Many people face money troubles every day. They deal with growing debt, tight budgets, and stress from bills that pile up. This leaves them feeling stuck and unsure about their future.

Dave Ramsey teaches that personal finance is 80% behavior and only 20% head knowledge. The Dave Ramsey family shows how simple steps can build strong habits. This blog post draws lessons from their methods to help you manage debt, budget well, and grow wealth.

It guides you through practical tips for better money choices. Keep reading to start your path to financial freedom.

The Importance of Financial Literacy

Dave Ramsey stresses that financial literacy forms the core of building strong financial foundations. He teaches that personal finance is 80% behavior and only 20% head knowledge. People succeed more from actions than from facts alone.

His approach centers on practical steps to manage money well. Ramsey points out the need to handle money God’s way. Good stewards use what they have wisely for true success. This mindset empowers individuals and families.

Readers can apply these ideas to improve their financial well-being. For more insights, check Dave Ramsey’s videos on YouTube about money habits.

Ramsey’s Five Foundations of Personal Finance guide students with basic steps to start money success. These include budgeting as a key focus in his teachings. Parents get practical help to teach young children wise money handling.

Families join in discussions and planning for better results. This builds financial education across ages. Wealth building starts with planning at every life stage. Anyone can learn to build wealth no matter their age.

These lessons offer valuable tools for money management and financial goals.

Lessons from the Ramsey Family on Debt Management

Dave Ramsey teaches people to skip unneeded loans, which keeps money free for other goals. His family shares stories in videos on YouTube, like “The Debt Snowball Method Explained,” that show quick wins in paying off bills.

Avoiding unnecessary debt

The Ramsey family stresses the need to avoid unnecessary debt as a core part of debt management. They teach that personal finance relies on 80% behavior and only 20% head knowledge.

People must act on what they know to build strong financial foundations. This approach fits into Dave Ramsey’s 7 Baby Steps program, which guides users to pay off debt step by step.

Families gain from open talks about money, as the Ramseys highlight communication to strengthen ties. Parents lead by example and involve kids in these plans. This method promotes financial responsibility from a young age.

Ramsey’s teachings urge people to handle money in God’s way and act as good stewards of their resources. His five foundations of personal finance offer basic steps for anyone to start building wealth at any age.

These steps focus on practical actions over mere facts. Budgeting plays a key role in this process. Families can use these ideas to improve their money management and reach financial goals.

Ramsey provides tools for parents to teach children wise money habits. His books and programs, like the debt snowball method, support this family-wide effort. View his videos on YouTube for more tips on avoiding debt and boosting savings plans.

The value of the debt snowball method

Dave Ramsey promotes the debt snowball method as a key tool in debt management. This approach focuses on paying off debts from smallest to largest, regardless of interest rates. Users list all debts and make minimum payments on most, while directing extra cash to the smallest one.

They eliminate that debt quickly, then roll the payment into the next smallest. Ramsey stresses that this method builds momentum through quick wins. He explains in his teachings, “Personal finance is 80% behavior and only 20% head knowledge.” People change habits by seeing progress, which boosts motivation for long-term financial goals.

This strategy fits into Ramsey’s 7 Baby Steps program, a core part of building strong financial foundations. Families apply it to avoid unnecessary debt and improve money management.

Parents teach kids these principles early, fostering financial literacy across generations. Ramsey’s books, like those on his practical steps, detail the method with examples. Readers can find videos on his website for more on cash flow management and wealth building.

The approach emphasizes actionable behavior over mere knowledge, helping individuals achieve financial empowerment.

Budgeting Strategies for Strong Financial Foundations

Dave Ramsey teaches people to build strong money habits with smart tools. He says, “A budget is telling your money where to go instead of wondering where it went,” which points to methods like zero-based plans and cash envelopes that help control spending and boost savings.

Check out his video on YouTube for tips that make these steps easy to follow.

