The EV battery recycling industry is moving from a “future problem” to a “right now” business reality. Electric vehicles are scaling globally, and every EV depends on battery materials that are expensive, supply-constrained, and increasingly strategic. That creates a simple economic truth: once enough batteries reach end-of-life, the cheapest and most reliable source of critical materials will not be new mining alone. It will be recovered material.

This is why recycling is not just an environmental story. It is a supply chain story, a manufacturing story, and a competitive advantage story. The companies that can collect batteries safely, recover high-value metals efficiently, and feed those materials back into new battery production will sit at the center of a massive circular economy loop.

Still, battery recycling is complicated. Lithium-ion packs are heavy, dangerous when damaged, and full of chemistry that can be difficult to separate. The industry has to solve logistics, safety, economics, and technology at scale. It also has to prove that recycled materials can meet the quality standards of new battery cells.

This cluster guide explains how EV battery recycling works, why it is becoming a major industry, what technologies are competing, what the real bottlenecks are, and what needs to happen for closed-loop battery supply chains to become mainstream.

Why EV Battery Recycling Is Becoming A Major Industry

Electric vehicle batteries are not like normal consumer electronics batteries. They are massive, high-value assets built from materials with volatile prices and geopolitical sensitivity. They also contain materials that require energy-intensive mining and processing.

EV battery recycling matters because it can:

-

Reduce dependence on newly mined critical minerals

-

Stabilize supply chains as EV production scales

-

Lower the lifecycle environmental footprint of EVs

-

Reduce waste and prevent unsafe disposal

-

Create domestic or regional material supply for manufacturers

As more batteries enter the market each year, the volume of future end-of-life batteries becomes predictable. That predictability attracts capital. Recycling becomes an industrial infrastructure play, not a side project.

What’s Actually Inside An EV Battery Pack

Understanding the EV battery recycling industry starts with knowing what is being recycled. EV batteries are complex systems. What people call “the battery” is really a pack made of multiple layers.

-

Cells: the fundamental electrochemical units

-

Modules: groups of cells combined into manageable units

-

Pack: the full system with housing, cooling, sensors, and control electronics

Inside the cells, most value sits in materials used in the cathode and anode, plus current collectors.

Key materials commonly involved include:

-

Nickel

-

Cobalt

-

Lithium

-

Manganese

-

Graphite

-

Copper

-

Aluminum

Not every battery chemistry uses the same mix. Some chemistries reduce cobalt, for example. But even when cobalt declines, nickel, lithium, copper, and aluminum remain highly relevant to recycling economics.

Battery Value Components Table

| Component | Why It Matters | Recycling Value |

|---|---|---|

| Cathode materials | Contains high-value metals | High |

| Anode materials | Often graphite-based | Medium |

| Copper and aluminum | Used in collectors and casing | Medium to high |

| Electronics and housing | Structure and controls | Medium |

| Electrolyte | Chemistry and safety risk | Complex to handle |

In short, EV batteries are not “trash.” They are material banks.

The Battery Lifecycle: Where Recycling Fits

Battery recycling is the final stage of a longer lifecycle. Many packs will not go directly from a car to a shredder.

A typical lifecycle can include:

-

First life in the vehicle

-

Second life in stationary storage if capacity remains usable

-

Recycling for material recovery when performance is too low or safety risk rises

Second-life use is often discussed as a sustainability win, and it can be. But it also adds complexity. It creates more time between manufacturing and recycling, and it requires systems to grade batteries safely.

The EV battery recycling industry will likely include both pathways: reuse where it is safe and economic, and recycling when reuse no longer makes sense.

