Planning a wedding can be exciting, but it’s also full of unknowns. From vendor no-shows to bad weather, unexpected issues can quickly turn your big day into a stressful mess. That’s where wedding insurance comes in—it’s a safety net for your special day.

In 2025, more couples are choosing to protect their wedding budget with insurance. It covers everything from venue closures to lost gifts, giving you peace of mind. This blog will explain why wedding insurance is worth considering in 2025 and how it can save you from costly surprises.

Keep reading to learn more!

Key Takeaways

- Wedding insurance protects against vendor no-shows and bankruptcies, covering costs for replacements or refunds. In 2025, policies often include vendor bankruptcy protection to avoid last-minute stress.

- It safeguards outdoor weddings from weather disruptions like storms or extreme heat, covering rescheduling fees and damaged decor. Weather-related coverage is crucial for unpredictable 2025 conditions.

- Policies cover lost or stolen wedding gifts and damaged attire, ensuring quick replacements without financial strain. Bridal gowns alone can cost $1k-$3k to replace.

- Liability insurance prevents financial loss from accidents or injuries during the event, including alcohol-related incidents. Many venues require this coverage before allowing alcohol service.

- Destination weddings benefit from insurance by covering travel delays, lost luggage, and medical emergencies abroad in 2025 plans with specific exclusions noted upfront.

Understanding the Value of Wedding Insurance in 2025

Wedding insurance helps couples handle unexpected issues like vendor cancellations or venue problems. It ensures peace of mind by offering financial protection and quick solutions for unforeseen challenges.

Coping with Vendor No-shows

Vendor no-shows can disrupt your wedding plans. Wedding insurance helps protect your investment if a vendor fails to show up. It covers costs for finding a last-minute replacement or refunds lost deposits.

This ensures your big day stays on track without added stress.

Insurance companies offer policies that include vendor bankruptcy protection. If a vendor goes out of business, you’re not left scrambling. Wedding insurance provides quick solutions to secure new vendors and avoid delays in your wedding planning process.

Handling Venue Closures Due to Structural Issues

Venue closures due to structural issues can derail even the most carefully planned weddings. Unexpected problems like building damage or safety hazards might force your chosen location to shut down suddenly.

Wedding insurance provides coverage for rescheduling or relocating your event, ensuring you’re not left scrambling at the last minute. This protection helps cover additional costs, such as new venue deposits or decor replacements, giving peace of mind when the unexpected happens. Prepare for the worst but hope for the best—insurance is your safety net.

Structural issues often come without warning, but having wedding insurance safeguards your investment. Policies typically include provisions for venue-related disruptions, allowing you to focus on celebrating rather than stressing over unforeseen complications.

Ensuring Financial Stability with Weather-Related Wedding Insurance

Weather-related wedding insurance guards against sudden storms or extreme conditions that could ruin your big day. It also covers costs for rescheduling ceremonies if the weather forces a change in plans.

Managing Impact from Unpredictable Weather on Outdoor Ceremonies

Outdoor weddings face risks from sudden weather changes. Heavy rain or strong winds can disrupt plans, damage decorations, and even force cancellations. Wedding insurance with weather-related coverage helps manage these issues.

It ensures costs for rescheduling or relocating the event are covered.

Unexpected storms can ruin floral arrangements, tents, and other outdoor setups. With proper insurance, the financial burden of repairs or replacements is reduced. Couples gain peace of mind knowing their investment in wedding traditions is protected against unpredictable conditions like hurricanes or heatwaves.

Choosing a plan that includes weather protection safeguards your special day without added stress.

Securing Rescheduling Due to Weather Disruptions

Weather disruptions can ruin outdoor wedding plans. Wedding insurance offers weather-related coverage to help reschedule your big day without extra costs. Policies often cover venue fees, vendor deposits, and other expenses tied to postponement.

