Saving money can be hard, especially with bills, student loans, and everyday expenses piling up. Many millennials feel stuck between wanting to save and pay off debts while trying to invest for their future.

It’s tough balancing everything without a clear plan.

The good news? Millennials can save and invest in stocks even on a tight budget. Starting early and making smart moves can help your money grow over time. This blog will show you eight simple ways to build wealth through stocks and investments.

Stick around—your future self will thank you!

Begin Investing Early in Stocks

Starting early helps your money grow faster. Thanks to compound interest, even small amounts can swell into big savings over time. A $1,000 investment at a 7% annual rate of return could turn into about $7,600 in 40 years.

Time becomes your best friend here.

Putting cash into green energy stocks or companies focused on social responsibility lets you invest with purpose. Even while managing student debt or building emergency savings, setting aside a little for stocks pays off later.

It also builds financial habits that last forever.

Maintain Consistent Stock Investments

Stick to a habit of investing in stocks regularly. Even small amounts can add up over time, thanks to compound growth. For example, putting $100 into the stock market every month can grow into thousands if done consistently for years.

Don’t wait for “perfect timing” on Wall Street; it rarely works. Markets rise and fall, but steady investments smooth out risks over time. Use automatic contributions from your paycheck or bank account to make this easier.

Aim for low-cost index funds like the S&P 500—they often perform well long-term and offer simple diversification without high fees.

Maximize Benefits from Retirement Accounts

Use retirement accounts to grow your stock investments while enjoying tax perks.

Explore 401[k] Plans for Stock Investments

A 401[k] allows you to invest in stocks while saving for retirement. Many jobs offer this plan and even match your contributions, which is like free money. For example, if you save $1,000 a year and your employer matches it, that’s $2,000 saved without extra work.

Employer matches are the closest thing to instant wealth growth.

It’s also tax-friendly. Your contributions lower your taxable income today or grow tax-free until later with a Roth 401[k]. This helps build wealth over time while preparing for life after work.

Consider Roth IRA Accounts for Diverse Portfolios

Roth IRAs grow your money tax-free. You pay taxes now, but later withdrawals don’t get taxed. This is helpful if you expect to be in a higher tax bracket when retiring. Millennials can use Roth IRAs to invest in stocks, boosting their long-term retirement savings.

These accounts offer flexibility too. Need cash for an emergency? You can pull out contributions without penalties—though not earnings. Start early and steadily contribute each year to build wealth over time while diversifying portfolios smartly with stocks or other investments.

Diversify Your Investment Portfolio

Spread your money across different investments. Don’t put all your eggs in one basket. Stocks, bonds, and real estate can balance risks. Try equity crowdfunding or peer-to-peer lending for extra options.

Green energy stocks are great if social responsibility matters to you.

Think about high-yield savings accounts or dividend-paying stocks for passive income. You could also mix in private equity or investment properties. If the stock market dips, other assets might stay strong.

Diversifying helps protect your financial goals even during an economic downturn like the Great Recession.

Embrace Technology for Stock Trading

Tech has made stock trading simpler and faster. Use smart tools to track prices and make informed choices.

Utilize Apps for Stock Investments

Apps make stock investing easy for millennials. Platforms like Robinhood and Acorns let you start small, even with just $5. Some apps use spare change from daily purchases to invest in stocks automatically.

This makes saving and growing money almost effortless.

Many apps also offer tools to track your portfolio. You can see gains, losses, and dividends in real-time. These tools help you stay on top of your financial goals without needing Wall Street experience.

Monitor Stock Performance with Digital Tools

Track stocks using digital tools like stock market apps. These platforms display prices, trends, and news in real-time. Apps such as Robinhood or E*TRADE can send alerts on changes in your portfolio.

Set up notifications for specific stocks you own or plan to buy. Many tools also have charts that show patterns over time, helping you spot opportunities for gains. This makes managing investments quicker and more efficient without guessing the job market shift from Wall Street news alone.

Plan for Long-Term Investment Goals

Set clear financial goals. Saving for retirement or buying real estate are smart choices. Use tools like 401[k] plans to build wealth over time. Roth IRA accounts can grow your money tax-free, adding diversity to your portfolio.

Start with small investments and stick with them.

Millennials often avoid stocks due to fear from the Great Recession. Don’t let that stop you. Long-term plans beat short-term fears every time. Include high-yield savings accounts or ladder certificates of deposit as backup options for cash reserves too! The goal is steady growth, not quick riches.

Learn Fundamental Stock Market Principles

Investing in the stock market can grow your savings. Understanding key ideas is crucial before putting in money. Learn about terms like “capital gains” and “dividends.” These explain how you’ll earn from stocks.

Study how supply and demand affect prices too—this helps you know when to buy or sell shares. For example, during the tech bubble, many bought tech stocks at high prices, leading to huge losses later.

