Cyber insurance is rapidly transforming as businesses continue to face the growing threat of cyberattacks. With an increasing number of breaches, hacks, and data leaks, companies are beginning to recognize the importance of not only having strong cybersecurity measures in place but also securing comprehensive insurance coverage.

Cyber insurance provides financial protection against a variety of cyber risks, including data breaches, business interruptions, and ransomware attacks.

As we approach 2025, the landscape of Trends in Cyber Insurance is expected to evolve significantly. Businesses must stay ahead of these changes to ensure that their coverage adapts to the growing threat landscape. In this article, we’ll explore the Top 5 Trends in Cyber Insurance for 2025, offering valuable insights into the key shifts shaping the future of this industry.

By the end of this article, you’ll have a clear understanding of what to expect from Trends in Cyber Insurance, and how your business can strategically prepare for the future.

Trend 1: The Shift Toward Comprehensive Coverage

As cyber risks continue to grow in complexity and scope, businesses are demanding more from their cyber insurance policies. Traditionally, policies covered only immediate financial losses from cyber incidents, such as data breaches or ransomware attacks. However, businesses now need insurance that addresses the full spectrum of cyber risks, from prevention to post-breach support.

Increased Demand for Holistic Cyber Insurance Plans

Businesses no longer want basic policies that only reimburse for data loss or downtime. They’re seeking holistic coverage plans that provide protection across all areas of cybersecurity, including proactive measures and post-breach assistance. This shift toward comprehensive coverage is one of the major Trends in Cyber Insurance for 2025.

In 2025, cyber insurance providers will likely offer packages that address multiple layers of protection. These policies will not only cover direct financial loss but will also include services such as risk assessments, employee training, and proactive monitoring, which are critical to mitigating potential threats before they occur.

Understanding the Types of Coverage Gaining Popularity

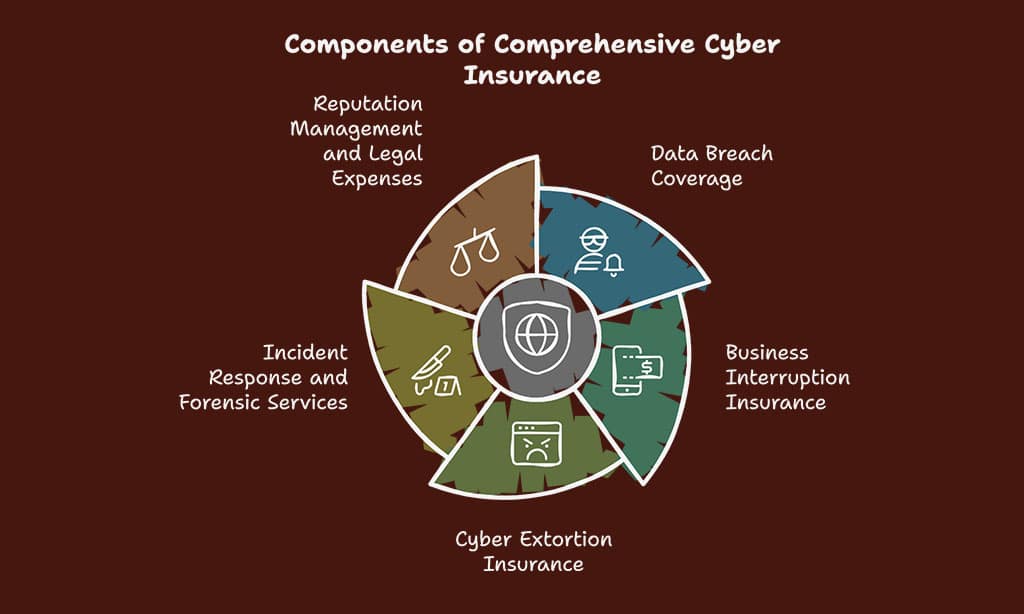

As part of this shift, several types of coverage are becoming more popular in comprehensive cyber insurance plans. These include:

- Data Breach Coverage: Covers the costs associated with a data breach, including legal fees, notification costs, and credit monitoring for affected individuals.

- Business Interruption Insurance: Compensates for the loss of revenue due to business operations being disrupted by a cyberattack.

- Cyber Extortion Insurance: Provides financial reimbursement if a business is the victim of a ransomware attack.

- Incident Response and Forensic Services: Pays for the services of experts who help identify and manage the aftermath of a breach, including investigating how the attack happened and helping the organization recover.

- Reputation Management and Legal Expenses: Covers the cost of managing public relations efforts and legal fees following a breach.

