Hong Kong’s SaaS market is booming, but finding the top players can feel like searching for a needle in a haystack. You might wonder which companies lead the pack and how they stack up in revenue.

Whether you’re an investor, entrepreneur, or just curious, knowing who’s who matters.

The top 6 SaaS firms in Hong Kong rake in a whopping $4.86 billion. This blog breaks down the top 10 highest-revenue SaaS companies, from travel giants like KLOOK to fintech stars like MioTech.

You’ll get the inside scoop on their success, challenges, and what’s next. Ready to see who made the cut? Keep reading.

Key Takeaways

- Six leading Saas brands earn nearly \$4.86B combined. Travel giant Klook tops at \$201.7m\, followed closely FreedGroup (digital biz-tools) raking \$100m annually.

- Finteh dominates rankings – four entries specialize there including Miotech (\$35m\,AI-driven investing\/ESG) \& Fundpark (\$95m\,supply-chain loans).

- Local VC fuels expansion – Alibaba Entrepreneurs Fund \& others inject \$454m+ specifically targeting BtoB segments within GBA region demands.

- Niche innovators shine despite modest sales figures – Examples include pharmacy-focused PocPharma (\$106mil) \& meme hub turned serious earner 99GAG (~24mil/yr).

- Challenges persist around scaling past HK borders due largely limited domestic client pools forcing lean ops tactics among most listed outfits today

Hong Kong’s SaaS Market Overview and Key Players

The tech scene in Hong Kong is booming with new ideas—SaaS companies in this city thrive on astute funding agreements from major investors like Alibaba Entrepreneurs Fund or Animoca Brands Ventures Fund, who place significant early-stage bets. They believe that short-term wins and long-term plays should be well-balanced so that everyone gets paid eventually and there isn’t too much drama on either side.

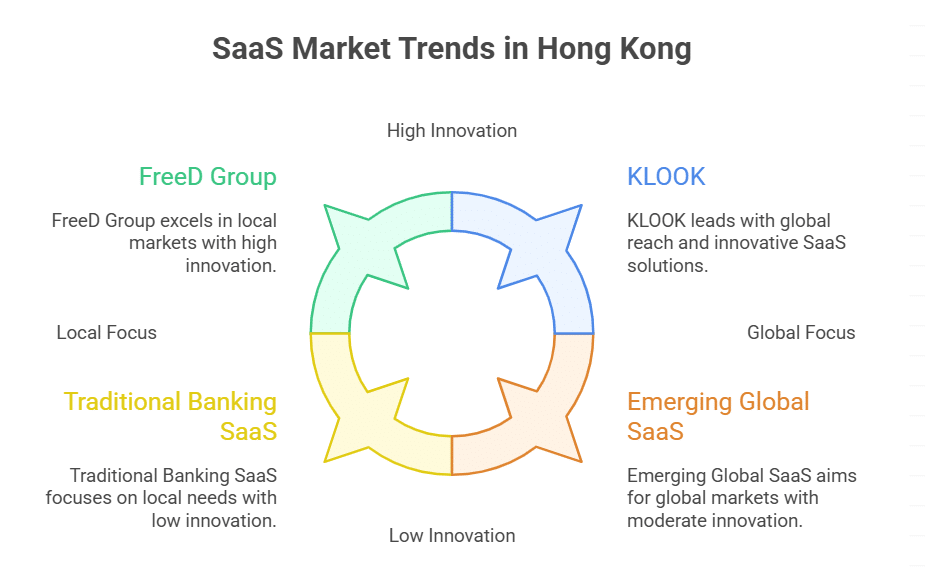

What are the current SaaS market trends in Hong Kong?

Hong Kong’s SaaS market is booming, with companies focusing more on app quality and customer service than vendor location. Venture capital is fueling growth, pushing B2B SaaS providers to aim for global markets.

Startups and established firms thrive, offering everything from fintech to cloud solutions.

The Greater Bay Area drives demand for SaaS tools in finance, AI, and compliance. Companies like KLOOK and FreeD Group lead with strong revenues. Cloud computing and digital transformation shape Hong Kong’s tech landscape, making SaaS a hot spot for investors.

Trends show hybrid models blending cloud platforms with local banking needs.

How is the startup ecosystem and investment climate evolving?

Hong Kong’s startup ecosystem is growing fast. The city has become a hot spot for fintech and SaaS companies. Venture capital firms are pouring money into the sector, with top fintech startups raising over $1.46 billion.

Software and data startups alone have secured more than $454 million in funding.

The investment climate favors innovation, especially in AI and blockchain. Ecommerce and retail startups grabbed $299 million in recent years. Big names like Tyme, Qupital, and Hex Trust led the charge with funding rounds of $492M, $419M, and $457M respectively.

The rise of cloud technology and digital property rights keeps drawing global investors to Hong Kong’s SaaS market.

What are the notable investments, acquisitions, and IPOs in this sector?