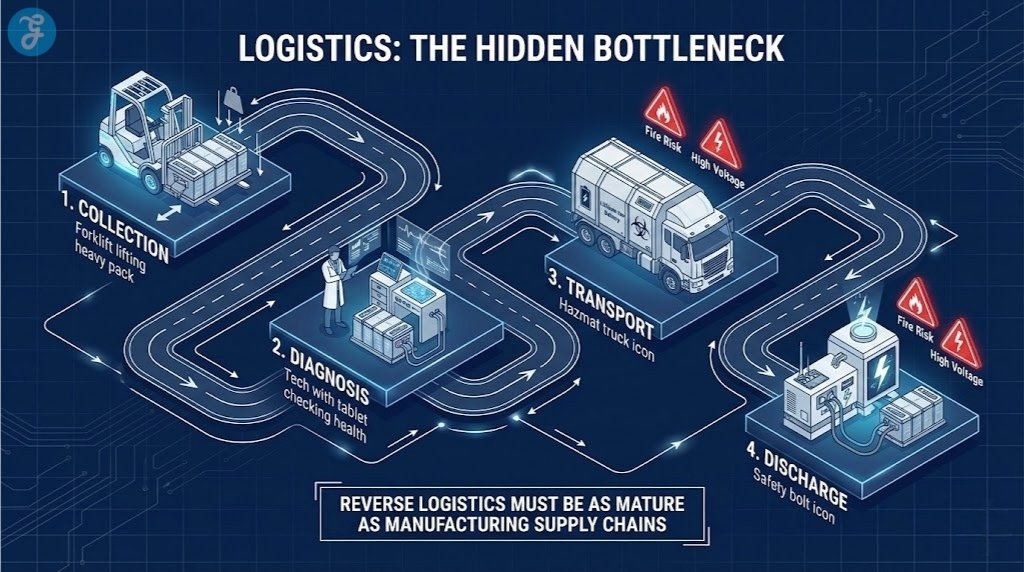

Collection And Logistics: The Real World Challenge

Recycling begins long before processing. The hardest part is getting batteries from vehicles to recycling facilities safely and efficiently.

Challenges include:

-

Pack weight and size

-

Transportation safety rules and handling requirements

-

Fire risk if packs are damaged or improperly discharged

-

Regional collection infrastructure and fragmentation

-

Ownership complexity between automakers, insurers, fleets, and consumers

A successful EV battery recycling industry needs reverse logistics that are as mature as forward supply chains.

Logistics Complexity Table

| Step | What Happens | Risk Point |

|---|---|---|

| Collection | Battery removed from vehicle | Damage and improper handling |

| Diagnosis | State-of-health and safety checked | Misclassification risk |

| Storage | Batteries staged for transport | Fire safety and monitoring |

| Transport | Pack moved to processing site | Regulatory and safety complexity |

| Intake | Facility prepares battery for processing | Discharge and disassembly hazards |

Logistics is where many early recycling systems struggle. Technology is only one part of the problem.

Safety: Why EV Battery Recycling Requires Industrial Discipline

Lithium-ion batteries can enter thermal runaway if damaged, shorted, overheated, or incorrectly handled. That makes safety non-negotiable.

Core safety practices typically include:

-

State-of-charge reduction before processing

-

Robust fire suppression and monitoring systems

-

Trained handling teams and strict protocols

-

Specialized storage for damaged packs

-

Controlled disassembly environments

The more the industry scales, the more standardized safety must become. Safety incidents can slow growth through regulation and public concern.

