The rise of Web3 has reshaped the digital economy, emphasizing decentralization, security, and seamless transactions. At the heart of this evolution lies stablecoins—a class of cryptocurrencies designed to maintain price stability, making them ideal for everyday transactions, DeFi applications, and cross-border payments.

These digital assets provide a bridge between traditional finance and the emerging decentralized world, offering both the stability of fiat currencies and the flexibility of blockchain technology.

Stablecoins enable users to avoid volatility while leveraging blockchain’s efficiency. They are essential for Web3’s financial infrastructure, facilitating seamless trading, lending, and decentralized applications (dApps). Their adoption has surged, with billions of dollars in daily transactions, solidifying their role in the digital economy.

This article explores 10 stablecoins powering transactions in Web3, detailing their role, advantages, and suitability for various financial activities.

Whether you’re a crypto enthusiast, DeFi trader, or blockchain developer, understanding these stablecoins will help you navigate the Web3 landscape effectively and choose the best one for your needs.

What Are Stablecoins and Why Are They Essential in Web3?

Stablecoins are digital assets pegged to a stable reserve, such as fiat currency, commodities, or algorithms. Unlike volatile cryptocurrencies like Bitcoin or Ethereum, stablecoins offer consistency, making them an essential component of the decentralized ecosystem.

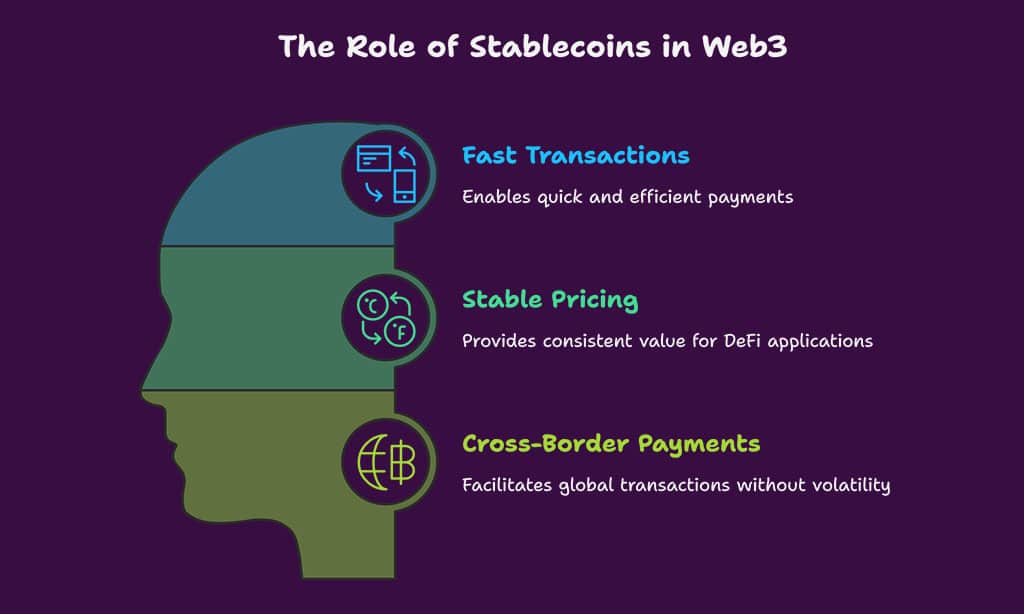

How Stablecoins Enable Transactions in Web3

Stablecoins provide a reliable medium of exchange within Web3, enabling:

- Fast and low-cost transactions compared to traditional banking systems.

- Stable pricing for DeFi applications and smart contracts.

- Seamless cross-border payments without the volatility of conventional cryptocurrencies.

- Enhanced liquidity in blockchain-based trading, lending, and borrowing.

Types of Stablecoins in Web3

Stablecoins are classified based on their reserve backing:

- Fiat-backed stablecoins (e.g., USDT, USDC) – Pegged to traditional currencies like the USD.

- Crypto-backed stablecoins (e.g., DAI) – Secured by over-collateralized digital assets.

- Algorithmic stablecoins (e.g., FRAX) – Managed through smart contracts and market mechanisms.

