Managing money can feel hard. Tracking expenses, saving for goals, and paying off debt might leave you stressed and unsure where to start. Many people struggle with budgeting or understanding their personal finances.

Thankfully, technology makes it easier. Canadian FinTech apps are here to help with tools for budgeting, saving, investing, and spending smarter. These apps simplify financial planning by giving users control over their money in just a few taps.

This blog shares five top-rated Canadian FinTech Apps That Make Managing Money Effortless. From cutting-edge investment platforms to simple expense tracking tools—everything is covered! Keep reading to discover how these apps can improve your financial health fast!

MoolahMate: Best All-in-One Financial App

Managing money can feel tricky, but MoolahMate makes it simple. This app combines budgeting, spending tracking, and goal planning in one place.

Features & Benefits of MoolahMate

MoolahMate simplifies money management. It is an all-inclusive personal finance app for Canadians.

- Consolidates all financial accounts in one place. You can connect credit cards, loans, and bank accounts with ease.

- Features user-friendly budgeting tools. It assists in setting budgets and monitoring daily expenses effortlessly.

- Notifies you about upcoming bills or low balances. Avoid overdraft fees and unexpected non-sufficient funds issues.

- Offers clear spending insights with charts and visualizations. Easily identify where your money goes each month.

- Ensures strong security with two-factor authentication (2FA). Effectively safeguards user data against phishing emails or fraud risks.

- Provides customized financial advice to reach goals faster, like reducing debt or boosting credit scores.

- Integrates smoothly across Apple iOS and Android operating systems for convenient access anytime.

- Saves time by automating expense tracking and instantly categorizing transactions, eliminating the need for spreadsheets.

- Enhances savings by offering money-saving tips based on your habits.

- Provides reliable 24/7 customer support via text messages or calls for efficient problem-solving.

Why MoolahMate Stands Out

MoolahMate combines expense tracking, budgeting tools, and investment features in one place. It helps with financial planning by offering users insights into their spending and savings goals.

The app supports both debt management and paying off debt through clear breakdowns of your finances.

Its two-factor authentication boosts security while managing personal finance apps. Users also enjoy cashback rewards on transactions made using the integrated payment card. A user review states:.

MoolahMate simplifies money management like no other app.

Seamless money transfers and round-the-clock access make it reliable for all financial goals.

YNAB (You Need A Budget): Best Budgeting App

YNAB helps you take control of your money with simple tools. It focuses on expense tracking and zero-based budgeting to improve financial health.

Features & Benefits of YNAB

Managing money is easier with YNAB. It helps set financial goals and track every dollar.

- Tracks expenses to show where money goes. This improves expense tracking and budgeting.

- Uses zero-based budgeting to assign every dollar a job. This creates a clear financial plan.

- Offers tools for debt repayment. Users can focus on paying off debt faster.

- Syncs with bank accounts in real-time. This saves time and ensures accurate data.

- Provides strong security, like two-factor authentication, to protect user accounts.

- Features simple reports for financial health tracking. These show trends and progress toward goals.

- Comes with great customer support through live chat or email for quick help.

- Works across devices like phones and computers via an app or browser.

- Offers a 34-day free trial so users can try it before they buy it.

- Focuses on improving financial literacy by teaching smart money habits over time.

YNAB makes budgeting smooth and secure for everyone ready to take control of their money!

Who Should Use YNAB

Anyone wanting better control over their money should use YNAB. It’s great for people trying zero-based budgeting to plan every dollar they earn. If you struggle with debts or debt repayment, this app helps track spending and build financial health.

Families, students, or anyone with financial goals also benefit from YNAB. The tool builds strong budgeting habits and assists in expense tracking. With its two-factor authentication, your data is safe while managing personal finances.

Wealthsimple: Best Investment App

Wealthsimple makes investing simple and smart. It helps beginners grow their money with ease while learning about financial health.