The Three Main Battery Recycling Pathways

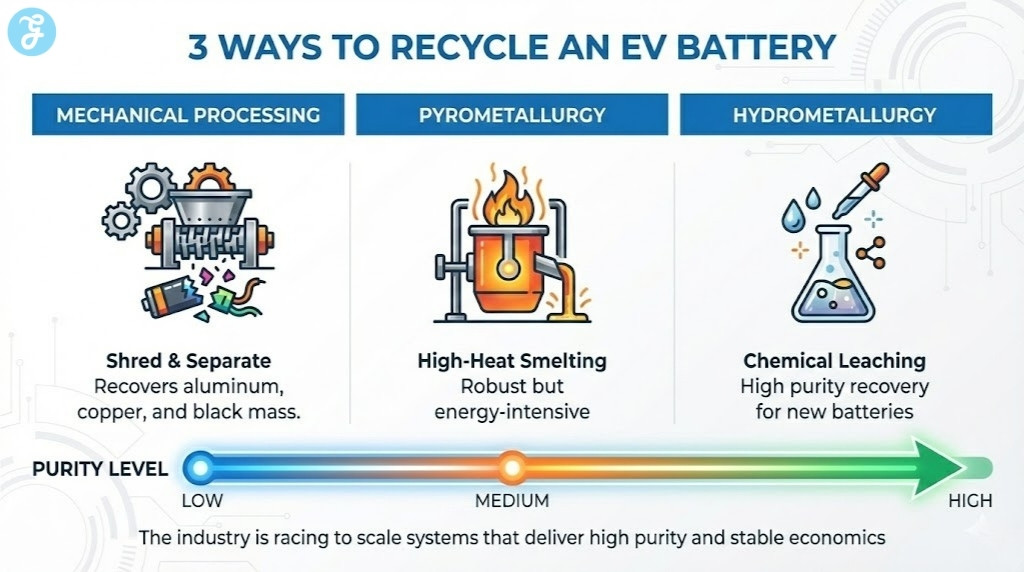

Most recycling approaches fall into three broad categories. Many real-world facilities combine elements of each.

1) Mechanical Processing

This is the front-end approach: disassembly, shredding, separation of components, and production of mixed material streams.

Mechanical steps can recover:

-

Aluminum and copper

-

Plastics and casings

-

“Black mass” (a powder containing cathode/anode materials and valuable metals)

Mechanical processing is often the first stage before chemical extraction. It is critical, but it does not fully separate and refine battery metals into reusable form.

2) Pyrometallurgy

Pyrometallurgy uses high heat to melt and separate materials. It has been used in metal recovery for a long time.

Typical strengths:

-

Can handle mixed feedstocks

-

Can recover valuable metals like nickel and cobalt effectively

-

Often robust and industrially proven

Typical limitations:

-

High energy use

-

Lithium recovery can be less efficient depending on process design

-

Some materials are lost or require additional steps

-

Emissions management and slag handling are major considerations

3) Hydrometallurgy

Hydrometallurgy uses chemical solutions to leach metals and then separate them into purified streams.

Typical strengths:

-

High recovery potential for lithium, nickel, cobalt, and manganese

-

Can produce high-purity outputs suitable for battery manufacturing

-

Often lower temperature than pyro approaches

Typical limitations:

-

Chemical handling and waste treatment complexity

-

Process sensitivity to feedstock variation

-

Capital and operational discipline required for high purity

Recycling Pathways Comparison Table

| Pathway | Core Method | Strength | Tradeoff |

|---|---|---|---|

| Mechanical | Shred and separate | Good front-end recovery | Needs downstream processing |

| Pyrometallurgy | High-heat smelting | Robust and proven | Energy intensity and losses |

| Hydrometallurgy | Chemical leaching | High recovery and purity | Complex chemistry and treatment |

The EV battery recycling industry is largely a race to scale systems that deliver high recovery, high purity, and stable economics.

What Is “Black Mass” And Why It Matters

Black mass is one of the most important terms in battery recycling. It refers to the mixed powder created after mechanical processing of cells. It contains the high-value active materials where most of the metal value sits.

Black mass typically contains combinations of:

-

Lithium compounds

-

Nickel, cobalt, manganese compounds

-

Graphite

-

Other traces and binders

It is valuable because it can be refined into battery-grade materials. But it is not automatically “ready to use.” It requires controlled chemical processing to separate and purify components.

In practical terms, many recycling businesses compete across the value chain:

-

Some focus on collection and producing black mass

-

Others focus on refining black mass into battery-grade outputs

-

Some aim to do both as a fully integrated model

This division influences business models and profit pools in the EV battery recycling industry.

Direct Recycling: The “Keep The Cathode” Approach

Beyond pyro and hydro methods, there is growing interest in direct recycling. The idea is to recover cathode materials in a form that can be reconditioned, rather than breaking everything down into base metals.

If it works at scale, direct recycling could:

-

Reduce energy use compared to full chemical breakdown

-

Preserve material structure and reduce processing steps

-

Improve economics and reduce emissions

But direct recycling is technically demanding because cathode chemistries vary and contamination can ruin quality. It also requires strong sorting and identification of incoming battery chemistries.

