The way we pay for goods and services is undergoing a massive transformation. Traditional cash transactions and even chip-based card payments are being replaced by faster, safer, and more convenient solutions.

One of the most significant advancements in this evolution is the rise of contactless payments. From major cities to remote regions, businesses and consumers alike are embracing this seamless technology.

But why is this happening? What are the driving forces behind this shift? In this article, we explore seven key reasons contactless payments are becoming the global standard and what the future holds for digital transactions.

What Are Contactless Payments?

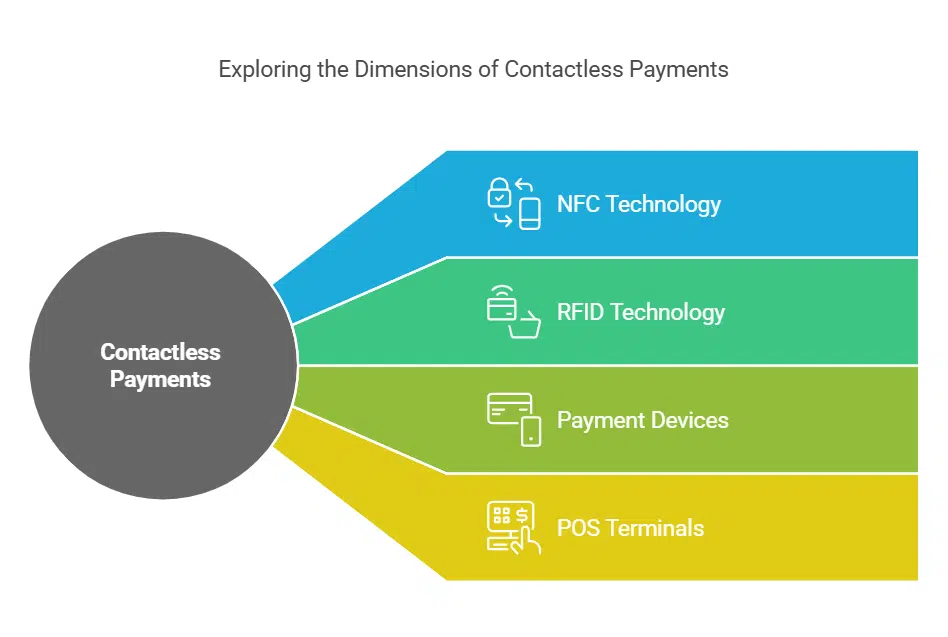

Contactless payments are a form of transaction that allows consumers to pay by simply tapping a card, smartphone, or wearable device on a point-of-sale (POS) terminal. This method uses Near Field Communication (NFC) or Radio Frequency Identification (RFID) technology to facilitate secure and instant payments.

How Contactless Payments Work

- The customer taps their NFC-enabled card or device on a contactless reader.

- The reader securely processes the transaction via encrypted data transmission.

- Within seconds, the transaction is approved, eliminating the need for PIN entry (in most cases).

Contactless vs. Traditional Payment Methods

| Feature | Contactless Payments | Chip & PIN Cards | Cash Transactions |

| Speed | Instant | Slower (requires PIN) | Slowest (manual counting) |

| Security | High (tokenization & encryption) | Moderate | Low (risk of theft) |

| Convenience | High (no PIN needed for small transactions) | Moderate | Low |

| Hygiene | Contact-free | Requires touching keypad | Requires handling cash |

Now, let’s explore the reasons contactless payments are becoming the global standard.

7 Reasons Contactless Payments Are Becoming the Global Standard

As digital transactions continue to dominate the global economy, more consumers and businesses are moving toward contactless solutions. The shift is driven by the demand for faster, safer, and more seamless payment methods that align with modern lifestyles. Let’s explore the key factors behind this transformation.

1. Speed and Convenience

Contactless payments are transforming the way people pay, offering a frictionless experience that reduces transaction times significantly. Whether at a busy retail store, a public transport gate, or a drive-thru, the ability to complete a transaction with just a tap eliminates unnecessary delays. This efficiency is why businesses and customers alike are shifting toward contactless solutions.

One of the biggest reasons contactless payments are becoming the global standard is their ability to provide a seamless and fast payment experience. Customers no longer need to fumble with cash, swipe cards, or enter PINs. A simple tap completes the transaction in seconds.

Benefits:

- Reduces checkout lines and waiting times.

- Ideal for high-traffic businesses like cafes, public transport, and retail stores.

- Enhances customer satisfaction with quick and effortless transactions.

2. Enhanced Security and Fraud Protection

The enhanced security of contactless payments is one of the most compelling reasons for their widespread adoption. Traditional payment methods are often vulnerable to skimming, fraud, and data breaches. In contrast, contactless technology ensures each transaction is unique and encrypted, making it extremely difficult for hackers to intercept and misuse financial information.