Case Studies of Comprehensive Coverage in Action

Several insurers are already offering comprehensive coverage, anticipating the rising demand for multi-faceted cyber insurance policies. For instance, AIG and Chubb offer policies that combine traditional coverage with proactive risk management services, such as cybersecurity training and vulnerability assessments.

By offering these bundled services, insurers are positioning themselves as partners in cybersecurity rather than just financial backers in the event of an incident.

Key Factors Driving the Shift in Coverage Options

Several factors are contributing to this shift toward more comprehensive coverage:

- Evolving Cyber Threats: As cyberattacks become more advanced, companies need coverage that encompasses a wider range of risks.

- Compliance Requirements: With regulations like the GDPR and CCPA imposing stricter data protection requirements, businesses are looking for coverage that helps them comply with these laws.

- Long-Term Cyber Resilience: Businesses are realizing that quick recovery from a cyberattack is essential, making post-breach support services crucial in their insurance plans.

Types of Comprehensive Coverage in Cyber Insurance

| Coverage Type | What It Covers |

| Data Breach Coverage | Costs related to notification, credit monitoring, and legal fees following a data breach. |

| Business Interruption Insurance | Revenue lost due to a cyberattack that interrupts business operations. |

| Cyber Extortion Insurance | Ransom payments and associated costs in the event of a ransomware attack. |

| Incident Response & Forensic Services | Services to help identify the cause of a cyberattack, including cybersecurity experts and investigators. |

| Reputation Management | Public relations efforts and legal assistance after a breach to mitigate brand damage. |

Trend 2: Integration of AI and Automation in Cyber Insurance

The rise of AI and automation is significantly altering the Trends in Cyber Insurance landscape. Insurers are using AI to enhance their risk assessment processes, price policies more accurately, and streamline claims processing. AI-driven insights allow businesses to better understand their risk profiles and tailor their insurance coverage accordingly.

How AI is Revolutionizing Risk Assessment and Claims Processing

AI and machine learning are revolutionizing the way insurers evaluate risk and handle claims. Rather than relying solely on traditional risk assessments based on a company’s size or industry, AI allows insurers to analyze more granular data, including real-time cybersecurity posture, historical breach data, and even social engineering risks. This enables a much more accurate, personalized risk evaluation.

For example, some insurers are using AI-powered platforms that analyze vast amounts of cybersecurity data to identify vulnerabilities in a business’s infrastructure. Based on these insights, businesses can be offered customized policies with premiums that reflect their actual risk levels.

The Role of Automation in Improving Cyber Insurance Efficiency

Automation is also enhancing operational efficiency in cyber insurance. By automating the underwriting process, claims management, and customer service tasks, insurers can provide faster service to businesses, helping them get back on their feet quickly after a cyber event. Automated claims processing is reducing administrative costs and speeding up response times, making the claims process much more efficient.

Real-World Examples of AI and Automation Enhancing Cyber Insurance

Several insurance providers have already adopted AI and automation technologies. For instance, Lloyd’s of London is using AI to help underwriters assess and predict cyber risks more accurately.

Similarly, Swiss Re has integrated AI to predict potential data breaches and offer more tailored policies. Automation is also being used by companies like Zurich Insurance, where customers can file claims and track the status through automated platforms.

Potential Challenges and Opportunities for Insurers

While AI and automation offer significant benefits, there are challenges as well. AI models depend heavily on the quality and diversity of the data they are trained on. If the data is incomplete or biased, it could lead to inaccurate risk assessments or policy pricing. However, the opportunity lies in the fact that these tools can continue to evolve, providing insurers with more accurate models that can better assess and mitigate risks.

AI and Automation in Cyber Insurance

| AI & Automation Use Case | Impact on Cyber Insurance |

| AI-Powered Risk Assessment | Allows insurers to offer personalized premiums based on real-time data. |

| Automated Claims Processing | Speeds up claims processing, reducing wait times for businesses. |

| Fraud Detection | AI algorithms help identify fraudulent claims, reducing risk for insurers. |

| Customer Service Chatbots | Provide 24/7 assistance to businesses, improving customer experience. |

Trend 3: Cyber Insurance Pricing Models Becoming More Dynamic

Traditional cyber insurance pricing models have largely been static, with insurers calculating premiums based on company size, industry, and general cyber risk factors.

However, as cyber threats become more complex and insurers gain better insights into individual risk factors, dynamic pricing models are emerging as the new standard in Trends in Cyber Insurance.

The Shift to Risk-Based Pricing Models

In 2025, expect to see a shift from static, one-size-fits-all pricing to more dynamic, risk-based pricing. This means that premiums will be adjusted based on real-time data and the specific risks associated with a company’s cybersecurity measures. Insurers will increasingly use data such as vulnerability scans, breach histories, and even employee cybersecurity training to determine the level of coverage needed and how much it will cost.