This ensures your wedding investment stays protected even if storms or extreme conditions hit. A rainy day doesn’t have to mean a ruined wedding—insurance keeps your plans on track.

With unpredictable weather patterns in 2025, having this safety net is smart. It lets you focus on celebrating rather than worrying about last-minute changes. Check with insurance providers for specific terms and exclusions in their policies.

Protect Your Investment Against Vendor Bankruptcy

Wedding insurance shields your budget if a vendor goes out of business. Quick replacements and refunds keep your plans on track without extra stress.

Securing Refunds for Vendor Contract Failures

Vendor contract failures can disrupt your wedding plans. They may leave you without a photographer, caterer, or even the venue. Wedding insurance helps secure refunds if vendors fail to deliver services as agreed upon in their contracts.

This coverage ensures you recover costs for deposits or payments made in advance.

Choosing the right insurance provider offers peace of mind during unpredictable situations. Look for policies that include vendor bankruptcy protection and clear terms for reimbursement.

Protecting your wedding budget from such risks allows you to focus on celebrating without financial stress.

Quick Solutions for Replacing Unavailable Vendors

Wedding insurance offers quick solutions if a vendor cancels or becomes unavailable. It helps cover costs for finding last-minute replacements, like photographers or caterers. This ensures your wedding day stays on track without added stress.

Many policies include access to networks of trusted vendors, making the process smoother and faster.

Insurance providers often assist in securing new vendors quickly. They handle contract details and payments, saving you time and effort. This protection keeps your wedding investment safe from unexpected disruptions.

With coverage in place, you can focus on enjoying your special day rather than solving vendor issues.

Secure Coverage for Wedding Items Loss or Damage

Wedding insurance protects your valuables like gifts and attire from theft or damage. It ensures quick replacements for lost items, keeping your special day stress-free.

Protecting Against Lost or Stolen Wedding Gifts

Weddings are a joyful celebration—but unfortunately, they’re also a tempting target for opportunistic thieves. With dozens or even hundreds of guests bringing valuable gifts, it’s crucial to take steps to secure those thoughtful presents. Here’s how you can safeguard your wedding gifts and enjoy your big day stress-free.

Use a Secure Gift Table Location

Keep it in view, not near exits: Place the gift table somewhere visible and monitored, away from entrances or exits. This discourages anyone from trying to discreetly walk away with a gift.

Hire a Gift Attendant

Designate someone to oversee gifts: Appoint a trusted friend or family member (or even hire a professional) to watch over the gift table. They can keep an eye on things and transfer gifts to a secure location as needed.

Consider a Wedding Safe or Lockbox

Use a secure container for cards and cash: Many guests bring envelopes with gift cards or cash. Use a lockbox or wedding card box that locks, especially for the gift table. These can be stylish and secure.

Opt for Online Registries and Direct Shipping

Avoid handling physical gifts: Encourage guests to use your online wedding registry and ship gifts directly to your home. This reduces the volume of gifts at the venue and minimizes risk.

Secure the Storage Area

Transport and store gifts carefully: Once the reception is underway or finished, have gifts moved to a secure room, locked vehicle, or straight to your hotel suite. Don’t leave them unattended overnight at the venue.

Get Wedding Insurance

Protect against theft and loss: Some wedding insurance policies cover stolen or lost gifts. Check with your provider to ensure you’re protected in case something goes missing.

Have a Post-Gift Checklist

Inventory your gifts: Keep a list of all expected gifts (especially from your registry) and check them off after the wedding. This helps you notice anything missing and helps with thank-you notes too!

Protecting against lost or stolen wedding gifts may not be the most romantic part of wedding planning, but it’s a necessary one. By being proactive and organized, you can focus on the joy of your celebration while ensuring your gifts are safe and sound.