Security concerns are one of the major reasons contactless payments are becoming the global standard. Unlike traditional magnetic stripe cards, which are susceptible to cloning, contactless payments leverage advanced encryption, tokenization, and biometric authentication.

Key Security Features:

- Tokenization: Each transaction generates a unique code, reducing fraud risks.

- Biometric Authentication: Mobile wallets often use fingerprint or facial recognition for added security.

- Limited Transaction Value: Many banks set a limit for contactless payments to prevent unauthorized use.

3. Growing Adoption by Businesses and Consumers

The rapid expansion of contactless payments is fueled by a combination of technological advancements, regulatory support, and evolving consumer expectations. More businesses, from multinational retailers to small local vendors, are recognizing the efficiency and security of contactless solutions, leading to an exponential increase in adoption rates worldwide.

The widespread acceptance of contactless technology is another reason why contactless payments are becoming the global standard. Businesses across industries—from retail and hospitality to transportation—are prioritizing contactless solutions.

Factors Driving Adoption:

- Retailers and restaurants upgrading to NFC-enabled POS systems.

- Governments and financial institutions promoting cashless economies.

- Increased smartphone penetration fueling mobile wallet usage.

4. Seamless Integration with Mobile Wallets

Mobile wallets have revolutionized the payment ecosystem by integrating various payment methods into a single digital platform. The convenience of storing multiple cards, loyalty programs, and transaction history in one place has further cemented contactless payments as the go-to option for modern consumers.

As mobile payment adoption continues to rise, this trend is expected to grow exponentially. Another major reason contactless payments are becoming the global standard is their integration with mobile payment platforms like Apple Pay, Google Pay, and Samsung Pay. These digital wallets enable users to store multiple cards, making payments even more convenient.

Advantages of Mobile Wallets:

- Contactless payments are stored securely in smartphones.

- Users can track spending and manage finances efficiently.

- Biometric authentication enhances security.

5. Contactless Payments and the Post-Pandemic World

The COVID-19 pandemic has drastically reshaped consumer behavior, accelerating the shift towards touch-free payment methods. With heightened concerns about hygiene and physical contact, businesses and consumers alike have embraced contactless transactions as a safer alternative.

This shift has made contactless payments an integral part of the modern payment landscape. Hygiene concerns have accelerated the shift to contactless transactions, making them an essential part of the new normal.

Post-Pandemic Trends:

- Reduced physical contact minimizes virus transmission risks.

- Businesses encourage touch-free payments for customer safety.

- Consumers prefer digital transactions over handling cash.

6. Increased Financial Inclusion

One of the most promising aspects of contactless payments is their role in fostering financial inclusion. In regions where access to traditional banking services is limited, mobile wallets and contactless transactions provide an accessible and secure means of financial participation.

By bridging the gap between the banked and unbanked populations, contactless payments are empowering more people to engage in the digital economy. Contactless payments are bridging the financial gap, allowing more people to participate in the digital economy.

How Contactless Payments Promote Inclusion:

- Mobile wallets provide banking solutions for unbanked populations.

- Digital payment methods simplify transactions in remote areas.

- Governments are encouraging digital payment systems in underdeveloped regions.

7. Future Innovations in Contactless Payment Technology

The future of contactless payments looks brighter than ever, with continuous innovations shaping the landscape. Emerging trends such as biometric authentication, AI-driven fraud detection, and blockchain-based payments are set to redefine security and convenience.

These advancements ensure that contactless payments remain at the forefront of financial technology for years to come. The final reason contactless payments are becoming the global standard is the continuous advancement in technology.

Emerging Trends:

- Wearable Payments: Smartwatches, rings, and bracelets enabling tap-to-pay.

- Biometric Cards: Cards with fingerprint scanners for enhanced authentication.

- Cryptocurrency Integration: Contactless solutions expanding into blockchain-based transactions.

Comparing Contactless Payments with Traditional Methods

| Feature | Contactless Payments | Traditional Cards | Cash Transactions |

| Speed | Instant | Requires PIN | Slowest |

| Security | High | Moderate | Low |

| User Experience | Seamless | Moderate | Inconvenient |

| Global Adoption | Rapidly Increasing | Declining | Decreasing |

Takeaways

The rapid adoption of digital payments highlights why contactless payments are becoming the global standard. With their unmatched convenience, security, and efficiency, contactless payments are revolutionizing the way transactions are conducted worldwide.

Businesses and consumers should embrace this technology to enjoy faster, safer, and more streamlined payments. As innovation continues, the future of contactless payments looks even more promising, paving the way for a truly cashless society.