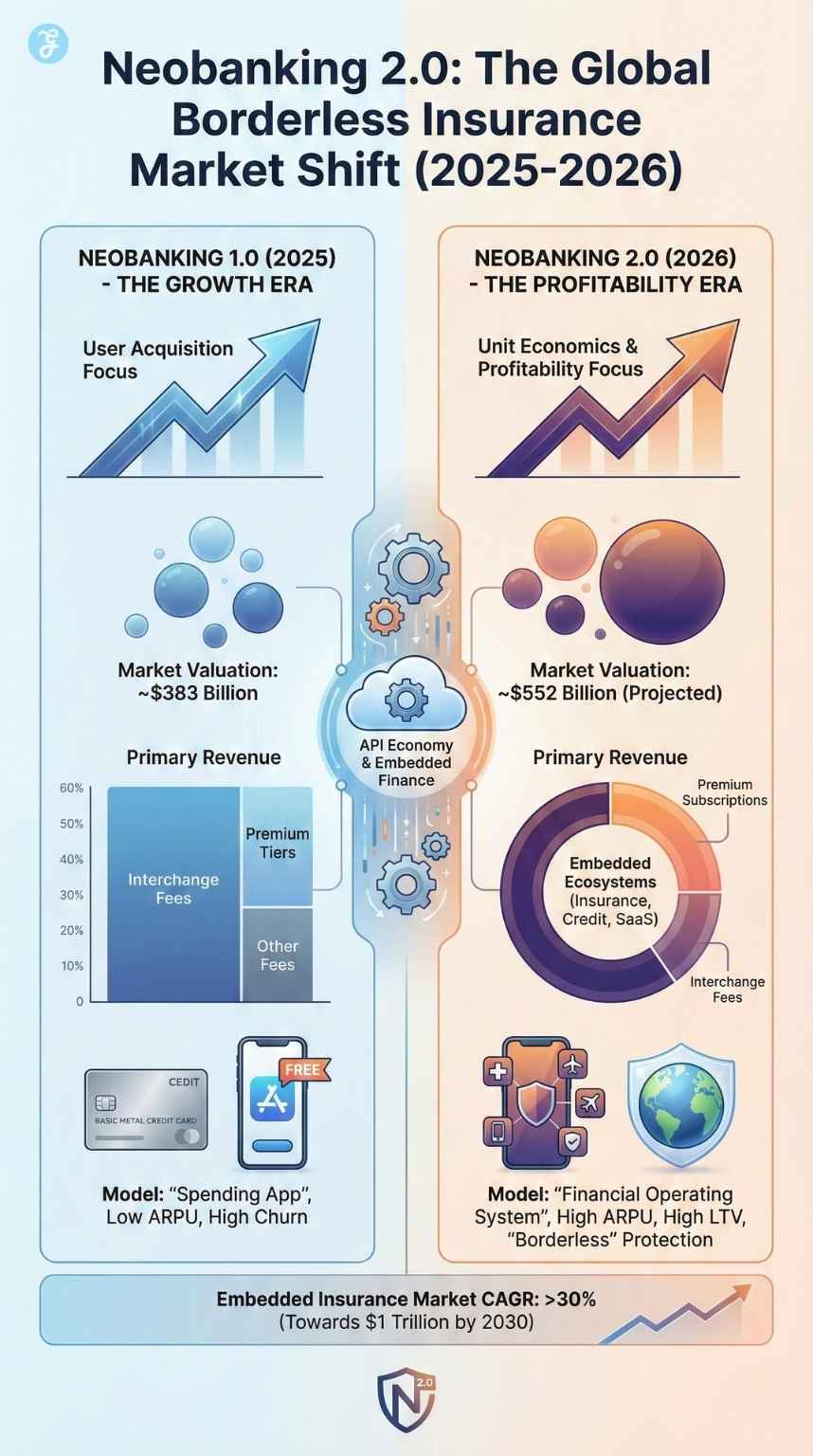

The financial technology sector has officially entered a new epoch. Our latest Neobanking 2.0 Global Borderless Insurance Market Analysis confirms that the era of “growth at all costs” has been superseded by a ruthless drive for unit economics and ecosystem value. For the past decade, the fintech narrative was dominated by a singular metric: user acquisition.

Startups in major financial hubs burned through venture capital to acquire millions of customers with the promise of slick interfaces and zero fees. However, as the market matures, the focus has shifted. The industry is no longer asking “How many users do you have?” but rather “What is the lifetime value of each user?”