Direct Recycling Pros And Cons Table

| Factor | Potential Benefit | Key Challenge |

|---|---|---|

| Energy use | Lower than full breakdown | Requires careful control |

| Output value | High if cathode is reusable | Quality consistency is hard |

| Complexity | Fewer chemical steps | Sorting and chemistry variation |

| Scalability | Could be very efficient | Still maturing industrially |

Direct recycling is one reason the industry is dynamic. The “best” method may differ by chemistry, region, and facility design.

Why Battery Chemistry Shapes Recycling Economics

Not all EV batteries are the same. Different chemistries change what is worth recovering and how.

For example:

-

Chemistries with high nickel and cobalt can have strong recycling value from those metals

-

Chemistries that reduce or eliminate cobalt shift value toward lithium, copper, and nickel, plus process efficiency

-

Some iron-based chemistries can be more challenging economically because high-value metals are lower, making process cost control essential

This does not mean lower-cobalt chemistries are “bad.” It means recycling economics must rely more on efficient recovery and scale rather than one expensive metal.

Chemistry Impact Table

| Chemistry Trend | What Changes | Recycling Implication |

|---|---|---|

| Less cobalt | Lower value from cobalt recovery | Need efficiency and scale |

| Higher nickel | More value in cathode metals | Strong incentive for recovery |

| Chemistry diversity | Mixed incoming feedstocks | Sorting and process flexibility required |

| Higher silicon/advanced anodes | More complex materials | Processing may need adaptation |

The EV battery recycling industry must be flexible enough to handle changing chemistries across a decade.

Battery Recycling And The Supply Chain: Why Manufacturers Care

Automakers and battery makers care about recycling because it can reduce supply risk. Even if mining expands, supply chain shocks can happen. Recycling creates a secondary supply that is closer to manufacturing centers and less exposed to raw extraction disruption.

Recycled materials can support:

-

More stable input availability

-

Potential cost advantages over mined materials

-

Lower carbon intensity in the material supply chain

-

Compliance with future regulations requiring recycled content

This is why many automakers and battery makers are building partnerships with recyclers or investing directly in recycling capacity.

Closed-Loop Batteries: The Big Goal

The most valuable long-term vision is closed-loop production. That means batteries are recycled into materials that become new batteries, repeatedly.

Closed-loop systems require:

-

Collection systems that capture large volumes

-

High recovery rates for key materials

-

Purification steps that achieve battery-grade standards

-

Manufacturing acceptance that recycled materials meet performance needs

-

Traceability systems that prove quality and origin

Closed loop is not just a technology problem. It is an ecosystem problem.

Closed-Loop Requirements Table

| Requirement | Why It Matters | What Enables It |

|---|---|---|

| High recovery | Makes economics work | Efficient processes |

| High purity | Meets battery standards | Strong refining controls |

| Traceability | Builds trust and compliance | Data systems and labeling |

| Stable feedstock | Keeps plants operating | Contracts and logistics |

| Market demand | Pulls recycled materials into production | OEM agreements |

Closed-loop is where the EV battery recycling industry becomes a foundational industrial layer, not an optional add-on.

The Environmental Side: Why Recycling Can Lower EV Footprints

EVs reduce tailpipe emissions compared to combustion vehicles, but batteries carry an environmental footprint from mining and manufacturing. Recycling can reduce that footprint by replacing some mined material with recovered material.

Key potential environmental benefits include:

-

Reduced mining pressure for certain metals

-

Lower processing emissions depending on recycling pathway and energy source

-

Reduced waste and hazardous disposal risks

-

Less land and water impact from extraction activity

But recycling is not automatically “clean.” The actual footprint depends on energy use, chemical management, and waste treatment.

The best outcome is when recycling facilities operate with efficient energy use, strong emissions controls, and responsible chemical handling. That is what makes the industry both a climate opportunity and a compliance-heavy industrial sector.

The Economics: What Makes EV Battery Recycling Profitable

Profit in the EV battery recycling industry comes from value recovery minus processing cost, plus the ability to scale reliably.