Creating a zero-based budget

A zero-based budget gives every dollar a job before the month starts. This method ensures your income minus expenses equals zero, promoting strict money management.

- Dave Ramsey stresses that personal finance is 80% behavior and only 20% head knowledge, so use a zero-based budget to focus on what you do with your money, assigning every cent to categories like savings, bills, and fun to build strong financial foundations.

- Follow Dave Ramsey’s 7 Baby Steps program within your zero-based budget, starting with an emergency fund of $1,000, then paying off debts, to jumpstart your future and align with proven budgeting strategies.

- Involve the entire family in creating a zero-based budget, as Dave Ramsey offers practical help to parents on teaching young children how to handle money wisely, fostering financial education and responsibility from an early age.

- Handle money God’s way in your zero-based budget, being good stewards of what God has given, which Dave Ramsey teaches is key for financial success and strengthening family relationships through open communication on money matters.

- Emphasize budgeting as part of the Five Foundations of Personal Finance in your zero-based plan, basic steps any student can follow to kick-start money success, including saving for emergencies and avoiding debt for better wealth building.

- Build wealth at any age with a zero-based budget by planning at every life stage, using practical and actionable steps from Dave Ramsey’s teachings to live below your means and improve total financial well-being.

- Strengthen relationships with a zero-based budget through the Dave Ramsey Family’s focus on communication and planning in money matters, making it a tool for household budgeting and shared financial goals.

- Apply Dave Ramsey’s approach in your zero-based budget for practical lessons on personal finance, turning head knowledge into behavior changes that support investment planning and cash flow management over time.

Using cash envelopes for spending control

Dave Ramsey teaches that cash envelopes help control spending in a simple way. This method ties into his focus on practical steps for money management.

- Cash envelopes promote better budgeting strategies by assigning specific amounts to categories like groceries or entertainment, which stops overspending once the cash runs out.

- Parents use cash envelopes to teach kids about money management, as Dave Ramsey stresses involving the whole family in financial planning for wise habits.

- This tool supports the idea that personal finance is 80% behavior and 20% head knowledge, since it forces people to act on their budget instead of just knowing it.

- Dave Ramsey’s approach highlights cash envelopes as part of actionable steps in his teachings, making financial education real and effective for households.

- Families build strong financial foundations with cash envelopes, aligning with Ramsey’s view on being good stewards of money in a faith-based way.

- Envelope systems aid debt management by limiting impulse buys, which fits into Ramsey’s 7 Baby Steps for jumpstarting financial success.

- Users of cash envelopes often see improved cash flow management, as this method encourages living below your means and focusing on savings plans.

- Dave Ramsey recommends cash envelopes in his books, where he explains their role in wealth building through disciplined personal finance.

- This technique empowers financial literacy by turning abstract financial goals into tangible, everyday actions that families can follow.

- Experts note that cash envelopes enhance financial empowerment, drawing from Ramsey’s emphasis on practical help for all ages in money matters.