This shift has birthed “Neobanking 2.0,” a phase defined not by the novelty of digital banking, but by the profitability of embedded financial lifestyles. The linchpin of this evolution is Global Borderless Insurance, a fundamental restructuring of how protection is delivered to a mobile-first world.

The 2026 Tipping Point

This report analyzes why 2026 is the tipping point. We are witnessing the convergence of a mature API economy, a post-pandemic “nomadic” workforce, and a banking sector desperate for high-margin recurring revenue. Neobanking 2.0 is not just about holding money; it is about protecting the life of the person who holds it.

The friction that once defined cross-border finance is vanishing, and insurance is the final frontier. In this new landscape, insurance is no longer a static document purchased annually; it is a dynamic, fluid code layer that wraps around the user’s life, activating and deactivating based on real-time behavior. This transition is not merely a feature update; it is an existential necessity for neobanks seeking to survive the coming consolidation.

State of the Market: 2025-2026 Data Landscape

To fully grasp the magnitude of this transition, we must examine the hard data underpinning the sector. The global neobanking market, once a niche challenger ecosystem, is currently valued at approximately $383 billion (as of late 2025) and is projected to surge to a staggering $552 billion by the end of 2026. This represents a year-over-year growth rate that outpaces almost every other sub-sector of traditional finance.

However, beneath these impressive topline numbers lies a critical vulnerability known as the “Profitability Gap.” Historically, the Average Revenue Per User (ARPU) for neobanks has been dangerously low, often hovering under $30 per year for non-subscription users. In comparison, traditional high-street banks generate hundreds of dollars per customer through lending, mortgages, and complex fee structures. Neobanks, lacking these heavy lending engines, found themselves with millions of users but a minimal margin.

The Data-Driven Pivot: The 2026 market analysis highlights a stark contrast in revenue quality.

- Free Users: Generate revenue primarily through interchange fees (approx. 0.2% – 1% per transaction). High churn, low loyalty.

- Premium/Metal Users: Generate fixed, recurring monthly revenue (MRR) plus higher transaction volumes.

- The Multiplier: The report indicates that “Premium” users generate 5x to 10x more revenue than free users over their lifecycle.

The question then becomes: How do you convert a free user into a paid subscriber? The answer, overwhelmingly, is Embedded Insurance. In 2026, the embedded insurance market itself is growing at a Compound Annual Growth Rate (CAGR) of over 30%, heading toward a trillion-dollar valuation by the end of the decade. As neobanks surpass 350 million active users globally, they are becoming the primary distribution channel for insurance products, effectively bypassing traditional brokers and agents. The bank app is the new insurance agent, and the policy is no longer a document in a drawer, but a feature in a UX.

Neobanking 1.0 vs. Neobanking 2.0 [Market Evolution]

| Feature | Neobanking 1.0 (The Growth Era) | Neobanking 2.0 (The Profitability Era) |

| Primary Goal | User Acquisition (Growth at all costs) | Unit Economics (Sustainable Profitability) |

| Revenue Driver | Interchange Fees (Swiping cards) | Embedded Ecosystems (Insurance, SaaS, Credit) |

| Insurance Model | Generic “Add-on” (e.g., standard travel insurance) | Hyper-Bundled (Global Health, Device, Income Protection) |

| User Experience | “Spending App” (Secondary account) | “Financial Operating System” (Primary account) |

| Key Metric | Total Registered Users | ARPU (Average Revenue Per User) & LTV (Lifetime Value) |

| Target Audience | Early Adopters / Millennials | Global Citizens / Remote Workforce / Gig Workers |

Regional Spotlight: The Tale of Two Markets [West vs. East]

While the global growth metrics are uniform, the drivers of Neobanking 2.0 differ radically depending on the hemisphere.

The Western Model (Lifestyle Enhancement)

In Europe and North America, the trend is driven by “Premiumization.” Users in the UK or the US already have basic banking and insurance. Neobanks win here by offering better, faster, and cooler coverage. The focus is on the “Metal Card” demographic, high-income earners who want seamless global mobility.

The Eastern & LatAm Model (Essential Access)

In Southeast Asia (Indonesia, Vietnam, Philippines) and Latin America (Brazil, Mexico), Neobanking 2.0 is a story of “Access.”

- The “Super-App” Ecosystem: Players like Grab (Asia) and Nubank (Brazil) are not just adding insurance as a perk; they are often the first insurance provider a user has ever had.

