to solve right now. Do you know what is teen banking? Teen banking has evolved far beyond the simple savings passbooks we grew up with. Today, institutions like Huntington Bank, Bank of America, and Wells Fargo are actively competing for Gen Alpha by offering sophisticated financial tools wrapped in user-friendly apps.

From what I’ve seen in the industry, this isn’t just about giving a kid a debit card. It is about locking in the next generation of customers with features that actually help families. We are seeing trends like debit cards teens design themselves and digital tools that let parents track spending in real-time. With over 50 customizable spending categories, instant “lock card” features for when a card inevitably goes missing, and seamless Zelle integration, these accounts are modern financial command centers.

The most important shift? The death of the overdraft fee. For example, Huntington’s Teen Banking blocks overspending entirely, while others simply decline the transaction. This article breaks down exactly how these accounts work, the specific fees you need to watch out for, and how to choose the right one for your family.

What Is Teen Banking?

Teen banking is a system that allows young people to manage their own checking accounts and debit cards under the watchful eye of an adult co-owner. While the “sweet spot” for these accounts is typically ages 13 to 17, some programs now cater to children as young as six.

Major players like Huntington Bank, Wells Fargo, and Bank of America have moved toward “checkless” accounts for this demographic. This means the account acts like a traditional checking account, but without the risk of writing checks that bounce. Parents remain co-owners, giving them full visibility into where every dollar goes.

These accounts offer hands-on money management experience. Teens get access to:

- Spending Limits: Parents can cap daily spending to prevent splurges.

- Transaction Alerts: Instant notifications sent to the parent’s phone for every swipe.

- Merchant Controls: The ability to block spending at specific types of stores or websites.

Most importantly, these accounts are designed to be low-risk. They typically strip away monthly maintenance charges and overdraft fees, creating a safe sandbox for financial learning. However, opening one usually requires an in-person visit to a local branch if the teen is under 18.

Key Features of Teen Banking Accounts

Modern teen accounts are defined by their digital utility. The focus is on mobile apps, speed, and safety. Below are the specific mechanics of how these accounts function for families.

How Joint Accounts with Parental Controls Work

A joint teen checking account legally binds an adult and a minor as co-owners. This shared ownership is what makes the parental controls possible.

The Documentation Requirement:

Opening these accounts is a formal banking process. Both the adult and the teen must be present. You will need to bring:

- For the Adult: Two forms of government-issued ID (like a driver’s license and a passport).

- For the Teen: A primary ID (like a state ID or driver’s license) or a secondary ID like a birth certificate or Social Security card.

Once opened, the adult has administrative power. You can set limits on over 50 specific spending categories. For instance, you could allow $20 for “Restaurants” but $0 for “Online Gaming.”

“Pro-Tip: Most banks, including Wells Fargo, strictly limit one adult and one teen per joint account. If you have multiple teenagers, you will likely need to open a separate joint account for each child.”

The safety features are robust. Parents can view transactions instantly in their own digital wallet app. If you notice a suspicious charge, you can lock the card immediately. Crucially, if the parent removes themselves as a co-owner, the bank will typically close the teen account immediately. This ensures a minor is never left managing a regulated financial product without supervision.

What Are Customizable Debit Card Designs?

Customization is a major draw for Gen Alpha. Teens view their debit card as an accessory, similar to a phone case. Huntington Bank and Wells Fargo (through their Card Design Studio) allow users to personalize their cards.

Teens can upload personal photos or choose from a gallery of images to create a card that feels unique. This small feature often increases the teen’s “buy-in” and excitement about managing their money. Beyond the physical plastic, these cards integrate seamlessly with digital wallets:

- Google Pay & Apple Pay: Teens can tap to pay with their phones, which is often their preferred method.

- Parental Setup: You can set up the digital wallet on your child’s phone before the physical card even arrives in the mail.