10 Stablecoins Powering Transactions in Web3

| Stablecoin | Backing Mechanism | Best Use Case | Notable Feature |

| Tether (USDT) | Fiat-backed (USD) | Trading, payments | Most widely adopted stablecoin |

| USD Coin (USDC) | Fiat-backed (USD) | DeFi, payments | Transparent and regulated |

| Binance USD (BUSD) | Fiat-backed (USD) | Binance ecosystem | Strong liquidity |

| Dai (DAI) | Crypto-backed | Decentralized finance | Fully decentralized |

| TrueUSD (TUSD) | Fiat-backed (USD) | Payments, trading | Real-time proof of reserves |

| Pax Dollar (USDP) | Fiat-backed (USD) | Institutional adoption | Compliance-focused |

| Frax (FRAX) | Algorithmic hybrid | DeFi, staking | Partially collateralized |

| TerraUSD (USTC) | Algorithmic | Experimentation | Lessons from its de-peg |

| Gemini Dollar (GUSD) | Fiat-backed (USD) | Institutional transactions | FDIC-insured reserves |

| sUSD | Crypto-backed (synthetic) | DeFi derivatives | Optimized for Synthetix platform |

1. Tether (USDT) – The Most Widely Used Stablecoin

USDT is the dominant stablecoin in Web3, offering deep liquidity and fast transaction speeds. It is widely used in trading, cross-border payments, and DeFi applications. However, concerns over its reserve transparency have led to scrutiny from regulators.

Despite these concerns, USDT remains the most popular stablecoin, with billions in daily transaction volume and integration across multiple blockchains.

Key Stats:

| Feature | Details |

| Market Cap | $90+ billion |

| Backing | USD reserves (claimed) |

| Blockchain Support | Ethereum, TRON, Solana, others |

| Use Cases | Trading, DeFi, payments |

| Daily Transaction Volume | $30+ billion |

| Regulatory Concerns | Lack of full audit transparency |

2. USD Coin (USDC) – A Regulated and Transparent Choice

Issued by Circle and Coinbase, USDC is fully backed by USD reserves and is frequently used in smart contracts and DeFi lending platforms. It is widely regarded as the safest fiat-backed stablecoin due to its regulatory compliance.

Unlike USDT, USDC undergoes regular audits, making it a preferred choice for users prioritizing transparency and regulatory oversight.

Key Stats:

| Feature | Details |

| Market Cap | $25+ billion |

| Backing | Fully reserved USD holdings |

| Blockchain Support | Ethereum, Polygon, Solana, others |

| Use Cases | DeFi, payments, cross-border transfers |

| Daily Transaction Volume | $5+ billion |

| Compliance | Regular audits by Grant Thornton |

3. Binance USD (BUSD) – A Stablecoin with Strong Utility

BUSD integrates seamlessly with Binance services, offering traders and investors a reliable means of settling transactions within the Binance ecosystem. It is regularly audited, ensuring transparency.

As an officially approved stablecoin by the New York State Department of Financial Services (NYDFS), BUSD enjoys strong institutional trust and liquidity.

Key Stats:

| Feature | Details |

| Market Cap | $10+ billion |

| Backing | Fully reserved USD holdings |

| Blockchain Support | Binance Smart Chain (BSC), Ethereum |

| Use Cases | Trading, staking, DeFi, Binance ecosystem |

| Regulatory Status | Approved by NYDFS |

4. Dai (DAI) – A Fully Decentralized Stablecoin

DAI is a crypto-backed stablecoin issued by MakerDAO, maintaining its stability through over-collateralization and smart contracts. Unlike fiat-backed stablecoins, DAI is decentralized and operates autonomously, making it a key asset in DeFi protocols.

Users can mint DAI by locking up Ethereum or other cryptocurrencies as collateral, ensuring trustless financial transactions without reliance on traditional banks.

Key Stats:

| Feature | Details |

| Market Cap | $5+ billion |

| Backing | Crypto collateral (Ethereum, others) |

| Blockchain Support | Ethereum, Polygon, Arbitrum |

| Use Cases | Lending, borrowing, DeFi |

| Governance | MakerDAO community |

5. TrueUSD (TUSD) – A Transparent Alternative

TUSD is a fiat-backed stablecoin known for its strong regulatory compliance and real-time proof of reserves.