- Micro-Premiums: Unlike the $15/month subscription model in the West, these markets thrive on “Sachet Marketing”, selling insurance for $0.10 per ride or $1 per week.

- Significance: The report suggests that while the West offers higher margins per user, the East offers vastly superior volume and data density. A neobank analysis is incomplete without acknowledging that the next 100 million users will likely come from these “mobile-first” emerging markets.

Defining “Global Borderless Insurance”

To understand why “Neobanking 2.0” is distinct, we must rigorously define the term “Borderless.” In the legacy insurance model (Insurance 1.0), risk and coverage were strictly tethered to residency and geography. A citizen of the UK moving to Bali for six months would typically find their domestic health policy void, their gadget insurance inapplicable, and their legal standing ambiguous. They would be forced to purchase expensive, often patchy “backpacker” insurance or specialized expat policies that required mounds of paperwork.

The 2.0 Model: Decoupling Risk from Residency

In Neobanking 2.0, coverage is tied to the account credentials, not the physical location of the user. If you are a verified user of the platform, you are covered. Period.

The “Big Three” Embedded Products:

- Nomad Health (The Vital Layer): Companies like SafetyWing and Genki pioneered the concept of “Nomad Insurance” that functions like a subscription (SaaS). You pay a monthly fee, and you are covered for medical emergencies in 185+ countries. Neobanks are now white-labeling this utility. The user experience is seamless: you land in Bangkok, your app detects the location change, and confirms your “Global Health” status is active. There is no need to notify the insurer of travel dates.

- Tech & Device Protection (The Lifestyle Layer): For the modern digital worker, a laptop is not just a tool; it is their livelihood. Traditional home insurance often limits coverage for items taken outside the home for extended periods. In the 2.0 model, if a user purchases a MacBook Pro or the latest iPhone using their Revolut Metal or Monzo Premium card, that device is automatically insured against theft, accidental damage, or loss globally for 365 days. There are no registration forms to fill out; the transaction data is the registration.

- Mobility & Transit (The Convenience Layer): This sector has seen the fastest adoption. Features like “SmartDelay” (pioneered by insurtechs like Collinson) automatically issue airport lounge passes or cash compensation if a flight is delayed by more than an hour. The innovation here is the parametric trigger. The user does not need to file a claim. The banking app is connected to global flight data APIs; it knows the flight is late before the pilot even announces it, and triggers the benefit instantly.

This “Invisible” user experience is the defining characteristic of Neobanking 2.0. The user doesn’t feel like they are “buying” insurance; they feel like they are unlocking a privilege of their banking tier.

Traditional Insurance vs. Embedded Borderless Insurance

| Feature | Traditional Legacy Insurance | Neobanking 2.0 (Borderless Embedded) |

| Jurisdiction | Residency-Based (Must live in home country) | Account-Based (Valid globally via banking tier) |

| Purchase Flow | Active (Fill forms, select dates, pay premium) | Passive/Contextual (Included in sub or triggered by AI) |

| Underwriting | Static Data (Age, Zip Code, Medical History) | Dynamic Data (Spending habits, location, flight data) |

| Claims Speed | Slow (Paperwork, TPA reviews, weeks/months) | Instant/Parametric (Auto-payouts for delays, in-app tracking) |

| Flexibility | Rigid (Annual contracts with cancellation fees) | Fluid (Monthly subscriptions, pause/resume instantly) |

| Primary Friction | “I have to call a broker.” | Zero Friction (Invisible background process) |

The “Neobanking 2.0” Consumer Profile: The Rise of the Global Citizen

The driving force behind this product evolution is a massive demographic shift. The target consumer for Neobanking 2.0 is the “Global Citizen” or the “Location-Independent Professional.”

The post-pandemic world of 2020-2023 normalized remote work, but the years 2024-2026 solidified it into a permanent economic class. We now have millions of software engineers, marketers, consultants, and creators who earn in strong currencies (USD, EUR, GBP) but reside in countries with a lower cost of living or higher quality of life (Thailand, Portugal, Mexico, Indonesia).

The Legacy Failure

This demographic views traditional insurance as archaic and incompatible with their lifestyle.

- Residency Issues: They may not have a permanent utility bill in their home country, disqualifying them from standard policies.

- Communication Friction: They do not want to call a broker during “office hours” in a time zone 12 hours away. They demand asynchronous, in-app chat support.

