In mid-February 2025, Argentine President Javier Milei found himself at the center of a significant controversy following his endorsement of a cryptocurrency known as $LIBRA. On February 14, Milei took to his official social media platforms to promote the token, describing it as an initiative aimed at stimulating economic growth by providing funding avenues for small businesses and startups in Argentina. He shared specific details, including the contract address for purchasing the newly launched token on the Solana blockchain.

The immediate aftermath of Milei’s endorsement saw a meteoric rise in $LIBRA’s value. The token’s price escalated from a mere $0.000001 to an impressive $5.20 within just 40 minutes. This surge attracted a substantial number of investors, eager to capitalize on the burgeoning opportunity. However, the euphoria was short-lived. Within hours, the token’s value experienced a precipitous decline, plummeting by approximately 85%. This sharp downturn resulted in significant financial losses for a vast majority of the investors involved. Reports indicate that the nine founding accounts associated with $LIBRA managed to amass approximately $87 million during this period, leading to allegations of a “rug pull” scam—a fraudulent maneuver where developers abruptly withdraw funds, leaving investors with worthless assets.

Milei’s Response and Subsequent Retraction

Facing mounting criticism and scrutiny, President Milei deleted his initial promotional posts mere hours after they went live. He addressed the situation by stating that he had shared information about $LIBRA without being fully informed about the project’s intricacies. In a subsequent interview with the TN news channel, Milei drew parallels between investing in cryptocurrencies and gambling, suggesting that those who chose to invest were cognizant of the inherent risks involved. He emphasized that his intention was to support private Argentine ventures and clarified that he did not personally benefit from the promotion. Milei stated, “I did not promote it. What I did was I spread it,” underscoring his belief that he was merely disseminating information rather than actively endorsing the investment.

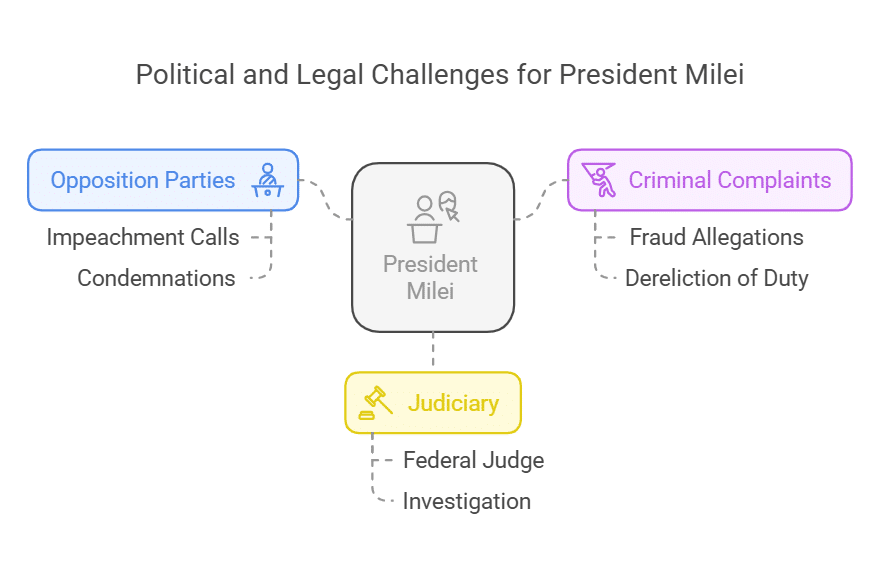

Legal and Political Repercussions

The incident has ignited a firestorm of political and legal challenges for President Milei. Opposition parties have been vocal in their condemnation, with some members calling for his impeachment. Multiple criminal complaints have been filed, accusing the president of fraud and dereliction of duty. One such complaint, lodged by the Popular Unity political party, alleges that the $LIBRA initiative was a premeditated scam designed to defraud investors. The complaint describes the operation as a “rug pull,” wherein developers entice investors to inflate the token’s value before abruptly withdrawing and absconding with the funds. The judiciary has taken note, with a federal judge appointed to spearhead the investigation into these serious allegations.

Involvement of Cryptocurrency Developers

Central to the unfolding scandal are the entities behind the creation and promotion of $LIBRA. The token was developed by KIP Protocol, a company registered in Panama. The technological infrastructure supporting $LIBRA was provided by Kelsier Ventures, owned by American entrepreneur Hayden Mark Davis. Davis has publicly claimed that the promotional campaign was orchestrated in collaboration with President Milei’s team. He expressed feelings of betrayal following Milei’s abrupt withdrawal of support, stating that the sudden distancing by the president significantly undermined the project’s credibility and stability. Davis has denied any malicious intent, describing the endeavor as an “experiment” that unfortunately failed, rather than a deliberate scam.

Impact on Argentina’s Financial Landscape

The ramifications of the $LIBRA debacle have extended beyond individual investor losses, casting a shadow over Argentina’s broader financial environment. The national stock index experienced a notable decline of 5.6% in the wake of the scandal, reflecting heightened investor apprehension and a potential erosion of confidence in the country’s financial markets. The incident has also reignited discussions about the necessity for stringent regulations in the cryptocurrency sector, aiming to safeguard investors from potential fraud and to ensure greater transparency in digital asset promotions.

The $LIBRA cryptocurrency scandal has plunged President Javier Milei into one of the most challenging crises of his tenure. The episode underscores the critical importance of due diligence, transparency, and regulatory oversight in the rapidly evolving and often volatile world of cryptocurrencies. As investigations proceed, the incident serves as a stark reminder of the potential pitfalls associated with digital asset investments and the profound impact that endorsements from public figures can have on investor behavior and market dynamics.