Avoid making such errors by knowing basic principles.

Diversification keeps risks low. This means investing in different areas like green energy, real estate, or commercial sectors instead of focusing on one company. The Great Recession taught lessons about being prepared for downturns with emergency savings and solid plans like retirement accounts paired with safe investments.

Always have extra cash reserves while learning these strategies; they protect against sudden drops in value!

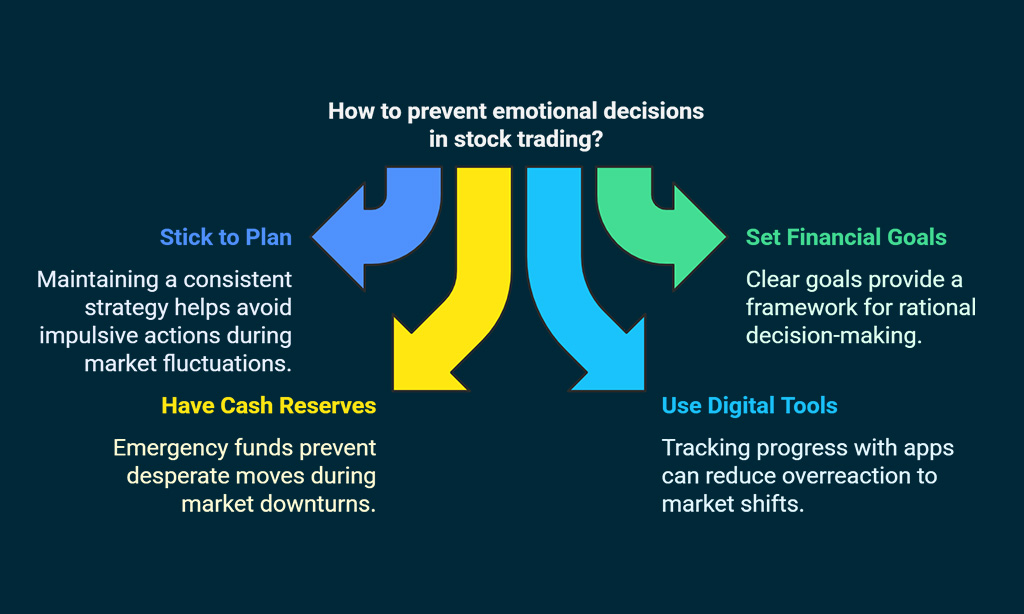

Prevent Emotional Decisions in Stock Trading

Fear and greed ruin good stock decisions. Many millennials avoid the stock market after seeing the Great Recession. Panic selling during drops or rushing to buy trending stocks can hurt savings fast.

Stick to your plan, even when markets shake.

Set clear financial goals before trading. Having cash reserves for emergencies stops you from making rash moves out of desperation. Use apps or digital tools to track progress calmly without overreacting to every Wall Street shift.

Consult Professionals for Financial Advice

Seek a financial planner if stock investing feels complex. Many millennials shy away from stocks due to fear or lack of knowledge. A professional can simplify this for you, showing how to grow your retirement savings or build cash reserves.

Choose advisors who understand millennial goals like saving for retirement, paying student debt, or budgeting emergency savings. They can guide you on alternative investments such as commercial real estate, P2P lending, or great recession-proof strategies.

Benefit from Employer Stock Match Programs

Employer stock match programs grow your money faster. Many companies offer these matches in their 401[k] plans. If you don’t take advantage, you’re leaving free cash on the table.

For example, if an employer matches up to 5% of your paycheck and you only save 3%, you’re missing out on extra funds. This benefit builds wealth better over time, especially with compound interest.

Set aside even small amounts to unlock this opportunity for saving for retirement effortlessly!

Takeaways

Saving and investing in stocks doesn’t have to be hard. Start early, stick to a plan, and keep your goals in sight. Use tools like apps or retirement accounts to make smart moves.

Small steps now can lead to big rewards later. Take charge of your future today—your wallet will thank you!

FAQs on Stock Investment and Saving Tips for Millennials

1. How can millennials start investing in stocks with student debt?

Millennials can begin by building emergency savings first, then invest small amounts in market portfolios while paying off student loans.

2. Why is saving for retirement important for the millennial generation?

Saving early helps build retirement savings over time, especially as social security may not fully cover future needs.

3. Should millennials work with a financial planner to meet their financial goals?

Yes, a financial planner can help create a clear retirement plan and guide investments like real estate or stocks based on personal finances.

4. What lessons did millennials learn from the Great Recession and Wall Street crashes?

The Great Recession taught many to keep cash reserves and avoid risky investments without proper research or planning.

5. Can millennials balance stock market investing with other priorities like buying real estate?

Yes, they can split funds between long-term investments like stocks and short-term goals such as saving for property purchases or other essentials.