College costs keep climbing higher each year. Many students feel lost when they search for the right student loan. You might wonder which lender offers the best rates or which loan fits your budget.

The maze of loan options can make your head spin.

Traceloans.com Student Loans provides a clear path through this confusion. The platform helps students compare different loan types and find competitive interest rates. Federal loans often beat private loans with lower rates and better repayment plans.

This guide will show you how to use Traceloans.com to make smart borrowing choices. You’ll learn about application steps, repayment options, and ways to save money on your education debt.

Your wallet will thank you later.

Key Takeaways

- Traceloans.com helps students compare federal and private loan options with competitive rates and transparent terms without hidden fees.

- Federal student loans typically offer lower fixed interest rates and better repayment plans than private loans with variable rates.

- The online application process takes minutes and most applications receive approval within 24 hours of submission.

- Students can choose flexible repayment options including deferred payments, interest-only payments, or full monthly payments based on their budget.

- Complete your FAFSA application first to determine federal aid eligibility before exploring private loan options through the platform.

Key Features of Traceloans. com Student Loans

Traceloans.com stands out from traditional banks by offering flexible loan options that match your specific financial needs. The platform provides competitive interest rates and transparent terms, so you know exactly what you’re signing up for without any hidden fees.

Customizable Loan Options

Traceloans offers loan options that fit your specific financial situation. Whether you’re an undergraduate or graduate student, the platform allows you to compare student loan choices that match your needs.

You can select from federal and private financing options, giving you control over your borrowing decisions. The online platform provides tools to help you find the right loan amount for your education costs.

Federal student loans typically offer lower fixed interest rates and flexible repayment plans, while private loans may provide larger borrowing limits with variable interest rates.

Traceloans.com allows borrowers to explore both types of loans in one place, making it easier to make informed financial decisions. The platform uses clear terms and provides straightforward information about loan terms, so you know exactly what you’re signing up for without hidden fees or charges.

Competitive Interest Rates

Beyond flexible loan options adapted to your needs, interest rates significantly influence your borrowing decision. Traceloans.com offers competitive rates that help students and families manage their financial goals affordably.

Federal student loans typically offer lower fixed interest rates, making them the preferred choice for most borrowers. Private student loans may carry variable interest rates that can change over time, affecting your repayment terms.

Savvy borrowers compare fixed versus variable rates before signing any loan agreement. Fixed rates remain constant throughout your loan term, providing predictable monthly payments.

Variable rates might start lower but can increase, impacting your total loan cost. Traceloans provides clear information about both options, helping you make informed decisions based on your credit score and financial stability.

The platform’s transparent approach means no hidden charges or unexpected fees that could affect your budget later.

How to Apply for Traceloans. com Student Loans

Getting your loan application started takes just minutes with Traceloans.com’s simple online process. You’ll find clear steps that walk you through each part, making the whole experience less stressful than you might expect.

Step-by-Step Application Process

Applying for a student loan through Traceloans.com begins with collecting your necessary documents. You’ll need your Social Security number, tax information, and bank statements on hand.

Complete the FAFSA application online first, as this determines your federal aid eligibility. Await your Student Aid Report (SAR), which indicates the financial assistance you qualify for.

Traceloans.com offers a straightforward online application that you can complete quickly. Input your personal details, school information, and the loan amount you require. The platform presents loan options based on your credit profile and financial circumstances.

Most applications receive prompt approvals, often within 24 hours. After approval, funds are sent directly to your school to cover tuition and fees.