Revenue sources can include:

-

Sale of recovered metals and battery-grade salts

-

Service fees for processing end-of-life batteries

-

Contracts with automakers and fleet operators

-

Value from recovered copper and aluminum

-

Long-term strategic premium for secure supply

Cost drivers include:

-

Collection and transport

-

Disassembly and safety management

-

Capital investment in facilities

-

Chemical and energy consumption

-

Waste treatment and environmental compliance

-

Labor and operational reliability

Economics Snapshot Table

| Profit Driver | What Helps | What Hurts |

|---|---|---|

| Material value | High recovery and purity | Low recovery or contaminated output |

| Throughput | Large volumes and steady supply | Intermittent feedstock |

| Costs | Efficient processes and automation | High energy and chemical waste |

| Contracts | Long-term OEM agreements | Spot-market dependence |

| Compliance | Strong environmental performance | Regulatory penalties and incidents |

Scale is a crucial lever. Recycling plants need steady volume to operate efficiently. Early in the market, volume can be uneven, which is why partnerships and contracts matter.

A Major Bottleneck: Feedstock Timing

One of the biggest challenges is timing. EV adoption has grown quickly, but many EV packs last for years. That means the wave of end-of-life packs is still building.

In the near term, recyclers often rely on:

-

Manufacturing scrap from battery production

-

Defective cells and modules

-

Damaged packs from accidents

-

Early-generation EV packs reaching end-of-life sooner

Manufacturing scrap can be a strong feedstock because it is more consistent and often cleaner than end-of-life packs. But long-term, the biggest volume will come from end-of-life vehicles.

This is why the industry is building capacity now. It expects much larger flows later.

Second-Life Batteries: Friend Or Competitor To Recycling

Second-life use means taking EV packs that still have useful capacity and deploying them in stationary storage. This can extend the useful life of the pack and delay recycling.

It can be beneficial when:

-

Safety can be verified reliably

-

The economics of repurposing are strong

-

Stationary storage demand is high

-

The system can be monitored and managed well

But second-life use also adds complexity. Batteries degrade differently depending on driving, climate, and charge patterns. Some packs may not be suitable. Also, delaying recycling delays material recovery, which can matter when supply chains are tight.

In practice, the EV battery recycling industry will likely coexist with second-life markets. The key is sorting: reuse what is safe and valuable to reuse, recycle what is not.

Regulation And Responsibility: Why Policy Will Accelerate The Industry

Battery recycling is increasingly shaped by policy frameworks that focus on:

-

Producer responsibility and take-back obligations

-

Safe transport and disposal rules

-

Minimum recycling efficiency targets

-

Recycled content expectations over time

-

Reporting and traceability requirements

Even without naming specific jurisdictions, the trend is consistent: batteries are being treated as strategic products with lifecycle responsibility. This policy direction pushes manufacturers to plan for end-of-life and strengthens demand for recycling infrastructure.

This is another reason the EV battery recycling industry can scale into a major industrial category. Regulation creates predictable demand.

Technology Competition: What Innovation Looks Like In Recycling

Recycling innovation is focused on five major goals.

-

Higher recovery rates for lithium and other key materials

-

Lower energy use per unit processed

-

Lower chemical consumption and cleaner waste streams

-

Higher purity outputs suitable for new batteries

-

Flexibility across different battery chemistries

Innovation is also happening in automation. Battery disassembly is dangerous and labor-intensive. Robotics and better pack design can reduce risk and cost.

Innovation Focus Table

| Innovation Area | Goal | Why It Matters |

|---|---|---|

| Recovery efficiency | Capture more material | Improves economics and sustainability |

| Purity | Meet battery-grade standards | Enables closed-loop supply |

| Energy efficiency | Reduce operational footprint | Cuts cost and emissions |

| Waste treatment | Reduce harmful byproducts | Builds regulatory trust |

| Automation | Safer and cheaper processing | Enables scale |

The winners will likely be companies that combine process efficiency with reliable industrial operations.

