Reddit co-founder Alexis Ohanian has officially joined a U.S.-led bid to acquire TikTok, aligning himself with a growing effort to wrest control of the social media giant from its Chinese parent company, ByteDance. Ohanian will serve as a strategic advisor to “The People’s Bid for TikTok,” an initiative spearheaded by real estate mogul and sports industry tycoon Frank McCourt.

This ambitious campaign is part of McCourt’s broader “Project Liberty” initiative, which seeks to redefine digital ownership and data privacy. Investor and entrepreneur Kevin O’Leary, widely recognized from the television show Shark Tank, has also joined the effort, further solidifying the bid’s credibility.

According to Ohanian, his involvement is driven by a deep-rooted belief in giving individuals more control over their digital presence. I’ve spent my entire career building tech that puts power back in people’s hands—that’s what got me excited about The People’s Bid,” Ohanian said in a public statement. “This isn’t just about TikTok; it’s about fundamentally rewiring how the internet works.”

Crowdfunding for Public Ownership and Blockchain Integration

One of the defining features of this bid is its crowdfunding component, which aims to allow everyday users, content creators, and small businesses to invest in the future of TikTok. This approach is designed to counter the perception that large corporations or hedge funds will dictate the app’s future.

Project Liberty has also pledged to integrate blockchain technology into TikTok’s infrastructure, a move that would enable greater data transparency and user control. The implementation of a custom blockchain platform would mean that TikTok users could own their personal data instead of surrendering it to corporate interests.

McCourt has been a vocal advocate for digital decentralization, stating that his plan is to “restore trust in social media by making user data ownership a fundamental right.” This proposal is particularly appealing to privacy-conscious individuals and policymakers who have long raised concerns about data exploitation by major tech companies.

The National Security Debate: Why the U.S. Government Wants ByteDance to Divest

The push to sell TikTok’s U.S. operations stems from growing national security concerns. The app, which has over 150 million users in the United States, has faced accusations that its parent company, ByteDance, could share user data with the Chinese government.

U.S. lawmakers argue that TikTok’s data collection practices could enable Beijing to access sensitive information about American citizens, potentially influencing public discourse or even interfering in elections. In response, Congress passed legislation requiring ByteDance to divest its U.S. operations or face a ban.

The law, originally signed by former President Joe Biden and later upheld by the Supreme Court, mandates that ByteDance sell TikTok’s U.S. assets by early April 2025. If the sale does not go through, TikTok could be forced to cease operations in the country. The ruling follows previous attempts by the Trump administration to ban the app, which were challenged in court but have since gained bipartisan support in Washington.

Big Tech and High-Profile Bidders Enter the Race to Buy TikTok

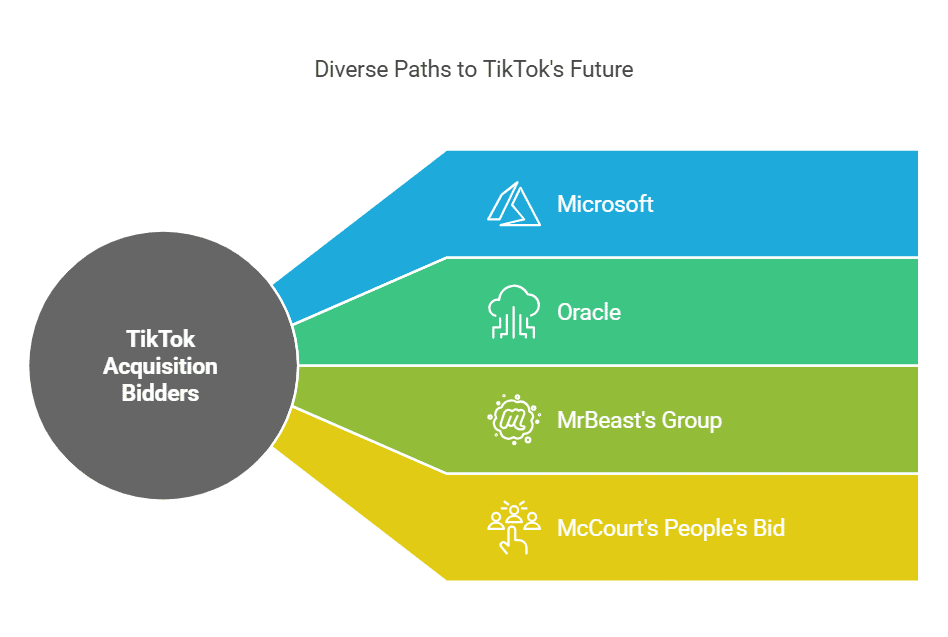

As the deadline for divestment nears, several major players have emerged as potential buyers for TikTok’s U.S. operations. Microsoft, Oracle, and an investment group featuring YouTube star MrBeast (real name Jimmy Donaldson) are all reportedly interested in acquiring the platform.

Among these contenders, McCourt’s “People’s Bid” stands out due to its focus on user empowerment and decentralization rather than traditional corporate ownership. While financial details have not been fully disclosed, sources suggest that McCourt’s consortium has offered approximately $20 billion in cash for the acquisition.

Industry analysts estimate TikTok’s total valuation at over $30 billion, meaning that any successful bid will need to meet or exceed this figure to gain serious consideration from ByteDance. Despite mounting pressure from U.S. regulators, ByteDance has not publicly signaled a strong willingness to sell, adding another layer of complexity to the negotiations.

ByteDance’s Financial Position and Resistance to Sale

Despite the forced divestment order, ByteDance has remained financially strong. In recent months, the company has increased its valuation through a share buyback program, offering $189.90 per share, indicating a total valuation of around $315 billion. This suggests that ByteDance is not struggling financially and may have the resources to resist a sale for as long as possible.

Moreover, China’s government has repeatedly expressed opposition to any forced sale of TikTok. The Chinese Ministry of Commerce has stated that it would “firmly oppose” any divestiture mandated by the U.S., citing concerns over intellectual property and national sovereignty. Some experts believe that Beijing could block the sale outright, further complicating the situation.

What Happens Next? The Future of TikTok in the U.S.

As the April deadline approaches, TikTok’s fate remains uncertain. If ByteDance refuses to comply with the U.S. law requiring divestment, it could face an outright ban, cutting off millions of American users from the platform.

Meanwhile, “The People’s Bid for TikTok” continues to gain traction, advocating for a future where users have a more significant stake in the platform they rely on for entertainment, business, and community-building.

Whether TikTok ultimately changes hands or remains entangled in geopolitical tensions, the situation underscores broader concerns about data privacy, digital ownership, and the power of major technology companies in shaping the internet’s future.

For now, all eyes are on ByteDance, Washington, and the emerging list of potential buyers, as the countdown to TikTok’s final decision continues.