For decades, the financial experience of higher education has been defined by friction. It is the long queue at the bursar’s office, the complex wire transfer code that parents frantically double-check, and the fragmented reality of carrying a student ID for the library but a bank card for the cafeteria.

But as we move through 2025, a quiet revolution is dismantling these barriers. We are witnessing the dawn of Embedded Finance 2.0 in Education, a paradigm shift where financial services are no longer just “added” to educational platforms but are woven so deeply into the infrastructure that they become invisible.

While Version 1.0 was about digitizing payments (adding a “Pay Now” button to a website), Version 2.0 is about automated logic. It is the move from manual entry to “flow,” where tuition settlement, cross-border treasury, and student lending happen in the background, triggered by academic events rather than banking forms. With the global embedded finance market projected to hit $7.2 trillion by 2030, the education sector is emerging as one of the most critical frontiers for this “invisible trade.”

Key Takeaways

-

From Friction to Flow: Embedded Finance 2.0 removes the manual “checkout” process, integrating finance into the academic lifecycle.

-

Vertical SaaS Dominance: Student Information Systems are becoming the new banking platforms, offering loans and insurance at the point of need.

-

The Cross-Border Unlock: Automating FX and compliance can save international students up to 5% in fees and save universities thousands of admin hours.

-

Ethical Design Required: As finance becomes invisible, institutions must build in safeguards to prevent students from accruing “silent debt.”

The Core Drivers of “Invisible” Education Finance

The transition to Embedded Finance 2.0 is not merely a cosmetic update to university websites; it is a fundamental restructuring of how money moves through the education ecosystem. Three primary drivers are fueling this change.

