Cryptocurrency has taken the world by storm, offering digital financial freedom, decentralization, and groundbreaking investment opportunities. However, with this financial revolution comes a growing number of fraudsters looking to exploit unsuspecting investors.

From fake ICOs to phishing schemes, common cryptocurrency scams and how to avoid them should be a top priority for every crypto enthusiast.

According to a 2024 report by Chainalysis, cryptocurrency scams accounted for over $10 billion in fraudulent activities worldwide. The rise of decentralized finance (DeFi) and digital assets has made it easier for scammers to create fraudulent schemes, impacting thousands of investors globally.

This article explores eight common cryptocurrency scams and how to avoid them, ensuring you stay one step ahead of cybercriminals. Whether you’re a beginner or a seasoned investor, understanding these scams is essential to safeguarding your digital assets and investments.

Understanding Cryptocurrency Scams

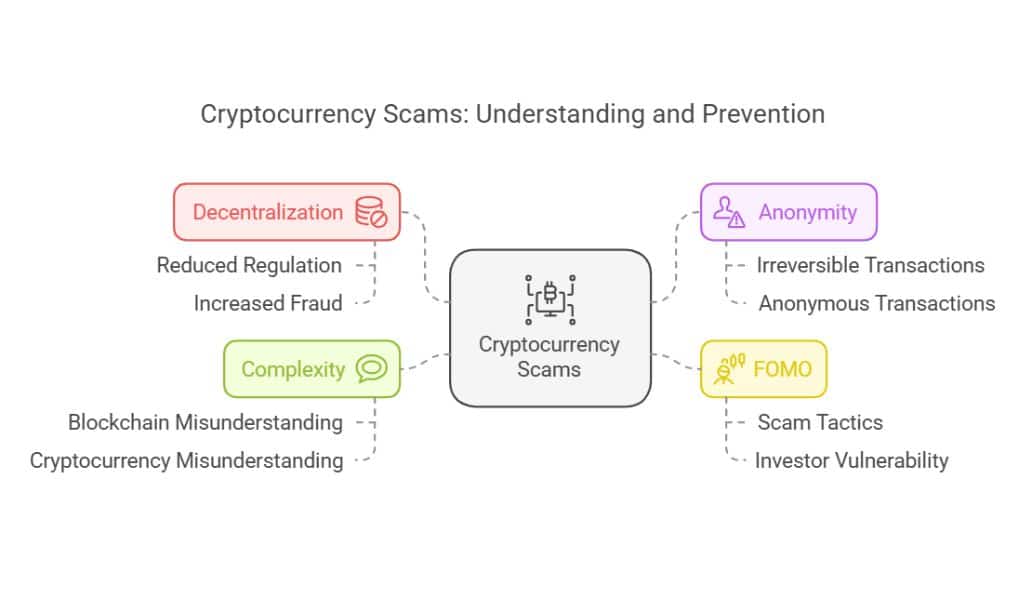

The cryptocurrency market is largely decentralized, meaning there are fewer regulatory protections compared to traditional financial institutions. This has led to an increase in fraud, making it crucial to recognize the tactics scammers use. Here’s why common cryptocurrency scams and how to avoid them should be a primary concern:

- Lack of Regulation: Cryptocurrencies operate outside of traditional banking systems, making it harder to track fraudulent activities.

- High Anonymity: Transactions are often irreversible and anonymous, making it difficult to recover stolen funds.

- FOMO (Fear of Missing Out): Many scams prey on the excitement and urgency of quick gains in the crypto space.

- Complexity of Technology: Many investors don’t fully understand blockchain and cryptocurrency, making them more susceptible to scams.

Now, let’s explore the most common cryptocurrency scams and how to avoid them effectively.

8 Common Cryptocurrency Scams and How to Avoid Them

Cryptocurrency scams have become increasingly sophisticated, targeting both new and experienced investors. Understanding these scams can help you protect your assets and make informed investment decisions. From phishing attacks to fake exchanges, staying alert and informed is your best defense against fraud.

1. Phishing Scams

Phishing scams are one of the most prevalent in the cryptocurrency space. Scammers create fake websites, emails, or social media messages that appear to be from legitimate crypto exchanges, wallets, or service providers. These fraudulent platforms trick users into providing their private keys, seed phrases, or login credentials.

Example: In 2023, a major phishing attack targeted users of MetaMask, where hackers created a fake login page, stealing credentials and draining funds from over 5,000 wallets.

Key Details Table

| Indicator | Details |

| Common Targets | Crypto exchanges, wallet users |

| Attack Methods | Fake emails, malicious websites, social media scams |

| Prevention | Enable 2FA, verify URLs, never share private keys |

How to Avoid It

- Always double-check URLs before entering credentials.

- Enable two-factor authentication (2FA) on all your accounts.

- Never share your private keys or seed phrases with anyone.

- Use official cryptocurrency wallet apps and bookmark trusted sites.

2. Ponzi & Pyramid Schemes

Ponzi and pyramid schemes promise investors high returns with little to no risk. They rely on new investors’ money to pay returns to earlier participants, rather than generating legitimate profits. Eventually, these schemes collapse, leaving most investors with significant losses.

Example: Bitconnect, one of the largest Ponzi schemes in crypto history, scammed investors out of $2 billion before shutting down in 2018.

Key Details Table

| Indicator | Details |

| Common Targets | New crypto investors |

| Signs of a Scam | Guaranteed returns, recruitment-based earnings |

| Prevention | Research the project’s team, avoid unrealistic ROI promises |

How to Avoid It

- Be skeptical of guaranteed high returns with minimal risk.

- Research the project’s team, technology, and revenue model.

- Avoid platforms that require you to recruit others to earn rewards.

- Look for transparency in fund management and business operations.