Issued by TrustToken, TUSD is one of the few stablecoins that provides frequent attestations by third-party auditors, ensuring transparency in its USD holdings.

Key Stats:

| Feature | Details |

| Market Cap | $2+ billion |

| Backing | Fully reserved USD holdings |

| Blockchain Support | Ethereum, Binance Smart Chain |

| Use Cases | Trading, institutional payments |

| Transparency | Frequent third-party audits |

6. Pax Dollar (USDP) – A Compliance-Focused Stablecoin

USDP, issued by Paxos, is a fiat-backed stablecoin designed for institutional use, prioritizing compliance and security.

It is regulated by the New York Department of Financial Services (NYDFS) and has a strong focus on trust and transparency.

Key Stats:

| Feature | Details |

| Market Cap | $1+ billion |

| Backing | Fully reserved USD holdings |

| Blockchain Support | Ethereum, Binance Smart Chain |

| Use Cases | Institutional transactions, payments |

| Regulatory Approval | NYDFS-compliant |

7. Frax (FRAX) – A Hybrid Algorithmic Stablecoin

FRAX is a partially algorithmic, partially collateralized stablecoin designed to maintain its peg using a mix of reserves and algorithmic mechanisms.

Unlike fully fiat-backed or crypto-backed stablecoins, FRAX utilizes a fractional reserve model, ensuring capital efficiency while maintaining stability.

Key Stats:

| Feature | Details |

| Market Cap | $1+ billion |

| Backing | Mix of crypto collateral & algorithmic mechanism |

| Blockchain Support | Ethereum, Avalanche, BSC |

| Use Cases | DeFi staking, lending, yield farming |

| Stability Mechanism | Fractional-algorithmic model |

8. TerraUSD (USTC) – The Lessons from Algorithmic Stability

TerraUSD (USTC), formerly UST, was an algorithmic stablecoin that lost its peg in 2022, leading to one of the biggest crashes in crypto history.

While it no longer functions as a reliable stablecoin, the lessons learned from its failure have influenced the development of more resilient algorithmic stablecoins.

Key Stats:

| Feature | Details |

| Market Cap | Below $500 million |

| Backing | Algorithmic (failed mechanism) |

| Blockchain Support | Terra ecosystem (limited) |

| Use Cases | Experimentation, research |

| Stability Issues | Collapsed due to de-pegging |

9. Gemini Dollar (GUSD) – A Trustworthy U.S.-Regulated Option

GUSD is a fiat-backed stablecoin issued by Gemini, a U.S.-based exchange known for its regulatory compliance.

Unlike many stablecoins, GUSD reserves are held in FDIC-insured banks, providing a high level of trust and security.

Key Stats:

| Feature | Details |

| Market Cap | $500+ million |

| Backing | Fully reserved USD holdings |

| Blockchain Support | Ethereum |

| Use Cases | Institutional transactions, payments |

| Regulatory Approval | U.S. government-regulated |

10. sUSD – A Synthetic Stablecoin for DeFi

sUSD is a crypto-backed stablecoin specifically designed for use within the Synthetix ecosystem.

Unlike traditional stablecoins, sUSD allows traders to create and trade synthetic assets, making it an essential tool in DeFi derivatives markets.

Key Stats:

| Feature | Details |

| Market Cap | $300+ million |

| Backing | Crypto collateral (Synthetix protocol) |

| Blockchain Support | Ethereum, Optimism |

| Use Cases | DeFi derivatives, trading |

| Integration | Synthetix platform |

Takeaways

Stablecoins are the backbone of Web3, facilitating seamless transactions, financial inclusion, and DeFi innovations. Understanding the top 10 stablecoins powering transactions in Web3 equips users with the knowledge to make informed choices. As the Web3 ecosystem evolves, stablecoins will play an even greater role in driving global digital finance.

Explore these stablecoins, assess their suitability for your needs, and embrace the decentralized future of finance!