Security remains the priority. If a custom card is lost, features like Wells Fargo Clear Access Banking allow parents to shut off access instantly. Plus, trusted banks provide a $0 Liability Guarantee, meaning you are not responsible for unauthorized transactions if the card details are stolen.

How Minimal Fees and Overdraft Protection Benefit Teens

The quickest way to discourage a young saver is to hit them with a fee they didn’t expect. The best teen accounts today are structurally designed to avoid this.

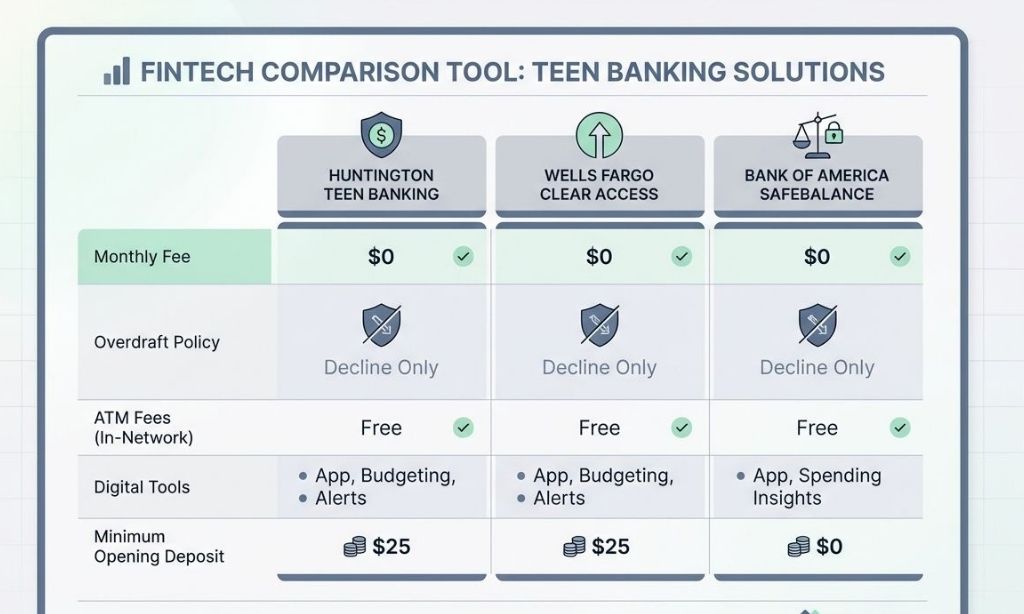

| Bank Account | Monthly Fee | Overdraft Policy |

|---|---|---|

| Huntington Teen Banking | $0 (if parent has an eligible account) | Zero overdraft fees. Transactions are declined or covered by a safety zone. |

| Wells Fargo Clear Access | $0 (for ages 13-24) | Checkless. No overdraft fees because you cannot spend what you don’t have. |

| Bank of America SafeBalance | $0 (for owners under 25) | Decline only. The account prevents negative balances automatically. |

This “decline only” structure is vital. It teaches teens that the money in the account is a hard limit, not a suggestion. By removing the ability to overdraft, banks also remove the fear of “insufficient funds” penalties. This creates a stress-free environment where mistakes result in a declined card rather than a fine.

The Appeal of Teen Banking for Gen Alpha

For Gen Alpha, banking is just another app on their phone. They expect their financial tools to be as intuitive as social media. The integration of Apple Pay, Google Pay, and Zelle is not a bonus for them; it is a baseline requirement.

How Teen Banking Promotes Financial Independence

The goal is to move from supervision to independence. Capital One MONEY Teen Checking and Chase First Banking are excellent examples of accounts that grow with the child. Initially, parents set strict transaction limits. As the teen proves they can budget, parents can lift these restrictions.

The “Zelle” Factor:

Many parents are surprised to learn that Zelle access for teens often requires a different setup. For example, at Wells Fargo, teens aged 13-17 can use Zelle, but they must have their own unique mobile number and email address registered; they cannot share yours.