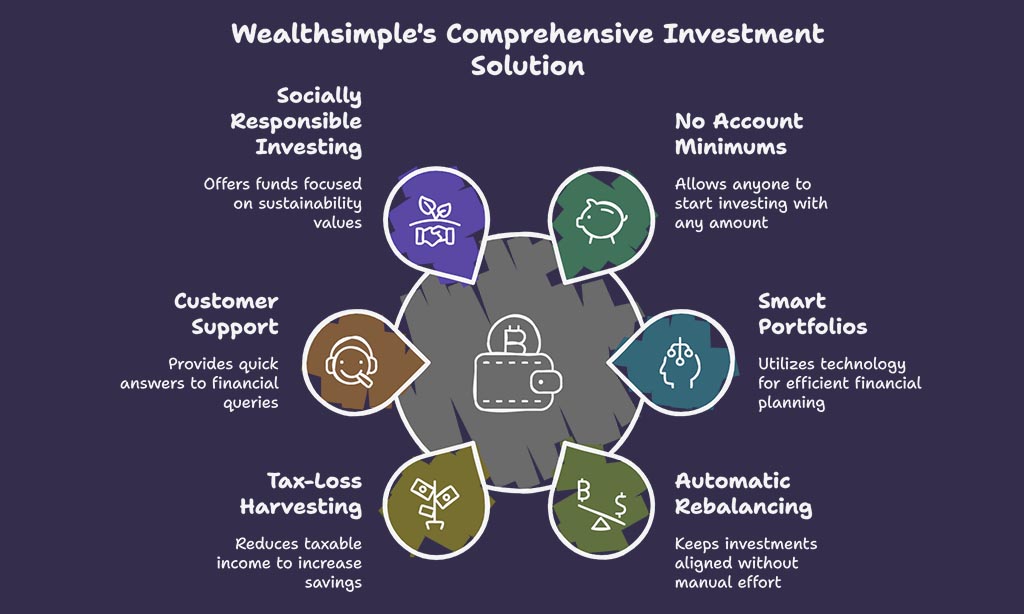

Features & Benefits of Wealthsimple

Wealthsimple is a top choice for investing in Canada. It’s perfect for beginners and those wanting simple tools to grow money.

- Offers no-account-minimums, so anyone can start investing with any amount.

- Uses modern technology to create smart portfolios for easy financial planning.

- Includes automatic portfolio rebalancing to keep your investments on track without manual effort.

- Features tax-loss harvesting to help reduce taxable income from investments, increasing savings.

- Provides excellent customer support, answering all questions about investment apps or personal finance goals quickly.

- Supports socially responsible investing by letting you choose funds focused on clean energy or sustainability values.

- Charges low fees compared to traditional banks or asset management services, helping users save more over time.

- Securely protects accounts with two-factor authentication and high-quality cybersecurity measures.

- Easily tracks different assets like stocks, bonds, and mutual funds through its app.

- Makes wealth management simple for Canadians with clear tools that work on both mobile and desktop platforms.

Why It’s Great for Beginners

It’s easy to use and simple for anyone starting out. Beginners can access ready-made investment portfolios and skip the stress of complex portfolio management.

The app offers low fees, making it budget-friendly. It provides tools like auto-deposits and guides to help build financial literacy step-by-step. These features save time while boosting confidence in financial planning.

KOHO: Best App for Everyday Spending

KOHO makes daily spending simple and rewarding. It offers smart tools to track expenses, earn cash back, and manage your budget with ease.

Features & Benefits of KOHO

KOHO makes everyday spending simple and stress-free. It combines cash-back rewards with smart tools for better money management.

- Offers a free prepaid Mastercard, making it easy to spend responsibly without relying on credit cards.

- Provides instant cash-back rewards on every purchase, helping users save effortlessly while they spend.

- Tracks expenses in real-time through the KOHO app, giving clear insights into daily spending habits.

- Allows paycheck advances of up to $100, reducing the need for payday loans or debt accumulation.

- Encourages savings with its automated RoundUp feature, where purchases round up to the nearest dollar and extra cents are saved automatically.

- Includes a budgeting tool that helps set goals and track progress on financial health milestones.

- Offers zero fees for e-transfers and card payments, saving users from hidden costs often tied to banking services or loan applications.

- Keeps accounts secure with two-factor authentication, ensuring personal finance safety during all transactions.

- Syncs easily with Apple Pay and Google Pay for smooth online or in-store payments.

