You might feel stuck in a mountain of paperwork and high fees when you make real estate transactions. Blockchain technology can speed up deals, cut costs, and add proof to every sale.

In this post we will show how smart contracts, digital assets, and public blockchain tools can cut steps and speed title and escrow work. Read on.

Key Takeaways

- Smart contracts on public blockchains like Hyperledger Fabric automate deeds and escrow rules. They cut manual paperwork and speed property transactions by up to 90% while slashing intermediary fees by up to 90%.

- Tokenization lets investors buy slices of a building like shares. In 2021, a luxury Manhattan loft split into 500 tokens at $5,000 each. Platforms such as Ethereum and Hyperledger Fabric log each token transaction in hours and cut broker fees by 90%.

- Public and private ledgers secure land registries with cryptographic hashes and digital identities. They cut title search times from weeks to hours and fight about 30% of title fraud in some markets. Smart contracts lock updates in a permanent audit trail.

- Blockchain speeds up real estate financing with self-executing mortgage contracts on Ethereum and Hyperledger Fabric. It cuts mortgage times from 45 days to about 10 days and saves buyers up to 20% in fees and closing costs. Peer-to-peer loans on public ledgers link investors directly to borrowers and remove bank fees.

- Adoption faces legal and technical hurdles. Germany set property token frameworks in 2021, but most US states have no guidance. Public blockchains like Ethereum handle about 15 transactions per second and Bitcoin handles about 7, which can bottleneck property deals. Firms must build custom APIs to link legacy databases with distributed ledgers and manage shared liability.

Smart Contracts in Real Estate

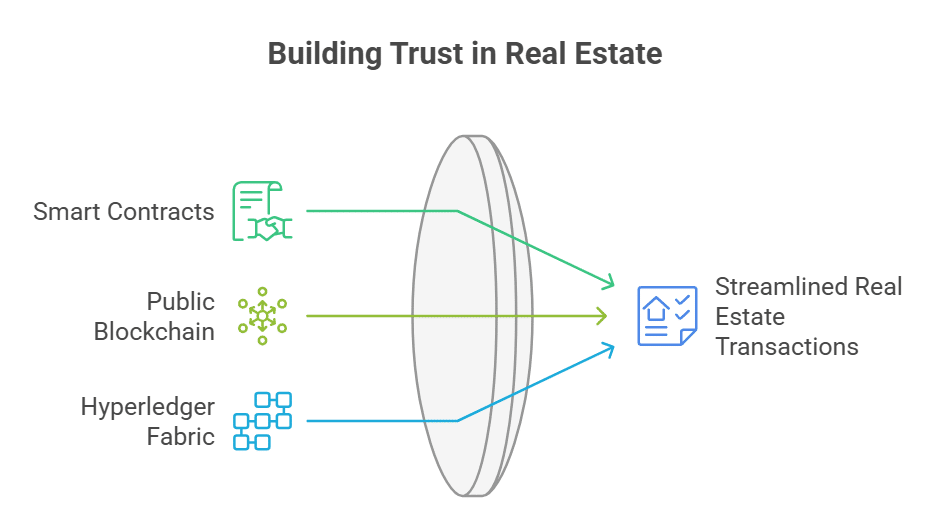

Smart contracts end old paper jams, and they run on a public blockchain. Developers build them on Hyperledger Fabric, so every deal lands on a tamper-proof ledger.

Automation of Property Transactions

A blockchain platform uses smart contract code to handle deeds and escrow rules. It logs every step on a shared database and locks funds once conditions meet. It slashes manual paperwork, cuts time by up to 90 percent, and drives efficiency in property exchanges.

The network confirms each action by consensus, so parties skip long trust checks and avoid shadow transactions.

Real estate firms now run prototypes on permissioned networks built with an open source blockchain framework. A digital identity layer links buyer credentials to land registry records.

Teams close deals faster, cut intermediary fees, and boost security. They drop extra expenses and keep every record verifiable.

Reducing Intermediary Costs

Smart contracts cut out escrow firms and title companies. They record property deals on permissioned blockchains. This shift slashes fees by up to 90%, boosting efficiency in real estate transactions.

It drops trust reliance, avoids manual paperwork and speeds fund transfers through crypto wallets and tokenized digital assets.

Tokenization of Real Estate Assets

A fungible token can slice a high-rise into tradable bits, so investors can buy a sliver of a building like they buy shares of stock. Token Studio and Securitize mint non-fungible collectibles that tie deeds to smart contracts on a public blockchain, cutting through red tape and speeding up closings.

Fractional Ownership Opportunities

Blockchain turns big properties into bite sized shares on public blockchains. In 2021, a luxury Manhattan loft got sliced into 500 tokens on an Ethereum smart contract. Investors bought digital shares starting at $5,000 each.