Building Wealth with Proven Principles

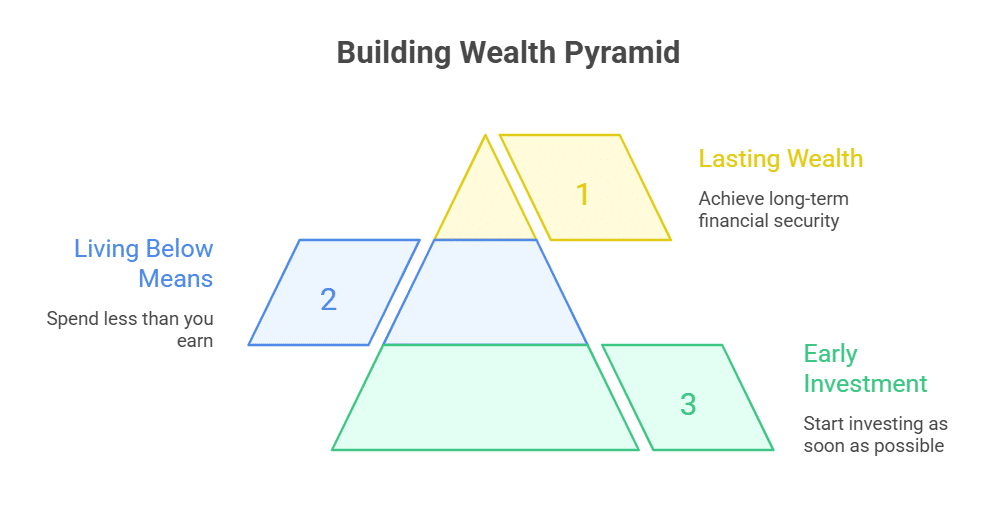

Dave Ramsey stresses the need to invest early, as he says in his book “The Total Money Makeover,” “The sooner you start, the more time your money has to grow.” People who live below their means build lasting wealth, and you can watch Ramsey explain this approach in his YouTube video on financial peace.

The importance of investing early

Investing early sets the stage for long-term wealth building. Ramsey stresses that personal finance relies 80% on behavior and just 20% on head knowledge. People must act on what they know to see real results.

Start small investments now, and watch compound interest grow your money over time. This approach fits into the 7 Baby Steps program, which guides families toward strong financial foundations.

Ramsey teaches that building wealth demands proper planning at every stage of life. Parents can involve kids in these talks to foster smart money management habits. Focus on practical steps like saving 15% of income for retirement.

“Money should always be handled God’s way,” Ramsey says, urging good stewardship for true success. Early action in investment planning empowers households to live below their means and reach big financial goals.

Living below your means

Dave Ramsey teaches that living below your means forms a core part of wealth building in personal finance. This principle encourages people to spend less than they earn, which supports strong financial goals and money management.

Ramsey stresses practical steps over just knowledge. He points out that personal finance is 80% behavior and only 20% head knowledge. People must act on what they know to succeed. Building wealth starts with proper planning at every stage of life.

Anyone can learn to build wealth at any age through these habits. The Dave Ramsey Family highlights communication and planning to strengthen relationships around money matters. They offer practical lessons for families to improve financial well-being.

Parents can lead by example in teaching kids about money management and financial education. Dave Ramsey provides help on handling money wisely as a family. He advises handling money God’s way and being good stewards of resources.

This approach ties into living below your means for long-term success. Practical actions, like following proven principles, help in cash flow management and savings plans. Ramsey’s teachings focus on actionable steps that empower individuals.

Families discuss and plan together to build strong foundations.

Teaching Kids About Money

Dave Ramsey teaches that parents must show good money habits to their children every day. He says, “We teach our kids to work, to save, and to give,” in his.

Instilling financial responsibility in children

Parents teach kids financial responsibility through everyday actions. Dave Ramsey stresses family involvement in money talks for better habits.

- Dave Ramsey helps parents guide young children on wise money handling, with a focus on family discussions and planning to build strong habits early. He points out that personal finance is 80% behavior and only 20% head knowledge, so kids learn more from what they do than from facts alone.

- Families strengthen bonds through open talks on money matters, as the Dave Ramsey Family highlights communication and planning in financial education. This approach fosters financial literacy and helps children set clear financial goals from a young age.

- Parents lead by example to instill responsibility, showing kids how to manage cash flow and create savings plans. Ramsey’s teachings urge adults to model good stewardship of resources, tying it to handling money in a faithful way for lasting success.

- Practical steps form the core of Ramsey’s method for teaching money management, rather than just theory. He advises involving the whole household in budgeting strategies to make financial planning a team effort that builds wealth over time.

- Children gain financial empowerment when parents use Ramsey’s lessons on debt management and investing. These ideas emphasize starting wealth building at any age, with tools like the 7 Baby Steps to jumpstart secure futures.