The SaaS scene in Hong Kong is buzzing with big moves. Companies like WATI, Shopline, and Respond.io have pulled in major funding for their customer engagement and e-commerce tools.

Ten unicorn startups in the city have raised over $7 billion, showing strong investor confidence. The Software & Data sector, which includes SaaS, has topped $454 million in funding.

Investments in AI-driven platforms like MioTech and travel SaaS giant KLOOK highlight the market’s diversity. While IPOs are fewer, firms like 9gag and FreeD Group prove steady growth with revenues hitting $23.7M and $100M.

Venture capital funds keep fueling innovations, especially in fintech and cloud apps. Hong Kong’s SaaS market isn’t slowing down.

Top 10 Highest-Revenue SaaS Companies in Hong Kong (2024/2025)

Hong Kong’s SaaS scene is booming, with companies like KLOOK and FreeD Group leading the pack. These tech giants rake in millions by solving real-world problems with smart software solutions.

What are the backgrounds, products, and revenues of the top SaaS companies?

Hong Kong’s SaaS market is booming, with companies like KLOOK leading the pack at $201.7M in revenue. The travel platform helps users book activities and e-tickets globally. FreeD Group follows, pulling in $100M by offering digital solutions for businesses.

MioTech uses AI to boost finance and ESG efforts, earning $35M.

Content lovers know 9gag, an online community making $23.7M yearly. OneSky Inc., a translation management system, hits $18.1M in revenue. Kiu Global supports SMEs with banking ERP tools for $18M.

Genesis Mining mines crypto via cloud tech and earns $13.2M. POC Pharma’s pharma SaaS makes $10.6M while WATI helps teams chat with customers on WhatsApp for $9.6M. FundPark rounds out the list at $9 .5 M , using fintech to streamline supply chain financing .

KLOOK – ($201. 7M revenue, travel SaaS platform)

KLOOK leads Hong Kong’s SaaS market with $201.7M in revenue. This travel platform helps users book tours, tickets, and activities worldwide. Its easy-to-use interface and strong partnerships make it a top choice for travelers.

The company thrives in Hong Kong’s fintech and digital property rights scene. AI tools and cloud applications boost its global reach. KLOOK’s focus on customer engagement keeps it ahead in the competitive SaaS space.

FreeD Group – ($100M revenue, digital solutions provider)

FreeD Group is a top SaaS company in Hong Kong, pulling in $100M in revenue. It offers digital solutions that help businesses streamline operations. The company stands out for its focus on innovation and scalability in the competitive SaaS market.

With a strong presence in Hong Kong, FreeD Group serves clients across finance, retail, and logistics. Its tools make workflows faster and more efficient. The company’s success comes from solving real-world problems with smart tech.

Investors and venture capitalists see big potential in its growth.

MioTech – ($35M revenue, AI for finance and ESG)

MioTech is a Hong Kong-based SaaS company making waves with AI-powered finance and ESG solutions. With $35 million in revenue, it serves businesses needing smart data tools for investment decisions and sustainability tracking.

The platform uses artificial intelligence to analyze financial trends and ESG metrics. It helps firms stay ahead in regulatory compliance and green investment strategies. Companies in banking and asset management rely on its deep insights for smarter moves in fast-changing markets.

9gag – ($23. 7M revenue, online community and content platform)

9gag is a popular online community and content platform based in Hong Kong. With $23.7M in revenue, it stands out as a major player in the SaaS market. The platform thrives on user-generated humor, memes, and viral content, attracting millions worldwide.

Its success comes from a simple yet engaging model, blending social media with SaaS tools. The company taps into digital trends, AI moderation, and scalable cloud infrastructure. While competing with giants, 9gag keeps its niche by focusing on quick, shareable content.

The Hong Kong startup ecosystem continues to support its growth.

OneSky Inc. Limited – ($18. 1M revenue, translation & localization)

OneSky Inc. Limited is a top SaaS company in Hong Kong. It brings in $18.1 million in revenue. The firm specializes in translation and localization services. Businesses use its tools to adapt content for global markets.

The platform helps companies reach customers in different languages. It streamlines workflows, saving time and costs. With strong growth, OneSky stands out in Hong Kong’s SaaS market.

Its solutions support e-commerce, apps, and marketing needs. Demand for localization is rising fast in Asia and beyond.

Kiu Global – ($18M revenue, banking and ERP for SMEs)

Kiu Global serves small and medium businesses with banking and ERP solutions. The company hit $18M in revenue by streamlining financial operations for SMEs in Hong Kong.

Their tools help firms manage payments, accounting, and other backend tasks easily. With a focus on fintech SaaS, Kiu Global boosts efficiency for growing companies. They prove that niche solutions can drive big results in the competitive SaaS market.

Genesis Mining – ($13. 2M revenue, cloud cryptocurrency mining)

Genesis Mining makes $13.2 million yearly by offering cloud-based cryptocurrency mining services. The Hong Kong SaaS company lets users mine Bitcoin and other digital currencies without buying expensive hardware.