This model slashes broker fees by 90 percent.

Digital wallets hold these real estate tokens like digital assets. Some platforms run on private networks built on Hyperledger Fabric to meet compliance rules. The ledger logs each share in real time so buyers track transactions with verifiable proof.

These tools cut manual paperwork, and extra expenses. This system removes the need for trust by letting network nodes verify every deal.

Enhanced Liquidity in Real Estate Markets

Tokenizing assets breaks a property’s value into digital tokens. This change speeds up sales. Platforms like Ethereum and Hyperledger Fabric power these markets. A transaction can settle in a few hours.

It cuts out manual paperwork and extra fees. Security rises as all transactions gain network verification.

Smart contracts handle escrow, title transfer and compliance automatically. Clients rely on blockchain technology to link token records with property deeds. Investors can trade tokens on digital asset exchanges at any hour.

The network verifies each step, removing the need for trust. Real estate investors see more market depth as buyers and sellers connect online. Liquidity flows fast, like water rushing through a riverbed.

Transparent and Secure Land Registries

A public ledger network shines light on each title swap, so you spot errors in real time. A permissioned ledger framework pairs smart contract logic with digital identity tokens and seals every deed with a tamper-proof hash.

Fighting Fraud and Ownership Disputes

Title fraud plagues 30 percent of property deals in some markets. Blockchain technology stamps out forged deeds with a shared ledger that all participants can inspect. Smart contract platforms like Ethereum and Hyperledger Fabric record each deed transfer with cryptographic signature and digital identity checks.

Property firms cut time by 40 percent and slash intermediary costs as the network verifies every step. Law firms flag fewer disputes when each record links to a public blockchain or private blockchain node and timestamp.

Courts still debate liability for errors on a distributed ledger, so legal teams watch blockchain governance rules closely. Safe title transfer requires clear standards and regulatory guidance, as shared liability can spark new lawsuits.

Improving Record Accuracy and Accessibility

Land registries suffer from shadow transactions, manual paperwork, and extra expenses. A public blockchain stores land deeds on a distributed ledger, giving every stakeholder a permanent, timestamped copy.

Smart contracts lock updates in an audit trail, so no one can tamper with titles. It boosts data security, cuts fraud, and speeds approvals. States test private blockchain pilots under new blockchain governance and blockchain standards.

Cloud-based databases link title offices, banks, and surveyors over a peer-to-peer network. Digital identity solutions map each owner to a cryptographic key, so only authorized users view records.

That setup cuts title search times from weeks to hours and removes the need for trust, since the network verifies all transactions. It meets privacy rules and data availability needs in capital markets.

Blockchain for Real Estate Financing

Blockchain can slash mortgage times, with self-executing smart contracts on an open-source chain. It also drives peer-to-peer loans, using secure digital identity checks on an enterprise ledger.

Streamlined Mortgage Processes

Lenders slice approval time with smart contracts on Ethereum, they automate property deals. Borrowers share digital identity via a public blockchain, so banks verify faster. Title firms scan deeds in minutes instead of days.

Real estate transactions shrink from 45 days to about 10.

Buyers save up to 20 percent in fees and closing costs. The network verifies each record, so no one needs extra trust. Private blockchain like Hyperledger Fabric links banks, underwriters, appraisers on one platform, cutting manual paperwork and shadow deals.

It boosts security, slashes expenses, and speeds the whole process.

Peer-to-Peer Lending Solutions

Property owners access cash directly from investors via smart contracts on a public blockchain like Ethereum. This setup cuts bank fees and speeds deals. It slashes manual paperwork and extra expenses.

Network peers verify each real estate transaction, so no one has to assign trust to a middleman.

A decentralized application handles loan origination and repayment. It ties digital identity to credit checks. Investors buy digital assets that represent mortgage shares. Platforms such as Hyperledger Fabric manage private blockchain records.

Firms weigh blockchain adoption as both a tech step and a key business move. They also mind legal risks around distributed liability on distributed ledgers.

Challenges in Real Estate Blockchain Adoption

Title insurers hit roadblocks when they code smart-contract deals on public ledgers. They wrestle with slow price feeds from oracles and legacy interfaces on a permissioned ledger platform.

Legal and Regulatory Barriers

Lawmakers lack clear rules on blockchain technology in real estate. They debate smart contracts and tokenized assets. In 2021, Germany set frameworks for property tokens but most states offer no guidance.

US regulators split on cryptoasset oversight, raising compliance concerns. No global standard on digital identity slows deed transfers on public blockchain networks. Real estate firms juggle business strategy and legal compliance.