3. Fake Initial Coin Offerings (ICOs) & Token Scams

Fake ICOs and token scams involve fraudsters launching deceptive cryptocurrency projects to lure investors. These scammers promise revolutionary technology or unrealistic gains, only to disappear once they’ve collected enough money.

Example: In 2017, the PlexCoin ICO raised over $15 million before being shut down by regulators for fraud.

Key Details Table

| Indicator | Details |

| Common Targets | ICO investors, DeFi enthusiasts |

| Scam Red Flags | Anonymous team, no working product, fake partnerships |

| Prevention | Verify whitepapers, check team legitimacy, review community engagement |

How to Avoid It

- Verify the legitimacy of ICOs by reviewing the whitepaper and team background.

- Check for project partnerships and community engagement.

- Use reputable sources like CoinMarketCap to verify token legitimacy.

- Be wary of projects that promise high returns without a clear roadmap.

4. Pump and Dump Schemes

Pump and dump schemes involve artificially inflating the price of a cryptocurrency through misleading hype, often in private groups or social media channels. Once enough investors buy in, the orchestrators sell their holdings, causing the price to crash and leaving unsuspecting investors at a loss.

Example: In 2021, a coordinated Telegram group pumped a little-known altcoin, increasing its value by 500% in minutes before dumping it, leaving investors with worthless assets.

Key Details Table

| Indicator | Details |

| Common Targets | New traders, retail investors |

| Signs of a Scam | Sudden price surges, social media hype |

| Prevention | Research projects, check trading volumes |

How to Avoid It

- Avoid investing in cryptocurrencies based on hype alone.

- Research a project’s fundamentals before investing.

- Be cautious of sudden, unexplained price spikes.

- Monitor trading volume and liquidity before buying.

5. Fake Cryptocurrency Exchanges

Fraudsters create fake cryptocurrency exchanges that look identical to legitimate ones. They attract users by offering competitive trading fees, only to steal funds when users attempt to withdraw their assets.

Example: In 2022, a fake exchange mimicking Binance tricked thousands of users, leading to millions in losses before authorities shut it down.

Key Details Table

| Indicator | Details |

| Common Targets | Traders, investors |

| Scam Red Flags | Unusual fees, no regulatory approval |

| Prevention | Use only trusted exchanges, check reviews |

How to Avoid It

- Use well-known, regulated cryptocurrency exchanges.

- Check online reviews and community feedback before using an exchange.

- Ensure the exchange has proper security measures, such as SSL encryption.

- Test with a small deposit before transferring large amounts.

6. Giveaway & Social Media Scams

Scammers impersonate celebrities, influencers, or crypto exchanges and promise to send free cryptocurrency in exchange for a small initial deposit. They often promote these fake giveaways through hacked or fake social media accounts.

Example: A Twitter account impersonating Elon Musk scammed users out of Bitcoin by promising to double their deposit in 2021.

Key Details Table

| Indicator | Details |

| Common Targets | Social media users |

| Signs of a Scam | Unrealistic promises, fake endorsements |

| Prevention | Verify official accounts, avoid free crypto offers |

How to Avoid It

- Never send cryptocurrency expecting to receive more in return.

- Verify social media accounts by checking for official verification marks.

- Report fraudulent posts and accounts to platform administrators.

- Follow only official channels of cryptocurrency projects and influencers.

7. Malware & Fake Wallets

Some scammers create fake wallet applications that look identical to legitimate crypto wallets. When users store their funds in these wallets, the scammers gain access to their private keys and steal their assets.

Example: In 2023, a fake Trust Wallet app on the Google Play Store led to significant losses for unsuspecting users who stored their assets in it.

Key Details Table

| Indicator | Details |

| Common Targets | Crypto users, DeFi investors |

| Scam Red Flags | Unverified apps, missing security protocols |

| Prevention | Download only from official sources, check reviews |

How to Avoid It

- Download wallets only from official sources like the Apple App Store or Google Play Store.

- Use hardware wallets for added security.

- Regularly update your security software to prevent malware infections.

- Never enter your private key into a website or app unless verified as legitimate.

8. Rug Pull Scams in DeFi Projects

A rug pull scam occurs when developers create a DeFi (decentralized finance) project, attract investors, and then withdraw all liquidity, leaving investors with worthless tokens.

Example: In 2022, the Squid Game Token surged over 1000% before the anonymous developers vanished, stealing millions in investor funds.

Key Details Table

| Indicator | Details |

| Common Targets | DeFi investors, yield farmers |

| Signs of a Scam | No liquidity lock, anonymous developers |

| Prevention | Research projects, check audit reports |

How to Avoid It

- Research whether liquidity is locked in the project’s smart contract.

- Check if the development team is transparent and has verifiable identities.

- Avoid projects with anonymous or unverified teams.

- Look for independent security audits of smart contracts.

How to Protect Yourself from Cryptocurrency Scams

To protect yourself from common cryptocurrency scams and how to avoid them, follow these best practices:

- Enable strong security measures: Always use 2FA, hardware wallets, and strong passwords.

- Do thorough research: Verify any investment opportunity through multiple sources before committing funds.

- Stay informed: Follow reputable cryptocurrency news sources for updates on scams and security threats.

- Report suspicious activities: If you encounter a scam, report it to relevant authorities or platforms.

Takeaways

Understanding common cryptocurrency scams and how to avoid them is essential in today’s rapidly evolving crypto landscape. Scammers continue to develop new tactics, making vigilance and education the best defense. By staying informed, using secure platforms, and practicing due diligence, you can safeguard your assets and navigate the cryptocurrency market with confidence.

For more tips on cryptocurrency security, consider following official regulatory bodies, security experts, and reputable crypto communities. Stay safe and invest wisely!