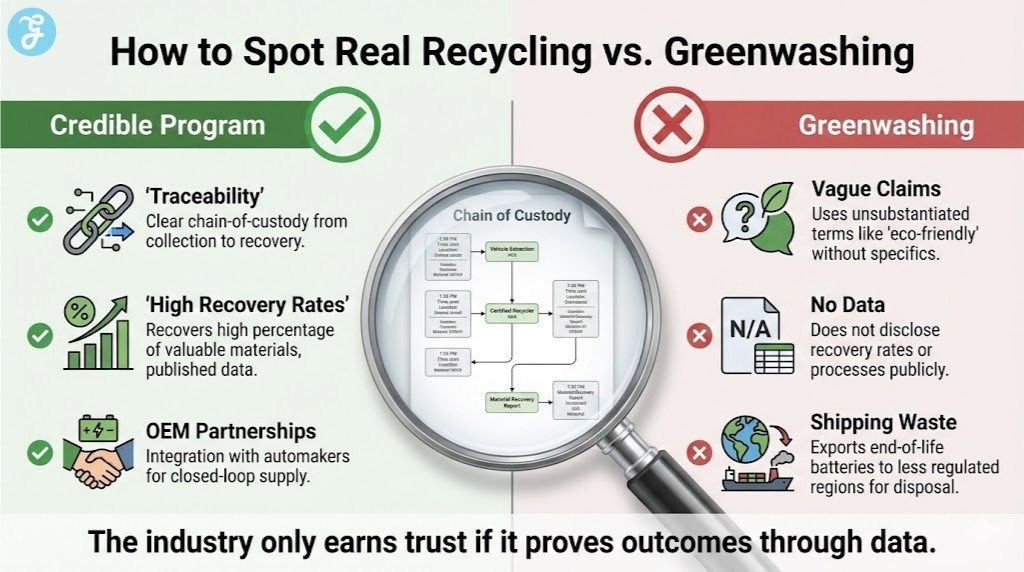

How To Tell If A Recycling Program Is Real Or Just Marketing

As recycling becomes popular, greenwashing risk rises. A program can claim “recycling” while shipping batteries long distances, recovering little value, or relying on weak downstream practices.

A credible recycling system usually includes:

-

Clear chain-of-custody and traceability

-

Transparent recovery goals and process description

-

Strong safety and environmental compliance practices

-

Partnerships with manufacturers who use recycled materials

-

Reporting that goes beyond vague claims

Credibility Checklist Table

| Signal | Strong Program | Weak Program |

|---|---|---|

| Traceability | Documented chain-of-custody | Unclear downstream handling |

| Recovery outcomes | High recovery and battery-grade outputs | No data, vague “recycled” claim |

| Safety | Strict protocols and monitoring | Minimal details |

| Partnerships | OEM integration for closed loop | No end-market clarity |

| Transparency | Clear process and reporting | Marketing language only |

This matters because the EV battery recycling industry will only earn trust if it proves outcomes.

What This Means For The Future Of EVs

As recycling scales, it can reshape how EV supply chains work.

Potential future changes include:

-

More regional battery supply loops

-

Reduced vulnerability to mineral supply shocks

-

Lower lifecycle carbon footprints for EV batteries

-

Increased recycled content in new cells

-

Better battery designs optimized for disassembly and recycling

The last point is important. When manufacturers design batteries with end-of-life in mind, recycling becomes cheaper and safer. That creates a positive feedback loop.

At this stage, the focus keyword should appear naturally again: the EV battery recycling industry becomes a cornerstone of the EV era when it shifts batteries from one-way products into circular material systems.

What Does the Future Look Like?

The EV battery recycling industry is growing because it solves three big problems at once: material supply risk, environmental impact, and end-of-life waste. EV batteries contain valuable metals and materials that can be recovered and reused. As EV adoption scales, recycling becomes a strategic infrastructure layer that feeds recovered materials back into new battery production.

The industry must still overcome challenges: safe logistics, efficient processing, chemistry variability, and the need for battery-grade output purity. But the direction is clear. Recycling is moving from optional to essential, and the companies that master recovery, purification, and closed-loop partnerships will become key players in the future of clean transportation.

This is why battery recycling is being described as one of the next great industrial opportunities. It is not only about waste. It is about building a circular supply chain for the most important component of the electric vehicle economy.