Repayment Options and Flexibility

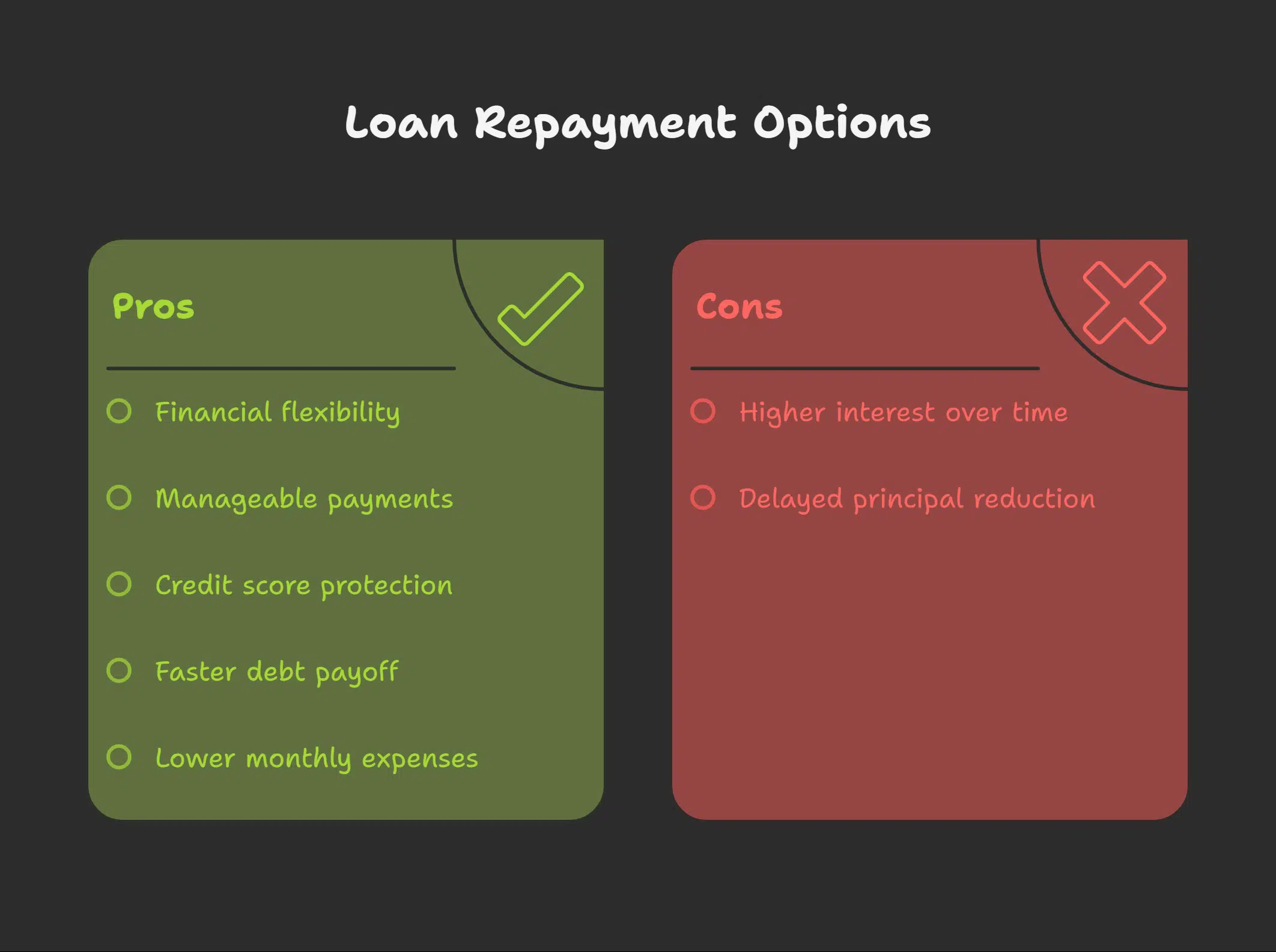

Traceloans.com provides flexible repayment terms that adapt to your financial situation, giving you breathing room when money gets tight and options to pay more when your income improves. Want to discover how these payment plans can save you thousands?

Deferred Payments

Deferred payments provide students with financial flexibility during challenging times. You can pause your monthly payments if you experience difficulties or return to school. This option helps when finances are constrained and you need time to recover.

Options for deferment or forbearance are available for financial hardships, making your loan more manageable during difficult periods.

Students appreciate this flexibility because life can be unpredictable. You might lose your job, face medical bills, or need car repairs. Traceloans.com offers solutions that accommodate your situation.

The company understands that unlike traditional banks that often adhere to strict rules, students need options that adapt to their circumstances. You can focus on regaining stability without worrying about missed payments affecting your credit score.

Full or interest-only repayments offer another level of control over your debt.

Full or Interest-Only Repayments

Traceloans.com student loans offer flexible repayment choices that fit your budget. You can make full payments that cover both principal and interest each month. This approach helps you pay off your debt faster and saves money on total interest costs.

Interest-only payments let you pay just the interest portion during school or financial hardship. This option keeps your monthly expenses lower when money is tight.

Full payments work best for borrowers with steady income who want to tackle their debt head-on. Interest-only repayments give students breathing room while they focus on their studies or find stable work.

Both options help you make informed financial decisions about your educational investment. The choice depends on your current financial health and long-term goals.

Takeaways

Smart borrowing begins with effective tools and resources. Traceloans.com offers financial tools to help you make informed decisions about your education funding. For students pursuing a Master of Business Administration or any tertiary education, this platform presents loan options tailored to your specific needs.

Complete your FAFSA first, compare interest rates carefully, and always practice responsible borrowing to safeguard your financial future.

FAQs on Traceloans.com Student Loans

1. What makes Traceloans.com different from traditional loan providers?

Traceloans.com provides tailored loan options designed specifically for students. The platform offers tools and resources that help you make informed decisions, plus they provide competitive rates with flexible terms.

2. How does the loan approval process work on Traceloans.com?

The site offers fast approvals through their streamlined system. Whether you’re a student looking for your first loan or need additional funding, they’ll help you find a loan that fits your needs.

3. What types of student loan options are available?

You can choose between fixed or variable interest rates depending on your situation. The loans are designed to be disbursed directly to your school, making the process smoother for students.

4. How does Traceloans.com help with responsible borrowing?

The platform provides a suite of financial tools, including calculators and clear information without confusing jargon. They focus on providing clear details so you know exactly what you’re signing up for.

5. What advantages does using Traceloans.com offer over federal lending?

While federal options exist, Traceloans.com provides tailored loan offers that might better match your specific needs. Their guide to smarter borrowing includes actionable advice and competitive terms that traditional sources might not offer.

6. Is my personal data safe when using Traceloans.com?

Security is a top priority for the platform. They protect your payment history, credit score information, and other sensitive data while connecting you with creditors who meet strict standards.