Repairing or Replacing Damaged Wedding Attire and Decorations

Damaged wedding attire can turn your special day into stress city! With **replacement costs** soaring—think bridal gowns averaging $1k-$3k—protecting these items makes sense! Similarly ruined decorations can add up fast too; damaged centerpieces? The price tag hurts! Including this type specific safeguard within **your chosen policy** ensures swift fixes without breaking bank accounts again so keep calm carry onto plan B seamlessly if something breaks during festivities ahead…

Always opt-in having suitable protective measures ready beforehand rather than facing unwelcome surprises later down line especially considering hefty bills attached each possible mishap scenario involved here today.

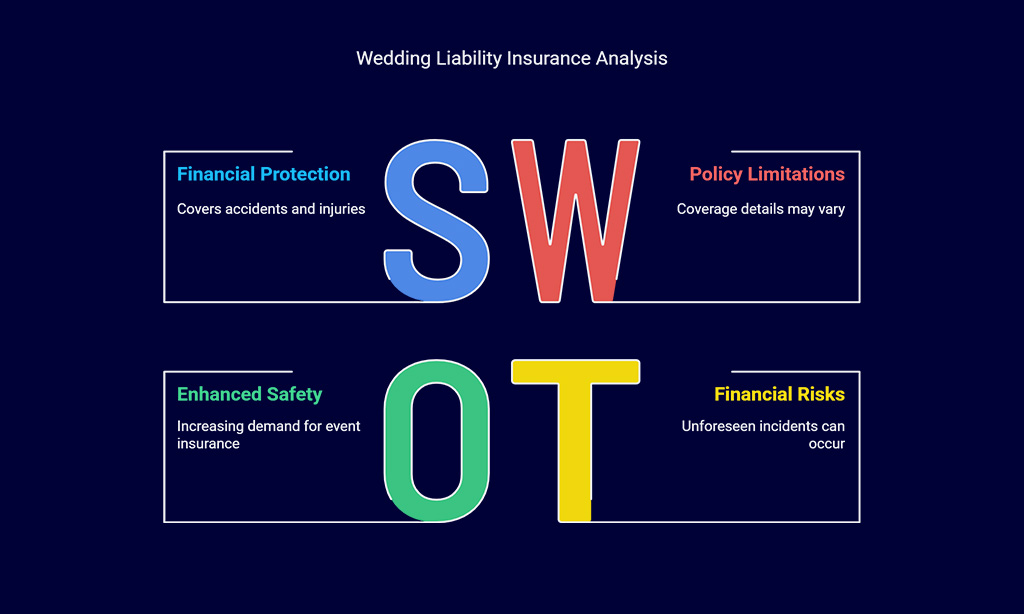

Liability Coverage for Wedding-Day Accidents and Injuries

Wedding liability insurance protects you from costs tied to accidents or injuries during the event. It covers incidents like slips, falls, or alcohol-related issues—keeping your finances safe.

Addressing Alcohol-Related Incidents

Alcohol-related incidents at weddings can lead to unexpected costs. Liability coverage helps protect against claims if a guest gets injured or causes damage after drinking. Many insurance providers offer alcohol liability as part of their event insurance plans.

It’s essential to check the policy for details on public liability and limits. Some venues may require this coverage before allowing alcohol service. Financial loss from such incidents can be significant without proper protection—wedding insurance acts as a safety net to handle these risks effectively while keeping your budget secure during the celebration.

Preventing Financial Loss from Injuries at the Event

Wedding liability insurance safeguards against financial risks from accidents during your big day. Guests might slip, trip, or get hurt—leaving you responsible for medical bills or legal claims.

General liability coverage helps pay for these costs, protecting your wedding budget. Public liability insurance is especially crucial if alcohol is served at the event. It covers incidents like falls or injuries caused by intoxicated guests.

Venues often require this type of insurance before allowing events on their property.

Liability coverage also shields you from unexpected expenses like legal fees or damages. For example, a guest could damage the venue’s property during the celebration. Wedding insurance policies typically include this protection, offering peace of mind while planning your nuptials.