- Ramsey’s Five Foundations of Personal Finance offer basic steps for students and kids to follow for money success. Parents apply these to teach household budgeting and the value of living below means for solid foundations.

- Family financial well-being improves with Ramsey’s actionable advice on savings and investment planning. He encourages treating money as a tool for stewardship, which helps kids develop responsible behaviors that last a lifetime.

Leading by example as parents

Dave Ramsey stresses that parents lead by example in money matters. This approach builds strong financial habits in kids through daily actions.

- Dave Ramsey teaches parents to show kids wise money handling by involving the whole family in talks and plans, which boosts financial literacy and strengthens bonds over budgeting strategies and money management.

- Parents model good stewardship of money as Dave Ramsey advises handling it God’s way, focusing on what God provides to reach financial goals and build wealth.

- The Dave Ramsey Family highlights communication and planning in money talks, which helps relationships grow while teaching personal finance through real examples.

- Ramsey notes personal finance is 80% behavior and 20% head knowledge, so parents demonstrate this by living out debt management and savings plans in front of their children.

- His lessons offer practical steps for families to improve well-being, with parents leading by showing investment planning and cash flow management in everyday life.

- Ramsey provides help for teaching young kids about money, where parents set examples in wealth building and financial education to start strong habits early.

Recommended Reading: Dave Ramsey Books

Readers can explore Dave Ramsey’s books to gain practical insights on personal finance. These works outline the Five Foundations of Personal Finance, which guide students toward money success.

They also detail the 7 Baby Steps program, a key method to build strong financial foundations. One core idea stresses that personal finance is 80% behavior and only 20% head knowledge.

This focus helps individuals act on their financial goals. Books emphasize budgeting strategies and debt management, with tips on avoiding debt and using the debt snowball method. They promote living below your means and investing early for wealth building.

Parents find value in sections that teach kids about money management. These parts encourage family discussions and financial education. Ramsey’s approach ties money handling to being good stewards, as he notes it aligns with handling resources God’s way.

His teachings foster communication in relationships through shared financial planning. To dive deeper, check Ramsey’s videos on YouTube for examples of these principles in action. Such resources enhance understanding of savings plans and cash flow management.

They offer actionable steps for household budgeting and investment planning at any age.

Takeaways

Dave Ramsey’s lessons guide families toward lasting financial stability. Families apply these principles to manage debt and build wealth effectively. “Personal finance is 80% behavior and 20% head knowledge,” Dave Ramsey states in his teachings.

Check out his website for videos on the 7 Baby Steps. These steps empower you to create a secure future.

FAQs

1. What key lessons does the Dave Ramsey family teach about building strong financial foundations?

The Dave Ramsey family stresses the value of living on a budget, avoiding debt, and saving for emergencies to create lasting financial security. They share real-life stories from their own experiences to show how these steps lead to freedom from money worries. In a video on his YouTube channel, Dave Ramsey says, “The borrower is slave to the lender,” highlighting the need to pay off loans quickly.

2. How can families apply Dave Ramsey’s advice to reduce debt?

Dave Ramsey promotes the debt snowball method, where you pay off smallest debts first to build momentum. This approach, drawn from his family’s journey out of bankruptcy, helps families gain control over their finances.

3. Why is an emergency fund vital in the Dave Ramsey family’s financial plan?

An emergency fund acts as a safety net for unexpected costs, preventing the need for new debt. The family recommends starting with $1,000, then building to three to six months of expenses. Dave Ramsey explains in his book, “Financial Peace,” that “Murphy repellant is what we call an emergency fund,” to prepare for life’s surprises.

4. What role does family communication play in building financial foundations, per the Dave Ramsey family?

Open talks about money help families align on goals and avoid conflicts. The Ramseys model this through shared decisions on spending and saving, as seen in their social media posts about family budget meetings. Such habits foster unity and teach kids smart money skills from a young age.