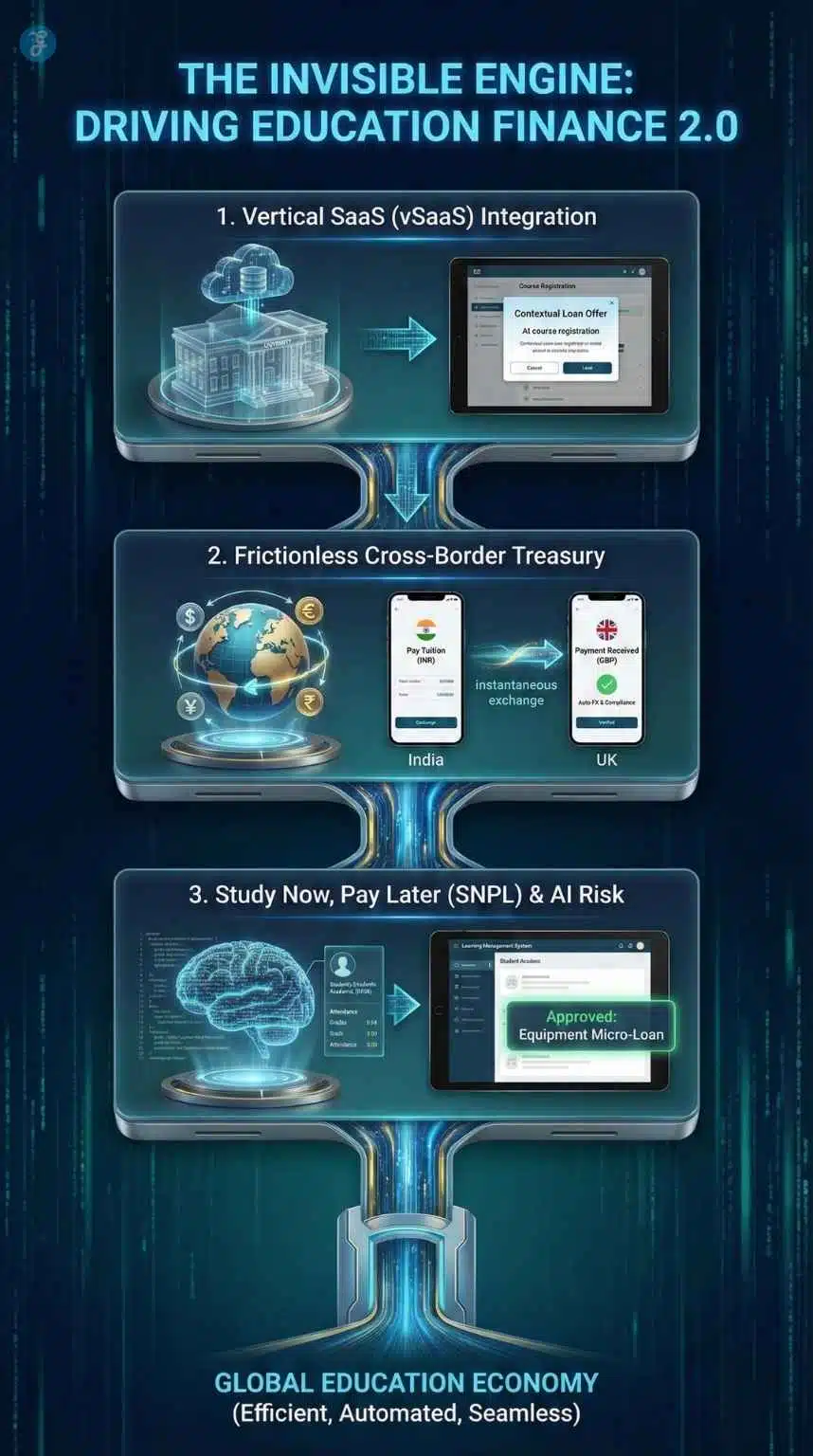

Driver A: The Rise of Vertical SaaS (vSaaS)

The most significant technical shift is the evolution of Student Information Systems (SIS). Traditionally, these platforms were databases for grades and attendance. Today, they are morphing into fintech platforms.

This is the era of “Contextual Banking.” Financial products are no longer sought out by the student; they are offered exactly when needed. When a student registers for a chemistry course requiring expensive lab equipment, the SIS doesn’t just record the enrollment—it can simultaneously offer a micro-loan or installment plan for the materials.

The Shift from SIS to Fintech-Enabled Platforms:

| Feature | Traditional SIS (The Database) | Embedded Finance 2.0 (The Operating System) |

| Primary Function | Record keeping (grades, attendance) | Comprehensive ecosystem (Learning + Finance) |

| Payments | Redirects to the 3rd-party payment gateway | Native, in-platform settlement |

| Financial Aid | Manual disbursement & reconciliation | Instant digital wallet crediting |

| Identity | Static ID card | Dynamic credential linked to payments |

Driver B: Frictionless Cross-Border “Tuition Treasury”

For the global education market, international students represent a massive economic engine, yet they have historically been taxed by inefficiency. The “invisible trade” of education exports is often hampered by very visible fees.

-

The Pain Point: Historically, international families lost 3-5% of tuition value in hidden foreign exchange (FX) spreads, correspondent banking fees, and antiquated SWIFT routing.

-

The 2.0 Solution: New platforms are embedding treasury services directly into the university’s admission portal. A student in Mumbai can pay in Rupees via UPI, and the university in London receives Pounds instantly. The “transaction”—including the FX conversion, AML (Anti-Money Laundering) checks, and KYC (Know Your Customer) verification—happens invisibly in milliseconds. The result is a reconciliation process that is automated, reducing administrative overhead by upwards of 40%.

The “Sponsor Dashboard”: Solving the Multi-Payer Puzzle

Education finance is rarely a single-player game. It involves parents, government sponsors, and employers. Embedded Finance 2.0 addresses this by “unbundling” the invoice.

-

Split-Payment Logic: Modern platforms now allow a single tuition invoice to be split automatically. A government grant pays 40%, a parent pays 40%, and the student pays the remaining 20%. Each party receives a custom login and payment link.

-

Visibility vs. Control: For international parents, this offers a “Sponsor Dashboard” where they can view exactly where their funds are going (e.g., locking funds so they can only be used for tuition and housing, not off-campus entertainment), adding a layer of trust to the cross-border transaction.

Driver C: Study Now, Pay Later (SNPL)

Education financing is moving away from the generic “Buy Now, Pay Later” (BNPL) model toward a specialized Study Now, Pay Later (SNPL) framework.

Unlike a bank that looks only at credit history (which most students lack), embedded lending algorithms inside Learning Management Systems (LMS) utilize alternative data. By analyzing academic performance, course progression, and future earning potential, these platforms can underwrite risk more accurately. This allows for “invisible lending,” where a student is approved for a tuition buffer or equipment loan simply by being in good standing, without ever leaving the school’s app.

Embedded Insurance: The “Invisible” Safety Net

In the 1.0 era, buying tuition insurance or protecting a laptop was a separate, clunky process involving third-party brokers. In the 2.0 era, protection is baked into the enrollment flow.

-

Tuition Protection: With global economic volatility, platforms are now embedding “Tuition Refund Insurance” at checkout. If a student is forced to withdraw due to medical reasons or visa denials, the claim is processed automatically via the platform, protecting both the student’s investment and the university’s retention metrics.

-

Micro-Insurance for Gadgets: As education becomes increasingly digital, the “tools of the trade” (VR headsets, high-performance tablets) are expensive. Vertical SaaS platforms now offer one-click “gadget protection” when students purchase equipment through the university store, underwritten instantly at the point of sale.

The AI Difference: Retention-Based Risk Models

How can a platform lend money to a student with no credit score? The secret sauce of Embedded Finance 2.0 is Behavioral Underwriting.