As teens approach adulthood, these accounts transition. At age 18 (or 2,5 depending on the bank’s specific rules), the account often converts to a standard adult checking account. This allows the user to start building a credit history and financial independence without having to change banks or account numbers.

What Digital Tools and Mobile Apps Are Available?

The app experience is where the real management happens. Huntington’s Mobile Banking app stands out for its clarity, giving parents a dashboard view of every transaction. Wells Fargo’s app includes “Fargo,” an AI assistant that can answer basic spending questions.

These apps allow teens to:

- Check Balances Instantly: No more guessing if they have enough for lunch.

- Deposit Checks: Using the smartphone camera saves a trip to the branch.

- Split Bills: Easy peer-to-peer payments make splitting costs with friends simple.

For families, the “Relationship Savings” feature is a powerful tool. It allows you to view and manage checking and savings accounts side-by-side in the same app, reinforcing the idea that spending and saving are connected activities.

Educating Teens on Financial Literacy

The best accounts don’t just store money; they teach teens how to use it. By putting clear spending data in front of them, these tools turn abstract concepts into concrete lessons.

How Budgeting and Saving Tools Help Teens

Budgeting tools are most effective when they are automated and visual. Here is how top accounts tackle this:

- Automated Savings: Wells Fargo’s Way2Save allows teens to transfer a specific amount, like $1, to savings every time they use their debit card.

- Visual Categorization: Huntington Bank automatically sorts expenses into categories (like “Fast Food” or “Entertainment”), so teens can see exactly where their cash is going.

- Real-Time Control: Mobile apps let teens check their balance before they buy, reducing the social awkwardness of a declined card.

- Goal Setting: Apps allow teens to create “buckets” or goals for big purchases, like a new gaming console or a car fund.

- Mobile Deposits: Teens learn the discipline of depositing income immediately rather than carrying cash that is easily spent.

- Transaction Limits: These act as “training wheels,” preventing a teen from blowing an entire month’s allowance in one weekend.

- Security Habits: Learning to lock a card from a phone teaches digital security hygiene early.

- Fee Awareness: Seeing a monthly fee (even if waived) on a statement teaches teens to read the fine print.

- Credit Prep: Responsible management of a debit card is the best preparation for the inevitable credit card offers they will receive at 18.

Why Setting Financial Goals Is Important

Setting financial goals shifts a teen’s mindset from “spending” to “building.” When a teen nicknames an account “College Fund” or “New Bike,” the money becomes personal. Capital One MONEY Teen Checking even offers a 0.10% APY, which is a rare feature that helps demonstrate the power of compound interest, however small.

Progress bars in mobile banking apps are highly motivating. They show how close the teen is to their target, turning saving into a game. As they hit these milestones, you can reward them by unlocking higher transaction limits or transferring a “matching bonus” to their account. This positive reinforcement builds the habits that lead to true financial stability later in life.

Final Words

Teen banking gives young people a safe, structured environment to learn about money before the stakes get high. It is a partnership where parents guide, but teens drive. For expert insight, meet Dr. Lisa Ramirez, who holds a PhD in Finance from Stanford University.

She leads youth financial studies at the National Center for Financial Education and has helped design programs for digital banking and mobile payments aimed at teens. With over 20 years of experience guiding banks on how to reach the next generation safely, Dr. Ramirez is an authority on these trends.

Dr. Ramirez notes that the success of these accounts lies in the combination of “easy online tools, spending controls, and custom debit cards.” She emphasizes that the real value comes from the “hands-on practice” that builds confidence. Parents can rest easier knowing that strict regulations, like the requirement for two government-issued IDs for adults and FDIC insurance, protect these accounts just as rigorously as adult ones.

Whether it is buying a snack with Apple Pay or setting up a weekly budget in an app, these tools bridge the gap between childhood allowance and adult responsibility. The key is to start early. By leveraging features like real-time alerts and zero overdraft fees, you can help your teen build a credit history and financial intuition that will serve them for decades.