- Flexibility: They need policies they can pause and resume instantly, mirroring their Netflix or Spotify subscriptions.

The Trust Mechanics

The report highlights a fascinating psychological insight: these users trust their neobank significantly more than they trust traditional insurers. A user might open their banking app 5 to 10 times a day to check balances, exchange crypto, or split bills. It is a “high-engagement surface.” Embedding insurance into this daily ritual feels natural and modern. In contrast, interacting with a legacy insurer feels like a chore associated with fear and bureaucracy. By leveraging this trust, neobanks are effectively “borrowing” the customer relationship to sell high-margin protection products.

Beyond Nomads: The “Gig Economy” Safety Net

While “Digital Nomads” grab the headlines, the “Neobanking 2.0” wave is quietly revolutionizing the safety net for the massive Gig Economy workforce. Freelancers, ride-share drivers, and delivery partners have historically been excluded from corporate benefits packages. They are the “uninsured workforce.”

- The 2.0 Solution: Neobanks are partnering with platforms (like Upwork, Uber, or Fiverr) to offer “Income Protection” and “Accident Coverage” that is calculated per gig.

- Dynamic Pricing: If a courier works 20 hours this week, they pay for 20 hours of accident insurance. If they take a week off, they pay zero. This “Pay-As-You-Work” model is only possible through the real-time API integrations characteristic of Neobanking 2.0.

- The Opportunity: By solving the “portable benefits” crisis, allowing a worker to carry their insurance history from Uber to DoorDash to a freelance design gig, neobanks are positioning themselves as the “HR Department” for the self-employed generation.

Technological Enablers: The Infrastructure of 2.0

It is critical to understand that most neobanks are not insurance companies. They do not employ thousands of actuaries, nor do they hold the catastrophic risk on their own balance sheets. Instead, the 2.0 ecosystem relies on a sophisticated new layer of infrastructure providers known as Insurtech Enablers or “Embedded Insurance Orchestrators.”

The API Economy

This integration is made possible by APIs (Application Programming Interfaces) that allow different systems to talk to each other in real-time.

- Cover Genius (XCover): A dominant player providing the global API rails. They handle the licensing in 60+ countries and the claims payouts, allowing a platform (like a bank) to sell insurance without becoming an insurer.

- Bolttech: Acts as a massive exchange, connecting insurers who have the capital with distributors (neobanks) who have the customers.

- Qover: Specializes in pan-European compliance, creating bespoke embedded insurance programs for major fintech players.

The Power of Contextual Data & AI: The true “secret sauce” of Neobanking 2.0 is Contextual Selling driven by AI. Traditional insurers rely on static demographic data (age, zip code). Neobanks possess dynamic, real-time transactional data.

- Scenario A (The Old Way): A user goes on a ski trip. They forget to buy travel insurance. They crash and break a leg. They are uninsured.

- Scenario B (The Neobanking 2.0 Way): The user’s banking app detects a transaction at a coffee shop in a known ski resort area, or sees a purchase for a lift pass. The AI analyzes this data point in milliseconds. It cross-references the user’s current subscription tier. If the user is uninsured, the app sends a push notification: “We noticed you’re hitting the slopes. Your current plan doesn’t cover Winter Sports. Activate immediate coverage for €2.50/day? Tap to confirm.”

This is Just-in-Time Insurance. It is highly personalized, incredibly timely, and converts at rates significantly higher than cold-email marketing. It changes insurance from a “grudge purchase” into a “lifestyle enabler.”

Competitive Analysis: Who is Winning Neobanking 2.0?

The landscape is becoming increasingly crowded, but distinct strategies are emerging among the market leaders.

The Super-Apps (The Bundlers):

- Revolut: Currently the aggressive leader in the “Super App” strategy. Their “Ultra” and “Metal” plans are masterclasses in bundling. For a high monthly fee, users get a package that includes “Cancel for Any Reason” travel insurance, global medical, car hire excess waiver, and personal liability. They are effectively competing with American Express Platinum, but for a younger, more digital demographic.

- Monzo & Starling: UK-based leaders who have focused heavily on quality and transparency. Their approach to insurance is less “aggressive expansion” and more “trusted advisor,” integrating seamlessly with trusted partners to offer income protection and phone insurance.

The Specialists (The disruptors):

- SafetyWing: While technically an insurtech, they are blurring the lines. They are building “Nomad Borderless,” a product suite that includes health insurance, remote health access, and eventually, a borderless physician network. Their vision is to build a “Country on the Internet,” where social safety nets are digital, not national.