-

Data Beyond FICO: Instead of checking a credit bureau, 2.0 algorithms analyze academic “persistence” data. A student who attends 95% of classes and logs into the LMS daily is statistically less likely to default on a micro-loan than a student who hasn’t logged in for two weeks.

-

Retention as Collateral: For universities, acting as the lender (or guaranteeing the loan) makes financial sense because it prevents “financial dropout.” It is cheaper to lend a student $500 for a shortfall than to lose their $20,000 tuition revenue entirely.

The “Campus Super-App” Economy

Perhaps the most tangible manifestation of Embedded Finance 2.0 for the average student is the “Campus Super-App.”

Universities are increasingly building “closed-loop” economies. The plastic student ID is being replaced by a digital credential that serves as a master key for both physical access and financial transactions. This single app opens the dorm room door, pays for laundry, checks out library books, and purchases meal plan credits.

Data as the New Currency

This integration generates a wealth of behavioral data. In the 2.0 era, this data is used to foster financial wellness.

-

Example: If a student’s spending on late-night dining spikes 20% above the average, the app can nudge them with a budget tip or a discount coupon for the campus cafeteria.

-

Institutional Benefit: For the university, it keeps spending on campus and provides real-time visibility into the student body’s economic health, allowing for proactive support for students at risk of financial dropout.

The “Earn-to-Learn” Loop: Closing the Liquidity Gap

While much of the Embedded Finance 2.0 conversation focuses on paying universities, a rapidly growing sub-sector focuses on how students earn. With 2025 data indicating that over 70% of students work part-time, the gap between “earning” and “spending” is a major friction point.

-

Instant Payroll Integration: Innovative “Campus Super-Apps” are now integrating with university payroll systems. Instead of waiting two weeks for a direct deposit from a campus library job, students can opt for “Instant Pay” directly into their student digital wallet.

-

The Liquidity Benefit: This creates a closed-loop “Earn-to-Learn” cycle. A student finishes a shift at the campus bookstore at 4:00 PM and instantly receives funds to buy dinner at the dining hall at 5:00 PM. This liquidity reduces reliance on predatory high-interest credit cards for short-term cash flow gaps.

Challenges & The Road Ahead [2026-2030]

While the technology promises seamlessness, the “invisible” nature of these transactions introduces new complexities.

1. The “Invisible” Risk

When payments become frictionless, the psychological “pain of paying” disappears. There is a valid ethical concern that removing friction could lead to impulse spending on educational add-ons—premium content, certifications, or merchandise—leading to accidental debt accumulation for vulnerable students.

2. Regulatory Spaghetti

A global university accepting payments from 50 different countries effectively operates as a multinational bank. Managing the “RegTech” (Regulatory Technology) required to comply with banking licenses, data privacy laws (like GDPR), and sanctions lists across borders is a massive undertaking. We will likely see a rise in “Compliance-as-a-Service” layers specifically designed for the education sector to handle this burden.

Case Studies: Who is Leading the 2.0 Shift?

Theoretical models are rapidly becoming operational realities. Two key players illustrate how this infrastructure is being deployed globally in 2025:

-

Transact Campus (The “One ID” Ecosystem): Transact has moved beyond simple ID cards to a fully mobile-centric credential. Recent reports show they have provisioned over 1 million mobile credentials on Apple and Google Wallets. This “One ID” system allows students to tap their phone to unlock their dorm (access control) and immediately tap again to pay for laundry or vending (embedded payments), creating a seamless physical-financial identity.

-

Flywire (The Enrollment Preserver): Flywire’s recent fiscal reports highlight a strategic pivot from “payment processing” to “enrollment preservation.” By embedding predictive analytics into their billing platform, they helped institutions collect over $320 million in past-due tuition not by aggressive collections, but by offering flexible, embedded payment plans at the exact moment a student was at risk of dropping out due to non-payment. This proves that embedded finance is not just an efficiency tool, but a retention tool.

The Long Game: The Alumni “Neobank”

The relationship shouldn’t end at graduation. Innovative institutions are converting their “Student Super-Apps” into “Alumni Neobanks.”

-

The “Forever” Account: Instead of closing their student account, graduates keep it as a low-fee digital bank account tailored for early career needs.

-

Embeddable Giving: This creates a frictionless path for future donations. An alumnus can round up their daily coffee purchases (bought with their university-branded digital card) to donate spare change back to their scholarship fund, automating philanthropy through invisible finance.

Final Thought: The Diploma of the Future is Digital and Solvency-Verified

Ultimately, the goal of Embedded Finance 2.0 is not to turn universities into banks, but to let them focus on being universities. By automating the financial plumbing of the institution, we strip away the bureaucracy that distracts from learning. The winners in the next decade of global education will be those who recognize that the best payment experience is the one the student doesn’t even notice.

In this new world, solvency is verified as quietly as a transcript, and the path to graduation is cleared of its financial hurdles, invisibly.