Without it, you risk paying out-of-pocket for unforeseen issues that could disrupt your special day and strain finances after months of careful preparation in 2025.

Smart Tips for Selecting the Best Wedding Insurance Plan

Compare coverage plans to find the best fit for your needs. Check if the policy includes protection for venue requirements and unexpected issues.

Comparing Different Coverage Options

Choosing the right wedding insurance plan requires careful evaluation. Here’s a breakdown of key coverage options to help you decide:

| Coverage Type | What It Includes | Why It Matters |

|---|---|---|

| Event Cancellation | Reimbursement for deposits and costs if the wedding is canceled. | Protects against unexpected cancellations due to illness or emergencies. |

| Weather Protection | Covers rescheduling costs for weather-related disruptions. | Essential for outdoor weddings in unpredictable climates. |

| Vendor Issues | Refunds or replacements if vendors fail to deliver. | Safeguards against no-shows or vendor bankruptcies. |

| Liability Coverage | Protects against accidents or injuries during the event. | Reduces financial risk from alcohol-related incidents or injuries. |

| Property Protection | Covers loss or damage to wedding attire, gifts, and decorations. | Ensures valuable items are replaced or repaired if damaged. |

Considering Insurance for Destination Weddings

Destination weddings often involve higher costs and unique risks. Wedding insurance can protect your investment from unexpected issues like travel delays or vendor cancellations. Many policies cover venue changes, lost luggage, or even medical emergencies abroad.

Check for exclusions in coverage—some plans may not include pre-existing conditions or certain locations. Compare options from wedding insurance providers to find the best fit for your multi-day event.

Liability coverage is especially important if alcohol is served at the ceremony. Ensure your policy meets venue requirements and offers weather-related protection for outdoor celebrations.

Takeaways

Wedding insurance offers peace of mind for couples planning their big day. To shed light on its value, we turn to Dr. Emily Carter, a seasoned expert in financial planning and risk management.

With over 15 years of experience and a Ph.D. in Economics from Stanford University, Dr. Carter has advised countless couples on protecting their wedding investments.

Dr. Carter highlights the core benefits of wedding insurance: “It safeguards against unexpected issues like vendor no-shows or weather disruptions—key risks in 2025.” She emphasizes how policies provide quick solutions for rescheduling or replacing vendors, ensuring minimal stress.

On safety and ethics, Dr. Carter notes: “Reputable insurers follow strict regulations and offer transparent terms.” She advises couples to review policy details carefully to avoid surprises during claims.

For practical use, she suggests: “Compare plans early in your planning process.” Look for coverage that matches your needs—whether it’s liability protection or weather-related cancellations.

Dr. Carter also points out potential drawbacks: “Premiums can add up, especially for destination weddings.” Yet she argues the cost is often worth it compared to potential losses without coverage.

Her final verdict? “Wedding insurance is a smart investment for modern couples,” says Dr. Carter. It protects both finances and peace of mind during one of life’s most important events.

FAQs

1. What is wedding insurance?

Wedding insurance protects your wedding budget from unexpected issues like vendor bankruptcy, weather problems, or event cancellations. It covers costs for things like liability coverage and cancellation coverage.

2. How much does wedding insurance cost?

The cost of wedding insurance depends on factors like the size of your event, location, and coverage type. Insurance premiums are usually a small part of your total wedding budget—often between $100 to $500.

3. Why should I get wedding liability insurance?

Wedding liability insurance protects you if someone gets hurt at your event or if there’s property damage at the venue. Many venues require it as part of their rules to avoid financial risks.

4. Does wedding insurance cover destination weddings?

Yes, many wedding insurance policies include coverage for destination weddings. They can protect against travel delays, lost items, or even multi-day event issues—giving you peace of mind far from home.

5. Can I claim for weather-related problems with my policy?

Most plans offer weather-related coverage if severe conditions force you to cancel or postpone your ceremony. Check with your provider about exclusions before buying to ensure you’re fully protected.