If you are running a business in the construction industry, then you already know just how rewarding it can be. So many projects that can bring in great profits. But then, you also know just how risky and dangerous it can be. Property damage, on-site injuries, project delays… Plenty of things that can cost your company quite a lot of money.

This is why you want to find a way to protect yourself, your workers, as well as your future in general. And proper insurance for your construction company is the way. While you may understand already, there is a chance that you are not entirely sure how to actually find and get a good solution for your particular company. Well, that has to change, hasn’t it?

So, if you are ready for that to change, here is what we are going to do. In the simplest words possible, below we are going to offer some tips on how you can find and get a good construction insurance for your company. Using those tips, you will have a much easier time going through the process and actually getting the perfect solution. Thus, you should keep on reading to figure out what you have to do in the process.

What Is Construction Insurance & Why Do You Need It?

Before we get to that topic, though, we first have to make sure that you understand what construction insurance is and why it is so important for your company in the first place. After all, if you’re not sure why you need it, you may not take things seriously, which could result in you not getting the coverage you need, and thus leaving your firm open and vulnerable to all kinds of risks. Since that is not what you want, let us make things clearer.

Construction insurance exists to protect your business against lawsuits, on-the-site injuries, equipment damage, and many, many more things. So, we are talking about a package of policies that serve to keep your business financially safe in case anyone files any kind of a claim against you. And, since it is a package of policies, it means that construction insurance comes in many forms, and that you should be careful to decide what it is that you precisely need, so that you can then get the best solution for you. We will, however, get to that a bit later.

First, we need to answer the question of why you may need this kind of coverage in the first place. That should be quite obvious, though. Basically, no matter how responsible you are when doing your business, accidents can happen, and you don’t want to wind up losing your company thousands and thousands of dollars just because you haven’t been properly covered. That’s where insurance comes in, aiming at protecting your finances in any unexpected situations, from accidents and injuries to property damage and much, much more.

How to Find and Get a Good Solution?

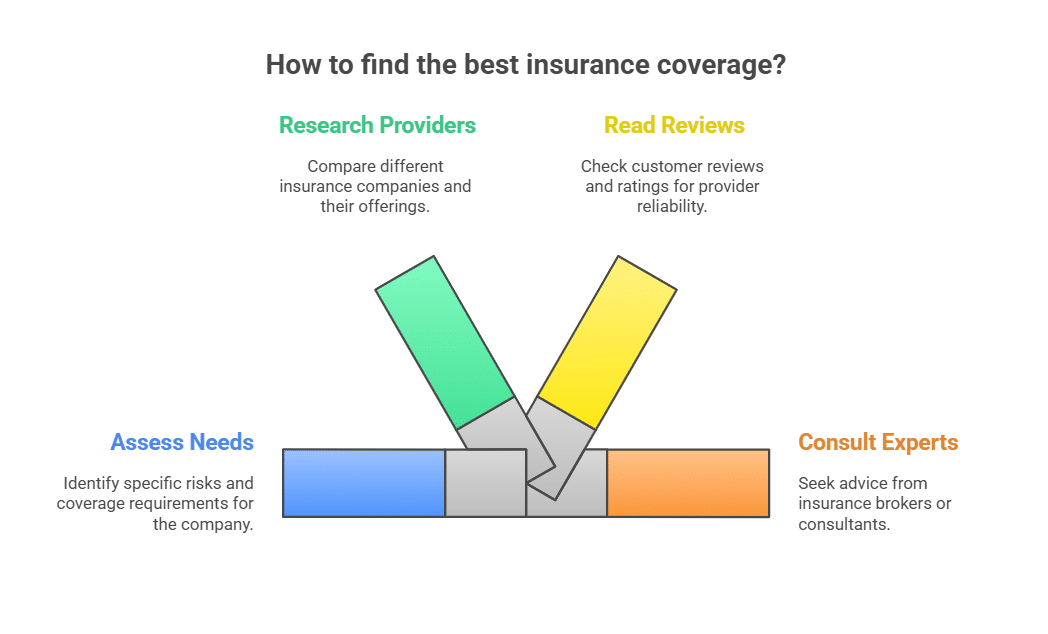

The above should have made things a bit clearer when it comes to why you may need this type of coverage. This allows us to proceed to our main question for the day. And, that is the question of how you can find great insurance for construction companies and thus get properly protected against various risks that may come your way while in this business. So, without any further ado, let me provide you with a list of tips that should help you find and get the best solution.

- Figure Out the Type You Need

As I have mentioned above, we are talking about a set of policies here, which means that there are different types of insurance you can get for your construction company. Clearly, thus, the first thing you have to do is figure out what it is that you precisely need. From general liability insurance, builder’s risk insurance, worker compensation, to subcontractor default insurance and more… Your task is to carefully check out all of those options, in an effort to understand what you can get from all of them, and then decide what it is that you precisely need. This will make the process of shopping around for the right coverage much easier.

- Work With an Experienced Broker

Of course, as much as understanding your needs is sure to make things easier, we cannot deny the fact that you may need help along the way. After all, there are just so many different insurance companies out there, and listing through all of them can be time-consuming. Not to mention that you may not know how to separate the good ones from the bad ones, which can result in you being nothing but confused during the researching process. Therefore, getting help is a very good idea.

What kind of help are we talking about here, though? Well, to cut right to the chase, to get the perfect construction insurance for your company, you should work with an experienced broker. Those professionals will be able to more easily find the right options for you, and to, thus, save you not only time, but also money. Go here to understand the importance of insurance in this industry even better.

- Research the Insurance Companies You Come Across

Now, either alone or through a broker, you will come across different insurance companies that will be ready to offer you the coverage you need. Naturally, you shouldn’t agree to work with any of them before you do some extensive research. Check how long they have been in this business and do your best to determine their reputation as well, as that is sure to help you figure out which companies may be trusted and reliable, and which ones you should better avoid. Search for the info online, but potentially also talk to previous clients if possible, and don’t forget to also get in touch with the pros you’re considering and ask any questions you may have.

- Review the Policies Carefully

Before you make the final choice, make sure to review the policies you have offered. Check what it is that’s covered. Check whether all your requirements are met. And compare various policies, but not only in terms of the prices, but also in terms of the actual level of protection they are offering.

- Regularly Review and Update if Necessary

Here is one final thing to know. As you keep on doing business, and growing for that matter, your needs and requirements may change. This is why you should regularly review your policies and then update them if necessary. That’s how you’ll stay protected, by always being properly covered with the right insurance solution.