Courts tackle cases about self-enforcing agreements. Distributed ledger liability falls on every node. A 2022 pilot with Sweden’s land agency paused when authorities demanded paper deeds.

Trials on private blockchain registries stalled under vague title laws. Investors see blockchain adoption as a business and legal choice. Firms must test blockchain governance and security to cut costs and boost efficiency.

Scalability and Integration Issues

Scaling a public blockchain feels like squeezing a 10-lane highway through a narrow alley. Ethereum and Bitcoin handle about 15 and 7 transactions per second, while real estate deals need more room.

A private blockchain can raise throughput, but it still hits a ceiling. Developers on a Fabric project say chaincode calls spike network load. Slow speeds stall title transfers and drag manual paperwork back into play.

Firms lose security gains and efficiency when they wait for verifiable digital assets on chain.

Integration of blockchain technology with legacy databases brings more headaches. A state land registry often runs on SQL servers. Merging distributed ledger data requires custom API work and a team of IT pros.

A title company might hire a software architect to stitch together digital identity modules, smart contracts, and mortgage lender systems. Those tools can clash with property management platforms.

Legal teams fret over the distributed liability hidden in each record link. Firms must balance cost reduction goals with compliance and security needs.

Future Opportunities in Blockchain Real Estate

Imagine a public ledger that ties digital identity to property deeds, while IoT sensors feed rent data into smart contracts, lighting up fresh finance models. Wallet apps and dev consoles let agents tap into cross-border funding streams and tokenized assets, triggering big shifts in how we buy and sell homes.

Expanding Global Market Access

Real estate firms tap cross-border markets with blockchain. A public blockchain ledger acts like a global posting board. It gives clear, verifiable property records. Smart contracts release digital assets once payment clears.

They cut processing time from weeks to days. They slash intermediary taxes and fees. They reduce manual paperwork and extra expenses. Blockchain removes the need for trust, since every detail gets network verification.

More investors join a digital economy with peer-to-peer lending and cross-border payments. They bring new venture-capital and global buyers into local markets via a stock exchange.

Private blockchain networks secure sensitive ownership details. They use digital identity tools and encryption methods to guard personal data. They fit large firms and startups worried about hacking or double spending.

Companies find strategic business value in blockchain adoption. They drop costs by automating workflows and speed up compliance checks. Some use a public blockchain tie-in for liquidity.

Others pick a private ledger for governance control. Those choices drive blockchain innovation and real estate transactions across borders.

Innovations in Smart Property Management

Blockchain technology records sensor readings on a public blockchain. IoT sensors track temperature, moisture, and door status. A private blockchain logs tenant digital identity and lease terms.

Building managers cut manual paperwork, stop shadow transactions, and slash extra costs.

Smart contracts release vendor pay once a repair clears automated checks. The system removes need for trust by checking each record across nodes. Data on digital assets flows fast, so tenants get quick fixes and rent notices.

Firms boost efficiency, drop processing time, and lower expenses. Legal teams flag risks from distributed liability on ledgers.

Takeaways

Token deals bring small investors. Coded agreements speed deals and cut fees. Land records stay clear and safe on a shared log. Mortgage workflows run fast with little fuss. Person-to-person loans power new buyers.

This wave holds real gains for agents and buyers. No magic wands here, just code.

FAQs on Blockchain in Real Estate

1. What is blockchain technology in real estate?

Blockchain technology works like a shared notebook, it records real estate transactions in a secure way. You can run it on a public blockchain or private blockchain network. It adds layers for digital identity, tracks digital assets, and powers smart contracts.

2. How do smart contracts speed up property deals?

Think of smart contracts as robot notaries that never sleep. They check deal terms, free funds, and tuck out the middleman. They make cross-border payments smoother and fit into other blockchain applications.

3. What are some blockchain use cases beyond buying homes?

These blockchain use cases help builders watch supply chains for materials, from cement mixers to door frames. They handle royalty payments for architects and log each step with radio-frequency identification. Developers spot issues fast, like finding a needle in a haystack.

4. What holds back blockchain adoption in real estate?

Blockchain scalability can stall when the network grows. We still lack firm blockchain standards for deals and tech. Groups like the global forum, weforum.org, call for better standardization and clear information from regulators.

5. How do developers measure return on investment with blockchain innovation?

They count cost cuts, speed gains, and fewer errors. They spot competitive advantages, new business models, and network effects that boost value. They build incentives, track return on investment, and join the digital economy in real time.

6. Can digital assets change real estate markets?

Yes, you can trade cryptoassets or tokenized property shares like digital baseball cards. You can launch initial coin offerings or list on an nft marketplace. This cashless society tool speeds cross-border payments and drives a global digital identity for assets.