- Wise (formerly TransferWise): While focusing on payments, Wise is slowly integrating “Assets” and protection features that cater to the multi-currency life, solving the specific pain point of holding wealth across borders.

The Legacy Response: Traditional banks are scrambling to catch up. Many are launching “digital spinoffs” or trying to integrate similar insurance products into their mobile apps. However, they are often hampered by legacy IT systems (COBOL mainframes) that cannot handle the real-time API calls required for “Just-in-Time” insurance. They are also held back by risk-averse compliance departments that struggle with the “borderless” concept.

Challenges and Regulatory Headwinds

Despite the bullish outlook for Neobanking 2.0, the path is not without significant obstacles. The report identifies three “existential threats” that could slow adoption.

- The Compliance Quagmire: “Global” is a marketing term; “Multi-Jurisdictional” is the legal reality. There is no such thing as a “Global Insurance License.” To offer borderless insurance, an enabler must navigate a patchwork of local regulations. The EU has GDPR and the Insurance Distribution Directive (IDD). The US has 50 different state insurance commissioners. Southeast Asia has highly protectionist insurance laws. Maintaining compliance across 100+ countries is an operational nightmare and a massive cost center. A slip-up here can lead to massive fines and the revocation of banking licenses.

- The “Claims Gap” (UX Dissonance): The user experience of buying embedded insurance is instant (10/10 UX). However, the experience of claiming often falls back on the legacy insurer providing the capital. If a neobank user taps “Buy” in one second, but then has to fill out a PDF form, fax it to a third-party administrator (TPA), and wait 6 weeks for a payout, the brand damage is catastrophic. The user blames the neobank, not the backend insurer. Bridging this “Claims Gap”, making payouts as instant as payments, is the next major technical hurdle.

- Economic Sensitivity & The “Subscription Fatigue”: As inflation continues to impact the global economy in 2026, discretionary spending is under pressure. “Premium” banking subscriptions are often viewed as luxuries. If users begin to downgrade to free accounts to save $15/month, the entire Neobanking 2.0 monetization model risks collapsing. Neobanks must essentially prove that the “bundled value” of the insurance is significantly cheaper than buying the services separately (which it usually is), but communicating this value proposition effectively is a constant marketing challenge.

Strategic Recommendations for Industry Stakeholders

Based on the trajectory of the 2026 market data, we offer the following strategic imperatives:

For Neobanks

- Stop Renting, Start Owning: Moving from a “referral model” (sending users to an insurer) to an MGA (Managing General Agent) model is critical. You must own the customer experience and a portion of the underwriting profit.

- Hyper-Personalize: Use your transaction data. If a user buys baby clothes, offer family health add-ons. If they buy flight tickets, offer travel delay. Generic “mass emails” will result in churn.

For Legacy Insurers

-

- Become the “Intel Inside”: You cannot compete with neobanks on UX (User Experience). Your survival strategy is to become the invisible capital provider behind them. Build robust APIs that allow fintechs to white-label your products seamlessly.

For Investors

-

- Look for “Stickiness”: Evaluate neobanks not just on “User Growth” but on “Products Per User” (PPU). A neobank where the average user has a bank account plus health coverage is infinitely more valuable than one with millions of dormant free accounts.

Future Predictions and Outlook

- M&A Activity: We predict that by late 2026 or 2027, a major neobank will acquire a mid-sized insurtech carrier. This vertical integration will allow them to bring the underwriting stack in-house, securing higher margins and, crucially, complete control over the claims experience.

- De-Fi Integration: The next frontier (Neobanking 3.0?) will likely involve the intersection of Decentralized Finance (DeFi) insurance protocols with mainstream neobanking interfaces, offering smart-contract-based payouts that require no human intervention at all.

For now, the verdict is clear: In the digital economy of 2026, a neobank without a robust, borderless insurance offering is merely a utility. Those that successfully embed protection into the daily flow of finance will evolve into the essential operating systems of modern life.

Final Thought: The Era of the “Invisible” Safety Net

Neobanking 2.0 Global Borderless Insurance Market Analysis concludes that the integration of banking and protection is inevitable. The era of the “dumb pipe”, a bank that simply moves money from A to B- is over. In a world where money moves instantly across borders, the protection mechanisms for that money and the people who earn it must be equally fluid.