The platform uses cloud computing to handle mining operations remotely. This approach cuts costs for customers while tapping into Hong Kong’s growing fintech and blockchain sector.

The company ranks among the top SaaS revenue generators in the region.

POC Pharma – ($10. 6M revenue, pharma SaaS platform)

POC Pharma brings digital solutions to the pharmaceutical industry. With $10.6M in revenue, its SaaS platform helps streamline drug discovery and precision medicine workflows.

The company focuses on biomarkers and drug candidates, making processes faster for researchers. Serving Hong Kong’s growing biotech sector, POC Pharma taps into artificial intelligence and cloud-based tools.

It’s a key player in Asia’s SaaS market for pharma.

WATI – WhatsApp Team Inbox – ($9. 6M revenue, customer engagement)

WATI helps businesses talk to customers on WhatsApp. This SaaS tool turns the messaging app into a team inbox, making chats easy to manage. With $9.6M in revenue, it’s a big player in Hong Kong’s customer engagement scene.

The platform suits small and large teams needing quick replies. It supports shared inboxes, automation, and analytics. WATI proves you don’t need flashy tech to win in fintech or e-commerce—just smart solutions people actually use.

What Makes These SaaS Companies Successful?

These SaaS companies thrive by solving real problems, using smart tech like AI and cloud tools, and quickly adapting to market needs—read on to see how they do it.

What are the key success factors like innovation and scalability?

Successful SaaS companies in Hong Kong thrive on innovation and scalability. They constantly adapt to market needs, using AI and cloud tech to stay ahead. Firms like MioTech leverage AI for finance and ESG, showing how smart tools drive growth.

Scalability comes from cloud services, allowing businesses to expand fast without heavy costs.

Local SaaS firms also focus on solving real problems. Kiu Global helps SMEs with banking and ERP software, filling a critical gap. Platforms like WATI improve customer engagement through WhatsApp, proving simplicity sells.

These companies scale globally by starting small, testing ideas, then expanding fast. Investors back winners who show clear value and steady growth.

How do these companies impact customers and industries locally and globally?

Hong Kong’s SaaS companies shape industries both locally and globally. Firms like KLOOK and FreeD Group streamline travel and digital solutions, boosting efficiency for small businesses and enterprises.

AI-driven tools from MioTech help financial firms meet ESG goals, while WATI improves customer engagement through WhatsApp. These innovations set trends across Asia and beyond.

Global markets benefit from Hong Kong’s SaaS growth. Products like ezTalks and PureVPN serve international users with localized features. B2B vendors expand worldwide, supported by venture capital.

The mix of fintech, e-commerce, and AI tools strengthens supply chains, healthcare, and digital economies far beyond the city.

What challenges do they face and how do they plan to grow?

Hong Kong’s SaaS companies face tough hurdles. A small local market forces them to expand globally for growth. Many firms report stagnant revenue, with 20 showing zero growth. Funding is scarce, as 23 out of 30 companies raised under $1 million.

Low customer engagement plagues some, with a few having no clients at all.

These firms tackle challenges by focusing on niche markets like e-commerce and finance. Lean teams, often under 10 employees, push efficiency. To scale, they leverage SaaS solutions and AI, targeting sectors with high demand.

Partnerships and VC funds help bridge funding gaps, while innovation drives customer interest.

Takeaways

Hong Kong’s SaaS scene is booming, with top players like KLOOK and FreeD Group leading the charge. Innovation and smart scaling drive their success, from travel tech to AI-powered finance tools.

The market’s small size pushes firms to think global early, adapting cloud solutions for Asia’s unique needs. Curious how your business can tap into this growth? Watch these companies for trends in fintech, customer engagement, and beyond.

With rising digital demand, Hong Kong’s SaaS stars are just getting started.

FAQs on Highest‑Revenue SaaS Companies in Hong Kong

1. Which SaaS companies in Hong Kong make the most money?

The top revenue-generating SaaS companies in Hong Kong include Animoca Brands, Freed Group, and Zhongan Online P&C Insurance. These firms lead in digital property rights, cloud services, and financial tech.

2. How does the SaaS market in Hong Kong compare to China?

Hong Kong’s SaaS market thrives on foreign exchange flexibility and ties to the Chinese market. Companies like Alibaba Group and Baidu Inc. expand here, but local players like Gogox dominate niche sectors.

3. Do Hong Kong SaaS startups focus only on software?

No. Many, like Nvidia-backed firms, blend AI, blockchain, and design software. Others, such as Meitu, mix SaaS with creative tools, proving versatility drives growth.

4. What fuels growth for SaaS firms in Hong Kong?

Venture funds, IPOs, and partnerships with giants like Oracle NetSuite push growth. The city’s public cloud adoption and economic policies help, too.

5. Can small SaaS startups compete with big players in Hong Kong?

Yes. Startups often target gaps, like omnichannel solutions or niche markets (e.g., breathalyzer tech). With agile strategies, they carve space beside giants.