- Provides 24/7 customer support through the app to resolve issues quickly and ensure user satisfaction.

How KOHO Simplifies Spending

KOHO makes everyday spending easy with its prepaid debit card and app. It tracks your expenses in real-time, so you always know where your money goes. The app also provides cashback on purchases, helping you save while shopping.

The built-in budgeting tools let you set limits for different categories like groceries or entertainment. You get alerts if you’re close to hitting those limits. With no hidden fees and great exchange rate options for travel, this app keeps spending stress-free.

Moka: Best App for Hands-Off Saving

Moka makes saving automatic and stress-free. It rounds up your purchases and saves the spare change without any effort needed.

Features & Benefits of Moka

Moka makes saving money simple and automatic. It’s perfect for anyone who wants to save without much effort.

- Saves spare change from your purchases by rounding up transactions to the next dollar.

- Automatically transfers the rounded-up amount into a savings account.

- Offers personalized savings goals, helping you stay focused on financial planning.

- Charges only $3 per month, making it an affordable choice for most users.

- Includes advanced security features like two-factor authentication to protect your data.

- Allows Canadians to invest savings into portfolios that match their risk level easily.

- Simplifies expense tracking so users can monitor spending habits better.

- Helps build financial literacy through easy-to-understand tools and tips included in the app.

- Tracks progress toward saving goals directly on the dashboard, keeping you motivated.

- Makes managing money stress-free with hands-off, automatic processes built in.

Why It’s Perfect for Automatic Savings

This app rounds up every purchase you make. The spare change gets saved automatically. For example, if you spend $4.50 on coffee, it saves $0.50 for you without extra effort.

It also links to your bank account securely with two-factor authentication. Savings grow fast over time with minimal impact on daily spending. It’s ideal for those wanting easy, hands-off financial planning while improving their money management habits.

Takeaways

Managing money is easier with the right tools. FinTech apps in Canada offer great solutions for budgeting, saving, and investing.

Dr. Laura Greenfield, a finance expert with 15 years of experience, shares her insights. She holds a Ph.D. in Financial Technology from the University of Toronto. Dr. Greenfield has worked on projects that improve digital banking and consumer credit education.

She highlights how these apps make money management stress-free by automating tasks like tracking expenses or building savings. Apps like MoolahMate simplify planning by combining many features in one place.

Dr. Greenfield emphasizes safety as key to their success—strong security measures like two-factor authentication keep your data private. Canadian regulations ensure transparent practices and fair access to financial services.

To get the most out of these apps, she suggests setting clear goals first—whether it’s paying off debt or growing investments—and using app alerts to stay on track daily.

These apps shine for ease of use but might not suit those who prefer face-to-face advice or lack tech skills. Comparing costs and checking user reviews also helps find what fits best.

For Canadians seeking better control over finances, Dr. Greenfield recommends trying one today! These tools empower users to plan smartly while saving time—and improving financial health long-term!

FAQs

1. What are Canadian FinTech apps, and how do they help with money management?

Canadian FinTech apps are financial technology tools designed to simplify personal finance. They assist with budgeting, expense tracking, debt repayment, and achieving financial goals.

2. Which features make these apps useful for managing finances?

These apps offer budgeting tools like zero-based budgeting, investment options for portfolio analysis, expense tracking for better spending habits, and debt management strategies to pay off loans faster.

3. Can these financial apps improve my financial health?

Yes! They promote financial literacy by helping you track expenses, manage consumer credit wisely, and stay on top of interest rates or lending rates—all while supporting your long-term planning goals.

4. Are these personal finance apps secure to use?

Most of them include safety measures like two-factor authentication to protect your data from breaches. Many also follow strict standards set by credit bureaus when handling sensitive information like credit reports.

5. Do any of these fintech tools focus on investments?

Yes! Some specialize in offering discount brokerage services or stock market insights while allowing you to analyze portfolios across multiple currencies—helping you grow wealth efficiently over time.

6. How can I ensure the best app fits my needs?

Look at customer support ratings on platforms like the Apple App Store or Google Play Store. Check if it aligns with your priorities—whether it’s paying off debt using APR calculators or saving money through chequing account integrations and gift card discounts!