For instance, if a company has implemented strong security practices such as regular penetration testing, multi-factor authentication, and robust endpoint protection, it may pay lower premiums than a competitor that lacks these measures. This encourages businesses to invest in their cybersecurity infrastructure to reduce their premium costs.

How Insurers Are Adapting to the Evolving Cyber Risk Landscape

Insurers are leveraging technologies such as continuous monitoring tools to assess a company’s cybersecurity posture in real-time.

These tools gather data on how often systems are updated, how quickly threats are identified, and how fast vulnerabilities are patched. This information is then used to adjust premiums dynamically, based on the level of protection in place.

Comparison of Traditional vs. Dynamic Pricing

| Factor | Traditional Pricing Model | Dynamic Pricing Model |

| Premium Calculation | Flat-rate based on company size, industry | Based on real-time risk assessment and security posture |

| Risk Adjustment | Annual or fixed adjustments | Continuous, real-time updates based on security metrics |

| Premium Variation | Less variation between businesses | Significant variation based on individual business risk factors |

Trend 4: Increased Focus on Incident Response and Post-Breach Support

Today, cyber insurance providers offer more than just financial compensation. They are expanding their services to include incident response, crisis management, forensic investigation, and even legThe importance of incident response and post-breach support is growing rapidly.

While financial compensation for breaches remains critical, businesses now need help recovering from attacks and managing the aftermath effectively. Trends in Cyber Insurance for 2025 indicate that insurers will increasingly offer post-breach services as part of their policies.al support.

These services are designed to help businesses quickly recover from a cyberattack, manage the reputational damage, and comply with regulations such as GDPR or CCPA.

The Role of Incident Response Plans in Cyber Insurance Policies

Incident response plans are becoming a staple of modern cyber insurance policies. These plans outline the steps a business should take if it experiences a cyberattack. Having a solid response plan in place helps ensure that companies can quickly assess the situation, contain the breach, and begin the recovery process.

Key Benefits of Post-Breach Support for Policyholders

Post-breach support is crucial for businesses to return to normal operations after an attack. Key benefits include:

- Crisis Communication: Helps manage the messaging during a cyber event to minimize damage to the brand’s reputation.

- Regulatory Compliance Assistance: Ensures that companies comply with data protection laws following a breach.

- Forensic Investigations: Helps identify the cause of the breach and mitigate future vulnerabilities.

Post-Breach Support Services in Cyber Insurance

| Service | Benefit for Businesses |

| Crisis Communication | Helps manage PR and media relations during an active cyber crisis. |

| Regulatory Assistance | Ensures compliance with data breach notification laws. |

| Forensic Investigation | Identifies the source of the attack and helps close security gaps. |

| Reputation Management | Works to rebuild trust and brand image following a breach. |

Trend 5: Regulatory Changes and Their Impact on Cyber Insurance

As the regulatory environment surrounding cybersecurity continues to evolve, businesses will need to ensure that their cyber insurance policies are aligned with the latest legal requirements.

Trends in Cyber Insurance for 2025 will see more insurers offering coverage designed to help businesses meet regulatory compliance, reducing the risk of non-compliance penalties.

New Global and Regional Regulations Impacting Cyber Insurance

Global and regional regulations, such as GDPR and the CCPA, are raising the stakes for businesses when it comes to data protection. In 2025, the landscape will likely include additional laws that require companies to take stronger actions to protect customer data and report breaches more quickly.

What Insurers and Businesses Need to Know About Compliance

Cyber insurers will have to stay abreast of evolving regulatory requirements to ensure their policies offer the appropriate level of coverage. At the same time, businesses need to be proactive in ensuring their cybersecurity practices align with these laws to avoid non-compliance penalties or gaps in insurance coverage.

Preparing for Future Regulatory Changes in Cyber Insurance

To keep up with the regulatory environment, insurers will likely develop policies with built-in compliance features, including automatic coverage updates as laws change. This will allow businesses to focus on their cybersecurity efforts without worrying about falling out of compliance.

Takeaways: Preparing for the Future of Cyber Insurance

The Trends in Cyber Insurance for 2025 reflect an evolving landscape driven by advancements in technology, increasing cyber threats, and more stringent regulatory requirements.

From comprehensive coverage to AI-driven risk assessments, businesses will need to adapt to these changes to ensure they have the right protections in place.

By staying informed and prepared, businesses can not only protect themselves financially but also build the resilience necessary to withstand future cyber challenges. As the cyber insurance industry continues to evolve, the companies that embrace these trends will be better positioned to thrive in an increasingly complex digital world.